On June 1, French luxury house Hermes opened the doors to a new store in Abu Dhabi. Set on the ground floor of the Galleria Mall on Al Maryah Island, the flagship replaces the recently shuttered space in Etihad Towers.

Designed by Parisian architectural agency RDAI, the store echoes the curves of the mall's main building, its fluid lines highlighted with walls covered in handmade champagne wallpaper, smooth oak countertops and bespoke carpets inspired by sea urchins and shells, with waved patterns in light pink, ochre and blue.

Introducing women's silks, with a central space dedicated to watches and jewellery, Hermes Abu Dhabi houses both men's and women's fashion, homeware and – as befitting its saddlery heritage – all manner of equestrian goods. Aimed at a clientele that prefers discreet luxury, the store is imbued with an air of elegant precision.

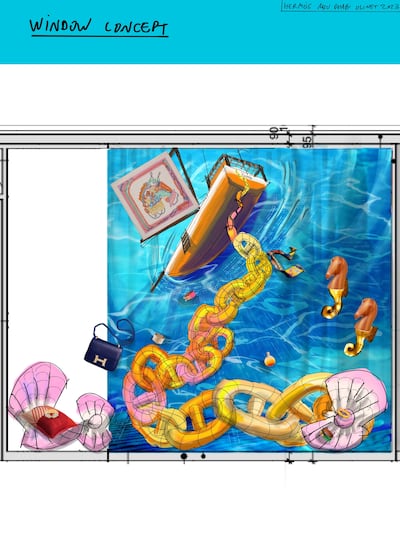

To celebrate the opening, Hermes invited French artist Vincent Olinet to create a site-specific art installation to form the store's first window display. Speaking with The National, Olinet outlined the thinking behind his work.

“I imagined a landscape that stretches under the sea. We are diving and seeing what is happening,” he explains.

Olinet's design, set against rippling blue walls, transports bystanders to an underwater world, looking up to the surface at the underside of a small boat, from which an oversized anchor chain tumbles. Surrounded by seahorses and giant clam shells, the chain is painted in vibrant yellow, orange and coral to echo the famous Hermes palette.

Lit from within, the glowing installation takes inspiration from Abu Dhabi's rich maritime history, mixed with the rounded links of the Hermes anchor chain used across the brand's bags and jewellery.

While the work was uniquely created for the UAE store, it is not Olinet's first experience working with the French maison.

“It started a few years ago with an invitation to do a window, which was supposed to be for the 2020 Cannes Film Festival,” he says. “I couldn’t do it in the end, because of Covid. But I got another invitation for the store in Omotesando, Tokyo.”

That design resulted in a second commission for the new store inside Charles de Gaulle Airport, Paris, where Olinet used paper lanterns for the first time, a motif he has returned to for Abu Dhabi. Made from thin paper, hand-painted and stretched over a metal frame, the installations are lit from within to bring them to life.

“I know how fascinating it looks,” he says, “and they are all handcrafted.”

As an artist, Olinet is known for creating works that turn expectations upside down, such as book shelves made from slices of buttered bread, tables laid with frozen flowers left to slowly thaw, and huge, lopsided cakes made from layers of resin.

Playing with perception is crucial to him, as it creates a “kind of poetry”.

“For me that is where art is,” he says. “I love to work by hand. I don’t like to use a machine or sophisticated tools. I am not shy to be a bit crazy and make things look unusual. I love that we can see the world from a new perspective just by shifting a few things.”

While the results are strikingly beautiful, the start of his design process is rather more crude. In this case, the initial sketches he shared with Hermes, he laughingly admits, were “pretty rough”.

“Luckily, I have found a metalwork company that can interpret my drawings and understand what it is supposed to look like. They make a metal frame, and then I have a team here who help cover it in paper, and I paint it myself with water colour.

“If I make a mistake with the painting, I have to restart the whole paper process. So I have to be very sure,” he says.

As with any artistic process however, a mishap can sometimes create the unexpected. “I will consider it well before I destroy it. Maybe it’s a mistake, but it’s part of the work. And I like that Hermes respects that; it doesn’t push me to have a special finish like its own objects,” he says.

And an imperfect feel is integral to his work, he explains.

“This enhances the handmade touch I look for. This fragility is the same when I work with sugar or ice, and I like that the artwork is really fragile. It brings some value.

“At the end of the journey it looks different, but it has integrity with things I didn’t expect to happen. So, I let such hazard and chance exist.”

Now on his third collaboration with the house, Olinet explains that with each project, he is given increased space to explore. “I have always loved the Hermes aesthetic and universe. The more I work with Hermes, the more they let me follow my intuition and make what I desire. I have a lot of freedom,” he says. “As an artist, it really is a blessing.”

Global state-owned investor ranking by size

|

1.

|

United States

|

|

2.

|

China

|

|

3.

|

UAE

|

|

4.

|

Japan

|

|

5

|

Norway

|

|

6.

|

Canada

|

|

7.

|

Singapore

|

|

8.

|

Australia

|

|

9.

|

Saudi Arabia

|

|

10.

|

South Korea

|

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%20Dual%20synchronous%20electric%20motors%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E660hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E1%2C100Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20automatic%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E488km-560km%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh850%2C000%20(estimate)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3EOctober%3C%2Fp%3E%0A

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

The specs

Engine: 4.0-litre V8 twin-turbocharged and three electric motors

Power: Combined output 920hp

Torque: 730Nm at 4,000-7,000rpm

Transmission: 8-speed dual-clutch automatic

Fuel consumption: 11.2L/100km

On sale: Now, deliveries expected later in 2025

Price: expected to start at Dh1,432,000

How Beautiful this world is!

Company%20profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%20%3C%2Fstrong%3EXare%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3EJanuary%2018%2C%202021%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFounders%3A%20%3C%2Fstrong%3EPadmini%20Gupta%2C%20Milind%20Singh%2C%20Mandeep%20Singh%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDubai%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EFinTech%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFunds%20Raised%3A%20%3C%2Fstrong%3E%2410%20million%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ECurrent%20number%20of%20staff%3A%20%3C%2Fstrong%3E28%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3Eundisclosed%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EMS%26amp%3BAD%20Ventures%2C%20Middle%20East%20Venture%20Partners%2C%20Astra%20Amco%2C%20the%20Dubai%20International%20Financial%20Centre%2C%20Fintech%20Fund%2C%20500%20Startups%2C%20Khwarizmi%20Ventures%2C%20and%20Phoenician%20Funds%3C%2Fp%3E%0A