Iraqi militia leader Hadi Al Ameri withdrew his candidacy for prime minister on Tuesday, leaving space for new candidates to take the nation's top political post.

The decision is expected to cause further delays to negotiations over the formation of a government that have already lasted four months since elections in May.

Mr Al Ameri, a prominent but controversial Shiite militia commander, heads the Fatih coalition bloc which came in second in May’s parliamentary elections. It has been vying to build the largest bloc which would form the government with him as prime minister.

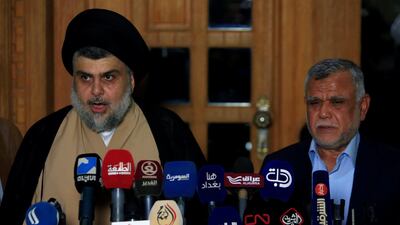

“I would like to announce to the dear Iraqi people the withdrawal of my candidacy for prime minister, to open the way for serious dialogue to elect a prime minister and his government according to the vision of the Supreme religious authority,” he said during a press conference.

The Shiite leader's coalition is composed of political groups tied to Iran-backed militias who assisted Iraqi security forces in their battle against ISIS.

Mr Al Ameri's Badr Organisation, a political umbrella group of Shiite militias, controls the country's interior ministry.

His Fatih alliance has been in advanced talks with Shiite cleric Moqtada Al Sadr to form a new government coalition in recent days.

Mr Al Sadr, whose Sairoon bloc scored a surprising victory in the elections, portrays himself as a fierce nationalist opposed to both US and Iranian interference in Iraq. He has formed an alliance with incumbent Prime Minister Haider Al Abadi since June, which now looks set to falter after the cleric announced he will form an alliance with Mr Al Ameri.

_________

Read more:

Iraqi PM Abadi weakened as Sistani appears to withdraw support

Iraqi PM Haider Al Abadi faces calls to quit over deadly violence in Basra

US calls for 'moderate, nationalist' government ahead of Iraqi parliament opening

_________

In recent days, Mr Al Abadi acknowledged that his days in office as limited, saying he “would not cling to power”.

The premier was credited with defeating ISIS and was expected to easily gain a second term in May’s parliamentary elections, in which he had the backing of the US and other Western states.

But, today, he stands alone. His Victory coalition has unraveled and his political partners are abandoning him for alliances with blocs loyal to Iran. He is still in office due to his opponents' failure to agree on the formation of a government.

Mr Al Abadi was unable to play legislative politics and wasn't able to gain influence over the judiciary of his opponents, Renad Mansour, senior research fellow at Chatham House, told The National.

"Although to some he may have said the right thing, he couldn’t really build a strong base and he couldn’t play politics among the different factions and because of that he quickly lost favour," Mr Mansour said.

The premier never really competed as a politician for a second term. If he had received a strong parliamentary result for his bloc, he might have been more inspired in his bid for reappointment, Michael Knights, senior fellow at The Washington Institute for Near East Policy, said.

“But he instead sat back, ran the country and waited for others to put him on the throne again, as in 2014. Mr Abadi never sought the role in 2014 and he didn't really try to get it this time either,” Mr Knights said.

A source in Baghdad who requested anonymity said an initial agreement has been made between the dominant ruling Shiite groups to nominate former oil minister Adel Abdul Mehdi for the premier's position.

Mr Abdul Mehdi is known to have good relations with Sunni, Shiite and Kurdish parties in government.

The politician appears to meet the most important requirement of the top position: an ability to achieve consensus between the Shiite, Sunni and Kurdish parties. He also is required to maintain good relations with both the US and Iran.

Other potential candidates are the governor of Basra, Asaad Al Eidani, and Abdul Wahab Al Saadi, a commander of the Iraqi Counter-Terrorism Service, an elite faction of the military that battled ISIS throughout its three-year occupation.

'Cheb%20Khaled'

%3Cp%3E%3Cstrong%3EArtist%3A%20%3C%2Fstrong%3EKhaled%3Cbr%3E%3Cstrong%3ELabel%3A%20%3C%2Fstrong%3EBelieve%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

Key facilities

- Olympic-size swimming pool with a split bulkhead for multi-use configurations, including water polo and 50m/25m training lanes

- Premier League-standard football pitch

- 400m Olympic running track

- NBA-spec basketball court with auditorium

- 600-seat auditorium

- Spaces for historical and cultural exploration

- An elevated football field that doubles as a helipad

- Specialist robotics and science laboratories

- AR and VR-enabled learning centres

- Disruption Lab and Research Centre for developing entrepreneurial skills

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

BULKWHIZ PROFILE

Date started: February 2017

Founders: Amira Rashad (CEO), Yusuf Saber (CTO), Mahmoud Sayedahmed (adviser), Reda Bouraoui (adviser)

Based: Dubai, UAE

Sector: E-commerce

Size: 50 employees

Funding: approximately $6m

Investors: Beco Capital, Enabling Future and Wain in the UAE; China's MSA Capital; 500 Startups; Faith Capital and Savour Ventures in Kuwait

Calls

Directed by: Fede Alvarez

Starring: Pedro Pascal, Karen Gillian, Aaron Taylor-Johnson

4/5

Ferrari 12Cilindri specs

Engine: naturally aspirated 6.5-liter V12

Power: 819hp

Torque: 678Nm at 7,250rpm

Price: From Dh1,700,000

Available: Now

UAE currency: the story behind the money in your pockets

Benefits of first-time home buyers' scheme

- Priority access to new homes from participating developers

- Discounts on sales price of off-plan units

- Flexible payment plans from developers

- Mortgages with better interest rates, faster approval times and reduced fees

- DLD registration fee can be paid through banks or credit cards at zero interest rates

Labour dispute

The insured employee may still file an ILOE claim even if a labour dispute is ongoing post termination, but the insurer may suspend or reject payment, until the courts resolve the dispute, especially if the reason for termination is contested. The outcome of the labour court proceedings can directly affect eligibility.

- Abdullah Ishnaneh, Partner, BSA Law

The%20Boy%20and%20the%20Heron

%3Cp%3E%3Cstrong%3EDirector%3A%C2%A0%3C%2Fstrong%3EHayao%20Miyazaki%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%C2%A0Soma%20Santoki%2C%20Masaki%20Suda%2C%20Ko%20Shibasaki%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E5%2F5%3C%2Fp%3E%0A