Bells tolled in Hiroshima on Thursday for the 75th anniversary of the world's first atomic bombing, with ceremonies downsized due to the coronavirus and the city's mayor urging nations to reject selfish nationalism and unite to fight all threats.

Though thousands usually pack the Peace Park in the centre of the Japanese city to pray, sing and offer paper cranes as a symbol of peace, entrance was sharply limited and only survivors and their families could attend the memorial ceremony.

The city said the significance of the anniversary of the bombing that killed 140,000 people before the end of 1945 had prompted its decision to hold the ceremony despite the spread of the virus, but taking strict precautions.

"On August 6, 1945, a single atomic bomb destroyed our city. Rumor at the time had it that 'Nothing will grow here for 75 years,'" said mayor Kazumi Matsui.

"And yet, Hiroshima recovered, becoming a symbol of peace."

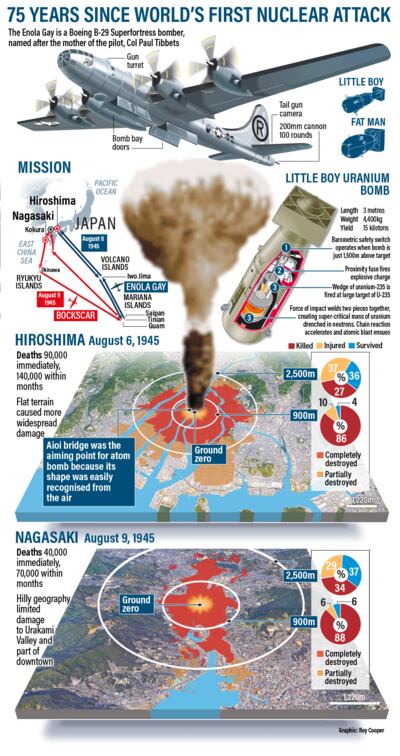

At 8.15am on August 6, 1945, U.S. B-29 warplane Enola Gay dropped a bomb nicknamed "Little Boy" and obliterated the city with an estimated population of 350,000, where thousands more died later from injuries and radiation-related illnesses.

On Thursday, as cicadas shrilled in the heavy summer heat and the Peace Bell sounded, the crowd stood to observe a moment of silence at the exact time the bomb exploded.

"When the 1918 flu pandemic attacked a century ago, it took tens of millions of lives and terrorised the world because nations fighting World War I were unable to meet the threat together," Matsui added.

"A subsequent upsurge in nationalism led to World War Two and the atomic bombings. We must never allow this painful past to repeat itself. Civil society must reject self-centered nationalism and unite against all threats."

Prime Minister Shinzo Abe attended as usual, but the number of foreign visitors was down. Overall attendance was scaled back to less than a tenth of the usual figure, with chairs spaced far apart and most people wearing masks.

Matsui urged Japan to ratify a 2017 United Nations pact banning nuclear arms, but Abe avoided any direct reference, saying Japan would "work as a bridge between nations" to abolish nuclear weapons.

Keiko Ogura, who was eight when the bomb blast knocked her off her feet, has dedicated her life to working for peace.

"The nuclear danger is spreading around the world, and under that mushroom cloud, no one can escape," she told a recent news conference.

The anniversary was a top trending topic on Japanese Twitter as most users offered prayers for world peace, although one drew a parallel with this week's huge blast that killed at least 135 in Beirut, the Lebanese capital.

"I really hadn't been able to imagine it before, but looking at the damage from the Beirut explosion and imagining something several times more powerful, I was struck with a huge sense of fear," wrote the commenter, identified as "Sato-san."

The bombing of Hiroshima was followed by the bombing of Nagasaki on Aug. 9, instantly killing more than 75,000 people. Japan surrendered six days later, ending World War Two.

The specs

AT4 Ultimate, as tested

Engine: 6.2-litre V8

Power: 420hp

Torque: 623Nm

Transmission: 10-speed automatic

Price: From Dh330,800 (Elevation: Dh236,400; AT4: Dh286,800; Denali: Dh345,800)

On sale: Now

Dubai Bling season three

Cast: Loujain Adada, Zeina Khoury, Farhana Bodi, Ebraheem Al Samadi, Mona Kattan, and couples Safa & Fahad Siddiqui and DJ Bliss & Danya Mohammed

Rating: 1/5

Springsteen: Deliver Me from Nowhere

Director: Scott Cooper

Starring: Jeremy Allen White, Odessa Young, Jeremy Strong

Rating: 4/5

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

Lexus LX700h specs

Engine: 3.4-litre twin-turbo V6 plus supplementary electric motor

Power: 464hp at 5,200rpm

Torque: 790Nm from 2,000-3,600rpm

Transmission: 10-speed auto

Fuel consumption: 11.7L/100km

On sale: Now

Price: From Dh590,000

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

More on animal trafficking

Paris%20Agreement

%3Cp%3EArticle%2014%3C%2Fp%3E%0A%3Cp%3E1.%20%5BThe%20Cop%5D%20shall%20periodically%20take%20stock%20of%20the%20implementation%20of%20this%20Agreement%20to%20assess%20the%20collective%20progress%20towards%20achieving%20the%20purpose%20of%20this%20Agreement%20and%20its%20long-term%20goals%20(referred%20to%20as%20the%20%22global%20stocktake%22)%3C%2Fp%3E%0A%3Cp%3E2.%20%5BThe%20Cop%5D%20shall%20undertake%20its%20first%20global%20stocktake%20in%202023%20and%20every%20five%20years%20thereafter%C2%A0%3C%2Fp%3E%0A

UAE currency: the story behind the money in your pockets

What is the definition of an SME?

SMEs in the UAE are defined by the number of employees, annual turnover and sector. For example, a “small company” in the services industry has six to 50 employees with a turnover of more than Dh2 million up to Dh20m, while in the manufacturing industry the requirements are 10 to 100 employees with a turnover of more than Dh3m up to Dh50m, according to Dubai SME, an agency of the Department of Economic Development.

A “medium-sized company” can either have staff of 51 to 200 employees or 101 to 250 employees, and a turnover less than or equal to Dh200m or Dh250m, again depending on whether the business is in the trading, manufacturing or services sectors.

UAE currency: the story behind the money in your pockets

Company profile

Company name: Nestrom

Started: 2017

Co-founders: Yousef Wadi, Kanaan Manasrah and Shadi Shalabi

Based: Jordan

Sector: Technology

Initial investment: Close to $100,000

Investors: Propeller, 500 Startups, Wamda Capital, Agrimatico, Techstars and some angel investors

KILLING OF QASSEM SULEIMANI