A steady rise in the number of family offices calling the UAE home and the influx of high-net-worth individuals to the country in the past few years has not only attracted asset managers and investment companies from across the globe, it has also given rise to peer networks for the ultra-wealthy.

One such network, which has recently opened a chapter in Dubai, is Tiger 21, a fraternity of ultra-successful professionals who work together to elevate and develop each other, personally and professionally.

Members of the group, which was set up in 1999 by American entrepreneur, philanthropist and political activist, Michael Sonnenfeldt, exchange advice on wealth preservation, inheritance, investments, legacy building and philanthropy.

Tiger 21 has 1,600 members, largely first-generation wealth creators, who manage $200 billion in aggregate assets. Most of the members are entrepreneurs who have sold their businesses and are now looking to preserve wealth. In September, the group opened its first chapters in Dubai and Singapore after growing interest from its members.

“Dubai has only continued its rather dramatic ascendance in terms of being a place that the ultra-high-net-worth community wants to call home, and where family offices want to establish themselves,” says Timothy Daniels, president and chief executive of Tiger 21.

“Demand from our members in other cities pulls us into new markets like Dubai and Singapore. [The] increased number of HNWIs coming to Dubai made them want to connect here.”

The UAE established itself as the leading destination for high-net-worth individuals, or HNWIs, globally in 2024, attracting more than 6,700 millionaires, according to British investment migration consultancy Henley & Partners.

Dubai hosts 15 billionaires, 212 centi-millionaires – individuals with net worth of investable assets of $100 million or more – and 72,273 millionaires, according to the Brics Wealth Report released last year by Henley & Partners.

Knight Frank’s Wealth Report 2024 noted that the UAE enjoyed an 18.1 per cent increase in ultra-high-net-worth individuals, or UHNWIs, ahead of Saudi Arabia’s 10.4 per cent. HNWIs have liquid investable wealth of $1 million or more. UHNWIs are those with a net worth of at least $30 million, according to Knight Frank.

Membership criteria

The Tiger21 community has two primary goals: wealth preservation and how to deal with family issues such as legacy building, inheritance and care of elderly parents. The network aims to create a safe place for members, who include private space investor Dylan Taylor, serial entrepreneur Martin Hermann, venture capitalist Howard Morgan and blockchain expert Perianne Boring, to learn from each other.

Membership of Tiger 21 is referral-based with an extensive background check, says Vijay Tirathrai, chair of one of the network's Dubai chapters. A chair curates the group, facilitates and nurtures it. “If I'm a member, I would view my group as a personal board of advisers,” he says.

There are five Cs for member selection: character, contribution (in terms of their experiences), capacity (time and ability to participate in meetings), conditions (confidentiality and no solicitation) and capital (a minimum $20 million in terms of net worth or investable assets).

There is a membership fee of Dh121,000 ($32,947) annually plus a one-time initiation fee of Dh18,000, according to Tiger 21’s website.

Mr Daniels says besides the two existing chapters in Dubai, two more are being considered in the emirate. Members will also have access to Tiger 21 groups globally through an app. They can travel to cities where Tiger 21 has a presence, such as London, Singapore and Boston, and participate in meetings as an equal member to “help broaden horizons”.

“For instance, if an Emirati member is considering an investment opportunity in Singapore, or their child is doing an internship in Zurich, or they want to find out the best restaurant in Miami, they can leverage the global network,” he adds.

“We do not offer advice to our members. All we do is create the conditions for them to be able to come together and talk about the complex matters that oftentimes accompany their wealth. Trusted relationships are oftentimes hard to develop. The counsel that you get to avoid making an investment that ultimately would have led to a multi-million-dollar loss is invaluable.”

Dubai chair Mr Tirathrai says that markets such as Mumbai, Singapore and Switzerland tend to have a significant number of long-established businesses and a rich history of family businesses. In comparison, Dubai is a very young city, but offers diversity, specifically around industry types, ethnicity, culture and the complexities that HNWIs face in dealing with transborder business and transactions.

“Our group offers a safe space, bounded by confidentiality, to support difficult conversations, allowing members to be vulnerable and knowing that they will get clear reflections from peers who have been through those journeys themselves,” he adds.

Wealth preservation

Mohamad El-Hage, chair of one of the Tiger 21 groups in Dubai, says members are “incredibly well-established individuals”, and with wealth comes blessings, but also responsibilities. Members discuss issues related to the next generation, elderly parents, philanthropy, wellness, selecting asset managers and managing asset classes. Real estate opportunities come up frequently in meetings, as well as crypto and Bitcoin, he adds.

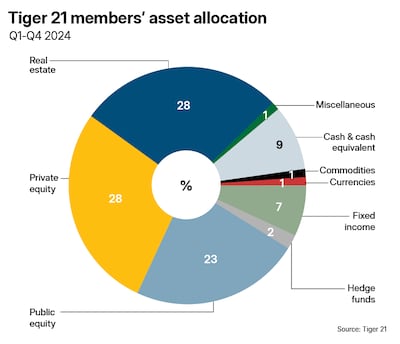

“Members in young groups like Dubai join with a purpose of becoming better investors and diversifying their assets. You may have individuals who are very heavily invested in real estate, private equity or direct investments. Asset allocation is of interest to members in a young group like Dubai,” says Mr El-Hage.

“The majority of Tiger 21 members in Dubai are entrepreneurs that have created their own businesses, so it keeps the conversation rich in terms of their experiences and perspectives on wealth.”

Members meet once a month in a private setting in hotels, Mr El-Hage says. They are recommended to attend 11 meetings annually and these run from September to July.

There are 12 to 15 members to a group, aged from their early thirties to about 60, according to Mr Tirathrai. They come from a range of professional backgrounds and may have created wealth in different ways.

“In a typical group of 12, you'll have very diverse asset allocation, almost to the extent of polar opposites. In the Middle East, there is a propensity to invest in real estate, because it’s more tangible,” he says.

“But on a global level, there’s a trend towards private equity, and more increasingly to private capital markets. Wealth owners prefer to manage their wealth more directly, as opposed to giving to fund managers, and also to go into sectors that they understand more.”

Mr Daniels says cryptocurrencies account for between 1 per cent and 3 per cent, or about $6 billion, of members’ portfolios. “I think that will rise rather significantly in the years to come under a crypto-friendly administration in the US,” he reckons.

Mr Tirathrai says members are required to make an investment portfolio defence once a year. This is followed by feedback from the peer group.

Tiger 21 is preparing to launch groups in the Indian cities of Mumbai and Bengaluru, and also in Milan in the first half of this year. “The tax law changes going into effect in the UK are causing many wealthy families to perhaps consider relocating to Italy, and Milan in particular, as the city has created a welcoming environment from a tax perspective,” Mr Daniels says.

More from Neighbourhood Watch:

MATCH INFO

Champions League quarter-final, first leg

Manchester United v Barcelona, Wednesday, 11pm (UAE)

Match on BeIN Sports

UK-EU trade at a glance

EU fishing vessels guaranteed access to UK waters for 12 years

Co-operation on security initiatives and procurement of defence products

Youth experience scheme to work, study or volunteer in UK and EU countries

Smoother border management with use of e-gates

Cutting red tape on import and export of food

If you go

The flights

There are various ways of getting to the southern Serengeti in Tanzania from the UAE. The exact route and airstrip depends on your overall trip itinerary and which camp you’re staying at.

Flydubai flies direct from Dubai to Kilimanjaro International Airport from Dh1,350 return, including taxes; this can be followed by a short flight from Kilimanjaro to the Serengeti with Coastal Aviation from about US$700 (Dh2,500) return, including taxes. Kenya Airways, Emirates and Etihad offer flights via Nairobi or Dar es Salaam.

Key facilities

- Olympic-size swimming pool with a split bulkhead for multi-use configurations, including water polo and 50m/25m training lanes

- Premier League-standard football pitch

- 400m Olympic running track

- NBA-spec basketball court with auditorium

- 600-seat auditorium

- Spaces for historical and cultural exploration

- An elevated football field that doubles as a helipad

- Specialist robotics and science laboratories

- AR and VR-enabled learning centres

- Disruption Lab and Research Centre for developing entrepreneurial skills

More on Quran memorisation:

BIGGEST CYBER SECURITY INCIDENTS IN RECENT TIMES

SolarWinds supply chain attack: Came to light in December 2020 but had taken root for several months, compromising major tech companies, governments and its entities

Microsoft Exchange server exploitation: March 2021; attackers used a vulnerability to steal emails

Kaseya attack: July 2021; ransomware hit perpetrated REvil, resulting in severe downtime for more than 1,000 companies

Log4j breach: December 2021; attackers exploited the Java-written code to inflitrate businesses and governments

Zayed Sustainability Prize

More from Neighbourhood Watch

Killing of Qassem Suleimani

Mohammed bin Zayed Majlis

More from Neighbourhood Watch:

How to help

Call the hotline on 0502955999 or send "thenational" to the following numbers:

2289 - Dh10

2252 - Dh50

6025 - Dh20

6027 - Dh100

6026 - Dh200

Zayed Sustainability Prize

LILO & STITCH

Starring: Sydney Elizebeth Agudong, Maia Kealoha, Chris Sanders

Director: Dean Fleischer Camp

Rating: 4.5/5

More from Neighbourhood Watch:

Skewed figures

In the village of Mevagissey in southwest England the housing stock has doubled in the last century while the number of residents is half the historic high. The village's Neighbourhood Development Plan states that 26% of homes are holiday retreats. Prices are high, averaging around £300,000, £50,000 more than the Cornish average of £250,000. The local average wage is £15,458.

More from Neighbourhood Watch:

The five pillars of Islam

Killing of Qassem Suleimani

More on Quran memorisation:

Dubai Bling season three

Cast: Loujain Adada, Zeina Khoury, Farhana Bodi, Ebraheem Al Samadi, Mona Kattan, and couples Safa & Fahad Siddiqui and DJ Bliss & Danya Mohammed

Rating: 1/5

The specs: 2018 Audi RS5

Price, base: Dh359,200

Engine: 2.9L twin-turbo V6

Transmission: Eight-speed automatic

Power: 450hp at 5,700rpm

Torque: 600Nm at 1,900rpm

Fuel economy, combined: 8.7L / 100km

The years Ramadan fell in May

Marathon results

Men:

1. Titus Ekiru(KEN) 2:06:13

2. Alphonce Simbu(TAN) 2:07:50

3. Reuben Kipyego(KEN) 2:08:25

4. Abel Kirui(KEN) 2:08:46

5. Felix Kemutai(KEN) 2:10:48

Women:

1. Judith Korir(KEN) 2:22:30

2. Eunice Chumba(BHR) 2:26:01

3. Immaculate Chemutai(UGA) 2:28:30

4. Abebech Bekele(ETH) 2:29:43

5. Aleksandra Morozova(RUS) 2:33:01

How to keep control of your emotions

If your investment decisions are being dictated by emotions such as fear, greed, hope, frustration and boredom, it is time for a rethink, Chris Beauchamp, chief market analyst at online trading platform IG, says.

Greed

Greedy investors trade beyond their means, open more positions than usual or hold on to positions too long to chase an even greater gain. “All too often, they incur a heavy loss and may even wipe out the profit already made.

Tip: Ignore the short-term hype, noise and froth and invest for the long-term plan, based on sound fundamentals.

Fear

The risk of making a loss can cloud decision-making. “This can cause you to close out a position too early, or miss out on a profit by being too afraid to open a trade,” he says.

Tip: Start with a plan, and stick to it. For added security, consider placing stops to reduce any losses and limits to lock in profits.

Hope

While all traders need hope to start trading, excessive optimism can backfire. Too many traders hold on to a losing trade because they believe that it will reverse its trend and become profitable.

Tip: Set realistic goals. Be happy with what you have earned, rather than frustrated by what you could have earned.

Frustration

Traders can get annoyed when the markets have behaved in unexpected ways and generates losses or fails to deliver anticipated gains.

Tip: Accept in advance that asset price movements are completely unpredictable and you will suffer losses at some point. These can be managed, say, by attaching stops and limits to your trades.

Boredom

Too many investors buy and sell because they want something to do. They are trading as entertainment, rather than in the hope of making money. As well as making bad decisions, the extra dealing charges eat into returns.

Tip: Open an online demo account and get your thrills without risking real money.

More on Quran memorisation:

The rules on fostering in the UAE

A foster couple or family must:

- be Muslim, Emirati and be residing in the UAE

- not be younger than 25 years old

- not have been convicted of offences or crimes involving moral turpitude

- be free of infectious diseases or psychological and mental disorders

- have the ability to support its members and the foster child financially

- undertake to treat and raise the child in a proper manner and take care of his or her health and well-being

- A single, divorced or widowed Muslim Emirati female, residing in the UAE may apply to foster a child if she is at least 30 years old and able to support the child financially

Our legal columnist

Name: Yousef Al Bahar

Advocate at Al Bahar & Associate Advocates and Legal Consultants, established in 1994

Education: Mr Al Bahar was born in 1979 and graduated in 2008 from the Judicial Institute. He took after his father, who was one of the first Emirati lawyers

KILLING OF QASSEM SULEIMANI

ROUTE%20TO%20TITLE

%3Cp%3E%3Cstrong%3ERound%201%3A%3C%2Fstrong%3E%20Beat%20Leolia%20Jeanjean%206-1%2C%206-2%3Cbr%3E%3Cstrong%3ERound%202%3A%20%3C%2Fstrong%3EBeat%20Naomi%20Osaka%207-6%2C%201-6%2C%207-5%3Cbr%3E%3Cstrong%3ERound%203%3A%20%3C%2Fstrong%3EBeat%20Marie%20Bouzkova%206-4%2C%206-2%3Cbr%3E%3Cstrong%3ERound%204%3A%3C%2Fstrong%3E%20Beat%20Anastasia%20Potapova%206-0%2C%206-0%3Cbr%3E%3Cstrong%3EQuarter-final%3A%20%3C%2Fstrong%3EBeat%20Marketa%20Vondrousova%206-0%2C%206-2%3Cbr%3E%3Cstrong%3ESemi-final%3A%20%3C%2Fstrong%3EBeat%20Coco%20Gauff%206-2%2C%206-4%3Cbr%3E%3Cstrong%3EFinal%3A%3C%2Fstrong%3E%20Beat%20Jasmine%20Paolini%206-2%2C%206-2%3C%2Fp%3E%0A

KILLING OF QASSEM SULEIMANI

Key figures in the life of the fort

Sheikh Dhiyab bin Isa (ruled 1761-1793) Built Qasr Al Hosn as a watchtower to guard over the only freshwater well on Abu Dhabi island.

Sheikh Shakhbut bin Dhiyab (ruled 1793-1816) Expanded the tower into a small fort and transferred his ruling place of residence from Liwa Oasis to the fort on the island.

Sheikh Tahnoon bin Shakhbut (ruled 1818-1833) Expanded Qasr Al Hosn further as Abu Dhabi grew from a small village of palm huts to a town of more than 5,000 inhabitants.

Sheikh Khalifa bin Shakhbut (ruled 1833-1845) Repaired and fortified the fort.

Sheikh Saeed bin Tahnoon (ruled 1845-1855) Turned Qasr Al Hosn into a strong two-storied structure.

Sheikh Zayed bin Khalifa (ruled 1855-1909) Expanded Qasr Al Hosn further to reflect the emirate's increasing prominence.

Sheikh Shakhbut bin Sultan (ruled 1928-1966) Renovated and enlarged Qasr Al Hosn, adding a decorative arch and two new villas.

Sheikh Zayed bin Sultan (ruled 1966-2004) Moved the royal residence to Al Manhal palace and kept his diwan at Qasr Al Hosn.

Sources: Jayanti Maitra, www.adach.ae

More from Neighbourhood Watch:

Killing of Qassem Suleimani

BMW M5 specs

Engine: 4.4-litre twin-turbo V-8 petrol enging with additional electric motor

Power: 727hp

Torque: 1,000Nm

Transmission: 8-speed auto

Fuel consumption: 10.6L/100km

On sale: Now

Price: From Dh650,000

More from Neighbourhood Watch:

'Panga'

Directed by Ashwiny Iyer Tiwari

Starring Kangana Ranaut, Richa Chadha, Jassie Gill, Yagya Bhasin, Neena Gupta

Rating: 3.5/5

THE BIO

Ms Al Ameri likes the variety of her job, and the daily environmental challenges she is presented with.

Regular contact with wildlife is the most appealing part of her role at the Environment Agency Abu Dhabi.

She loves to explore new destinations and lives by her motto of being a voice in the world, and not an echo.

She is the youngest of three children, and has a brother and sister.

Her favourite book, Moby Dick by Herman Melville helped inspire her towards a career exploring the natural world.

More coverage from the Future Forum

UAE currency: the story behind the money in your pockets

Killing of Qassem Suleimani

How to apply for a drone permit

- Individuals must register on UAE Drone app or website using their UAE Pass

- Add all their personal details, including name, nationality, passport number, Emiratis ID, email and phone number

- Upload the training certificate from a centre accredited by the GCAA

- Submit their request

What are the regulations?

- Fly it within visual line of sight

- Never over populated areas

- Ensure maximum flying height of 400 feet (122 metres) above ground level is not crossed

- Users must avoid flying over restricted areas listed on the UAE Drone app

- Only fly the drone during the day, and never at night

- Should have a live feed of the drone flight

- Drones must weigh 5 kg or less

Read more about the coronavirus

MATCH INFO

Euro 2020 qualifier

Ukraine 2 (Yaremchuk 06', Yarmolenko 27')

Portugal 1 (Ronaldo 72' pen)

57%20Seconds

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Rusty%20Cundieff%0D%3Cbr%3E%3Cstrong%3EStars%3A%20%3C%2Fstrong%3EJosh%20Hutcherson%2C%20Morgan%20Freeman%2C%20Greg%20Germann%2C%20Lovie%20Simone%0D%3Cbr%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E2%2F5%0D%3Cbr%3E%0D%3Cbr%3E%3C%2Fp%3E%0A

The years Ramadan fell in May

WOMAN AND CHILD

Director: Saeed Roustaee

Starring: Parinaz Izadyar, Payman Maadi

Rating: 4/5

KILLING OF QASSEM SULEIMANI