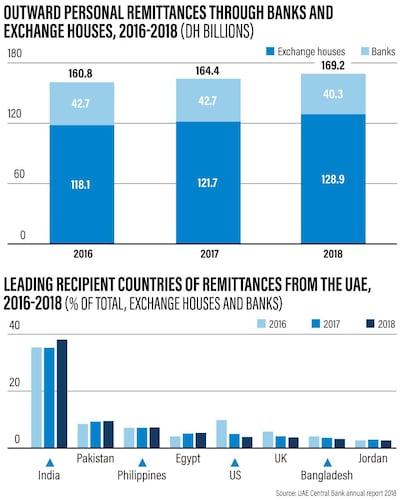

Outward personal remittances reached Dh169.2 billion last year, an increase of 3 per cent or Dh4.8bn compared to 2017, according to the UAE Central Bank’s annual report released this week.

Money sent home through exchange houses increased by 6 per cent from Dh121.6bn in 2017 to Dh128.9bn last year, while the amount sent through banks decreased by 5.6 per cent from Dh42.7bn to Dh40.3bn.

The highest share by far went to India, accounting for 38.1 per cent of the total outflows, “in accordance with the significant share of expats from India working in the UAE and the depreciation of the Indian rupee against the dirham”, the report said. Indian nationals account for about 30 per cent of the UAE’s total expatriate population, according to the Indian Embassy in Abu Dhabi.

The next five top countries receiving remittances from the UAE were Pakistan (9.5 per cent), the Philippines (7.2 per cent), Egypt (5.3 per cent), the US (3.9 per cent) and the UK (3.7 per cent).

The UAE is the second biggest outward remittance country in the world, only after the US, which sent out close to $68bn (Dh250bn) in 2017, according to the World Bank. Globally remittances reached $689bn last year, up from $633bn in 2017, and is estimated to reach $715bn this year.

“The overall increase was driven by a stronger economy and employment situation in the United States and a rebound in outward flows from some Gulf Cooperation Council countries and the Russian Federation,” said the World Bank’s Migration and Development Brief published in April.

UAE exchange houses and banks have recently been investing in digital technologies, such as mobile apps, to make it easier for customers to send money home. Lulu Exchange introduced its "LuLu Money" app last year. In April, global money transfer company Western Union rolled out digital services in the UAE with local partner Al Fardan Exchange.

“Such technologies have increased the market share of exchange houses versus banks,” said Rajiv Raipancholia, chief executive of Orient Exchange and treasurer of the non-profit Foreign Exchange & Remittance Group.

Mr Raipancholia also attributed the higher market share of exchange houses to having more competitive rates than banks. He predicts that remittances through money exchanges will continue to increase over the next two to three years as more introduce their digital platforms.

But UAE banks, too, are entering the digital market. Noor Bank partnered with ICICI Bank in India this month to allow customers to make instant money transfers to India through its online portal and mobile banking app. The Islamic bank is planning to extend its instant remittance services to other countries in the subcontinent in the next few months.

“There will be tough competition between exchange houses and banks,” Mr Raipancholia said. “The personal interaction with the customer will be a thing of the past.”

Yuki Means Happiness

Alison Jean Lester

John Murray

The specs: 2019 Infiniti QX50

Price, base: Dh138,000 (estimate)

Engine: 2.0L, turbocharged, in-line four-cylinder

Transmission: Continuously variable transmission

Power: 268hp @ 5,600rpm

Torque: 380Nm @ 4,400rpm

Fuel economy: 6.7L / 100km (estimate)

Learn more about Qasr Al Hosn

In 2013, The National's History Project went beyond the walls to see what life was like living in Abu Dhabi's fabled fort:

More on Quran memorisation:

More coverage from the Future Forum

Defence review at a glance

• Increase defence spending to 2.5% of GDP by 2027 but given “turbulent times it may be necessary to go faster”

• Prioritise a shift towards working with AI and autonomous systems

• Invest in the resilience of military space systems.

• Number of active reserves should be increased by 20%

• More F-35 fighter jets required in the next decade

• New “hybrid Navy” with AUKUS submarines and autonomous vessels

UAE currency: the story behind the money in your pockets

More from Neighbourhood Watch:

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%201.8-litre%204-cyl%20turbo%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E190hp%20at%205%2C200rpm%0D%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20320Nm%20from%201%2C800-5%2C000rpm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESeven-speed%20dual-clutch%20auto%0D%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%3C%2Fstrong%3E%206.7L%2F100km%0D%3Cbr%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20From%20Dh111%2C195%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3ENow%3C%2Fp%3E%0A

Mohammed bin Zayed Majlis

Farage on Muslim Brotherhood

Nigel Farage told Reform's annual conference that the party will proscribe the Muslim Brotherhood if he becomes Prime Minister.

"We will stop dangerous organisations with links to terrorism operating in our country," he said. "Quite why we've been so gutless about this – both Labour and Conservative – I don't know.

“All across the Middle East, countries have banned and proscribed the Muslim Brotherhood as a dangerous organisation. We will do the very same.”

It is 10 years since a ground-breaking report into the Muslim Brotherhood by Sir John Jenkins.

Among the former diplomat's findings was an assessment that “the use of extreme violence in the pursuit of the perfect Islamic society” has “never been institutionally disowned” by the movement.

The prime minister at the time, David Cameron, who commissioned the report, said membership or association with the Muslim Brotherhood was a "possible indicator of extremism" but it would not be banned.

The specs

Engine: four-litre V6 and 3.5-litre V6 twin-turbo

Transmission: six-speed and 10-speed

Power: 271 and 409 horsepower

Torque: 385 and 650Nm

Price: from Dh229,900 to Dh355,000

Mohammed bin Zayed Majlis

21 Lessons for the 21st Century

Yuval Noah Harari, Jonathan Cape

More from Neighbourhood Watch:

The Voice of Hind Rajab

Starring: Saja Kilani, Clara Khoury, Motaz Malhees

Director: Kaouther Ben Hania

Rating: 4/5

360Vuz PROFILE

Date started: January 2017

Founder: Khaled Zaatarah

Based: Dubai and Los Angeles

Sector: Technology

Size: 21 employees

Funding: $7 million

Investors: Shorooq Partners, KBW Ventures, Vision Ventures, Hala Ventures, 500Startups, Plug and Play, Magnus Olsson, Samih Toukan, Jonathan Labin

UAE currency: the story behind the money in your pockets

The five pillars of Islam

1. Fasting

2. Prayer

3. Hajj

4. Shahada

5. Zakat

The National's picks

4.35pm: Tilal Al Khalediah

5.10pm: Continous

5.45pm: Raging Torrent

6.20pm: West Acre

7pm: Flood Zone

7.40pm: Straight No Chaser

8.15pm: Romantic Warrior

8.50pm: Calandogan

9.30pm: Forever Young

UAE currency: the story behind the money in your pockets