Today, life in the Emirates moves in the fast lane. In a regular series to mark the 50th anniversary of the UAE we take a little trip back in time to see just how much the country has changed.

Visiting the area today, it is hard to tell that this was once the commercial heart of old Abu Dhabi.

The district behind the Corniche, south of Khalifa bin Zayed Street and between Al Lulu Street and Sheikh Rashid bin Saaed Street (Airport Road), was the city's original souq.

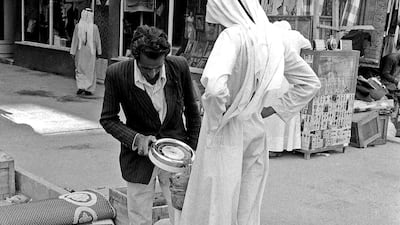

It was a haphazard warren of barasti and coral stone stalls. Its origins are lost in the mists of time, or at least the 19th century.

In the beginning, mostly fish, vegetables and dried goods were sold.

The influx of oil money in the late 1950s led to the introduction of exotic goods such as Heinz baked beans, tinned peaches and Wrigley's chewing gum.

Ambitious plans by Sheikh Zayed, the UAE's Founding Father, for a new modern city in the late 1960s led to the old souq being swept away, along with the Brahman cattle that once roved the stalls and a dusty path that led directly to Qasr Al Hosn.

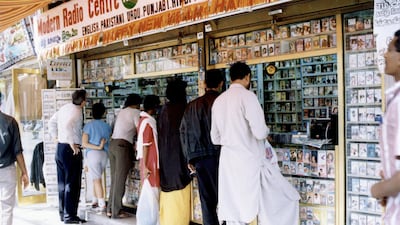

It was replaced with a concrete version, covering the old site but much expanded. The 1970s souq extended up to Hamdan Street, bisected by Khalifa bin Zayed Street, which was crossed by a pedestrian walkway.

Particularly popular with the city's growing South Asian population, this second souq did not age well, and a fire in 2003 that gutted large sections prompted a decision to knock it down.

It was eventually replaced in 2010 by a complex that includes the World Trade Centre mall and souq, which covers the original footprint. Many of the traders from the 1970s souq still conduct business on the streets around the area.

The older of these photographs shows the second souq and the bridge over Khalifa bin Zayed Street, which has also since been replaced.

It was taken from the large roundabout on Airport Road next to Etihad Square, which has a history of its own, being the site of the Al Fahim Mosque that dated back to the 1940s.

Commissioned by Mohammed Abdul Jalil Al Fahim, of the famous Abu Dhabi business dynasty, its numerous turrets and minarets made it popular with photographers, until it, too, fell to the sands of time. Trading on this spot, then, has been conducted for three centuries.

Today shoppers browse in air-conditioned comfort, with everything on offer from cupcakes to women's lingerie.

There is a Spinneys at the mall and a Lulu hypermarket at the adjacent Central Market.

Customers of the old souq, more accustomed to rice and dried fish, would surely be much impressed at the selection on offer today.

The Gentlemen

Director: Guy Ritchie

Stars: Colin Farrell, Hugh Grant

Three out of five stars

INVESTMENT PLEDGES

Cartlow: $13.4m

Rabbitmart: $14m

Smileneo: $5.8m

Soum: $4m

imVentures: $100m

Plug and Play: $25m

How much do leading UAE’s UK curriculum schools charge for Year 6?

- Nord Anglia International School (Dubai) – Dh85,032

- Kings School Al Barsha (Dubai) – Dh71,905

- Brighton College Abu Dhabi - Dh68,560

- Jumeirah English Speaking School (Dubai) – Dh59,728

- Gems Wellington International School – Dubai Branch – Dh58,488

- The British School Al Khubairat (Abu Dhabi) - Dh54,170

- Dubai English Speaking School – Dh51,269

*Annual tuition fees covering the 2024/2025 academic year

UAE currency: the story behind the money in your pockets

ANATOMY%20OF%20A%20FALL

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EJustine%20Triet%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%20%3C%2Fstrong%3ESandra%20Huller%2C%20Swann%20Arlaud%2C%20Milo%20Machado-Graner%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%205%2F5%3C%2Fp%3E%0A

Director: Laxman Utekar

Cast: Vicky Kaushal, Akshaye Khanna, Diana Penty, Vineet Kumar Singh, Rashmika Mandanna

Rating: 1/5

hall of shame

SUNDERLAND 2002-03

No one has ended a Premier League season quite like Sunderland. They lost each of their final 15 games, taking no points after January. They ended up with 19 in total, sacking managers Peter Reid and Howard Wilkinson and losing 3-1 to Charlton when they scored three own goals in eight minutes.

SUNDERLAND 2005-06

Until Derby came along, Sunderland’s total of 15 points was the Premier League’s record low. They made it until May and their final home game before winning at the Stadium of Light while they lost a joint record 29 of their 38 league games.

HUDDERSFIELD 2018-19

Joined Derby as the only team to be relegated in March. No striker scored until January, while only two players got more assists than goalkeeper Jonas Lossl. The mid-season appointment Jan Siewert was to end his time as Huddersfield manager with a 5.3 per cent win rate.

ASTON VILLA 2015-16

Perhaps the most inexplicably bad season, considering they signed Idrissa Gueye and Adama Traore and still only got 17 points. Villa won their first league game, but none of the next 19. They ended an abominable campaign by taking one point from the last 39 available.

FULHAM 2018-19

Terrible in different ways. Fulham’s total of 26 points is not among the lowest ever but they contrived to get relegated after spending over £100 million (Dh457m) in the transfer market. Much of it went on defenders but they only kept two clean sheets in their first 33 games.

LA LIGA: Sporting Gijon, 13 points in 1997-98.

BUNDESLIGA: Tasmania Berlin, 10 points in 1965-66

Dengue%20fever%20symptoms

%3Cul%3E%0A%3Cli%3EHigh%20fever%3C%2Fli%3E%0A%3Cli%3EIntense%20pain%20behind%20your%20eyes%3C%2Fli%3E%0A%3Cli%3ESevere%20headache%3C%2Fli%3E%0A%3Cli%3EMuscle%20and%20joint%20pains%3C%2Fli%3E%0A%3Cli%3ENausea%3C%2Fli%3E%0A%3Cli%3EVomiting%3C%2Fli%3E%0A%3Cli%3ESwollen%20glands%3C%2Fli%3E%0A%3Cli%3ERash%3C%2Fli%3E%0A%3C%2Ful%3E%0A%3Cp%3EIf%20symptoms%20occur%2C%20they%20usually%20last%20for%20two-seven%20days%3C%2Fp%3E%0A

ENGLAND WORLD CUP SQUAD

Eoin Morgan (captain), Moeen Ali, Jonny Bairstow, Jos Buttler (wicketkeeper), Tom Curran, Joe Denly, Alex Hales, Liam Plunkett, Adil Rashid, Joe Root, Jason Roy, Ben Stokes, David Willey, Chris Woakes, Mark Wood

FIVE%20TRENDS%20THAT%20WILL%20SHAPE%20UAE%20BANKING

%3Cp%3E%E2%80%A2%20The%20digitisation%20of%20financial%20services%20will%20continue%3C%2Fp%3E%0A%3Cp%3E%E2%80%A2%20Managing%20and%20using%20data%20effectively%20will%20become%20a%20competitive%20advantage%3C%2Fp%3E%0A%3Cp%3E%E2%80%A2%20Digitisation%20will%20require%20continued%20adjustment%20of%20operating%20models%3C%2Fp%3E%0A%3Cp%3E%E2%80%A2%20Banks%20will%20expand%20their%20role%20in%20the%20customer%20life%20through%20ecosystems%3C%2Fp%3E%0A%3Cp%3E%E2%80%A2%20The%20structure%20of%20the%20sector%20will%20change%3C%2Fp%3E%0A

Dhadak 2

Director: Shazia Iqbal

Starring: Siddhant Chaturvedi, Triptii Dimri

Rating: 1/5

UAE currency: the story behind the money in your pockets

Abaya trends

The utilitarian robe held dear by Arab women is undergoing a change that reveals it as an elegant and graceful garment available in a range of colours and fabrics, while retaining its traditional appeal.

MATCH INFO

Day 1 at Mount Maunganui

England 241-4

Denly 74, Stokes 67 not out, De Grandhomme 2-28

New Zealand

Yet to bat

Match info

Premier League

Manchester United 2 (Martial 30', Lingard 69')

Arsenal 2 (Mustafi 26', Rojo 68' OG)

Joker: Folie a Deux

Starring: Joaquin Phoenix, Lady Gaga, Brendan Gleeson

Director: Todd Phillips

Rating: 2/5

2024%20Dubai%20Marathon%20Results

%3Cp%3E%3Cstrong%3EWomen%E2%80%99s%20race%3A%3C%2Fstrong%3E%0D%3Cbr%3E1.%20Tigist%20Ketema%20(ETH)%202hrs%2016min%207sec%0D%3Cbr%3E2.%20Ruti%20Aga%20(ETH)%202%3A18%3A09%0D%3Cbr%3E3.%20Dera%20Dida%20(ETH)%202%3A19%3A29%0D%3Cbr%3EMen's%20race%3A%0D%3Cbr%3E1.%20Addisu%20Gobena%20(ETH)%202%3A05%3A01%0D%3Cbr%3E2.%20Lemi%20Dumicha%20(ETH)%202%3A05%3A20%0D%3Cbr%3E3.%20DejeneMegersa%20(ETH)%202%3A05%3A42%3C%2Fp%3E%0A

Jeff Buckley: From Hallelujah To The Last Goodbye

By Dave Lory with Jim Irvin

Living in...

This article is part of a guide on where to live in the UAE. Our reporters will profile some of the country’s most desirable districts, provide an estimate of rental prices and introduce you to some of the residents who call each area home.

Wicked: For Good

Director: Jon M Chu

Starring: Ariana Grande, Cynthia Erivo, Jonathan Bailey, Jeff Goldblum, Michelle Yeoh, Ethan Slater

Rating: 4/5

Racecard

6pm: Al Maktoum Challenge Round 2 Group 1 (PA) $55,000 (Dirt) 1,900m

6.35pm: Oud Metha Stakes Rated Conditions (TB) $60,000 (D) 1,200m

7.10pm: Jumeirah Classic Listed (TB) $150,000 (Turf) 1,600m

7.45pm: Firebreak Stakes Group 3 (TB) $150,000 (D) 1,600m

8.20pm: Al Maktoum Challenge Round 2 Group 2 (TB) $350,000 (D) 1,900m

8.55pm: Al Bastakiya Trial Conditions (TB) $60,000 (D) 1,900m

9.30pm: Balanchine Group 2 (TB) $180,000 (T) 1,800m

Student Of The Year 2

Director: Punit Malhotra

Stars: Tiger Shroff, Tara Sutaria, Ananya Pandey, Aditya Seal

1.5 stars

In-demand jobs and monthly salaries

- Technology expert in robotics and automation: Dh20,000 to Dh40,000

- Energy engineer: Dh25,000 to Dh30,000

- Production engineer: Dh30,000 to Dh40,000

- Data-driven supply chain management professional: Dh30,000 to Dh50,000

- HR leader: Dh40,000 to Dh60,000

- Engineering leader: Dh30,000 to Dh55,000

- Project manager: Dh55,000 to Dh65,000

- Senior reservoir engineer: Dh40,000 to Dh55,000

- Senior drilling engineer: Dh38,000 to Dh46,000

- Senior process engineer: Dh28,000 to Dh38,000

- Senior maintenance engineer: Dh22,000 to Dh34,000

- Field engineer: Dh6,500 to Dh7,500

- Field supervisor: Dh9,000 to Dh12,000

- Field operator: Dh5,000 to Dh7,000

German plea

Ukrainian President Volodymyr Zelenskyy told the German parliament that. Russia had erected a new wall across Europe.

"It's not a Berlin Wall -- it is a Wall in central Europe between freedom and bondage and this Wall is growing bigger with every bomb" dropped on Ukraine, Zelenskyy told MPs.

Mr Zelenskyy was applauded by MPs in the Bundestag as he addressed Chancellor Olaf Scholz directly.

"Dear Mr Scholz, tear down this Wall," he said, evoking US President Ronald Reagan's 1987 appeal to Soviet leader Mikhail Gorbachev at Berlin's Brandenburg Gate.

Mohammed bin Zayed Majlis

The specs

Engine: 3.0-litre twin-turbo flat-six

Power: 480hp at 6,500rpm

Torque: 570Nm from 2,300-5,000rpm

Transmission: 8-speed dual-clutch auto

Fuel consumption: 10.4L/100km

Price: from Dh547,600

On sale: now

RIDE%20ON

%3Cp%3EDirector%3A%20Larry%20Yang%3C%2Fp%3E%0A%3Cp%3EStars%3A%20Jackie%20Chan%2C%20Liu%20Haocun%2C%20Kevin%20Guo%3C%2Fp%3E%0A%3Cp%3ERating%3A%202%2F5%3C%2Fp%3E%0A

Company profile

Date started: 2015

Founder: John Tsioris and Ioanna Angelidaki

Based: Dubai

Sector: Online grocery delivery

Staff: 200

Funding: Undisclosed, but investors include the Jabbar Internet Group and Venture Friends

The biog

Name: Timothy Husband

Nationality: New Zealand

Education: Degree in zoology at The University of Sydney

Favourite book: Lemurs of Madagascar by Russell A Mittermeier

Favourite music: Billy Joel

Weekends and holidays: Talking about animals or visiting his farm in Australia

The National photo project

Chris Whiteoak, a photographer at The National, spent months taking some of Jacqui Allan's props around the UAE, positioning them perfectly in front of some of the country's most recognisable landmarks. He placed a pirate on Kite Beach, in front of the Burj Al Arab, the Cheshire Cat from Alice in Wonderland at the Burj Khalifa, and brought one of Allan's snails (Freddie, which represents her grandfather) to the Dubai Frame. In Abu Dhabi, a dinosaur went to Al Ain's Jebel Hafeet. And a flamingo was taken all the way to the Hatta Mountains. This special project suitably brings to life the quirky nature of Allan's prop shop (and Allan herself!).

UAE squad to face Ireland

Ahmed Raza (captain), Chirag Suri (vice-captain), Rohan Mustafa, Mohammed Usman, Mohammed Boota, Zahoor Khan, Junaid Siddique, Waheed Ahmad, Zawar Farid, CP Rizwaan, Aryan Lakra, Karthik Meiyappan, Alishan Sharafu, Basil Hameed, Kashif Daud, Adithya Shetty, Vriitya Aravind

Premier League results

Saturday

Crystal Palace 1 Brighton & Hove Albion 2

Cardiff City 2 West Ham United 0

Huddersfield Town 0 Bournemouth 2

Leicester City 3 Fulham 1

Newcastle United 3 Everton 2

Southampton 2 Tottenham Hotspur 1

Manchester City 3 Watford 1

Sunday

Liverpool 4 Burnley 2

Chelsea 1 Wolverhampton Wanderers 1

Arsenal 2 Manchester United 0

Company%C2%A0profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%20%3C%2Fstrong%3ETuhoon%0D%3Cbr%3E%3Cstrong%3EYear%20started%3A%20%3C%2Fstrong%3EJune%202021%0D%3Cbr%3E%3Cstrong%3ECo-founders%3A%20%3C%2Fstrong%3EFares%20Ghandour%2C%20Dr%20Naif%20Almutawa%2C%20Aymane%20Sennoussi%0D%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3ERiyadh%0D%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3Ehealth%20care%0D%3Cbr%3E%3Cstrong%3ESize%3A%20%3C%2Fstrong%3E15%20employees%2C%20%24250%2C000%20in%20revenue%0D%3Cbr%3EI%3Cstrong%3Envestment%20stage%3A%20s%3C%2Fstrong%3Eeed%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EWamda%20Capital%2C%20Nuwa%20Capital%2C%20angel%20investors%3C%2Fp%3E%0A

RESULTS

Manchester United 2

Anthony Martial 30'

Scott McTominay 90 6'

Manchester City 0

NATIONAL%20SELECTIONS

%3Cp%3E6pm%3A%20Falling%20Shadow%3Cbr%3E6.35pm%3A%20Quality%20Boone%3Cbr%3E7.10pm%3A%20Al%20Dasim%3Cbr%3E7.45pm%3A%20Withering%3Cbr%3E8.20pm%3A%20Lazuli%3Cbr%3E8.55pm%3A%20Tiger%20Nation%3Cbr%3E9.30pm%3A%20Modern%20News%3C%2Fp%3E%0A

Evacuations to France hit by controversy

- Over 500 Gazans have been evacuated to France since November 2023

- Evacuations were paused after a student already in France posted anti-Semitic content and was subsequently expelled to Qatar

- The Foreign Ministry launched a review to determine how authorities failed to detect the posts before her entry

- Artists and researchers fall under a programme called Pause that began in 2017

- It has benefited more than 700 people from 44 countries, including Syria, Turkey, Iran, and Sudan

- Since the start of the Gaza war, it has also included 45 Gazan beneficiaries

- Unlike students, they are allowed to bring their families to France

ACL Elite (West) - fixtures

Monday, Sept 30

Al Sadd v Esteghlal (8pm)

Persepolis v Pakhtakor (8pm)

Al Wasl v Al Ahli (8pm)

Al Nassr v Al Rayyan (10pm)

Tuesday, Oct 1

Al Hilal v Al Shorta (10pm)

Al Gharafa v Al Ain (10pm)

How The Debt Panel's advice helped readers in 2019

December 11: 'My husband died, so what happens to the Dh240,000 he owes in the UAE?'

JL, a housewife from India, wrote to us about her husband, who died earlier this month. He left behind an outstanding loan of Dh240,000 and she was hoping to pay it off with an insurance policy he had taken out. She also wanted to recover some of her husband’s end-of-service liabilities to help support her and her son.

“I have no words to thank you for helping me out,” she wrote to The Debt Panel after receiving the panellists' comments. “The advice has given me an idea of the present status of the loan and how to take it up further. I will draft a letter and send it to the email ID on the bank’s website along with the death certificate. I hope and pray to find a way out of this.”

November 26: ‘I owe Dh100,000 because my employer has not paid me for a year’

SL, a financial services employee from India, left the UAE in June after quitting his job because his employer had not paid him since November 2018. He owes Dh103,800 on four debts and was told by the panellists he may be able to use the insolvency law to solve his issue.

SL thanked the panellists for their efforts. "Indeed, I have some clarity on the consequence of the case and the next steps to take regarding my situation," he says. "Hopefully, I will be able to provide a positive testimony soon."

October 15: 'I lost my job and left the UAE owing Dh71,000. Can I return?'

MS, an energy sector employee from South Africa, left the UAE in August after losing his Dh12,000 job. He was struggling to meet the repayments while securing a new position in the UAE and feared he would be detained if he returned. He has now secured a new job and will return to the Emirates this month.

“The insolvency law is indeed a relief to hear,” he says. "I will not apply for insolvency at this stage. I have been able to pay something towards my loan and credit card. As it stands, I only have a one-month deficit, which I will be able to recover by the end of December."

Mica

Director: Ismael Ferroukhi

Stars: Zakaria Inan, Sabrina Ouazani

3 stars

Stats at a glance:

Cost: 1.05 billion pounds (Dh 4.8 billion)

Number in service: 6

Complement 191 (space for up to 285)

Top speed: over 32 knots

Range: Over 7,000 nautical miles

Length 152.4 m

Displacement: 8,700 tonnes

Beam: 21.2 m

Draught: 7.4 m

BIG SPENDERS

Premier League clubs spent £230 million (Dh1.15 billion) on January transfers, the second-highest total for the mid-season window, the Sports Business Group at Deloitte said in a report.

TEST SQUADS

Bangladesh: Mushfiqur Rahim (captain), Tamim Iqbal, Soumya Sarkar, Imrul Kayes, Liton Das, Shakib Al Hasan, Mominul Haque, Nasir Hossain, Sabbir Rahman, Mehedi Hasan, Shafiul Islam, Taijul Islam, Mustafizur Rahman and Taskin Ahmed.

Australia: Steve Smith (captain), David Warner, Ashton Agar, Hilton Cartwright, Pat Cummins, Peter Handscomb, Matthew Wade, Josh Hazlewood, Usman Khawaja, Nathan Lyon, Glenn Maxwell, Matt Renshaw, Mitchell Swepson and Jackson Bird.

Europa League group stage draw

Group A: Villarreal, Maccabi Tel Aviv, Astana, Slavia Prague.

Group B: Dynamo Kiev, Young Boys, Partizan Belgrade, Skenderbeu.

Group C: Sporting Braga, Ludogorets, Hoffenheim, Istanbul Basaksehir.

Group D: AC Milan, Austria Vienna , Rijeka, AEK Athens.

Group E: Lyon, Everton, Atalanta, Apollon Limassol.

Group F: FC Copenhagen, Lokomotiv Moscow, Sheriff Tiraspol, FC Zlin.

Group G: Vitoria Plzen, Steaua Bucarest, Hapoel Beer-Sheva, FC Lugano.

Group H: Arsenal, BATE Borisov, Cologne, Red Star Belgrade.

Group I: Salzburg, Marseille, Vitoria Guimaraes, Konyaspor.

Group J: Athletic Bilbao, Hertha Berlin, Zorya Luhansk, Ostersund.

Group K: Lazio, Nice, Zulte Waregem, Vitesse Arnhem.

Group L: Zenit St Petersburg, Real Sociedad, Rosenborg, Vardar

The%20specs%20

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E2.0-litre%204cyl%20turbo%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E261hp%20at%205%2C500rpm%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E400Nm%20at%201%2C750-4%2C000rpm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E7-speed%20dual-clutch%20auto%0D%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%20%3C%2Fstrong%3E10.5L%2F100km%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3ENow%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C999%20(VX%20Luxury)%3B%20from%20Dh149%2C999%20(VX%20Black%20Gold)%3C%2Fp%3E%0A

Miss Granny

Director: Joyce Bernal

Starring: Sarah Geronimo, James Reid, Xian Lim, Nova Villa

3/5

(Tagalog with Eng/Ar subtitles)

RACE CARD

5pm: Handicap (PA) Dh70,000 1,400m

5.30pm: Handicap (TB) Dh70,000 1,000m

6pm: Maiden (PA) Dh70,000 2,000m

6.30pm: Handicap (PA) Dh70,000 2,000m

7pm: Maiden (PA) Dh70,000 1,600m

7.30pm: Al Ain Mile Group 3 (PA) Dh350,000 1,600m

8pm: Handicap (PA) Dh70,000 1,600m

Amith's selections:

5pm: AF Sail

5.30pm: Dahawi

6pm: Taajer

6.30pm: Pharitz Oubai

7pm: Winked

7.30pm: Shahm

8pm: Raniah

COMPANY%20PROFILE

%3Cp%3EFounder%3A%20Hani%20Abu%20Ghazaleh%3Cbr%3EBased%3A%20Abu%20Dhabi%2C%20with%20an%20office%20in%20Montreal%3Cbr%3EFounded%3A%202018%3Cbr%3ESector%3A%20Virtual%20Reality%3Cbr%3EInvestment%20raised%3A%20%241.2%20million%2C%20and%20nearing%20close%20of%20%245%20million%20new%20funding%20round%3Cbr%3ENumber%20of%20employees%3A%2012%3C%2Fp%3E%0A

The%20specs

%3Cp%3E%3Cstrong%3EPowertrain%3A%20%3C%2Fstrong%3ESingle%20electric%20motor%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E201hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E310Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20auto%0D%3Cbr%3E%3Cstrong%3EBattery%3A%20%3C%2Fstrong%3E53kWh%20lithium-ion%20battery%20pack%20(GS%20base%20model)%3B%2070kWh%20battery%20pack%20(GF)%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E350km%20(GS)%3B%20480km%20(GF)%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C900%20(GS)%3B%20Dh149%2C000%20(GF)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A

Our legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants