Deliveroo riders have spoken out about low pay and unsafe conditions they face while working on London’s streets.

Investor concerns over employee conditions at the firm contributed to its disastrous London Stock Exchange debut on Wednesday.

Many riders make below minimum wage during shifts that can last 10 to 12 hours. They do not currently receive sick or holiday pay due to their self-employed status.

The role is gruelling and, at times, dangerous. Riders face threats from heavy traffic and brazen thieves who frequently steal bicycles and mopeds with little fear of being arrested by overstretched police forces.

Muhamed Ahmed began working for Deliveroo after arriving in Britain from his home town of Hyderabad, India.

He makes £50 ($70) on weekdays but this can rise to £70 ($96) a day on weekends, a figure that works out to £3.50 ($5) per delivery. Once, Muhamed made just £17 in a day, despite working a nine-and-a-half hour shift.

"I cannot survive in this kind of situation", he told The National. "Up until now, I have not had any support from Deliveroo. If they give sick pay, holiday pay or wages, then that would be very helpful for us.

“When we are on the road, we do not feel safe. We have to do it because we need the money. We are putting our life on the road and still we are not getting proper pay."

Jabed Hussain says he was one of Deliveroo’s first delivery riders in 2015 but gave up after he was sprayed with acid during a robbery in East London several years ago. The disturbing attack brought the plight of gig economy drivers to national attention.

Since then, he has campaigned for better conditions for riders, who he says are treated like “slaves”.

“I have been out of work. I feel I still have trauma. I am not getting any help, nothing at all, which is really unfair to me and for my family as well."

“I know a lot of drivers are depending on the food bank because they're delivering food and don’t have enough money left in their pockets.”

Naveed, a student from India, told The National he had made just £38 for nine deliveries.

“It’s not good for us ... There are a lot of drivers who are struggling,” he said.

In stark contrast, Deliveroo founders Will Shu and Greg Orlowski stand to make millions from Wednesday's IPO, despite shares flopping 26 per cent.

Deliveroo was contacted for comment but no one was immediately available.

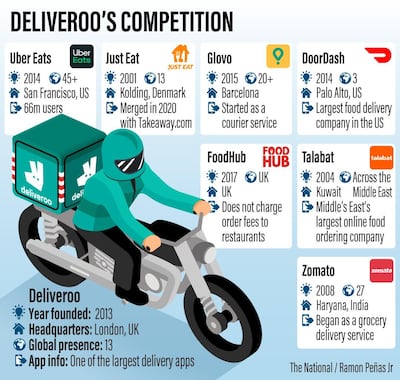

Deliveroo to DoorDash: the crowded food delivery scene

EMIRATES'S%20REVISED%20A350%20DEPLOYMENT%20SCHEDULE

%3Cp%3E%3Cstrong%3EEdinburgh%3A%3C%2Fstrong%3E%20November%204%20%3Cem%3E(unchanged)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBahrain%3A%3C%2Fstrong%3E%20November%2015%20%3Cem%3E(from%20September%2015)%3C%2Fem%3E%3B%20second%20daily%20service%20from%20January%201%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EKuwait%3A%3C%2Fstrong%3E%20November%2015%20%3Cem%3E(from%20September%2016)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EMumbai%3A%3C%2Fstrong%3E%20January%201%20%3Cem%3E(from%20October%2027)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EAhmedabad%3A%3C%2Fstrong%3E%20January%201%20%3Cem%3E(from%20October%2027)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EColombo%3A%3C%2Fstrong%3E%20January%202%20%3Cem%3E(from%20January%201)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EMuscat%3A%3C%2Fstrong%3E%3Cem%3E%20%3C%2Fem%3EMarch%201%3Cem%3E%20(from%20December%201)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ELyon%3A%3C%2Fstrong%3E%20March%201%20%3Cem%3E(from%20December%201)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBologna%3A%3C%2Fstrong%3E%20March%201%20%3Cem%3E(from%20December%201)%3C%2Fem%3E%3C%2Fp%3E%0A%3Cp%3E%3Cem%3ESource%3A%20Emirates%3C%2Fem%3E%3C%2Fp%3E%0A

Why it pays to compare

A comparison of sending Dh20,000 from the UAE using two different routes at the same time - the first direct from a UAE bank to a bank in Germany, and the second from the same UAE bank via an online platform to Germany - found key differences in cost and speed. The transfers were both initiated on January 30.

Route 1: bank transfer

The UAE bank charged Dh152.25 for the Dh20,000 transfer. On top of that, their exchange rate margin added a difference of around Dh415, compared with the mid-market rate.

Total cost: Dh567.25 - around 2.9 per cent of the total amount

Total received: €4,670.30

Route 2: online platform

The UAE bank’s charge for sending Dh20,000 to a UK dirham-denominated account was Dh2.10. The exchange rate margin cost was Dh60, plus a Dh12 fee.

Total cost: Dh74.10, around 0.4 per cent of the transaction

Total received: €4,756

The UAE bank transfer was far quicker – around two to three working days, while the online platform took around four to five days, but was considerably cheaper. In the online platform transfer, the funds were also exposed to currency risk during the period it took for them to arrive.

UAE currency: the story behind the money in your pockets