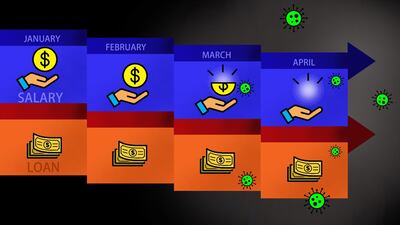

I called my bank to find out how I could secure a repayment holiday on my loan during the pandemic. I have been on unpaid leave from my job in the F&B sector since April 1 and last month I only received half of my salary.

I cannot afford to pay the loan instalments, which is why I asked for the grace period.

How can I pay instalments if I was paid half my salary last month and am now on unpaid leave?

I was very surprised when the bank rejected my request on the basis that the loan is a card loan. The bank said for this reason it is not eligible for a grace period. I signed up for the loan when the bank offered loans to its credit card holders.

We have never missed a payment until now and our inability to pay is only because of the pandemic, so it’s only fair that we get a grace period.

Surely a loan is a loan, whether it is a personal loan or a card loan? A customer has to pay both back in instalments and the bank's decision seems unfair.

How can I pay instalments if I was paid half my salary last month and am now on unpaid leave?

When I took on the four-year loan in October 2018 the outstanding balance was Dh65,000 with monthly payments of Dh1,970. The outstanding balance is now Dh42,730 and there are 29 more instalments to go. I also have a car loan, which costs Dh2,000 a month.

My monthly expenses come to about Dh10,370 a month and includes Dh4,000 for rent, Dh800 for transport, Dh1,000 for remittances, Dh3,970 for debt repayments and Dh600 for utilities and groceries.

My unpaid leave will continue until further notice, so where can I report this issue to get it resolved? KS, Abu Dhabi

Debt panellist 1: Ambareen Musa, founder and chief executive of Souqalmal.com

It is true that the standard three-month, penalty-free payment holiday under UAE banks' new financial relief measures is applicable only on retail loans. This means it applies to personal loans, car loans or mortgages and SME business loans. Credit card repayments are not included under this provision.

Loans on credit cards are a credit card-linked facility that works like a preapproved loan, based on your authorised credit limit. Unfortunately, even though it may seem like just another type of personal loan to you, the bank may not treat it the same way.

While repayment relief is available for retail loans across most banks, we are seeing some banks offer their credit card customers the option to postpone their repayments by one month with deferred interest. We're also aware of some banks that have reduced their late payment fees on credit cards. Speak to your bank to figure out if there's any other way they can help ease your repayments on the loan, maybe by restructuring it, extending the repayment tenure or waiving certain penalties.

You also mention having a car loan on top of this. Therefore, you can get access to a three-month repayment holiday on that to ease some of your financial burden. At the same time, it is also important that you look into your own budget to see how you can cut back and consolidate your savings. If you managed to set up some emergency savings earlier, you may need to tap into this fund to keep up with your household expenses and debt obligations.

It may also be a good idea to look for part-time or temporary work opportunities to stay afloat during this crisis. Speak to your employer to see if you can offer your services in a different function within the company, or reach out to companies that are seeing consistent demand during this time. They may be able to offer you a temporary assignment based on your skills and experience.

Debt panellist 2: R Sivaram, executive vice president, head of retail banking products, Emirates NBD

This can be a challenging time financially but there are viable solutions that you can explore.

As a first step, request a conversation with the concerned department in the bank to get a clear understanding on why your payment deferment request was denied. While there could be multiple reasons for rejection such as system limitations or product and policy restrictions, it is useful to discuss this with the bank and explore alternate solutions that could help address your request.

One potential option would be to convert your existing loan on the credit card into a personal loan. If you pursue this route, I would advise rescheduling your personal loan for a tenor of four years which would lower your future equal monthly instalments (EMIs) and allow for a 90-day first payment deferral which is typically a standard feature in personal loans.

I would also advise you to cancel your credit card to better manage your finances, and to explore deferring your existing auto loan. You may find it easier to secure a car loan deferral and it will provide immediate relief to your cash flow.

Having a job in hand is definitely a positive, even if you are on unpaid leave. Given you are being forthcoming about managing your financial commitments with a good and regular repayment history, I am sure your bank will view your current situation favourably and find a suitable solution that could help address your predicament.

Debt panellist 3: Rasheda Khatun Khan, founder of Design Your Life

This pandemic is hitting some people's finances very hard. What's super important is to revisit your own expenses to help you get through this period until your income starts again. This is crucial for anyone who has been affected financially by the crisis and is also a good exercise for those in better financial situations.

Firstly, identify which expenses are essential. Then look at what costs you can get rid of for now. The restrictive measures we have all been observing means you won't be spending in the same way you used to. Ask yourself, 'what do I no longer need or what can do without for now?' This can include expenses such as petrol, Salik, entertainment, sports and dining out. Really limit yourself and see this as a temporary situation.

Now identify the bigger expenses you can also trim, such as rent or school fees. Contact your landlord and see what flexibility they can offer you at this time. Many landlords will help tenants facing financial difficulty – you just have to ask. Could you negotiate a payment holiday until you get back on your feet? The same may apply for school fees as some schools are also being flexible and trying to help parents meet their obligations.

Crises like this really highlight the importance of having an emergency fund. Ideally, everyone should have three months of expenses set aside for emergencies, and for extreme scenarios such as this one the goal is to have six months of expenses.

As well as keeping your expenses to the minimum, do your best to negotiate with the bank and perhaps take a repayment on the car loan instead of the card loan. This will help you get through this period until you start earning again. Once your income returns, remember to build up your emergency fund to get you through the next crisis.

The Debt Panel is a weekly column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae

if you go

The flights

Etihad and Emirates fly direct from the UAE to Seoul from Dh3,775 return, including taxes

The package

Ski Safari offers a seven-night ski package to Korea, including five nights at the Dragon Valley Hotel in Yongpyong and two nights at Seoul CenterMark hotel, from £720 (Dh3,488) per person, including transfers, based on two travelling in January

The info

Visit www.gokorea.co.uk

Our legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants

PREMIER LEAGUE FIXTURES

All times UAE ( 4 GMT)

Saturday

West Ham United v Tottenham Hotspur (3.30pm)

Burnley v Huddersfield Town (7pm)

Everton v Bournemouth (7pm)

Manchester City v Crystal Palace (7pm)

Southampton v Manchester United (7pm)

Stoke City v Chelsea (7pm)

Swansea City v Watford (7pm)

Leicester City v Liverpool (8.30pm)

Sunday

Brighton and Hove Albion v Newcastle United (7pm)

Monday

Arsenal v West Bromwich Albion (11pm)

The%20specs

%3Cp%3E%3Cstrong%3EPowertrain%3A%20%3C%2Fstrong%3ESingle%20electric%20motor%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E201hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E310Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20auto%0D%3Cbr%3E%3Cstrong%3EBattery%3A%20%3C%2Fstrong%3E53kWh%20lithium-ion%20battery%20pack%20(GS%20base%20model)%3B%2070kWh%20battery%20pack%20(GF)%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E350km%20(GS)%3B%20480km%20(GF)%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C900%20(GS)%3B%20Dh149%2C000%20(GF)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A

THE DETAILS

Solo: A Star Wars Story

Dir: Ron Howard

Starring: Alden Ehrenreich, Emilia Clarke, Woody Harrelson

3/5

Another way to earn air miles

In addition to the Emirates and Etihad programmes, there is the Air Miles Middle East card, which offers members the ability to choose any airline, has no black-out dates and no restrictions on seat availability. Air Miles is linked up to HSBC credit cards and can also be earned through retail partners such as Spinneys, Sharaf DG and The Toy Store.

An Emirates Dubai-London round-trip ticket costs 180,000 miles on the Air Miles website. But customers earn these ‘miles’ at a much faster rate than airline miles. Adidas offers two air miles per Dh1 spent. Air Miles has partnerships with websites as well, so booking.com and agoda.com offer three miles per Dh1 spent.

“If you use your HSBC credit card when shopping at our partners, you are able to earn Air Miles twice which will mean you can get that flight reward faster and for less spend,” says Paul Lacey, the managing director for Europe, Middle East and India for Aimia, which owns and operates Air Miles Middle East.

Four motivational quotes from Alicia's Dubai talk

“The only thing we need is to know that we have faith. Faith and hope in our own dreams. The belief that, when we keep going we’re going to find our way. That’s all we got.”

“Sometimes we try so hard to keep things inside. We try so hard to pretend it’s not really bothering us. In some ways, that hurts us more. You don’t realise how dishonest you are with yourself sometimes, but I realised that if I spoke it, I could let it go.”

“One good thing is to know you’re not the only one going through it. You’re not the only one trying to find your way, trying to find yourself, trying to find amazing energy, trying to find a light. Show all of yourself. Show every nuance. All of your magic. All of your colours. Be true to that. You can be unafraid.”

“It’s time to stop holding back. It’s time to do it on your terms. It’s time to shine in the most unbelievable way. It’s time to let go of negativity and find your tribe, find those people that lift you up, because everybody else is just in your way.”

Tonight's Chat on The National

Tonight's Chat is a series of online conversations on The National. The series features a diverse range of celebrities, politicians and business leaders from around the Arab world.

Tonight’s Chat host Ricardo Karam is a renowned author and broadcaster with a decades-long career in TV. He has previously interviewed Bill Gates, Carlos Ghosn, Andre Agassi and the late Zaha Hadid, among others. Karam is also the founder of Takreem.

Intellectually curious and thought-provoking, Tonight’s Chat moves the conversation forward.

Facebook | Our website | Instagram

Company%20Profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Cargoz%3Cbr%3E%3Cstrong%3EDate%20started%3A%3C%2Fstrong%3E%20January%202022%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Premlal%20Pullisserry%20and%20Lijo%20Antony%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%3C%2Fstrong%3E%2030%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20Seed%3C%2Fp%3E%0A

Vaccine Progress in the Middle East

David Haye record

Total fights: 32

Wins: 28

Wins by KO: 26

Losses: 4

F1 drivers' standings

1. Lewis Hamilton, Mercedes 281

2. Sebastian Vettel, Ferrari 247

3. Valtteri Bottas, Mercedes 222

4. Daniel Ricciardo, Red Bull 177

5. Kimi Raikkonen, Ferrari 138

6. Max Verstappen, Red Bull 93

7. Sergio Perez, Force India 86

8. Esteban Ocon, Force India 56

UAE%20athletes%20heading%20to%20Paris%202024

%3Cp%3E%3Cstrong%3EEquestrian%3C%2Fstrong%3E%3Cbr%3EAbdullah%20Humaid%20Al%20Muhairi%2C%20Abdullah%20Al%20Marri%2C%20Omar%20Al%20Marzooqi%2C%20Salem%20Al%20Suwaidi%2C%20and%20Ali%20Al%20Karbi%20(four%20to%20be%20selected).%3Cbr%3E%3Cstrong%3EJudo%3C%2Fstrong%3E%3Cbr%3EMen%3A%20Narmandakh%20Bayanmunkh%20(66kg)%2C%20Nugzari%20Tatalashvili%20(81kg)%2C%20Aram%20Grigorian%20(90kg)%2C%20Dzhafar%20Kostoev%20(100kg)%2C%20Magomedomar%20Magomedomarov%20(%2B100kg)%3B%20women's%20Khorloodoi%20Bishrelt%20(52kg).%3Cbr%3E%3Cbr%3E%3Cstrong%3ECycling%3C%2Fstrong%3E%3Cbr%3ESafia%20Al%20Sayegh%20(women's%20road%20race).%3Cbr%3E%3Cbr%3E%3Cstrong%3ESwimming%3C%2Fstrong%3E%3Cbr%3EMen%3A%20Yousef%20Rashid%20Al%20Matroushi%20(100m%20freestyle)%3B%20women%3A%20Maha%20Abdullah%20Al%20Shehi%20(200m%20freestyle).%3Cbr%3E%3Cbr%3E%3Cstrong%3EAthletics%3C%2Fstrong%3E%3Cbr%3EMaryam%20Mohammed%20Al%20Farsi%20(women's%20100%20metres).%3C%2Fp%3E%0A

'Saand Ki Aankh'

Produced by: Reliance Entertainment with Chalk and Cheese Films

Director: Tushar Hiranandani

Cast: Taapsee Pannu, Bhumi Pednekar, Prakash Jha, Vineet Singh

Rating: 3.5/5 stars

Founders: Abdulmajeed Alsukhan, Turki Bin Zarah and Abdulmohsen Albabtain.

Based: Riyadh

Offices: UAE, Vietnam and Germany

Founded: September, 2020

Number of employees: 70

Sector: FinTech, online payment solutions

Funding to date: $116m in two funding rounds

Investors: Checkout.com, Impact46, Vision Ventures, Wealth Well, Seedra, Khwarizmi, Hala Ventures, Nama Ventures and family offices

The specs

Engine: 77.4kW all-wheel-drive dual motor

Power: 320bhp

Torque: 605Nm

Transmission: Single-speed automatic

Price: From Dh219,000

On sale: Now

The National Archives, Abu Dhabi

Founded over 50 years ago, the National Archives collects valuable historical material relating to the UAE, and is the oldest and richest archive relating to the Arabian Gulf.

Much of the material can be viewed on line at the Arabian Gulf Digital Archive - https://www.agda.ae/en

Price, base / as tested From Dh173,775 (base model)

Engine 2.0-litre 4cyl turbo, AWD

Power 249hp at 5,500rpm

Torque 365Nm at 1,300-4,500rpm

Gearbox Nine-speed auto

Fuel economy, combined 7.9L/100km

Pathaan

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Siddharth%20Anand%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Shah%20Rukh%20Khan%2C%20Deepika%20Padukone%2C%20John%20Abraham%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%203%2F5%3C%2Fp%3E%0A

Monday's results

- UAE beat Bahrain by 51 runs

- Qatar beat Maldives by 44 runs

- Saudi Arabia beat Kuwait by seven wickets

The specs

Price, base / as tested Dh1,100,000 (est)

Engine 5.2-litre V10

Gearbox seven-speed dual clutch

Power 630bhp @ 8,000rpm

Torque 600Nm @ 6,500rpm

Fuel economy, combined 15.7L / 100km (est)

ONCE UPON A TIME IN GAZA

Starring: Nader Abd Alhay, Majd Eid, Ramzi Maqdisi

Directors: Tarzan and Arab Nasser

Rating: 4.5/5

Our legal consultant

Name: Dr Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

World record transfers

1. Kylian Mbappe - to Real Madrid in 2017/18 - €180 million (Dh770.4m - if a deal goes through)

2. Paul Pogba - to Manchester United in 2016/17 - €105m

3. Gareth Bale - to Real Madrid in 2013/14 - €101m

4. Cristiano Ronaldo - to Real Madrid in 2009/10 - €94m

5. Gonzalo Higuain - to Juventus in 2016/17 - €90m

6. Neymar - to Barcelona in 2013/14 - €88.2m

7. Romelu Lukaku - to Manchester United in 2017/18 - €84.7m

8. Luis Suarez - to Barcelona in 2014/15 - €81.72m

9. Angel di Maria - to Manchester United in 2014/15 - €75m

10. James Rodriguez - to Real Madrid in 2014/15 - €75m