This past year was very different from 2018, when US Federal Reserve Chairman Jerome Powell came into office. Last year, the Fed increased its benchmark interest rate four times, moving to 2.5 per cent from 1.5 per cent. US President Donald Trump heavily criticised the hikes, saying at one point that the central bank was "going loco".

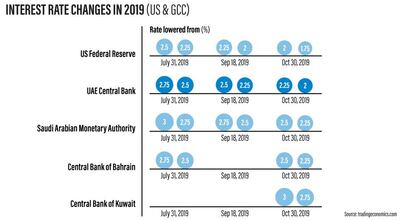

In 2019, Mr Powell took a policy U-turn and cut rates three times, moving down to 1.75 per cent from 2.5 per cent. At its latest meeting last week, the Federal Open Market Committee suggested it would hold rates steady in 2020 “to support sustained expansion of economic activity, strong labour market conditions and inflation near the committee’s symmetric 2 per cent objective”.

Often where the US Fed goes, central banks in the GCC follow.

“Given the dollar peg GCC currencies have in place, central banks in the bloc tend to move in lockstep with the US,” says Daniel Richards, Mena economist at Emirates NBD.

“The change in monetary policy direction in the US was thus a positive for the region, given that the rate hikes we had previously been envisaging were perhaps not in keeping with the UAE’s current stage in its growth cycle,” he adds.

To align with US monetary policy last year, the UAE central bank increased interest rates on its certificates of deposits and its repo rate, which applies to banks’ borrowing of short-term liquidity from the central bank against their holding of CDs.

However, as the central bank’s 2018 report notes, “increasing interest rates in the US has not been compatible with the slowdown in non-oil activities”.

This year the UAE and Saudi Arabia mimicked the Federal Reserve’s moves, cutting rates three times. Bahrain cut rates twice and Kuwait once.

The Central Bank of the UAE lowered rates to 2 per cent from 2.75 per cent this year, a move that will protect its currency and support the economy amid rising external risks, central bank governor Mubarak Al Mansouri said last month.

“When we have a turning cycle, lower rates really help our economy,” he said in a panel discussion with CNBC.

Amid a global economic slowdown, the International Monetary Fund slashed its GDP forecasts to 1.6 per cent for the UAE in 2019, but expects it to recover to 2.5 per cent in 2020.

But aside from the macroeconomic picture, how are consumers directly affected by lower interest rates? The implications for UAE residents of the change in Fed policy direction depends on whether they are bigger savers or borrowers.

“Lower interest rates translate into lower borrowing costs, so they’re obviously great news for new borrowers as well as existing borrowers,” says Ambareen Musa, chief executive of financial comparison website souqalmal.com. At the same time, “lower interest rates also spell lower returns on bank deposits”.

Here we break down what the dovish Fed policy means for UAE consumers this year and going into 2020.

Mortgages

Banks have become more competitive with regards to the mortgage products they are offering, says Warren Philliskirk, director at Mortgage Finder.

“The rates released recently by some leading banks are now closer to those offered by lenders in other parts of the world, like Europe, which many of our clients tend to compare to when considering finance options,” Mr Philliskirk says.

Last year, the average mortgage interest rate was around 3.99 per cent. At the beginning of this year, there was a marginal decrease in mortgage rates to around 3.89 per cent, he says. “In recent months, we have seen more notable decreases with some rates as low as 2.75 per cent fixed for one year, and more attractive rates for longer terms of 3.33 per cent fixed for three years and 3.75 per cent for five years,” says Mr Philliskirk.

Rates for non-residents are slightly higher, ranging between 3.99 per cent fixed for five years to 4.89 per cent fixed for two years. “While resident rates have lowered and become more attractive, we have not seen any notable changes in rates for non-residents,” he says.

Lower rates have made securing a mortgage easier for those who may not have previously been able to afford it and “mean lower repayments for borrowers, leaving them with more disposable income”, says Mr Philliskirk.

In addition to lower rates, several moves from the UAE central bank this year have made mortgage refinancing more attractive. In October, the central bank removed the 3 per cent early settlement fee for mortgages introduced last year and reverted to a 1 per cent or Dh10,000 cap (whichever is less). A maximum age requirement, which stipulates that loan holders must be under 70 before their last repayment is due, was also lifted.

Property market

The UAE property market has seen five years of declining residential property prices, largely due to oversupply and an economic slowdown following a slump in oil prices. In September, Dubai formed the Higher Committee for Real Estate Planning led by Deputy Ruler Sheikh Maktoum bin Mohammed to achieve a balance between supply and demand.

“Tracker mortgage rates have fallen as the key policy rate has been slashed, contributing — along with the ongoing fall in property prices — to a spike in applications this year and a rise in owner occupiers,” says Mr Richards of ENBD.

If the reduced interest rates coincide with a softening of the dollar, it will lead to lower risk of further declines in real estate prices, the Institute of International Finance said in an August report.

Savings

On the flip side of the coin, lower interest rates mean lower returns on bank deposits. “Deposit rates have always been less-than-stellar in the UAE. And just as some interesting savings and deposit products were beginning to pop up in the market, offering incremental interest rates, increased flexibility and more, the rate cuts look set to dampen this trend,” says Ms Musa of souqalmal.

These conditions leave expatriates with little incentive to save in the UAE. "We could see more expats remit their savings and leftover cash back to their home countries [especially in the subcontinent where deposit rates are higher]."

Outlook for 2020

The Fed decides monetary policy with the goals of maximum employment and stable prices in mind. The jobless rate in the US is expected to be 3.5 per cent by late 2020, the same as it is now. The annual inflation rate was 2.1 per cent for the 12 months to end of November, compared to 1.8 per cent previously, according to US Labour Department data published last week.

For now, Mr Powell said the economy and monetary policy “are in a good place” and that he “would want to see a significant move up in inflation that’s also persistent before raising rates”.

Mr Richards of Emirates NBD says the Fed’s change in policy in 2019 can be characterised as a ‘mid-cycle adjustment’, in part offsetting the US-China Trade War fallout and in part compensating for the tightening implemented last year.

“We maintain that there could be one more rate cut in 2020, but for now the data suggests that Powell has been successful in securing a soft landing and that President Trump’s desire for far lower – or even negative – rates is unlikely to be met,” he says.