Money laundering, market manipulation and online theft are the biggest threats globally to decentralised finance (DeFi) on Web3 and collaborative solutions are needed to ensure user trust in the next iteration of the internet, according to report by Chainalysis.

While it cannot be totally eradicated, reduced volume of illicit activity is a sign that stakeholders are more engaged to combat these threats, which have the potential to cost users billions, the blockchain data platform said in its State of Web3 report.

The pattern is similar to previous cycles of emerging technologies: as decentralised finance protocols steadily rise in popularity, illicit use is also trending upwards, said Ethan McMahon, an economist at New York-based Chainalysis.

“As with any emerging technology that has tremendous potential for widespread use, bad actors are among the first to act. It, therefore, isn’t surprising to see that,” Mr McMahon told The National.

“That being said, experience tells us that as the DeFi space matures, illicit usage will make up an ever-smaller share of the total usage.

“Of course, this will require a concerted effort by industry stakeholders to harness the inherent transparency of blockchains to mitigate malicious activity and thus increase consumer confidence in the technology.”

Web3 is the latest iteration of the world wide web, with blockchain, decentralisation, openness and greater user utility among its core components. Its market value is expected to reach about $6.2 billion in 2023 and is projected to grow at a compound annual rate of 44.6 per cent from 2023 to 2030, Market Research Future said.

Blockchain-based DeFi, meanwhile, is generally considered to be a safer way to conduct transactions and can potentially replace middlemen, such as brokers and banks, in the financial system.

The global DeFi platform market is expected to hit $507.92bn in 2028, at a compound annual growth rate of about 44 per cent, Emergen Research reported.

It is proving to be a lucrative opportunity for the digital underworld. Losses in the cryptocurrency sector surged to $14bn in 2021, a 79 per cent jump over 2020, largely due to the rise in DeFi platforms and the proliferation of fraud, Chainalysis said earlier this year.

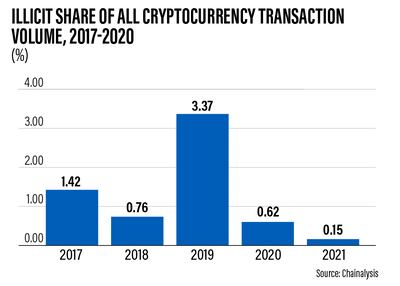

The share of illicit activity in the cryptocurrency market dropped to a mere 0.15 per cent in 2021, the lowest level since 2017, with the only notable spike coming in 2019 when it rose to almost 3.4 per cent.

That peak, however, was largely attributed to the PlusToken scandal, which defrauded investors of about $2.25bn in China. The perpetrators were sentenced to 11 years in prison in late 2020.

“The volume of illicit cryptocurrency transactions as a share of the overall market is at a record low. This bodes well for the adoption and utilisation of these digital assets by a broader segment of consumers and businesses,” Mr McMahon said.

However, DeFi specifically appears to be going through the same growing pains that cryptocurrencies as a whole did previously, with illicit activity rising over the past two years, Chainalysis said.

“As the cryptocurrency ecosystem matures, cyber criminals are setting their sights on the emerging trends of DeFi and NFTs [non-fungible tokens]. As with the early days of cryptocurrencies, hackers have been quick to execute their illicit schemes,” Mr McMahon said.

The value of cryptocurrency stolen from DeFi protocols surged to about $1.25bn in the first quarter of 2022, only half a year removed from the first time it breached the $1bn mark.

The Chainalysis study showed that much of the cryptocurrency stolen from DeFi protocols has gone to hacking groups associated with North Korea, with around $840 million funnelled there in 2022.

The transparency of blockchain allows government agencies to identify and hit services being used for money laundering, Mr McMahon said, but with hacking at a record high, he recommends prioritising investments in preventive measures to stem this rise.

“Attacks on DeFi protocols by North Korean-linked hackers demonstrate the need for these protocols to shore up their systems not just to protect consumers, but also for national security,” he added.

“For confidence to grow, it is imperative for industry stakeholders to step up and stamp out this abuse of these technologies.”

PROFILE

Name: Enhance Fitness

Year started: 2018

Based: UAE

Employees: 200

Amount raised: $3m

Investors: Global Ventures and angel investors

Dengue%20fever%20symptoms

%3Cul%3E%0A%3Cli%3EHigh%20fever%3C%2Fli%3E%0A%3Cli%3EIntense%20pain%20behind%20your%20eyes%3C%2Fli%3E%0A%3Cli%3ESevere%20headache%3C%2Fli%3E%0A%3Cli%3EMuscle%20and%20joint%20pains%3C%2Fli%3E%0A%3Cli%3ENausea%3C%2Fli%3E%0A%3Cli%3EVomiting%3C%2Fli%3E%0A%3Cli%3ESwollen%20glands%3C%2Fli%3E%0A%3Cli%3ERash%3C%2Fli%3E%0A%3C%2Ful%3E%0A%3Cp%3EIf%20symptoms%20occur%2C%20they%20usually%20last%20for%20two-seven%20days%3C%2Fp%3E%0A

Scoreline:

Cardiff City 0

Liverpool 2

Wijnaldum 57', Milner 81' (pen)

Killing of Qassem Suleimani

MATCH INFO

Everton v Tottenham, Sunday, 8.30pm (UAE)

Match is live on BeIN Sports

MATCH INFO

Karnatake Tuskers 114-1 (10 ovs)

Charles 57, Amla 47

Bangla Tigers 117-5 (8.5 ovs)

Fletcher 40, Moores 28 no, Lamichhane 2-9

Bangla Tiger win by five wickets

MATCH INFO

Day 2 at Mount Maunganui

England 353

Stokes 91, Denly 74, Southee 4-88

New Zealand 144-4

Williamson 51, S Curran 2-28

MATCH DETAILS

Barcelona 0

Slavia Prague 0

SEMI-FINAL

Monterrey 1

Funes Mori (14)

Liverpool 2

Keita (11), Firmino (90 1)

Genesis G80 2020 5.0-litre Royal Specs

Engine: 5-litre V8

Gearbox: eight-speed automatic

Power: 420hp

Torque: 505Nm

Fuel economy, combined: 12.4L/100km

Price: Dh260,500

THE SPECS

Engine: 3.5-litre supercharged V6

Power: 416hp at 7,000rpm

Torque: 410Nm at 3,500rpm

Transmission: 6-speed manual

Fuel consumption: 10.2 l/100km

Price: Dh375,000

On sale: now

What are the GCSE grade equivalents?

- Grade 9 = above an A*

- Grade 8 = between grades A* and A

- Grade 7 = grade A

- Grade 6 = just above a grade B

- Grade 5 = between grades B and C

- Grade 4 = grade C

- Grade 3 = between grades D and E

- Grade 2 = between grades E and F

- Grade 1 = between grades F and G

THE SPECS

Range Rover Sport Autobiography Dynamic

Engine: 5.0-litre supercharged V8

Transmission: six-speed manual

Power: 518bhp

Torque: 625Nm

Speed: 0-100kmh 5.3 seconds

Price: Dh633,435

On sale: now

UAE currency: the story behind the money in your pockets

UAE squad

Esha Oza (captain), Al Maseera Jahangir, Emily Thomas, Heena Hotchandani, Indhuja Nandakumar, Katie Thompson, Lavanya Keny, Mehak Thakur, Michelle Botha, Rinitha Rajith, Samaira Dharnidharka, Siya Gokhale, Sashikala Silva, Suraksha Kotte, Theertha Satish (wicketkeeper) Udeni Kuruppuarachchige, Vaishnave Mahesh.

UAE tour of Zimbabwe

All matches in Bulawayo

Friday, Sept 26 – First ODI

Sunday, Sept 28 – Second ODI

Tuesday, Sept 30 – Third ODI

Thursday, Oct 2 – Fourth ODI

Sunday, Oct 5 – First T20I

Monday, Oct 6 – Second T20I

The%20specs

%3Cp%3E%3Cstrong%3EPowertrain%3A%20%3C%2Fstrong%3ESingle%20electric%20motor%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E201hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E310Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20auto%0D%3Cbr%3E%3Cstrong%3EBattery%3A%20%3C%2Fstrong%3E53kWh%20lithium-ion%20battery%20pack%20(GS%20base%20model)%3B%2070kWh%20battery%20pack%20(GF)%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E350km%20(GS)%3B%20480km%20(GF)%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C900%20(GS)%3B%20Dh149%2C000%20(GF)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A

THE BIO: Mohammed Ashiq Ali

Proudest achievement: “I came to a new country and started this shop”

Favourite TV programme: the news

Favourite place in Dubai: Al Fahidi. “They started the metro in 2009 and I didn’t take it yet.”

Family: six sons in Dubai and a daughter in Faisalabad

Dhadak 2

Director: Shazia Iqbal

Starring: Siddhant Chaturvedi, Triptii Dimri

Rating: 1/5

RESULTS

6.30pm UAE 1000 Guineas Trial Conditions (TB) US$100,000 (Dirt) 1,400m

Winner Final Song, Christophe Soumillon (jockey), Saeed bin Suroor (trainer).

7.05pm Handicap (TB) $135,000 (Turf) 1,000m

Winner Almanaara, Dane O’Neill, Doug Watson.

7.40pm Handicap (TB) $175,000 (D) 1,900m

Winner Grand Argentier, Brett Doyle, Doug Watson.

8.15pm Meydan Challenge Listed Handicap (TB) $175,000 (T) 1,400m

Winner Major Partnership, Patrick Cosgrave, Saeed bin Suroor.

8.50pm Dubai Stakes Group 3 (TB) $200,000 (D) 1,200m

Winner Gladiator King, Mickael Barzalona, Satish Seemar.

9.25pm Dubai Racing Club Classic Listed Handicap (TB) $175,000 (T) 2,410m

Winner Universal Order, Richard Mullen, David Simcock.

SPECS

Nissan 370z Nismo

Engine: 3.7-litre V6

Transmission: seven-speed automatic

Power: 363hp

Torque: 560Nm

Price: Dh184,500

KILLING OF QASSEM SULEIMANI

Brief scores

Toss India, chose to bat

India 281-7 in 50 ov (Pandya 83, Dhoni 79; Coulter-Nile 3-44)

Australia 137-9 in 21 ov (Maxwell 39, Warner 25; Chahal 3-30)

India won by 26 runs on Duckworth-Lewis Method

Green ambitions

- Trees: 1,500 to be planted, replacing 300 felled ones, with veteran oaks protected

- Lake: Brown's centrepiece to be cleaned of silt that makes it as shallow as 2.5cm

- Biodiversity: Bat cave to be added and habitats designed for kingfishers and little grebes

- Flood risk: Longer grass, deeper lake, restored ponds and absorbent paths all meant to siphon off water

DSC Eagles 23 Dubai Hurricanes 36

Eagles

Tries: Bright, O’Driscoll

Cons: Carey 2

Pens: Carey 3

Hurricanes

Tries: Knight 2, Lewis, Finck, Powell, Perry

Cons: Powell 3

SPECS

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%20Dual%20electric%20motors%20with%20102kW%20battery%20pack%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E570hp%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20890Nm%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERange%3A%3C%2Fstrong%3E%20Up%20to%20428km%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh1%2C700%2C000%3C%2Fp%3E%0A

Cultural fiesta

What: The Al Burda Festival

When: November 14 (from 10am)

Where: Warehouse421, Abu Dhabi

The Al Burda Festival is a celebration of Islamic art and culture, featuring talks, performances and exhibitions. Organised by the Ministry of Culture and Knowledge Development, this one-day event opens with a session on the future of Islamic art. With this in mind, it is followed by a number of workshops and “masterclass” sessions in everything from calligraphy and typography to geometry and the origins of Islamic design. There will also be discussions on subjects including ‘Who is the Audience for Islamic Art?’ and ‘New Markets for Islamic Design.’ A live performance from Kuwaiti guitarist Yousif Yaseen should be one of the highlights of the day.

Cricket World Cup League Two

Oman, UAE, Namibia

Al Amerat, Muscat

Results

Oman beat UAE by five wickets

UAE beat Namibia by eight runs

Fixtures

Wednesday January 8 –Oman v Namibia

Thursday January 9 – Oman v UAE

Saturday January 11 – UAE v Namibia

Sunday January 12 – Oman v Namibia

The specs

Engine: 4-litre twin-turbo V8

Transmission: eight-speed PDK

Power: 630bhp

Torque: 820Nm

Price: Dh683,200

On sale: now

RESULTS

5pm: Maiden | Dh80,000 | 1,600m

Winner: AF Al Moreeb, Tadhg O’Shea (jockey), Ernst Oertel (trainer)

5.30pm: Handicap | Dh80,000 | 1,600m

Winner: AF Makerah, Adrie de Vries, Ernst Oertel

6pm: Handicap | Dh80,000 | 2,200m

Winner: Hazeme, Richard Mullen, Jean de Roualle

6.30pm: Handicap | Dh85,000 | 2,200m

Winner: AF Yatroq, Brett Doyle, Ernst Oertel

7pm: Shadwell Farm for Private Owners Handicap | Dh70,000 | 2,200m

Winner: Nawwaf KB, Patrick Cosgrave, Helal Al Alawi

7.30pm: Handicap (TB) | Dh100,000 | 1,600m

Winner: Treasured Times, Bernardo Pinheiro, Rashed Bouresly

The biog

Name: Gul Raziq

From: Charsadda, Pakistan

Family: Wife and six children

Favourite holes at Al Ghazal: 15 and 8

Golf Handicap: 6

Childhood sport: cricket

The specs: 2017 Dodge Ram 1500 Laramie Longhorn

Price, base / as tested: Dhxxx

Engine: 5.7L V8

Transmission: Eight-speed automatic

Power: 395hp @ 5,600rpm

Torque: 556Nm @ 3,950rpm

Fuel economy, combined: 12.7L / 100km

The Voice of Hind Rajab

Starring: Saja Kilani, Clara Khoury, Motaz Malhees

Director: Kaouther Ben Hania

Rating: 4/5