The British pound isn’t the only global currency that has been crashing lately — the South African rand has taken an even greater hammering amid growing political and economic uncertainty.

But while British expatriates in the UAE have been taking advantage of Brexit uncertainty to send money home at favourable exchange rates, South Africans find themselves in a more complicated situation. Many are reluctant to send money to their home country for fear that the rand's troubles could have much further to run.

I've decided against topping up my South African saving accounts because it is difficult to predict how far the rand may drop in future.

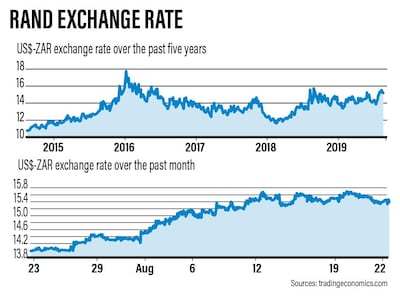

The decline of the rand is a steady, long-term trend but one that has accelerated lately. Fifteen years ago, one US dollar bought 6.54 rand. Five years ago, the dollar had strengthened to 10.70. At time of writing, one dollar buys 15.22, more than double the amount it bought in 2004. That follows a drop of almost 10 per cent in the last month alone.

The recent decline was sparked by several factors, including weak economic growth, employment rates of 29 per cent, the $16 billion bailout of state-owned power monopoly Eskom and rumours of an IMF intervention. South Africa’s economy contracted 3.2 per cent in the first quarter, the most since the 2009 recession.

South African expat David Julies, 48, says the short-term benefits from the rand’s latest devaluation are overshadowed by the longer-term challenges facing his country.

While Britons in the UAE have enjoyed a salary rise in sterling terms, the impact isn’t as strong for South Africans, due to spiralling inflation back home. “Our spending power in South Africa hasn't increased much, so there’s no real impact when sending income back,” says Mr Julies.

The general medical practitioner relocated to the UAE with his wife Maria to work as a hospital administrator in Al Ain and build a stable future for their two children. At the time of his job interview in 2014, the rand was relatively strong, trading at 2.98 to the UAE dirham, but it fell sharply as then-President Jacob Zuma launched a string of controversial cabinet reshuffles. By 2017 the exchange rate had dropped to 4.47, which meant it had lost half its value in three years.

Sentiment picked up after Mr Zuma resigned in February of last year, to be replaced by current President Cyril Ramaphosa, but the rand has now dropped back to 4.15 amid rising economic concerns.

Mr Julies has responded by almost doubling his usual monthly remittance and prepaying short-term South African expenses such as life insurance premiums and school fees, as well as settling a car loan, but says currency weakness remains a double-edged sword.

“I've decided against topping up my South African saving accounts because it is difficult to predict how far the rand may drop in future,” he says.

Mr Julies is not the only UAE expat wary about building long-term savings in South Africa, where it may be subject to currency volatility. Armand Loggenberg, 41, sends money to South Africa to meet family commitments, so he has enjoyed some advantage from recent rand weakness, but says the devaluation rate makes it a bad place to invest for the future.

“When I moved to the UAE two-and-a-half years ago, the UAE dirham bought 3.20 rand, lately it has been trading at around 4.20,” says Mr Loggenberg, who lives in Dubai and is head of aerospace safety for the Dubai Civil Aviation Authority.

If Mr Loggenberg had left his retirement pot in South Africa it would have depreciated by almost a third in that time, and there could be worse to come. He says most South Africans he knows store their long-term wealth elsewhere.

“I might get a little more by sending money back now, but the devaluation rate is so high it makes far more sense to invest offshore,” he says. “Political instability is so high at the moment and I don't want to go back until that changes drastically, and realistically, nothing will change for years.”

Rather than sending money home, Jen Louise, 40, is taking advantage of favourable currency shifts to get her money out of South Africa at a decent exchange rate.

“The minute the British pound dropped I sent the maximum I could for this year from South Africa to the UK,” says Ms Louise, a health care professional who plans to retire either in the UK or Spain. “I can't imagine there are many actually sending money back to South Africa, unless they’re helping to support family.”

Ms Louise says many of her South African friends have similar plans to retire and build up a savings pot elsewhere. “Even South Africans who are not expats sent rand to the UK when the pound dropped recently,” she says. “They were wise to take advantage, as sterling is already back up against the rand.”

The situation was different when Ms Louise moved to the Middle East in 2001, working first in Saudi Arabia followed by a spell in Abu Dhabi. “All my South African friends sent money back home and we used to rejoice when the rand got weak,” she says. “All that money paid for properties, education, mortgages, charities and churches. I knew one girl who sent her entire salary to her local church for a year to help build houses, while I supported the Society for the Prevention of Cruelty to Animals charity.”

Those days are now over. “All the South Africans I know either send nothing home, like me, or the minimum to support family, and save everything they can in the UK or another country of choice,” she says.

South African expat Henry Hollingdrake, who works in financial services in Dubai, says it makes sense for his countrymen to store their wealth offshore and hedge against foreign exchange risk by investing in a spread of different asset classes and currency bases, such as euros, Swiss francs, British pounds and US dollars.

“The problem with investing in a volatile currency like the rand is that if your investment in a South African equity increases, say, by 50 per cent but the currency falls 50 per cent and the original trade was executed in, say, US dollars, then effectively you are back at square one. You have lost all you have gained,” he explains.

South African expats in the UAE face a further complication, in the shape of the controversial South African Expat Tax, which comes into force in March next year, when it will tax expats on all income exceeding 1 million rand (Dh241,590). The weak rand aggravates the problem, as expats will see more of their foreign currency earnings falling above that threshold.

Mr Hollingdrake says many South African expats now want to “financially emigrate” but may find that escaping the punitive tax isn’t so easy. "Financial emigration can cost you a lot of money — and you could still end up paying the tax anyway.”

What matters is your residency, rather than domicile or citizenship, he adds. “The problem is that residency is a subjective term and not always measured in terms of actual days away or days in a certain country. If you are a contract worker, it is even harder to prove non-residency,” he says.

Anybody who wants to change their residency status or at least be treated as a non-resident needs to tread carefully, and in some cases may need to prove they have a stronger residency elsewhere.

These are challenging times for South African expats who want to keep ties with their country. “Emerging markets are at the mercy of wider events, they are not always in control of their own destinies,” says Mr Hollingdrake.

Tips to stay safe during hot weather

- Stay hydrated: Drink plenty of fluids, especially water. Avoid alcohol and caffeine, which can increase dehydration.

- Seek cool environments: Use air conditioning, fans, or visit community spaces with climate control.

- Limit outdoor activities: Avoid strenuous activity during peak heat. If outside, seek shade and wear a wide-brimmed hat.

- Dress appropriately: Wear lightweight, loose and light-coloured clothing to facilitate heat loss.

- Check on vulnerable people: Regularly check in on elderly neighbours, young children and those with health conditions.

- Home adaptations: Use blinds or curtains to block sunlight, avoid using ovens or stoves, and ventilate living spaces during cooler hours.

- Recognise heat illness: Learn the signs of heat exhaustion and heat stroke (dizziness, confusion, rapid pulse, nausea), and seek medical attention if symptoms occur.

How they line up for Sunday's Australian Grand Prix

1 Lewis Hamilton, Mercedes

2 Kimi Raikkonen, Ferrari

3 Sebastian Vettel, Ferrari

4 Max Verstappen, Red Bull

5 Kevin Magnussen, Haas

6 Romain Grosjean, Haas

7 Nico Hulkenberg, Renault

*8 Daniel Ricciardo, Red Bull

9 Carlos Sainz, Renault

10 Valtteri Bottas, Mercedes

11 Fernando Alonso, McLaren

12 Stoffel Vandoorne, McLaren

13 Sergio Perez, Force India

14 Lance Stroll, Williams

15 Esteban Ocon, Force India

16 Brendon Hartley, Toro Rosso

17 Marcus Ericsson, Sauber

18 Charles Leclerc, Sauber

19 Sergey Sirotkin, Williams

20 Pierre Gasly, Toro Rosso

* Daniel Ricciardo qualified fifth but had a three-place grid penalty for speeding in red flag conditions during practice

UAE currency: the story behind the money in your pockets

Dhadak 2

Director: Shazia Iqbal

Starring: Siddhant Chaturvedi, Triptii Dimri

Rating: 1/5

Killing of Qassem Suleimani

How much do leading UAE’s UK curriculum schools charge for Year 6?

- Nord Anglia International School (Dubai) – Dh85,032

- Kings School Al Barsha (Dubai) – Dh71,905

- Brighton College Abu Dhabi - Dh68,560

- Jumeirah English Speaking School (Dubai) – Dh59,728

- Gems Wellington International School – Dubai Branch – Dh58,488

- The British School Al Khubairat (Abu Dhabi) - Dh54,170

- Dubai English Speaking School – Dh51,269

*Annual tuition fees covering the 2024/2025 academic year

What the law says

Micro-retirement is not a recognised concept or employment status under Federal Decree Law No. 33 of 2021 on the Regulation of Labour Relations (as amended) (UAE Labour Law). As such, it reflects a voluntary work-life balance practice, rather than a recognised legal employment category, according to Dilini Loku, senior associate for law firm Gateley Middle East.

“Some companies may offer formal sabbatical policies or career break programmes; however, beyond such arrangements, there is no automatic right or statutory entitlement to extended breaks,” she explains.

“Any leave taken beyond statutory entitlements, such as annual leave, is typically regarded as unpaid leave in accordance with Article 33 of the UAE Labour Law. While employees may legally take unpaid leave, such requests are subject to the employer’s discretion and require approval.”

If an employee resigns to pursue micro-retirement, the employment contract is terminated, and the employer is under no legal obligation to rehire the employee in the future unless specific contractual agreements are in place (such as return-to-work arrangements), which are generally uncommon, Ms Loku adds.

Dust and sand storms compared

Sand storm

- Particle size: Larger, heavier sand grains

- Visibility: Often dramatic with thick "walls" of sand

- Duration: Short-lived, typically localised

- Travel distance: Limited

- Source: Open desert areas with strong winds

Dust storm

- Particle size: Much finer, lightweight particles

- Visibility: Hazy skies but less intense

- Duration: Can linger for days

- Travel distance: Long-range, up to thousands of kilometres

- Source: Can be carried from distant regions

DUNE%3A%20PART%20TWO

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Denis%20Villeneuve%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%20Timothee%20Chamalet%2C%20Zendaya%2C%20Austin%20Butler%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%205%2F5%3C%2Fp%3E%0A

Bharatanatyam

A ancient classical dance from the southern Indian state of Tamil Nadu. Intricate footwork and expressions are used to denote spiritual stories and ideas.

Generation Start-up: Awok company profile

Started: 2013

Founder: Ulugbek Yuldashev

Sector: e-commerce

Size: 600 plus

Stage: still in talks with VCs

Principal Investors: self-financed by founder

Specs

Engine: Dual-motor all-wheel-drive electric

Range: Up to 610km

Power: 905hp

Torque: 985Nm

Price: From Dh439,000

Available: Now

The specs

AT4 Ultimate, as tested

Engine: 6.2-litre V8

Power: 420hp

Torque: 623Nm

Transmission: 10-speed automatic

Price: From Dh330,800 (Elevation: Dh236,400; AT4: Dh286,800; Denali: Dh345,800)

On sale: Now

The specs

Engine: 2.0-litre 4-cylinder turbo

Power: 258hp from 5,000-6,500rpm

Torque: 400Nm from 1,550-4,000rpm

Transmission: Eight-speed auto

Fuel consumption: 6.1L/100km

Price: from Dh362,500

On sale: now

Dubai Bling season three

Cast: Loujain Adada, Zeina Khoury, Farhana Bodi, Ebraheem Al Samadi, Mona Kattan, and couples Safa & Fahad Siddiqui and DJ Bliss & Danya Mohammed

Rating: 1/5

Company%20profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Letswork%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202018%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3EFounders%3A%20%3C%2Fstrong%3EOmar%20Almheiri%2C%20Hamza%20Khan%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20co-working%20spaces%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20%242.1%20million%20in%20a%20seed%20round%20with%20investors%20including%20500%20Global%2C%20The%20Space%2C%20DTEC%20Ventures%20and%20other%20angel%20investors%3Cbr%3E%3Cstrong%3ENumber%20of%20employees%3A%3C%2Fstrong%3E%20about%2020%3C%2Fp%3E%0A

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%20Dual%20synchronous%20electric%20motors%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E660hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E1%2C100Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20automatic%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E488km-560km%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh850%2C000%20(estimate)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3EOctober%3C%2Fp%3E%0A

Founders: Abdulmajeed Alsukhan, Turki Bin Zarah and Abdulmohsen Albabtain.

Based: Riyadh

Offices: UAE, Vietnam and Germany

Founded: September, 2020

Number of employees: 70

Sector: FinTech, online payment solutions

Funding to date: $116m in two funding rounds

Investors: Checkout.com, Impact46, Vision Ventures, Wealth Well, Seedra, Khwarizmi, Hala Ventures, Nama Ventures and family offices

Killing of Qassem Suleimani

Champions League Last 16

Red Bull Salzburg (AUT) v Bayern Munich (GER)

Sporting Lisbon (POR) v Manchester City (ENG)

Benfica (POR) v Ajax (NED)

Chelsea (ENG) v Lille (FRA)

Atletico Madrid (ESP) v Manchester United (ENG)

Villarreal (ESP) v Juventus (ITA)

Inter Milan (ITA) v Liverpool (ENG)

Paris Saint-Germain v Real Madrid (ESP)

GAC GS8 Specs

Engine: 2.0-litre 4cyl turbo

Power: 248hp at 5,200rpm

Torque: 400Nm at 1,750-4,000rpm

Transmission: 8-speed auto

Fuel consumption: 9.1L/100km

On sale: Now

Price: From Dh149,900

Why your domicile status is important

Your UK residence status is assessed using the statutory residence test. While your residence status – ie where you live - is assessed every year, your domicile status is assessed over your lifetime.

Your domicile of origin generally comes from your parents and if your parents were not married, then it is decided by your father. Your domicile is generally the country your father considered his permanent home when you were born.

UK residents who have their permanent home ("domicile") outside the UK may not have to pay UK tax on foreign income. For example, they do not pay tax on foreign income or gains if they are less than £2,000 in the tax year and do not transfer that gain to a UK bank account.

A UK-domiciled person, however, is liable for UK tax on their worldwide income and gains when they are resident in the UK.

500 People from Gaza enter France

115 Special programme for artists

25 Evacuation of injured and sick

What can victims do?

Always use only regulated platforms

Stop all transactions and communication on suspicion

Save all evidence (screenshots, chat logs, transaction IDs)

Report to local authorities

Warn others to prevent further harm

Courtesy: Crystal Intelligence

Electric scooters: some rules to remember

- Riders must be 14-years-old or over

- Wear a protective helmet

- Park the electric scooter in designated parking lots (if any)

- Do not leave electric scooter in locations that obstruct traffic or pedestrians

- Solo riders only, no passengers allowed

- Do not drive outside designated lanes

The Transfiguration

Director: Michael O’Shea

Starring: Eric Ruffin, Chloe Levine

Three stars

Vidaamuyarchi

Director: Magizh Thirumeni

Stars: Ajith Kumar, Arjun Sarja, Trisha Krishnan, Regina Cassandra

Rating: 4/5

Squads

Sri Lanka Tharanga (c), Mathews, Dickwella (wk), Gunathilaka, Mendis, Kapugedera, Siriwardana, Pushpakumara, Dananjaya, Sandakan, Perera, Hasaranga, Malinga, Chameera, Fernando.

India Kohli (c), Dhawan, Rohit, Rahul, Pandey, Rahane, Jadhav, Dhoni (wk), Pandya, Axar, Kuldeep, Chahal, Bumrah, Bhuvneshwar, Thakur.

Kibsons%20Cares

%3Cp%3E%3Cstrong%3ERecycling%3Cbr%3E%3C%2Fstrong%3EAny%20time%20you%20receive%20a%20Kibsons%20order%2C%20you%20can%20return%20your%20cardboard%20box%20to%20the%20drivers.%20They%E2%80%99ll%20be%20happy%20to%20take%20it%20off%20your%20hands%20and%20ensure%20it%20gets%20reused%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EKind%20to%20health%20and%20planet%3C%2Fstrong%3E%3Cbr%3ESolar%20%E2%80%93%2025-50%25%20of%20electricity%20saved%3Cbr%3EWater%20%E2%80%93%2075%25%20of%20water%20reused%3Cbr%3EBiofuel%20%E2%80%93%20Kibsons%20fleet%20to%20get%2020%25%20more%20mileage%20per%20litre%20with%20biofuel%20additives%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ESustainable%20grocery%20shopping%3C%2Fstrong%3E%3Cbr%3ENo%20antibiotics%3Cbr%3ENo%20added%20hormones%3Cbr%3ENo%20GMO%3Cbr%3ENo%20preservatives%3Cbr%3EMSG%20free%3Cbr%3E100%25%20natural%3C%2Fp%3E%0A