Imagine that a group of litigants took the US government to court in Russia, and won a ruling that they were owed billions of dollars over an agreement signed in the early 19th century – on the grounds that Alaska belonged to Russia before 1867. Similarly, what if the Greek government were determined by courts in Turkey to owe a huge sum of money over an historical contract, the argument being that, because Greece was then in the Ottoman Empire, Turkey would be the right place to deal with this issue? Both cases are unthinkable, and the latter could bring the combustible Greco-Turkish relations to the brink.

Something very similar to this, though, has just happened to Malaysia. Last week, it led to a bailiff serving asset seizure notices at the Luxembourg offices of two subsidiaries of Petronas, Malaysia’s state-owned energy giant, and sent panic through the government that national assets anywhere in the world could be at risk.

The asset seizure notices were delivered as the result of a ruling that Malaysia owes $14.9 billion to a group who claim to be the heirs of a sultanate that has not existed since 1915, and is an unwelcome example of how the international legal system can still be entangled by almost-forgotten relics of colonial history.

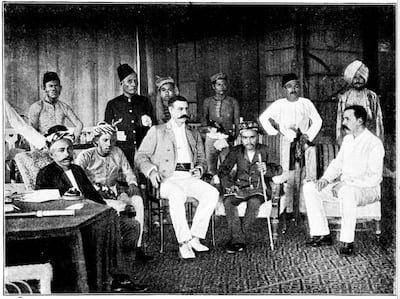

The story begins in 1878, when the then sultan of Sulu, a group of islands in western Philippines, signed an agreement that allowed the British North Borneo Company to take over a chunk of land in what is now the Malaysian state of Sabah. Any dispute over whether it was a lease or a cession should have been cleared up by a subsequent treaty in 1903 that confirmed the “cession”. North Borneo later became a British colony, and in 1963 agreed to become part of the newly created state of Malaysia.

While colonialism may be long gone, international law needs to catch up

Up until nine years ago, Malaysia continued paying an annual cession payment of 5,300 ringgit ($1,190) to descendants of the last sultan, who died in 1936. But in 2013, a 235-strong group associated with one of the pretenders to the defunct sultanate “invaded” Sabah – which sounds like a joke, except 56 of the militants died, as did 10 Malaysian security force personnel and six civilians.

The sum of money that could reasonably be claimed, therefore – if it was not deemed fairly forfeited after the attack on Malaysia – may be around $13,500, with interest. Hardly a sultan’s ransom. The heirs and their lawyers, however, have brazenly taken this as an opportunity to demand compensation for the vast mineral wealth in Sabah that nobody was aware of back in 1878.

Tommy Thomas, who was Malaysia's attorney general when the case was proceeding, recently said that the heirs told the Malaysian government “that they tried to go to the UK” as the former colonial power in North Borneo. "The UK chased them away. The UK said: ‘We have nothing to do with this, go to the courts of Malaysia’".

The heirs then went to Spain, the former colonial rulers of the Philippines, where the Madrid High Court appointed an arbitrator, Gonzalo Stampa. According to Mr Thomas, Malaysia contacted the Spanish authorities, and “the Madrid court agreed with us and set aside everything” – whereupon Mr Stampa took the case to France, which likes to call itself “the home of international arbitration”. In February, the huge sum was awarded, a judgment the French Court of Appeal ordered stayed on July 12 – except by then, the bailiffs had already sprung into action in Luxembourg.

The story is even more convoluted than that, and if it seems strange that the case moved to France, the explanation given by one involved source to a Malaysian paper, The Edge, was that an “arbitration is like a plane – once it takes off, there is no way the control tower where the plane took off can dictate what happens”.

The Malaysian government is confident that it is in the right. Perhaps a relatively small sum may be due to the heirs, but nothing remotely close to $14.9bn. And that is being generous, because many historians dispute that the Sulu sultanate ever had any legitimate claim to the land in Sabah in the first place; in fact, they argue, it belonged to Brunei.

"Sulu never had a treaty or a title deed from Brunei, and no record or evidence exists of Sulu ever possessing or governing North Borneo,” says Bunn Nagara, convener of the Sabah Malaysia Study Group. Brunei ceded the area to the British North Borneo Company in 1877. “Sulu was asserting a claim to the territory and had a reputation for raiding coastal settlements, so as an insurance policy the company made another cession agreement with Sulu."

In short, the heirs were lucky to receive cession payments for a land that may never have been theirs to begin with for so long. Until recently, all this was mostly a matter for historians, although as Mr Bunn points out, “the claim remains a very populist issue in the Philippines, unsupported by the facts as it is. Previous presidents such as Corazon Aquino and Gloria Arroyo, who tried to mitigate Manila’s claim on Sabah, have been accused by some as traitors".

Now, however, while the Malaysian government told the Financial Times that the award’s suspension in Paris was grounds for other countries to refuse its enforcement, the heirs’ lawyers in London insisted that “the seizure process is a rolling programme”.

Malaysian officials are taking measures to protect assets abroad, but the worry at the moment is that the heirs’ lawyers, who are believed to be backed by a major litigation fund in London, “can pick from the other 167 jurisdictions that are party to the New York Convention on arbitration, and then Malaysia will have to show up and say we have a stay from the Paris Court of Appeal", says one involved in how to combat this action in Kuala Lumpur. “What’s the limit to this? Should European countries have any role in these kinds of disputes? Shouldn’t colonialism have ended already?”

All good points. What this bizarre story shows, however, is that while colonialism may be long gone, its legacy can still be exploited. International law needs to catch up. Ordinary Malaysians do not deserve this attempt to squeeze billions out of them. And somehow, I suspect that deep sympathy for the descendants of the last Sultan of Sulu does not top their lawyers’ list of concerns.

UAE currency: the story behind the money in your pockets

UAE currency: the story behind the money in your pockets

Killing of Qassem Suleimani

UAE SQUAD FOR ASIAN JIU-JITSU CHAMPIONSHIP

Men’s squad: Faisal Al Ketbi, Omar Al Fadhli, Zayed Al Kathiri, Thiab Al Nuaimi, Khaled Al Shehhi, Mohamed Ali Al Suwaidi, Farraj Khaled Al Awlaqi, Muhammad Al Ameri, Mahdi Al Awlaqi, Saeed Al Qubaisi, Abdullah Al Qubaisi and Hazaa Farhan

Women's squad: Hamda Al Shekheili, Shouq Al Dhanhani, Balqis Abdullah, Sharifa Al Namani, Asma Al Hosani, Maitha Sultan, Bashayer Al Matrooshi, Maha Al Hanaei, Shamma Al Kalbani, Haya Al Jahuri, Mahra Mahfouz, Marwa Al Hosani, Tasneem Al Jahoori and Maryam Al Amri

Jetour T1 specs

Engine: 2-litre turbocharged

Power: 254hp

Torque: 390Nm

Price: From Dh126,000

Available: Now

Specs

Engine: Duel electric motors

Power: 659hp

Torque: 1075Nm

On sale: Available for pre-order now

Price: On request

Islamophobia definition

A widely accepted definition was made by the All Party Parliamentary Group on British Muslims in 2019: “Islamophobia is rooted in racism and is a type of racism that targets expressions of Muslimness or perceived Muslimness.” It further defines it as “inciting hatred or violence against Muslims”.

the pledge

I pledge to uphold the duty of tolerance

I pledge to take a first stand against hate and injustice

I pledge to respect and accept people whose abilities, beliefs and culture are different from my own

I pledge to wish for others what I wish for myself

I pledge to live in harmony with my community

I pledge to always be open to dialogue and forgiveness

I pledge to do my part to create peace for all

I pledge to exercise benevolence and choose kindness in all my dealings with my community

I pledge to always stand up for these values: Zayed's values for tolerance and human fraternity

Herc's Adventures

Developer: Big Ape Productions

Publisher: LucasArts

Console: PlayStation 1 & 5, Sega Saturn

Rating: 4/5

More from Rashmee Roshan Lall

The Sand Castle

Director: Matty Brown

Stars: Nadine Labaki, Ziad Bakri, Zain Al Rafeea, Riman Al Rafeea

Rating: 2.5/5

Tamkeen's offering

- Option 1: 70% in year 1, 50% in year 2, 30% in year 3

- Option 2: 50% across three years

- Option 3: 30% across five years

Florence and the Machine – High as Hope

Three stars

Skoda Superb Specs

Engine: 2-litre TSI petrol

Power: 190hp

Torque: 320Nm

Price: From Dh147,000

Available: Now

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%20Dual%20synchronous%20electric%20motors%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E660hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E1%2C100Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20automatic%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E488km-560km%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh850%2C000%20(estimate)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3EOctober%3C%2Fp%3E%0A

The rules on fostering in the UAE

A foster couple or family must:

- be Muslim, Emirati and be residing in the UAE

- not be younger than 25 years old

- not have been convicted of offences or crimes involving moral turpitude

- be free of infectious diseases or psychological and mental disorders

- have the ability to support its members and the foster child financially

- undertake to treat and raise the child in a proper manner and take care of his or her health and well-being

- A single, divorced or widowed Muslim Emirati female, residing in the UAE may apply to foster a child if she is at least 30 years old and able to support the child financially

RESULTS

5pm: Handicap (PA) Dh80,000 (Turf) 2,200m

Winner: Jawal Al Reef, Fernando Jara (jockey), Ahmed Al Mehairbi (trainer)

5.30pm: Handicap (PA) Dh80,000 (T) 1,600m

Winner: AF Seven Skies, Bernardo Pinheiro, Qais Aboud

6pm: Maiden (PA) Dh80,000 (T) 1,200m

Winner: Almahroosa, Fabrice Veron, Eric Lemartinel

6.30pm: Maiden (PA) Dh80,000 (T) 1,200m

Winner: AF Sumoud, Tadhg O’Shea, Ernst Oertel

7pm: Wathba Stallions Cup Handicap (PA) Dh70,000 (T) 1,200m

Winner: AF Majalis, Tadhg O’Shea, Ernst Oertel

7.30pm: Handicap (TB) Dh90,000 (T) 1,400m

Winner: Adventurous, Sandro Paiva, Ali Rashid Al Raihe

Series info

Test series schedule 1st Test, Abu Dhabi: Sri Lanka won by 21 runs; 2nd Test, Dubai: Play starts at 2pm, Friday-Tuesday

ODI series schedule 1st ODI, Dubai: October 13; 2nd ODI, Abu Dhabi: October 16; 3rd ODI, Abu Dhabi: October 18; 4th ODI, Sharjah: October 20; 5th ODI, Sharjah: October 23

T20 series schedule 1st T20, Abu Dhabi: October 26; 2nd T20, Abu Dhabi: October 27; 3rd T20, Lahore: October 29

Tickets Available at www.q-tickets.com

Stat Fourteen Fourteen of the past 15 Test matches in the UAE have been decided on the final day. Both of the previous two Tests at Dubai International Stadium have been settled in the last session. Pakistan won with less than an hour to go against West Indies last year. Against England in 2015, there were just three balls left.

Key battle - Azhar Ali v Rangana Herath Herath may not quite be as flash as Muttiah Muralitharan, his former spin-twin who ended his career by taking his 800th wicket with his final delivery in Tests. He still has a decent sense of an ending, though. He won the Abu Dhabi match for his side with 11 wickets, the last of which was his 400th in Tests. It was not the first time he has owned Pakistan, either. A quarter of all his Test victims have been Pakistani. If Pakistan are going to avoid a first ever series defeat in the UAE, Azhar, their senior batsman, needs to stand up and show the way to blunt Herath.

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E3.5-litre%20twin-turbo%20V6%20%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E456hp%20at%205%2C000rpm%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E691Nm%20at%203%2C500rpm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E10-speed%20auto%20%0D%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%20%3C%2Fstrong%3E14.6L%2F100km%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3Efrom%20Dh349%2C545%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3Enow%3C%2Fp%3E%0A

Emergency phone numbers in the UAE

Estijaba – 8001717 – number to call to request coronavirus testing

Ministry of Health and Prevention – 80011111

Dubai Health Authority – 800342 – The number to book a free video or voice consultation with a doctor or connect to a local health centre

Emirates airline – 600555555

Etihad Airways – 600555666

Ambulance – 998

Knowledge and Human Development Authority – 8005432 ext. 4 for Covid-19 queries

Killing of Qassem Suleimani

Why%20all%20the%20lefties%3F

%3Cp%3ESix%20of%20the%20eight%20fast%20bowlers%20used%20in%20the%20ILT20%20match%20between%20Desert%20Vipers%20and%20MI%20Emirates%20were%20left-handed.%20So%2075%20per%20cent%20of%20those%20involved.%0D%3Cbr%3EAnd%20that%20despite%20the%20fact%2010-12%20per%20cent%20of%20the%20world%E2%80%99s%20population%20is%20said%20to%20be%20left-handed.%0D%3Cbr%3EIt%20is%20an%20extension%20of%20a%20trend%20which%20has%20seen%20left-arm%20pacers%20become%20highly%20valued%20%E2%80%93%20and%20over-represented%2C%20relative%20to%20other%20formats%20%E2%80%93%20in%20T20%20cricket.%0D%3Cbr%3EIt%20is%20all%20to%20do%20with%20the%20fact%20most%20batters%20are%20naturally%20attuned%20to%20the%20angles%20created%20by%20right-arm%20bowlers%2C%20given%20that%20is%20generally%20what%20they%20grow%20up%20facing%20more%20of.%0D%3Cbr%3EIn%20their%20book%2C%20%3Cem%3EHitting%20Against%20the%20Spin%3C%2Fem%3E%2C%20cricket%20data%20analysts%20Nathan%20Leamon%20and%20Ben%20Jones%20suggest%20the%20advantage%20for%20a%20left-arm%20pace%20bowler%20in%20T20%20is%20amplified%20because%20of%20the%20obligation%20on%20the%20batter%20to%20attack.%0D%3Cbr%3E%E2%80%9CThe%20more%20attacking%20the%20batsman%2C%20the%20more%20reliant%20they%20are%20on%20anticipation%2C%E2%80%9D%20they%20write.%0D%3Cbr%3E%E2%80%9CThis%20effectively%20increases%20the%20time%20pressure%20on%20the%20batsman%2C%20so%20increases%20the%20reliance%20on%20anticipation%2C%20and%20therefore%20increases%20the%20left-arm%20bowler%E2%80%99s%20advantage.%E2%80%9D%0D%3Cbr%3E%3C%2Fp%3E%0A

Some of Darwish's last words

"They see their tomorrows slipping out of their reach. And though it seems to them that everything outside this reality is heaven, yet they do not want to go to that heaven. They stay, because they are afflicted with hope." - Mahmoud Darwish, to attendees of the Palestine Festival of Literature, 2008

His life in brief: Born in a village near Galilee, he lived in exile for most of his life and started writing poetry after high school. He was arrested several times by Israel for what were deemed to be inciteful poems. Most of his work focused on the love and yearning for his homeland, and he was regarded the Palestinian poet of resistance. Over the course of his life, he published more than 30 poetry collections and books of prose, with his work translated into more than 20 languages. Many of his poems were set to music by Arab composers, most significantly Marcel Khalife. Darwish died on August 9, 2008 after undergoing heart surgery in the United States. He was later buried in Ramallah where a shrine was erected in his honour.

ANDROID%20VERSION%20NAMES%2C%20IN%20ORDER

%3Cp%3EAndroid%20Alpha%3C%2Fp%3E%0A%3Cp%3EAndroid%20Beta%3C%2Fp%3E%0A%3Cp%3EAndroid%20Cupcake%3C%2Fp%3E%0A%3Cp%3EAndroid%20Donut%3C%2Fp%3E%0A%3Cp%3EAndroid%20Eclair%3C%2Fp%3E%0A%3Cp%3EAndroid%20Froyo%3C%2Fp%3E%0A%3Cp%3EAndroid%20Gingerbread%3C%2Fp%3E%0A%3Cp%3EAndroid%20Honeycomb%3C%2Fp%3E%0A%3Cp%3EAndroid%20Ice%20Cream%20Sandwich%3C%2Fp%3E%0A%3Cp%3EAndroid%20Jelly%20Bean%3C%2Fp%3E%0A%3Cp%3EAndroid%20KitKat%3C%2Fp%3E%0A%3Cp%3EAndroid%20Lollipop%3C%2Fp%3E%0A%3Cp%3EAndroid%20Marshmallow%3C%2Fp%3E%0A%3Cp%3EAndroid%20Nougat%3C%2Fp%3E%0A%3Cp%3EAndroid%20Oreo%3C%2Fp%3E%0A%3Cp%3EAndroid%20Pie%3C%2Fp%3E%0A%3Cp%3EAndroid%2010%20(Quince%20Tart*)%3C%2Fp%3E%0A%3Cp%3EAndroid%2011%20(Red%20Velvet%20Cake*)%3C%2Fp%3E%0A%3Cp%3EAndroid%2012%20(Snow%20Cone*)%3C%2Fp%3E%0A%3Cp%3EAndroid%2013%20(Tiramisu*)%3C%2Fp%3E%0A%3Cp%3EAndroid%2014%20(Upside%20Down%20Cake*)%3C%2Fp%3E%0A%3Cp%3EAndroid%2015%20(Vanilla%20Ice%20Cream*)%3C%2Fp%3E%0A%3Cp%3E%3Cem%3E*%20internal%20codenames%3C%2Fem%3E%3C%2Fp%3E%0A

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3EName%3A%3C%2Fstrong%3E%20Floward%0D%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3ERiyadh%2C%20Saudi%20Arabia%0D%3Cbr%3E%3Cstrong%3EFounders%3A%20%3C%2Fstrong%3EAbdulaziz%20Al%20Loughani%20and%20Mohamed%20Al%20Arifi%0D%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EE-commerce%0D%3Cbr%3E%3Cstrong%3ETotal%20funding%3A%20%3C%2Fstrong%3EAbout%20%24200%20million%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EAljazira%20Capital%2C%20Rainwater%20Partners%2C%20STV%20and%20Impact46%0D%3Cbr%3E%3Cstrong%3ENumber%20of%20employees%3A%20%3C%2Fstrong%3E1%2C200%3C%2Fp%3E%0A

Business Insights

- Canada and Mexico are significant energy suppliers to the US, providing the majority of oil and natural gas imports

- The introduction of tariffs could hinder the US's clean energy initiatives by raising input costs for materials like nickel

- US domestic suppliers might benefit from higher prices, but overall oil consumption is expected to decrease due to elevated costs

Groom and Two Brides

Director: Elie Semaan

Starring: Abdullah Boushehri, Laila Abdallah, Lulwa Almulla

Rating: 3/5

The story of Edge

Sheikh Mohamed bin Zayed, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the Armed Forces, established Edge in 2019.

It brought together 25 state-owned and independent companies specialising in weapons systems, cyber protection and electronic warfare.

Edge has an annual revenue of $5 billion and employs more than 12,000 people.

Some of the companies include Nimr, a maker of armoured vehicles, Caracal, which manufactures guns and ammunitions company, Lahab

The Voice of Hind Rajab

Starring: Saja Kilani, Clara Khoury, Motaz Malhees

Director: Kaouther Ben Hania

Rating: 4/5

Global state-owned investor ranking by size

|

1.

|

United States

|

|

2.

|

China

|

|

3.

|

UAE

|

|

4.

|

Japan

|

|

5

|

Norway

|

|

6.

|

Canada

|

|

7.

|

Singapore

|

|

8.

|

Australia

|

|

9.

|

Saudi Arabia

|

|

10.

|

South Korea

|