Green and sustainable finance issuance, aimed at environmentally friendly projects, grew 32 per cent in the UAE last year, compared with 2021, according to Arthur D Little.

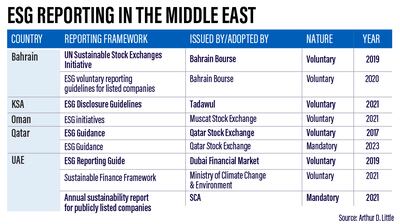

Major public and private institutions in the UAE, including the Dubai Financial Market, the Ministry of Climate Change and Environment, and publicly listed companies in the Securities and Commodities Authority, have shown an increase in environmental, social and governance standards (ESG) reporting, the consultancy said in a report on Monday.

“Green issuances from countries in the Middle East and North Africa are not standing still but are, in fact, outpacing global growth,” said Andreas Buelow, a partner at Arthur D Little.

“With new reporting requirements taking effect, banks are facing an urgent need to kick-start their strategies and execute concepts throughout their organisations.”

Less than two weeks ago, Dubai Islamic Bank, the UAE’s biggest Sharia-compliant lender by assets, raised $1 billion from its second sustainable sukuk as it continues to diversify its financing base.

In September, Abu Dhabi Commercial Bank, the country's third-largest lender, priced its debut $500 million green bond that will help it finance projects following ESG standards.

Last year, First Abu Dhabi Bank, the UAE's largest lender by assets, provided a multimillion-dollar green trade credit line to wind turbine maker Senvion India, as part of the bank's efforts to advance its net-zero ambitions.

The global sustainable finance market, which was valued at $3.65 trillion in 2021, is projected to hit $22.48 trillion by 2031, growing at a compound annual rate of more than 20 per cent between 2022 and 2031, according to Allied Market Research.

Green bond and sukuk issuances from the GCC hit a record in 2022 at $8.5 billion from 15 deals, compared with $605 million from six deals in 2021, data from Bloomberg’s Capital Markets League Tables showed last month.

“Many financial institutions in the Middle East have designed comprehensive ESG strategies that open the door to new pathways to top-line growth, business opportunities, cost reductions, regulatory compliance and employee satisfaction,” said Nael Amin, senior manager in the financial services practice at Arthur D Little.

“This growing trend demonstrates the momentum that ESG is gathering in financial institutions, as the world’s banks increasingly emphasise ESG and infuse it into their business models.”

The issuance of green bonds in the Middle East region grew by 38 per cent between 2016 and 2020, and in 2020 alone, Middle Eastern governments drove 97 per cent of green bond issuances, compared with 13 per cent four years earlier, according to the Boston Consulting Group.

“Banks in the Middle East have embraced the importance of a well-defined ESG strategy. During the next step, implementation, frameworks such as data governance are vitally necessary,” said Mr Amin.

Arthur D Little said that $24.55 billion in green and sustainable finance was generated by the Mena region in 2021, a more than sixfold increase from $3.8 billion in 2020.

The Emirates is investing Dh600 billion in clean and renewable energy projects over the next three decades as it aims to achieve net-zero emissions by 2050.

It is building the Mohammed bin Rashid Solar Park in Dubai with a capacity of five gigawatts.

Abu Dhabi, which is developing a two-gigawatt solar plant in its Al Dhafra region, has set a target of 5.6 gigawatts of solar PV capacity by 2026.

Premier Futsal 2017 Finals

Al Wasl Football Club; six teams, five-a-side

Delhi Dragons: Ronaldinho

Bengaluru Royals: Paul Scholes

Mumbai Warriors: Ryan Giggs

Chennai Ginghams: Hernan Crespo

Telugu Tigers: Deco

Kerala Cobras: Michel Salgado

Asian Cup 2019

Quarter-final

UAE v Australia, Friday, 8pm, Hazza bin Zayed Stadium, Al Ain

Tour de France 2017: Stage 5

Vittel - La Planche de Belles Filles, 160.5km

It is a shorter stage, but one that will lead to a brutal uphill finish. This is the third visit in six editions since it was introduced to the race in 2012. Reigning champion Chris Froome won that race.

About Okadoc

Date started: Okadoc, 2018

Founder/CEO: Fodhil Benturquia

Based: Dubai, UAE

Sector: Healthcare

Size: (employees/revenue) 40 staff; undisclosed revenues recording “double-digit” monthly growth

Funding stage: Series B fundraising round to conclude in February

Investors: Undisclosed

New UK refugee system

- A new “core protection” for refugees moving from permanent to a more basic, temporary protection

- Shortened leave to remain - refugees will receive 30 months instead of five years

- A longer path to settlement with no indefinite settled status until a refugee has spent 20 years in Britain

- To encourage refugees to integrate the government will encourage them to out of the core protection route wherever possible.

- Under core protection there will be no automatic right to family reunion

- Refugees will have a reduced right to public funds

Wicked: For Good

Director: Jon M Chu

Starring: Ariana Grande, Cynthia Erivo, Jonathan Bailey, Jeff Goldblum, Michelle Yeoh, Ethan Slater

Rating: 4/5

Killing of Qassem Suleimani

About Krews

Founder: Ahmed Al Qubaisi

Based: Abu Dhabi

Founded: January 2019

Number of employees: 10

Sector: Technology/Social media

Funding to date: Estimated $300,000 from Hub71 in-kind support

Common OCD symptoms and how they manifest

Checking: the obsession or thoughts focus on some harm coming from things not being as they should, which usually centre around the theme of safety. For example, the obsession is “the building will burn down”, therefore the compulsion is checking that the oven is switched off.

Contamination: the obsession is focused on the presence of germs, dirt or harmful bacteria and how this will impact the person and/or their loved ones. For example, the obsession is “the floor is dirty; me and my family will get sick and die”, the compulsion is repetitive cleaning.

Orderliness: the obsession is a fear of sitting with uncomfortable feelings, or to prevent harm coming to oneself or others. Objectively there appears to be no logical link between the obsession and compulsion. For example,” I won’t feel right if the jars aren’t lined up” or “harm will come to my family if I don’t line up all the jars”, so the compulsion is therefore lining up the jars.

Intrusive thoughts: the intrusive thought is usually highly distressing and repetitive. Common examples may include thoughts of perpetrating violence towards others, harming others, or questions over one’s character or deeds, usually in conflict with the person’s true values. An example would be: “I think I might hurt my family”, which in turn leads to the compulsion of avoiding social gatherings.

Hoarding: the intrusive thought is the overvaluing of objects or possessions, while the compulsion is stashing or hoarding these items and refusing to let them go. For example, “this newspaper may come in useful one day”, therefore, the compulsion is hoarding newspapers instead of discarding them the next day.

Source: Dr Robert Chandler, clinical psychologist at Lighthouse Arabia

Guide to intelligent investing

Investing success often hinges on discipline and perspective. As markets fluctuate, remember these guiding principles:

- Stay invested: Time in the market, not timing the market, is critical to long-term gains.

- Rational thinking: Breathe and avoid emotional decision-making; let logic and planning guide your actions.

- Strategic patience: Understand why you’re investing and allow time for your strategies to unfold.

THE BIO

Occupation: Specialised chief medical laboratory technologist

Age: 78

Favourite destination: Always Al Ain “Dar Al Zain”

Hobbies: his work - “ the thing which I am most passionate for and which occupied all my time in the morning and evening from 1963 to 2019”

Other hobbies: football

Favorite football club: Al Ain Sports Club

The specs: 2018 Nissan 370Z Nismo

The specs: 2018 Nissan 370Z Nismo

Price, base / as tested: Dh182,178

Engine: 3.7-litre V6

Power: 350hp @ 7,400rpm

Torque: 374Nm @ 5,200rpm

Transmission: Seven-speed automatic

Fuel consumption, combined: 10.5L / 100km

David Haye record

Total fights: 32

Wins: 28

Wins by KO: 26

Losses: 4

Sunday:

GP3 race: 12:10pm

Formula 2 race: 1:35pm

Formula 1 race: 5:10pm

Performance: Guns N' Roses

Real estate tokenisation project

Dubai launched the pilot phase of its real estate tokenisation project last month.

The initiative focuses on converting real estate assets into digital tokens recorded on blockchain technology and helps in streamlining the process of buying, selling and investing, the Dubai Land Department said.

Dubai’s real estate tokenisation market is projected to reach Dh60 billion ($16.33 billion) by 2033, representing 7 per cent of the emirate’s total property transactions, according to the DLD.

The specs

Engine: 3.8-litre twin-turbo V8

Power: 611bhp

Torque: 620Nm

Transmission: seven-speed automatic

Price: upon application

On sale: now

White hydrogen: Naturally occurring hydrogen

Chromite: Hard, metallic mineral containing iron oxide and chromium oxide

Ultramafic rocks: Dark-coloured rocks rich in magnesium or iron with very low silica content

Ophiolite: A section of the earth’s crust, which is oceanic in nature that has since been uplifted and exposed on land

Olivine: A commonly occurring magnesium iron silicate mineral that derives its name for its olive-green yellow-green colour

Results

2pm: Handicap Dh 90,000 1,800m; Winner: Majestic Thunder, Tadhg O’Shea (jockey), Satish Seemar (trainer).

2.30pm: Handicap Dh120,000 1,950m; Winner: Just A Penny, Sam Hitchcott, Doug Watson.

3pm: Handicap Dh105,000 1,600m; Winner: Native Appeal, Pat Dobbs, Doug Watson.

3.30pm: Jebel Ali Classic Conditions Dh300,000 1,400m; Winner: Thegreatcollection, Adrie de Vries, Doug Watson.

4pm: Maiden Dh75,000 1,600m; Winner: Oktalgano, Xavier Ziani, Salem bin Ghadayer.

4.30pm: Conditions Dh250,000 1,400m; Winner: Madame Ellingtina, Richard Mullen, Satish Seemar.

5pm: Maiden Dh75,000 1,600m; Winner: Mystery Land, Fabrice Veron, Helal Al Alawi.

5.30pm: Handicap Dh85,000 1,000m; Winner: Shanaghai City, Jesus Rosales, Rashed Bouresly.

More from Rashmee Roshan Lall

Brief scoreline:

Manchester United 0

Manchester City 2

Bernardo Silva 54', Sane 66'

COMPANY PROFILE

Founders: Alhaan Ahmed, Alyina Ahmed and Maximo Tettamanzi

Total funding: Self funded

The candidates

Dr Ayham Ammora, scientist and business executive

Ali Azeem, business leader

Tony Booth, professor of education

Lord Browne, former BP chief executive

Dr Mohamed El-Erian, economist

Professor Wyn Evans, astrophysicist

Dr Mark Mann, scientist

Gina MIller, anti-Brexit campaigner

Lord Smith, former Cabinet minister

Sandi Toksvig, broadcaster

COMPANY PROFILE

Name: Kumulus Water

Started: 2021

Founders: Iheb Triki and Mohamed Ali Abid

Based: Tunisia

Sector: Water technology

Number of staff: 22

Investment raised: $4 million