Amid the artificial intelligence boom, chip maker Nvidia’s surge has elevated the semiconductor giant's market capitalisation to exceed that of its large-cap tech counterparts, securing its position as the world's most valuable company.

Nvidia's stock jumped 3.51 per cent to $135.58 per share at market close on Tuesday, pushing the company's market value to more than $3.4 trillion, surpassing those of other US technology giants Microsoft and Apple.

The company’s market value has more than tripled over the past year as enthusiasm for AI increases.

With Wednesday being a federal holiday in the US, Nvidia is expected to maintain its status unchallenged at least until Thursday morning, when the markets reopen.

The National looks at Nvidia's journey to the top and explores the market factors driving its growth.

What is Nvidia?

Nvidia designs and makes AI hardware and software graphic processing units (GPUs) for industries. GPUs can process many tasks simultaneously, making them useful for machine learning, video editing and gaming applications.

Since its inception in 1993, the company has been known for manufacturing computer chips that power graphics-heavy video games. Recently, however, AI laboratories and researchers have started using the same chips to run AI algorithms, thereby disrupting the field.

This shift quickly drew the attention of investors and technology giants.

Competition among technology firms and AI developers is intense, with companies like Microsoft, Google’s parent Alphabet, Meta, and Apple all striving to create next generation AI products. The fierce competition benefits Nvidia, which not only develops its own AI technology but is also a major player in the AI chip market.

In the past few quarters, Nvidia sales have jumped as companies such as Meta, Amazon, OpenAI and Microsoft bought its chips.

Best rally yet

This year, Nvidia's stock is one of the best performers in the S&P 500 index, which has jumped more than 15 per cent.

The California-based company’s shares have increased more than 3,477 per cent, from $3.79 to $135.58, in the past five years.

It has surged by more than 209 per cent and 181 per cent in the past 12 months and since the start of the year, respectively. In comparison, Microsoft and Apple’s share have risen 20.3 per cent and 15.4 per cent, respectively, this year.

Nvidia overtook Microsoft by market cap on Tuesday. The Redmond-headquartered company’s market cap stood at $3.32 trillion at market close on Tuesday, nearly $20 billion less than Nvidia.

Nvidia surpassed iPhone maker Apple (market cap $3.29 trillion) earlier this month. Last week, Apple also briefly surpassed Microsoft to trade on the top.

They are followed by Alphabet ($2.2 trillion), Amazon ($1.9 trillion) and Saudi oil major Aramco ($1.8 trillion).

Huang among richest in world

Nvidia’s soaring stock price has put Jensen Huang, company’s co-founder and chief executive, among the world’s wealthiest individuals.

Mr Huang’s net worth stood at $119 billion, increasing by almost $75 billion since the start of the year, according to the Bloomberg Billionaires Index. He is at the 12th spot among the world’s richest.

Nvidia’s AI accelerators, which are chips that assist global companies and data centres in developing AI chatbots, have become highly sought after in recent years.

“Nvidia finally stole the title of the world’s most valuable company … the catalyst was just a bullish call from an analyst at Rosenblatt Securities who revised his PT [price target] up to $200 from $140 and said that its market cap will reach $5 trillion in the coming year,” Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said in a note.

Industry analysts said Nvidia will continue to perform well despite the competitive and changing market conditions.

Despite the mounting competition and the prediction that big tech companies will become more self-reliant in producing their own chips, Nvidia's profitability and outlook suggest that the increasing demand across sectors is likely to offset any challenges faced for the rest of the year, Thomas Monteiro, senior analyst at Investing.com, said.

“The company’s last quarter’s numbers [earnings] remain incredibly strong, leaving no doubt that the company's leadership in the AI revolution remains unchallenged for now,” Mr Monteiro told The National.

Nvidia said it expected revenue of $28 billion, plus or minus 2 per cent, in the quarter ending in July, compared to the $26.6 billion forecast by LSEG analysts.

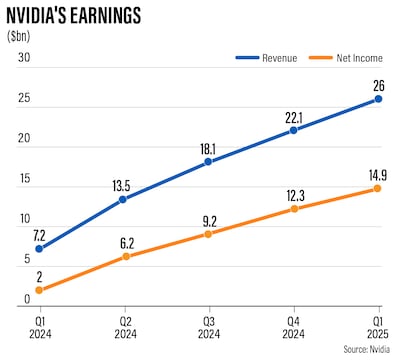

In the first quarter, which ended on April 28, Nvidia reported revenue of $26.04 billion, up 18 per cent from the previous quarter and up 262 per cent on an annual basis. It exceeded expectations of $24.65 billion.

Net income during the period surged 628 per cent yearly to almost $14.9 billion.

It was the company’s fourth quarter in a row with more than $10 billion in revenue.

Nvidia’s strong performance in the last quarter was primarily driven by its data centre business that makes chips used to build and run generative AI technology such as ChatGPT.

The division’s first quarter revenue stood at a record $22.6 billion, up 427 per cent from a year ago.

Race to $4 trillion

Last month, Nvidia announced a 10-for-one forward stock split, impressing investors and demonstrating that investment in AI computing continues to be robust.

Shares started trading on a split-adjusted basis on June 10. Each holder of common stock received nine additional shares of common stock.

“Nvidia is extremely well placed at least for the next couple of years as demand continues to explode and it seems we are still early in the phase-shift to AI … It is not easy to compete with them anytime soon,” Vijay Marolia, chief investment officer at Orlando-based Regal Point Capital management, told The National.

“Now that the stock has split, I expect more demand from smaller investors … the stock just needs to increase by a bit over 21 per cent to get the market cap to $4 trillion. I would not be surprised if this happens within 12 months.”

Splitting stocks is a tactic companies use to make it less expensive to buy individual shares. It does not alter a company's financial fundamentals but attracts retail investors who make small trades.

Following Nvidia's rise to the top, the company’s global head of business development for telco, Chris Penrose, said the chip maker is working to improve its production and technology as the demand surges.

He forecast further growth in the industry.

“The generative AI journey is really transforming businesses and telcos around the world … we are just at the beginning,” said Mr Penrose while speaking at an event in Copenhagen.

“We believe over the next year, the race to $4 trillion market cap in tech will be front and centre between Nvidia, Apple and Microsoft,” Wedbush Securities said in a note.