“Sell in May, come back in on St Ledger's Day” is the traditional behaviour of stockbrokers in London – close off your positions for the summer, head for the Med and worry about the market when you get back.

It's not as closely observed as it might once have been, but for those who did sell in May, it's nearly time to come back – St Ledger's Day is on Saturday, September 16.

What are they coming back to? Turns out the absentees have missed a lot of action; much of it could spell trouble on their return.

The central banks weren't finished with interest rises in May – rates went up at least twice in the US, the eurozone and the UK. Inflation started to come down but remained “stickily” high in Britain.

Alarm bells began ringing as the US Treasury's inverted yield curve worsened in June. A yield curve inverts when short-term bonds are paying higher interest rates than long-term bonds.

In 2006, yield curves were inverted for much of the year. Long-term Treasuries then outperformed shares in 2007. The year that followed was the stock market crash of 2008 and the start of what became known as the Great Recession.

It's not something that makes headlines every day, but in early July, when the deepest inversion since 1981 occurred, it caused a stir.

That's because inverted yield curves can point towards recessions, and this particular inversion has “been screaming recession for over a year now”, Russ Mould, investment director at AJ Bell, told The National.

Some big names in the investing world made some gloomy statements about the stock markets over the summer.

Citigroup predicted the S&P 500 would lose around 10 per cent of its value by the end of the year. Well-known Wall Street bearish voices, including Mike Wilson from Morgan Stanley and Marko Kolanvovic from JP Morgan Chase, reiterated their downbeat forecasts during July.

Share markets have done well so far this year, especially in the US. The Dow Jones Industrial Average is 4 per cent higher, while the Nasdaq has put on nearly 30 per cent.

The British billionaire investor Jeremy Grantham, who cofounded of investment management company GMO, believes bubbles are building and the likelihood of a crash is about 70 per cent.

Michael Burry, the man who made $100 million on short positions in the run-up to the 2008 subprime financial crisis, recently made a similar $1.6 billion bet against the S&P 500 and the Nasdaq in the US.

It's thought Mr Burry, who was Christian Bale portrayed in the film, The Big Short, is staking more than 90 per cent of his hedge fund’s portfolio on his prediction of a crash before the end of the year.

Metal moves

While the drama and speculation make for good headlines, analysts use many different mathematical tools to calculate possible market movements and the fortunes of economies.

The copper-gold ratio is one such tool.

As the copper-gold ratio employs the prices of two metals with very different uses, economists and market strategists use it as an indicator of possible future recessions.

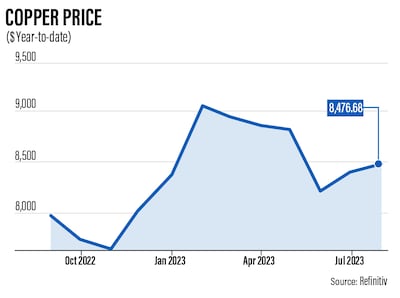

Copper is an industrial metal and serves as an indicator of global economic health. Its widespread use in construction, infrastructure and technology means that if there's a strong demand for copper, economies should be growing. Indeed, copper is often referred to as “Dr Copper” because of its ability to signify the well-being of economies.

Gold, on the other hand, is traditionally a store of value during troubled times. It's a safe haven investment that has limited use in industry. If the value of other assets is eroded by rising inflation or debt, investors are always tempted to go for gold.

As such, the relationship between the prices of copper and gold becomes an important tool for traders and a device for economists attempting to predict future economic fortunes.

“A study of the copper-to-gold ratio could therefore be informative,” said Russ Mould, investment director at AJ Bell.

“If copper does better, this may be the markets’ way of saying that the good times might be ready to keep rolling.

“If the precious metal outperforms the industrial one, that could be an indicator that something bad is going to happen – an inflationary outbreak or a recession [or even both at the same time, in the worst of all worlds, and a return to the stagflation of the 1970s].”

So, as the price of gold rises and that of copper falls, the copper-gold ratio declines and vice versa.

If the price of copper rises and the price of gold plunges, the ratio will move well above one standard deviation from the 30-year average, denoting a growing economy. In reverse, it can point to a recession.

“I think it is useful to gauge economic momentum, that is when the ratio is rising, it is generally associated with rising economic activity since copper is a proxy for industrial commodity demand,” Janet Mui, head of market analysis at RBC Brewin Dolphin, told The National.

“Plotting against other indicators, it can be useful in seeing whether there is divergence/deviation between the ratio and other market indicators, such as bond yields.”

However, market strategists and economists have many tools when it comes to analysis. The copper-gold ratio is just one. Its usefulness waxes and wanes in relation to other indicators and specific developments.

“Nothing's going to be perfect, right?” Mr Mould told The National. “Because if it was that easy, we'd all be sat at home or on the beach, wouldn't we?

“People are always looking for this sort of pointer, and previously reliable mechanisms like an inverted US yield curve, which has been screaming recession for well over a year, currently aren't working.

“But we all have to bend ultimately to the adage that the past is no currency for the future, but it generally has been in the past as a reliable indicator.”

Ms Mui agrees that, as will all analytical tools, the copper-gold ratio is not a perfect predictor of recessions.

“For example, the ratio was above 10 when the 2008 recession started,” she told The National.

“There have been several occasions when the ratio fell below one standard deviation of the 30-year average, but there was no recession.”

China worries

Also, copper prices can be quite volatile as demand can be both structural and cyclical. China's quest to build more cities in recent decades has been one of the main pillars of copper price support, but that looked somewhat shaky given a deflating bubble in the country's property sector.

Recent analysis from S&P shows that more than 50 Chinese property development firms have defaulted on their debts in the last three years.

However, the energy transition to net zero is sparking up new demand for the metal as the production of electric cars provides just one example of the use of copper in a post-fossil fuel world.

The energy transition was a large factor when Europe's largest copper producer, Aurubis, restated a strong profit forecast this year after posting a 20 per cent rise in quarterly earnings last week.

This has created a debate in the market over which way the copper price will move next.

Golden future?

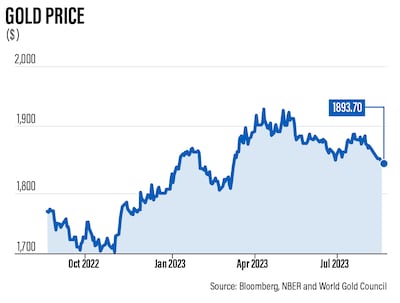

Gold prices are also struggling to find direction at the moment. The precious metal had a solid first half, rising by 5.4 per cent.

But if, as some predict, the world's major central banks switch from tightening monetary policy to keeping interest rates on hold, the upside to gold prices may be limited.

“Despite signs of cooling inflation, the combination of stock market volatility and ‘event risk’ [such as geopolitical or financial crisis] is likely to keep hedging strategies, including gold, in place,” the World Gold Council said recently.

If nothing else, the copper-gold ratio illustrates the risk of relying on one particular indicator as a forecaster of future events.

Starting blocks or precipice?

However, there is some consensus that it may be an eventful Autumn. There are conflicting views on which direction events and metrics will take markets and economies.

Kevin O'Leary, the Canadian businessman and star of the TV show Shark Tank, feels Michael Burry's bet against the S&P 500 and the Nasdaq is “very risky”.

Many economists still see a soft landing for the US economy as a distinct possibility, given that many indicators are pointing that way. The Federal Reserve also appears close to the peak of its tightening cycle.

Nonetheless, because interest rate rises take between six to 18 months to take effect, exactly how much the US economy will be affected by several interest rate rises remains to be seen.

Back in May, a survey of investment firms by Bloomberg put a target level of 4,000 on the S&P 500 by the end of the year. That's now been raised to 4,300.

For Mr Mould at AJ Bell, there are risks – US equities look overvalued. Due to their sheer size and clout, the handful of big tech shares – known as the Magnificent Seven (Microsoft, Apple, Amazon, Google parent Alphabet, Tesla, Nvidia and Meta) – exert significant influence over market indices.

“I think those things do naturally make you nervous, but they've made me nervous a year ago and a year before that,” he told The National.

“Ultimately, you rely on the old saying that if something can't go on forever, it will eventually stop, but nobody knows when.”

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Clinicy%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202017%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Prince%20Mohammed%20Bin%20Abdulrahman%2C%20Abdullah%20bin%20Sulaiman%20Alobaid%20and%20Saud%20bin%20Sulaiman%20Alobaid%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Riyadh%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%3C%2Fstrong%3E%2025%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20HealthTech%3Cbr%3E%3Cstrong%3ETotal%20funding%20raised%3A%3C%2Fstrong%3E%20More%20than%20%2410%20million%3Cbr%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20Middle%20East%20Venture%20Partners%2C%20Gate%20Capital%2C%20Kafou%20Group%20and%20Fadeed%20Investment%3C%2Fp%3E%0A

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

Cinco in numbers

Dh3.7 million

The estimated cost of Victoria Swarovski’s gem-encrusted Michael Cinco wedding gown

46

The number, in kilograms, that Swarovski’s wedding gown weighed.

1,000

The hours it took to create Cinco’s vermillion petal gown, as seen in his atelier [note, is the one he’s playing with in the corner of a room]

50

How many looks Cinco has created in a new collection to celebrate Ballet Philippines’ 50th birthday

3,000

The hours needed to create the butterfly gown worn by Aishwarya Rai to the 2018 Cannes Film Festival.

1.1 million

The number of followers that Michael Cinco’s Instagram account has garnered.

How Beautiful this world is!

The smuggler

Eldarir had arrived at JFK in January 2020 with three suitcases, containing goods he valued at $300, when he was directed to a search area.

Officers found 41 gold artefacts among the bags, including amulets from a funerary set which prepared the deceased for the afterlife.

Also found was a cartouche of a Ptolemaic king on a relief that was originally part of a royal building or temple.

The largest single group of items found in Eldarir’s cases were 400 shabtis, or figurines.

Khouli conviction

Khouli smuggled items into the US by making false declarations to customs about the country of origin and value of the items.

According to Immigration and Customs Enforcement, he provided “false provenances which stated that [two] Egyptian antiquities were part of a collection assembled by Khouli's father in Israel in the 1960s” when in fact “Khouli acquired the Egyptian antiquities from other dealers”.

He was sentenced to one year of probation, six months of home confinement and 200 hours of community service in 2012 after admitting buying and smuggling Egyptian antiquities, including coffins, funerary boats and limestone figures.

For sale

A number of other items said to come from the collection of Ezeldeen Taha Eldarir are currently or recently for sale.

Their provenance is described in near identical terms as the British Museum shabti: bought from Salahaddin Sirmali, "authenticated and appraised" by Hossen Rashed, then imported to the US in 1948.

- An Egyptian Mummy mask dating from 700BC-30BC, is on offer for £11,807 ($15,275) online by a seller in Mexico

- A coffin lid dating back to 664BC-332BC was offered for sale by a Colorado-based art dealer, with a starting price of $65,000

- A shabti that was on sale through a Chicago-based coin dealer, dating from 1567BC-1085BC, is up for $1,950

In numbers

1,000 tonnes of waste collected daily:

- 800 tonnes converted into alternative fuel

- 150 tonnes to landfill

- 50 tonnes sold as scrap metal

800 tonnes of RDF replaces 500 tonnes of coal

Two conveyor lines treat more than 350,000 tonnes of waste per year

25 staff on site

UAE currency: the story behind the money in your pockets

The%C2%A0specs%20

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E4.4-litre%2C%20twin-turbo%20V8%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3Eeight-speed%20auto%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E617hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E750Nm%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3Efrom%20Dh630%2C000%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3Enow%3C%2Fp%3E%0A

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Alaan%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202021%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Parthi%20Duraisamy%20and%20Karun%20Kurien%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20FinTech%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20%247%20million%20raised%20in%20total%20%E2%80%94%20%242.5%20million%20in%20a%20seed%20round%20and%20%244.5%20million%20in%20a%20pre-series%20A%20round%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

Profile of Udrive

Date started: March 2016

Founder: Hasib Khan

Based: Dubai

Employees: 40

Amount raised (to date): $3.25m – $750,000 seed funding in 2017 and a Seed round of $2.5m last year. Raised $1.3m from Eureeca investors in January 2021 as part of a Series A round with a $5m target.

HOW TO WATCH

Facebook: TheNationalNews

Twitter: @thenationalnews

Instagram: @thenationalnews.com

TikTok: @thenationalnews

UAE currency: the story behind the money in your pockets

COMPANY PROFILE

Name: Kumulus Water

Started: 2021

Founders: Iheb Triki and Mohamed Ali Abid

Based: Tunisia

Sector: Water technology

Number of staff: 22

Investment raised: $4 million

White hydrogen: Naturally occurring hydrogen

Chromite: Hard, metallic mineral containing iron oxide and chromium oxide

Ultramafic rocks: Dark-coloured rocks rich in magnesium or iron with very low silica content

Ophiolite: A section of the earth’s crust, which is oceanic in nature that has since been uplifted and exposed on land

Olivine: A commonly occurring magnesium iron silicate mineral that derives its name for its olive-green yellow-green colour

What are the GCSE grade equivalents?

- Grade 9 = above an A*

- Grade 8 = between grades A* and A

- Grade 7 = grade A

- Grade 6 = just above a grade B

- Grade 5 = between grades B and C

- Grade 4 = grade C

- Grade 3 = between grades D and E

- Grade 2 = between grades E and F

- Grade 1 = between grades F and G

Labour dispute

The insured employee may still file an ILOE claim even if a labour dispute is ongoing post termination, but the insurer may suspend or reject payment, until the courts resolve the dispute, especially if the reason for termination is contested. The outcome of the labour court proceedings can directly affect eligibility.

- Abdullah Ishnaneh, Partner, BSA Law

Our legal consultants

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

if you go

The flights

Air Astana flies direct from Dubai to Almaty from Dh2,440 per person return, and to Astana (via Almaty) from Dh2,930 return, both including taxes.

The hotels

Rooms at the Ritz-Carlton Almaty cost from Dh1,944 per night including taxes; and in Astana the new Ritz-Carlton Astana (www.marriott) costs from Dh1,325; alternatively, the new St Regis Astana costs from Dh1,458 per night including taxes.

When to visit

March-May and September-November

Visas

Citizens of many countries, including the UAE do not need a visa to enter Kazakhstan for up to 30 days. Contact the nearest Kazakhstan embassy or consulate.

The specs

Engine: Two permanent-magnet synchronous AC motors

Transmission: two-speed

Power: 671hp

Torque: 849Nm

Range: 456km

Price: from Dh437,900

On sale: now

SECRET%20INVASION

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Ali%20Selim%20%3Cbr%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Samuel%20L%20Jackson%2C%20Olivia%20Coleman%2C%20Kingsley%20Ben-Adir%2C%20Emilia%20Clarke%20%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%203%2F5%26nbsp%3B%3C%2Fp%3E%0A

Women’s World T20, Asia Qualifier

UAE results

Beat China by 16 runs

Lost to Thailand by 10 wickets

Beat Nepal by five runs

Beat Hong Kong by eight wickets

Beat Malaysia by 34 runs

Standings (P, W, l, NR, points)

1. Thailand 5 4 0 1 9

2. UAE 5 4 1 0 8

3. Nepal 5 2 1 2 6

4. Hong Kong 5 2 2 1 5

5. Malaysia 5 1 4 0 2

6. China 5 0 5 0 0

Final

Thailand v UAE, Monday, 7am

AndhaDhun

Director: Sriram Raghavan

Producer: Matchbox Pictures, Viacom18

Cast: Ayushmann Khurrana, Tabu, Radhika Apte, Anil Dhawan

Rating: 3.5/5

All%20We%20Imagine%20as%20Light

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EPayal%20Kapadia%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%20Kani%20Kusruti%2C%20Divya%20Prabha%2C%20Chhaya%20Kadam%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

The specs: 2018 Infiniti QX80

Price: base / as tested: Dh335,000

Engine: 5.6-litre V8

Gearbox: Seven-speed automatic

Power: 400hp @ 5,800rpm

Torque: 560Nm @ 4,000rpm

Fuel economy, combined: 12.1L / 100km

New UK refugee system

- A new “core protection” for refugees moving from permanent to a more basic, temporary protection

- Shortened leave to remain - refugees will receive 30 months instead of five years

- A longer path to settlement with no indefinite settled status until a refugee has spent 20 years in Britain

- To encourage refugees to integrate the government will encourage them to out of the core protection route wherever possible.

- Under core protection there will be no automatic right to family reunion

- Refugees will have a reduced right to public funds

The specs: Macan Turbo

Engine: Dual synchronous electric motors

Power: 639hp

Torque: 1,130Nm

Transmission: Single-speed automatic

Touring range: 591km

Price: From Dh412,500

On sale: Deliveries start in October

The specs

BMW M8 Competition Coupe

Engine 4.4-litre twin-turbo V8

Power 625hp at 6,000rpm

Torque 750Nm from 1,800-5,800rpm

Gearbox Eight-speed paddleshift auto

Acceleration 0-100kph in 3.2 sec

Top speed 305kph

Fuel economy, combined 10.6L / 100km

Price from Dh700,000 (estimate)

On sale Jan/Feb 2020

Tips to keep your car cool

- Place a sun reflector in your windshield when not driving

- Park in shaded or covered areas

- Add tint to windows

- Wrap your car to change the exterior colour

- Pick light interiors - choose colours such as beige and cream for seats and dashboard furniture

- Avoid leather interiors as these absorb more heat

India Test squad

Virat Kohli (c), Mayank Agarwal, Rohit Sharma, Cheteshwar Pujara, Ajinkya Rahane, Hanuma Vihari, Rishabh Pant (wk), Wriddhiman Saha (wk), Ravichandran Ashwin, Ravindra Jadeja, Kuldeep Yadav, Mohammed Shami, Umesh Yadav, Ishant Sharma, Shubman Gill

MATCH INFO

Manchester City 6 Huddersfield Town 1

Man City: Agüero (25', 35', 75'), Jesus (31'), Silva (48'), Kongolo (84' og)

Huddersfield: Stankovic (43')

UAE - India ties

The UAE is India’s third-largest trade partner after the US and China

Annual bilateral trade between India and the UAE has crossed US$ 60 billion

The UAE is the fourth-largest exporter of crude oil for India

Indians comprise the largest community with 3.3 million residents in the UAE

Indian Prime Minister Narendra Modi first visited the UAE in August 2015

His visit on August 23-24 will be the third in four years

Sheikh Mohamed bin Zayed, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the Armed Forces, visited India in February 2016

Sheikh Mohamed was the chief guest at India’s Republic Day celebrations in January 2017

Modi will visit Bahrain on August 24-25