Global funding for the insurance technology sector posted a modest recovery in the second quarter of 2022, but is still down more than half from a year ago, a report from reinsurance company Gallagher Re has shown.

While funding rebounded by about 9 per cent to $2.41 billion from April to June, from $2.2bn in the first quarter, the level of investment in the three-month period ending June 30 was still 50.2 per cent below the $4.84bn the sector recorded in the second quarter of 2021, which was its second-best on record, the London-based advisory said in its quarterly update.

A total of $948 million was raised in the second quarter through six mega rounds, including four based in the US, with average deal size rising 18.3 per cent quarterly to about $22.1m, the report said.

The total was about 43 per cent higher than the first quarter's $668m. This was offset by a 7.7 per cent decline in total deals 132 in the second quarter, from 143 in the first three months of the year.

With stock markets on the downside, insurance technology companies are poised to deliver growth and profitability in the long term, and are an “excellent opportunity” for investors to diversify their portfolios, said Andrew Johnston, global head of InsurTech at Gallagher Re.

“A number of [InsurTechs] will undoubtedly change the face of our industry, or parts of it and, in some cases, are already doing so. As markets begin to recover, those InsurTechs should rise to the surface with the utmost buoyancy.”

The demand for InsurTech solutions is rising as it helps predict consumer demands, increase purchasing quantities, as well as enhance decision-making and insurance planning through the use of machine learning, artificial intelligence and cloud computing, according to Future Market Insights.

The global InsurTech industry is expected to hit $165.4bn by 2032, from about $16.6bn in 2022, at a compound annual growth rate of about 26 per cent, it said.

In 2021, the InsurTech sector recorded $15.8bn raised in funding, a record high, from 564 deals, as more capital flowed into the industry last year than in 2020 and 2019 combined, Gallagher Re said in April.

Total disclosed funding for life and health InsurTech hit $918m in the second quarter of 2022, which is a 12.4 per cent quarterly rise, with deals growing to 40, from 37, during the period, Gallagher Re said. The average deal size was $24.8m for the quarter, with about 58 per cent for companies focused on lead generation or distribution.

Funding in the property and casualty segment was also up, rising about 6 per cent quarterly to $1.49bn, although deals were down 13.2 per cent. The average deal size for the quarter was $20.73m, and the bulk of transactions was between companies focused on distribution and business-to-business operations.

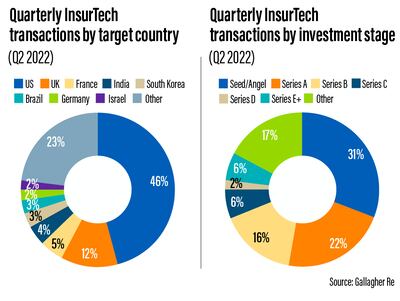

US-based InsurTech companies concluded 60 deals — their highest — in the second quarter, making up 46 per cent of the market.

There was a big increase to the UK's share, which was the only other country to record a double-digit market share of more than 12 per cent.

Gallagher Re said that the InsurTech industry remains a viable investment alternative, especially given shaky economic conditions. Technology's potential to improve insurance services is also an attractive proposition.

Market participants are “nervous about overall global economic growth”, the company said, citing high oil prices, the war in Ukraine and a sharp rise in Covid-19 cases in China.

The recent downgrade of company values could lead to mergers, acquisitions and divestitures that were unlikely six months ago, Mr Johnston said.

“It has caused some InsurTechs to coalesce, and thrown cold water over many other InsurTechs that previously considered themselves special or unique,” he said.

“After value realisation, certain InsurTechs should offload and certain investors — even certain InsurTechs — should acquire. For both sides of the trade, this moment could be seen as an enormous opportunity.”

Zayed Sustainability Prize

Directed by Sam Mendes

Starring Dean-Charles Chapman, George MacKay, Daniel Mays

4.5/5

Plastic tipping points

Mohammed bin Zayed Majlis

More on Quran memorisation:

Our commentary on Brexit

- Alistair Burt: Despite Brexit, Britain can remain a world power

- Con Coughlin: Choice of the British people will be vindicated

Company%C2%A0profile

More from Neighbourhood Watch:

War on waste

Tomorrow 2021

The five pillars of Islam

1.

2.

3.

4.

5.

The specs

BLACKBERRY

School uniforms report

World Mental Health Day

• Remittance charges will be tackled by blockchain

• UAE's monumental and risky Mars Mission to inspire future generations, says minister

• Could the UAE drive India's economy?

• News has a bright future and the UAE is at the heart of it

• Architecture is over - here's cybertecture

• The National announces Future of News journalism competition

• Round up: Experts share their visions of the world to come

More from this package

Killing of Qassem Suleimani

National Editorial: Suleimani has been killed, now we must de-escalate

Mina Al Oraibi: Air strike casts a long shadow over the decade ahead

Jack Moore: Why the assassination is such a monumental gamble

Matthew Levitt: Iran retains its ability to launch terror attacks

Damien McElroy: A CEO tasked with spreading Iran's influence

Hussein Ibish: Trump's order on solid constitutional ground

Rashmee Roshan Lall: Sound of silence in South Asia

RESULTS

World Mental Health Day

The specs

Engine: 2.0-litre 4cyl turbo

Power: 261hp at 5,500rpm

Torque: 405Nm at 1,750-3,500rpm

Transmission: 9-speed auto

Fuel consumption: 6.9L/100km

On sale: Now

Price: From Dh117,059

KILLING OF QASSEM SULEIMANI

National Editorial: Suleimani has been killed, now we must de-escalate

Mina Al Oraibi: Air strike casts a long shadow over the decade ahead

Jack Moore: Why the assassination is such a monumental gamble

Matthew Levitt: Iran retains its ability to launch terror attacks

Hussein Ibish: Trump's order on solid constitutional ground

Simon Waldman: Cautious Israel keeping a low profile

Rashmee Roshan Lall: Sound of silence in South Asia

Fanar Haddad: The Iranian response will be gradual

Richard Olson: Why Afghanistan will be very wary

• Remittance charges will be tackled by blockchain

• UAE's monumental and risky Mars Mission to inspire future generations, says minister

• Could the UAE drive India's economy?

• News has a bright future and the UAE is at the heart of it

• Architecture is over - here's cybertecture

• The National announces Future of News journalism competition

• Round up: Experts share their visions of the world to come

Neighbourhood Watch

Towering concerns

MORE FROM ED HUSAIN: The UAE-Israel accord is a win for every Muslim

The specs

Engine: 2.0-litre 4-cylinder turbo

Power: 258hp from 5,000-6,500rpm

Torque: 400Nm from 1,550-4,000rpm

Transmission: Eight-speed auto

Fuel consumption: 6.1L/100km

Price: from Dh362,500

On sale: now

Tomorrow 2021

More coverage from the Future Forum

• Remittance charges will be tackled by blockchain

• UAE's monumental and risky Mars Mission to inspire future generations, says minister

• Could the UAE drive India's economy?

• News has a bright future and the UAE is at the heart of it

• Architecture is over - here's cybertecture

• The National announces Future of News journalism competition

• Round up: Experts share their visions of the world to come

The specs

Engine: 6.2-litre V8

Power: 502hp at 7,600rpm

Torque: 637Nm at 5,150rpm

Transmission: 8-speed dual-clutch auto

Price: from Dh317,671

On sale: now

COMPANY PROFILE

More from Neighbourhood Watch:

Our commentary on Brexit

- Con Coughlin: Choice of the British people will be vindicated

- Sam Williams: Departure is influenced by its sense of place

The view from The National

While you're here

Con Coughlin: To survive, Nato must renew its sense of common purpose

Gavin Esler: Nato summit failed for making news more than it made deals

Simon Waldman: Nato continues to be Ankara’s best security guarantor

Tomorrow 2021

War 2

Director: Ayan Mukerji

Stars: Hrithik Roshan, NTR, Kiara Advani, Ashutosh Rana

Rating: 2/5

Biog

Mr Kandhari is legally authorised to conduct marriages in the gurdwara

He has officiated weddings of Sikhs and people of different faiths from Malaysia, Sri Lanka, Russia, the US and Canada

Father of two sons, grandfather of six

Plays golf once a week

Enjoys trying new holiday destinations with his wife and family

Walks for an hour every morning

Completed a Bachelor of Commerce degree in Loyola College, Chennai, India

2019 is a milestone because he completes 50 years in business

While you're here

Hend Al Otaiba: A year ago, Covid-19 forced us apart – now, vaccines can bring us back together

National Editorial: Iata travel pass – 'digital passports' will get the world moving again

Lucy Sherriff: Covid vaccine passports: safeguard or ethical nightmare?

Hajj 2019

While you're here

Kareem Shaheen: Even a pandemic could not unite today's America

Michele Wucker: The difference between a black swan and a grey rhino

Robert Matthews: Has flawed science and rushed research failed us?

More from Neighbourhood Watch:

More from this package

Ni Jian: Why China and the UAE are brothers

Lin Yaduo: This is the time for facts, not fear

Bill Gates: How the world can end the pandemic

Zayed Sustainability Prize

You might also like

RESULTS

6.30pm UAE 1000 Guineas Trial Conditions (TB) US$100,000 (Dirt) 1,400m

Winner Final Song, Christophe Soumillon (jockey), Saeed bin Suroor (trainer).

7.05pm Handicap (TB) $135,000 (Turf) 1,000m

Winner Almanaara, Dane O’Neill, Doug Watson.

7.40pm Handicap (TB) $175,000 (D) 1,900m

Winner Grand Argentier, Brett Doyle, Doug Watson.

8.15pm Meydan Challenge Listed Handicap (TB) $175,000 (T) 1,400m

Winner Major Partnership, Patrick Cosgrave, Saeed bin Suroor.

8.50pm Dubai Stakes Group 3 (TB) $200,000 (D) 1,200m

Winner Gladiator King, Mickael Barzalona, Satish Seemar.

9.25pm Dubai Racing Club Classic Listed Handicap (TB) $175,000 (T) 2,410m

Winner Universal Order, Richard Mullen, David Simcock.

Killing of Qassem Suleimani

National Editorial: Suleimani has been killed, now we must de-escalate

Mina Al Oraibi: Air strike casts a long shadow over the decade ahead

Jack Moore: Why the assassination is such a monumental gamble

Matthew Levitt: Iran retains its ability to launch terror attacks

Hussein Ibish: Trump's order on solid constitutional ground

Simon Waldman: Cautious Israel keeping a low profile

Citizenship-by-investment programmes

United Kingdom

The UK offers three programmes for residency. The UK Overseas Business Representative Visa lets you open an overseas branch office of your existing company in the country at no extra investment. For the UK Tier 1 Innovator Visa, you are required to invest £50,000 (Dh238,000) into a business. You can also get a UK Tier 1 Investor Visa if you invest £2 million, £5m or £10m (the higher the investment, the sooner you obtain your permanent residency).

All UK residency visas get approved in 90 to 120 days and are valid for 3 years. After 3 years, the applicant can apply for extension of another 2 years. Once they have lived in the UK for a minimum of 6 months every year, they are eligible to apply for permanent residency (called Indefinite Leave to Remain). After one year of ILR, the applicant can apply for UK passport.

The Caribbean

Depending on the country, the investment amount starts from $100,000 (Dh367,250) and can go up to $400,000 in real estate. From the date of purchase, it will take between four to five months to receive a passport.

Portugal

The investment amount ranges from €350,000 to €500,000 (Dh1.5m to Dh2.16m) in real estate. From the date of purchase, it will take a maximum of six months to receive a Golden Visa. Applicants can apply for permanent residency after five years and Portuguese citizenship after six years.

“Among European countries with residency programmes, Portugal has been the most popular because it offers the most cost-effective programme to eventually acquire citizenship of the European Union without ever residing in Portugal,” states Veronica Cotdemiey of Citizenship Invest.

Greece

The real estate investment threshold to acquire residency for Greece is €250,000, making it the cheapest real estate residency visa scheme in Europe. You can apply for residency in four months and citizenship after seven years.

Spain

The real estate investment threshold to acquire residency for Spain is €500,000. You can apply for permanent residency after five years and citizenship after 10 years. It is not necessary to live in Spain to retain and renew the residency visa permit.

Cyprus

Cyprus offers the quickest route to citizenship of a European country in only six months. An investment of €2m in real estate is required, making it the highest priced programme in Europe.

Malta

The Malta citizenship by investment programme is lengthy and investors are required to contribute sums as donations to the Maltese government. The applicant must either contribute at least €650,000 to the National Development & Social Fund. Spouses and children are required to contribute €25,000; unmarried children between 18 and 25 and dependent parents must contribute €50,000 each.

The second step is to make an investment in property of at least €350,000 or enter a property rental contract for at least €16,000 per annum for five years. The third step is to invest at least €150,000 in bonds or shares approved by the Maltese government to be kept for at least five years.

Candidates must commit to a minimum physical presence in Malta before citizenship is granted. While you get residency in two months, you can apply for citizenship after a year.

Egypt

A one-year residency permit can be bought if you purchase property in Egypt worth $100,000. A three-year residency is available for those who invest $200,000 in property, and five years for those who purchase property worth $400,000.

Source: Citizenship Invest and Aqua Properties

The Indo-Pacific

Rashmee Roshan Lall: US-India chemistry can no longer be dismissed

Brahma Chellaney: South China Sea has become Asean's Achilles heel

Brahma Chellaney: Trump's unpredictability is making China great again

The specs

Engine: 1.6-litre 4-cyl turbo

Power: 217hp at 5,750rpm

Torque: 300Nm at 1,900rpm

Transmission: eight-speed auto

Price: from Dh130,000

On sale: now

KILLING OF QASSEM SULEIMANI

National Editorial: Suleimani has been killed, now we must de-escalate

Mina Al Oraibi: Air strike casts a long shadow over the decade ahead

Jack Moore: Why the assassination is such a monumental gamble

Matthew Levitt: Iran retains its ability to launch terror attacks

Damien McElroy: A CEO tasked with spreading Iran's influence

Hussein Ibish: Trump's order on solid constitutional ground

Simon Waldman: Cautious Israel keeping a low profile

Rashmee Roshan Lall: Sound of silence in South Asia

Richard Olson: Why Afghanistan will be very wary

The Sand Castle

Director: Matty Brown

Stars: Nadine Labaki, Ziad Bakri, Zain Al Rafeea, Riman Al Rafeea

Rating: 2.5/5

FIXTURES (all times UAE)

Sunday

Brescia v Lazio (3.30pm)

SPAL v Verona (6pm)

Genoa v Sassuolo (9pm)

AS Roma v Torino (11.45pm)

Monday

Bologna v Fiorentina (3.30pm)

AC Milan v Sampdoria (6pm)

Juventus v Cagliari (6pm)

Atalanta v Parma (6pm)

Lecce v Udinese (9pm)

Napoli v Inter Milan (11.45pm)

Lexus LX700h specs

Engine: 3.4-litre twin-turbo V6 plus supplementary electric motor

Power: 464hp at 5,200rpm

Torque: 790Nm from 2,000-3,600rpm

Transmission: 10-speed auto

Fuel consumption: 11.7L/100km

On sale: Now

Price: From Dh590,000

Mohammed bin Zayed Majlis

Read more about the coronavirus

THE SPECS

Engine: 1.6-litre turbo

Transmission: six-speed automatic

Power: 165hp

Torque: 240Nm

Price: From Dh89,000 (Enjoy), Dh99,900 (Innovation)

On sale: Now

Mina Al-Oraibi: Suleimani death casts a long shadow over decade ahead

Khaled Yacoub Oweis: Hezbollah bids to control Lebanon’s financial system

National Editorial: Hezbollah's murky dealings in Iraq have been unveiled

The burning issue

The internal combustion engine is facing a watershed moment – major manufacturer Volvo is to stop producing petroleum-powered vehicles by 2021 and countries in Europe, including the UK, have vowed to ban their sale before 2040. The National takes a look at the story of one of the most successful technologies of the last 100 years and how it has impacted life in the UAE.

Read part four: an affection for classic cars lives on

Read part three: the age of the electric vehicle begins

Read part two: how climate change drove the race for an alternative

While you're here

The National editorial: Turkey's soft power weighs heavy on Europe's Muslims

Con Coughlin: How extremists use Zoom and other tools to exploit pandemic

Nicky Harley: Peace TV preacher Zakir Naik prompts UK hate laws review

The%20Genius%20of%20Their%20Age

• Remittance charges will be tackled by blockchain

• UAE's monumental and risky Mars Mission to inspire future generations, says minister

• Could the UAE drive India's economy?

• News has a bright future and the UAE is at the heart of it

• Architecture is over - here's cybertecture

• The National announces Future of News journalism competition

• Round up: Experts share their visions of the world to come

Mohammed bin Zayed Majlis

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

While you're here

Gavin Esler: Coronavirus offers stinging rebuke to protectionists

Kareem Shaheen: Pandemics can save us from waging wars

Sholto Byrnes: Why the climate change clash will get nastier

More from Rashmee Roshan Lall

What the law says

Micro-retirement is not a recognised concept or employment status under Federal Decree Law No. 33 of 2021 on the Regulation of Labour Relations (as amended) (UAE Labour Law). As such, it reflects a voluntary work-life balance practice, rather than a recognised legal employment category, according to Dilini Loku, senior associate for law firm Gateley Middle East.

“Some companies may offer formal sabbatical policies or career break programmes; however, beyond such arrangements, there is no automatic right or statutory entitlement to extended breaks,” she explains.

“Any leave taken beyond statutory entitlements, such as annual leave, is typically regarded as unpaid leave in accordance with Article 33 of the UAE Labour Law. While employees may legally take unpaid leave, such requests are subject to the employer’s discretion and require approval.”

If an employee resigns to pursue micro-retirement, the employment contract is terminated, and the employer is under no legal obligation to rehire the employee in the future unless specific contractual agreements are in place (such as return-to-work arrangements), which are generally uncommon, Ms Loku adds.

School uniforms report

On Women's Day

Dr Nawal Al-Hosany: Why more women should be on the frontlines of climate action

Shelina Janmohamed: Why shouldn't a spouse be compensated fairly for housework?

Samar Elmnhrawy: How companies in the Middle East can catch up on gender equality

The National Editorial: Is there much to celebrate on International Women's Day 2021?

• Remittance charges will be tackled by blockchain

• UAE's monumental and risky Mars Mission to inspire future generations, says minister

• Could the UAE drive India's economy?

• News has a bright future and the UAE is at the heart of it

• Architecture is over - here's cybertecture

• The National announces Future of News journalism competition

• Round up: Experts share their visions of the world to come

While you're here

The National Editorial: Fawzia Koofi's shooting reminds us who the Taliban really are

Ruchi Kumar: In Afghanistan, Taliban gives with one hand and takes away with the other

Sulaiman Hakemy: 'Afghan' is now a globalised identity, whether the Taliban likes it or not

The specs

Long read

Mageed Yahia, director of WFP in UAE: Coronavirus knows no borders, and neither should the response

Combating coronavirus

Nick March: coronavirus dark cloud could have a silver lining

Gavin Esler: coronavirus offers a stinging rebuke to protectionists

Rashmee Roshan Lall: we will learn how to be vulnerable together

KILLING OF QASSEM SULEIMANI

National Editorial: Suleimani has been killed, now we must de-escalate

Mina Al Oraibi: Air strike casts a long shadow over the decade ahead

Jack Moore: Why the assassination is such a monumental gamble

Matthew Levitt: Iran retains its ability to launch terror attacks

Damien McElroy: A CEO tasked with spreading Iran's influence

Hussein Ibish: Trump's order on solid constitutional ground

Simon Waldman: Cautious Israel keeping a low profile

Rashmee Roshan Lall: Sound of silence in South Asia

Fanar Haddad: The Iranian response will be gradual

A little about CVRL

Founded in 1985 by Sheikh Mohammed bin Rashid, Vice President and Ruler of Dubai, the Central Veterinary Research Laboratory (CVRL) is a government diagnostic centre that provides testing and research facilities to the UAE and neighbouring countries.

One of its main goals is to provide permanent treatment solutions for veterinary related diseases.

The taxidermy centre was established 12 years ago and is headed by Dr Ulrich Wernery.

On Women's Day

Dr Nawal Al-Hosany: Why more women should be on the frontlines of climate action

Shelina Janmohamed: Why shouldn't a spouse be compensated fairly for housework?

Samar Elmnhrawy: How companies in the Middle East can catch up on gender equality

Justin Thomas: Challenge the notion that 'men are from Mars, women are from Venus'

Transgender report

Plastic tipping point

Ponti

Sharlene Teo, Pan Macmillan

Transgender report

On Women's Day

Shelina Janmohamed: Why shouldn't a spouse be compensated fairly for housework?

Samar Elmnhrawy: How companies in the Middle East can catch up on gender equality

The National Editorial: Is there much to celebrate on International Women's Day 2021?

Justin Thomas: Challenge the notion that 'men are from Mars, women are from Venus'

Brief scores:

Toss: Northern Warriors, elected to field first

Bengal Tigers 130-1 (10 ov)

Roy 60 not out, Rutherford 47 not out

Northern Warriors 94-7 (10 ov)

Simmons 44; Yamin 4-4

While you're here

Joyce Karam: Chaotic first debate unlikely to swing undecideds

Hussein Ibish: Donald Trump's 3-step plan to cling to power

Sulaiman Hakemy: Make America lose again

UAE%20athletes%20heading%20to%20Paris%202024

Plastic tipping points

Jetour T1 specs

Engine: 2-litre turbocharged

Power: 254hp

Torque: 390Nm

Price: From Dh126,000

Available: Now

The National's picks

4.35pm: Tilal Al Khalediah

5.10pm: Continous

5.45pm: Raging Torrent

6.20pm: West Acre

7pm: Flood Zone

7.40pm: Straight No Chaser

8.15pm: Romantic Warrior

8.50pm: Calandogan

9.30pm: Forever Young