The Covid-19 pandemic sparked the largest decrease in taxes on wages since the 2008 global financial crisis, according to a new report by the Organisation for Economic Co-operation and Development.

Lower household incomes coupled with tax reforms linked to the pandemic are driving widespread declines in taxes on wages across the 37-member bloc, the OECD's Taxing Wages 2021 report said on Thursday.

Governments and central banks have provided more than $12 trillion in monetary and fiscal support to economies since the outbreak of the pandemic, which disrupted economic activity and tipped the world into one of the steepest recessions since the Great Depression.

The decrease was derived for the most part from lower income taxes, linked in part to lower nominal average wages in 16 countries, and in part to policy changes

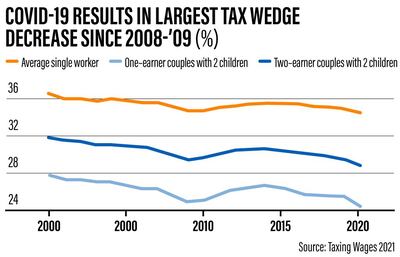

The report highlighted record falls in the tax wedge – a measure of how much a government receives after taxing employers and employees, minus family benefits – across the OECD during 2020.

"In some countries, employees have taxes withheld from their pay cheques, which means their take-home pay is less than the gross salary or the cost of employing them," Anurag Chaturvedi, managing partner at Chartered House Tax Consultancy, told The National. "The tax wedge is the difference between what employees take home in earnings and what it costs to employ them."

The tax wedge for a single worker at the average wage was 34.6 per cent in 2020, a decrease of 0.39 percentage points from the previous year.

“This is a significant fall, but is smaller than the decreases seen in the global financial crisis – 0.48 percentage points in 2008 and 0.52 percentage points in 2009,” the report said.

“The tax wedge increased in seven of the 37 OECD countries over the 2019-20 period and fell in 29, mainly due to lower income taxes.”

The OECD also found that labour taxation varied considerably across the bloc, with the tax wedge on the average single worker ranging from zero in Colombia to 51.5 per cent in Belgium.

“The decrease was derived for the most part from lower income taxes, linked in part to lower nominal average wages in 16 countries and in part to policy changes, including tax and benefit measures introduced in response to the Covid-19 pandemic,” the report said. “The rises in tax wedge were driven by higher income tax.”

An increase in the tax wedge reduces the quantity of goods and services that workers can buy due to an increase in withheld tax, Mr Chaturvedi said. He added that a decrease in buying power suppresses demand, which can lead to a rise in inflation and fiscal deficits.

Meanwhile, the drop in the tax wedge was more significant for households with children, bringing tax rates to new lows for families.

The average tax wedge for a one-earner couple at the average wage with children in 2020 was 24.4 per cent, a decrease of 1.1 percentage points from 2019. This is the largest fall and lowest level seen for this household type since the OECD started producing the Taxing Wages report in 2000.

The tax wedge for this household type decreased in 31 countries and rose in only six between 2019 and 2020. The largest decreases were in Lithuania, the US, Poland, Italy, Canada and Korea. The only increase over 1 percentage point was in New Zealand.

The gap between the OECD average tax wedge for the single average worker (34.6 per cent) and the one-earner couple with children (24.4 per cent) has widened by 0.7 percentage points since 2019. This is because policymakers provided additional support to families with children during the Covid-19 crisis.

In the 10 countries where specific Covid-19 measures affected the indicators, support was primarily delivered through enhanced or one-off cash benefits, with a focus on supporting families with children.

Only a few countries introduced measures to change the structure of their personal income taxes or social security contributions in direct response to the Covid-19 pandemic, the report said.

The Bio

Hometown: Bogota, Colombia

Favourite place to relax in UAE: the desert around Al Mleiha in Sharjah or the eastern mangroves in Abu Dhabi

The one book everyone should read: 100 Years of Solitude by Gabriel Garcia Marquez. It will make your mind fly

Favourite documentary: Chasing Coral by Jeff Orlowski. It's a good reality check about one of the most valued ecosystems for humanity

The National Archives, Abu Dhabi

Founded over 50 years ago, the National Archives collects valuable historical material relating to the UAE, and is the oldest and richest archive relating to the Arabian Gulf.

Much of the material can be viewed on line at the Arabian Gulf Digital Archive - https://www.agda.ae/en

Results

6.30pm: Mazrat Al Ruwayah Group Two (PA) US$55,000 (Dirt) 1,600m; Winner: Rasi, Harry Bentley (jockey), Sulaiman Al Ghunaimi (trainer).

7.05pm: Meydan Trophy (TB) $100,000 (Turf) 1,900m; Winner: Ya Hayati, William Buick, Charlie Appleby.

7.40pm: Handicap (TB) $135,000 (D) 1,200m; Winner: Bochart, Richard Mullen, Satish Seemar.

8.15pm: Balanchine Group Two (TB) $250,000 (T) 1,800m; Winner: Magic Lily, William Buick, Charlie Appleby.

8.50pm: Handicap (TB) $135,000 (T) 1,000m; Winner: Waady, Jim Crowley, Doug Watson.

9.25pm: Firebreak Stakes Group Three (TB) $200,000 (D) 1,600m; Winner: Capezzano, Mickael Barzalona, Salem bin Ghadayer.

10pm: Handicap (TB) $175,000 (T) 2,410m; Winner: Eynhallow, Mickael Barzalona, Charlie Appleby.

Key findings of Jenkins report

- Founder of the Muslim Brotherhood, Hassan al Banna, "accepted the political utility of violence"

- Views of key Muslim Brotherhood ideologue, Sayyid Qutb, have “consistently been understood” as permitting “the use of extreme violence in the pursuit of the perfect Islamic society” and “never been institutionally disowned” by the movement.

- Muslim Brotherhood at all levels has repeatedly defended Hamas attacks against Israel, including the use of suicide bombers and the killing of civilians.

- Laying out the report in the House of Commons, David Cameron told MPs: "The main findings of the review support the conclusion that membership of, association with, or influence by the Muslim Brotherhood should be considered as a possible indicator of extremism."

More from Rashmee Roshan Lall

The Voice of Hind Rajab

Starring: Saja Kilani, Clara Khoury, Motaz Malhees

Director: Kaouther Ben Hania

Rating: 4/5

The biog

Favourite food: Tabbouleh, greek salad and sushi

Favourite TV show: That 70s Show

Favourite animal: Ferrets, they are smart, sensitive, playful and loving

Favourite holiday destination: Seychelles, my resolution for 2020 is to visit as many spiritual retreats and animal shelters across the world as I can

Name of first pet: Eddy, a Persian cat that showed up at our home

Favourite dog breed: I love them all - if I had to pick Yorkshire terrier for small dogs and St Bernard's for big

Diriyah%20project%20at%20a%20glance

%3Cp%3E-%20Diriyah%E2%80%99s%201.9km%20King%20Salman%20Boulevard%2C%20a%20Parisian%20Champs-Elysees-inspired%20avenue%2C%20is%20scheduled%20for%20completion%20in%202028%0D%3Cbr%3E-%20The%20Royal%20Diriyah%20Opera%20House%20is%20expected%20to%20be%20completed%20in%20four%20years%0D%3Cbr%3E-%20Diriyah%E2%80%99s%20first%20of%2042%20hotels%2C%20the%20Bab%20Samhan%20hotel%2C%20will%20open%20in%20the%20first%20quarter%20of%202024%0D%3Cbr%3E-%20On%20completion%20in%202030%2C%20the%20Diriyah%20project%20is%20forecast%20to%20accommodate%20more%20than%20100%2C000%20people%0D%3Cbr%3E-%20The%20%2463.2%20billion%20Diriyah%20project%20will%20contribute%20%247.2%20billion%20to%20the%20kingdom%E2%80%99s%20GDP%0D%3Cbr%3E-%20It%20will%20create%20more%20than%20178%2C000%20jobs%20and%20aims%20to%20attract%20more%20than%2050%20million%20visits%20a%20year%0D%3Cbr%3E-%20About%202%2C000%20people%20work%20for%20the%20Diriyah%20Company%2C%20with%20more%20than%2086%20per%20cent%20being%20Saudi%20citizens%0D%3C%2Fp%3E%0A

Company profile

Date started: Founded in May 2017 and operational since April 2018

Founders: co-founder and chief executive, Doaa Aref; Dr Rasha Rady, co-founder and chief operating officer.

Based: Cairo, Egypt

Sector: Health-tech

Size: 22 employees

Funding: Seed funding

Investors: Flat6labs, 500 Falcons, three angel investors

Skewed figures

In the village of Mevagissey in southwest England the housing stock has doubled in the last century while the number of residents is half the historic high. The village's Neighbourhood Development Plan states that 26% of homes are holiday retreats. Prices are high, averaging around £300,000, £50,000 more than the Cornish average of £250,000. The local average wage is £15,458.

THE SPECS

2020 Toyota Corolla Hybrid LE

Engine: 1.8 litre combined with 16-volt electric motors

Transmission: Automatic with manual shifting mode

Power: 121hp

Torque: 142Nm

Price: Dh95,900

LOVE%20AGAIN

%3Cp%3EDirector%3A%20Jim%20Strouse%3C%2Fp%3E%0A%3Cp%3EStars%3A%20Priyanka%20Chopra%20Jonas%2C%20Sam%20Heughan%2C%20Celine%20Dion%3C%2Fp%3E%0A%3Cp%3ERating%3A%202%2F5%3C%2Fp%3E%0A

Bullet%20Train

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20David%20Leitch%3Cbr%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Brad%20Pitt%2C%20Aaron%20Taylor-Johnson%2C%20Brian%20Tyree%20Henry%2C%20Sandra%20Bullock%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%203%2F5%3C%2Fp%3E%0A