The rapid growth of India's digital economy is a model nations around the world would like to emulate.

The phenomenal rise in its online payments industry has made the country one of its global leaders, and the entity that engineered the digital revolution in Asia's third-largest economy has now set its sights on global expansion.

National Payments Corporation of India (NPCI) is an initiative of the Reserve Bank of India and Indian Banks’ Association. Its Unified Payments Interface (UPI) is the engine behind the digital payments system in India. Launched in 2016, the UPI allows people to make instant payments with their mobile phones, with their number linked directly to their bank account.

Digital payments platforms including Paytm, Google Pay, and Walmart-owned PhonePe all use this system, which is linked to more than 300 banks. In the last financial year to the end of March, the value of UPI transactions crossed $1 trillion, according to NPCI data.

“Having delivered the magnitude of cash displacement that we have achieved here in India, it's very natural for us to look beyond the current horizons,” Ritesh Shukla, chief executive at NPCI International Payments, says in an interview with The National.

“We are looking at taking the solutions that NPCI has built, deployed and scaled up in India to international markets.”

NPCI has already teamed up with companies in the UAE, Nepal and Bhutan to make its UPI system available in these markets. It has also signed an initial agreement to enable cashless transactions for Indian customers in the Netherlands.

The Monetary Authority of Singapore and the RBI are working on plans to link Singapore’s PayNow and India’s UPI systems.

NPCI has more than 300 opportunities in different stages of discussion internationally, Mr Shukla says.

It is looking at options to help countries to create their own “UPI-like ecosystem” by sharing knowledge, technology, as well as partnerships to allow Indians to use UPI for payments and remittances when they travel and live abroad, he said.

The expansion drive beyond its home market comes amid a stellar growth of India's digital payments industry. New Delhi has been pushing for the country — which had long been a cash-dependent economy — to go digital.

In 2016, Prime Minister Narendra Modi's 2016 banned the two highest value banknotes overnight, in an effort to crack down on black money. It kick-started the growth of digital payments in the country, which was further boosted by the Covid-19 pandemic.

The value of digital payments in India is projected to grow more than threefold to $10tn by 2026 from $3tn, according to a report released in June by Boston Consulting Group and digital payments company PhonePe.

As a result of this expansion, digital non-cash payments will make up two out of three transactions in the country by 2026.

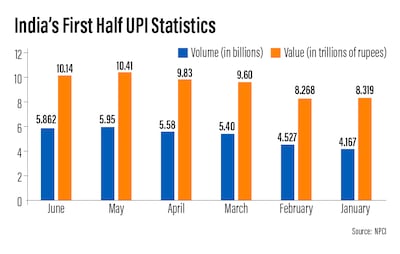

UPI is playing a fundamental role in this growth. In the first quarter of this year, UPI payments to merchants made up 64 per cent in volume and 50 per cent in terms of value of a total of 9.36 billion transactions in India, with the remainder accounted for by credit and debit cards and prepaid options such as mobile wallets, a report by multinational payment services company Worldline reveals.

UPI transactions almost doubled in both value and volume in the first three months of the year compared to the same time last year, data shows.

“UPI is fundamental,” says Utkarsh Sinha, managing director of Mumbai-based boutique investment bank Bexley Advisers. “Its impact can’t be overstated. It could also be one of India’s most significant exports to the rest of the world and we are already seeing efforts to evangelise it in other economies.”

UPI involves “a standard and open source layer that can enable a lot of innovation on top”, he says.

“It simplifies authentication and consent, the two pillars of payment, in a way that is consistent with 21st-century tech, rather than iteratively building on legacy infrastructure.”

Globally, India has firmly cemented its position in the digital payments sector. The country accounted for 48.6 billion transactions, the largest number of real-time payments in 2021, almost threefold that of the next biggest market, China, according to a research report by ACI Worldwide.

Real-time payments make up 31.3 per cent of India's total payments transaction volume in 2021, helped by UPI-based mobile payments apps being widely adopted by stores — from small grocery shops and market vendors to large retail chains, according to the report.

“India is the poster child for real-time payments and a shining example of how a co-ordinated, collective, nationwide effort can unlock huge economic and social potential,” says Ankur Saxena, head of South Asia at ACI Worldwide.

UPI's growth in India has also been propelled by the uptake of the system by digital payments platforms, along with the push by the central bank, says Ketan Patel, chief executive of digital payments and financial solutions company Mswipe Technologies.

Factors that have boosted the digital economy more broadly include increased smartphone ownership and a change in mindset of consumers towards online transactions have also helped, he adds.

“The entire payments ecosystem is moving to digital,” says Mr Patel.

In addition to international growth plans, the RBI last month outlined proposals to further expand digital payments domestically by linking credit cards to the UPI system.

“UPI-based payments accelerated the shift towards electronic payments in India over the last few years, thanks to large consumer and merchant acceptance,” says Nikhil Reddy, senior banking and payments analyst at GlobalData. “Linking credit cards with UPI will further propel UPI payments and benefit credit card market growth.”

The benefits of further digitalisation of the Indian economy are enormous, says Manoj Yadav, founder of Delhi-based Legal-N-Tax Advisory and Taxadvocateindia.com.

“It brings lots of benefits to the Indian economy like transaction transparency, security from fraud and the government can easily track and monitor the monetary payments,” Mr Yadav says.

“It's also helpful for budget discipline and a liquidity problem resolver for the economy.”

The government is keen to push for further digitisation of its economy, but there are challenges, analysts say.

Patchy internet access that can lead to digital transactions failing or simply not being possible in certain areas due to poor connectivity is one of the major hurdles. The problem is worst in rural areas, where most of India's population resides.

chief executive, NPCI International Payments.

Access to the internet, along with consumers' preference of generally using UPI payments for smaller transactions of less than 2,000 rupees ($25.33), means that credit and debit cards will continue to play a major role, Mr Patel says.

However, NPCI sees the potential of growth in the value and volume of transactions through the UPI system and is prepared for that influx.

Its platforms have been built to handle a billion transactions a day, Mr Shukla says.

“I think this journey is going to continue as more and more Indians adapt to digital payments,” he says. “If we are able to add an international dimension to it, then it's only a good addition to the existing experience.”

He believes that India could play a role in the digital payments growth story of other markets.

“Today, India is in such a sweet spot that we can call ourselves the guru in instant payments and we can teach the whole world about how it is done,” he says.