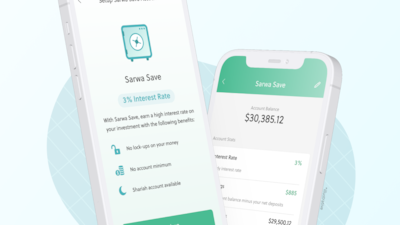

UAE low-cost robo-advisory platform Sarwa has unveiled a cash account with a 3 per cent annual interest rate, as banks in the Emirates continue to offer customers low savings yields despite eight consecutive base rate rises by the UAE Central Bank since last year.

Sarwa Save comes with a zero-transfer cost for local dirham accounts, requires no minimum balance and has no management fees, Sarwa said.

The account will hold customer funds in US dollars. It will be held offshore with Sarwa's banking partner Saxo Bank in Denmark.

Sarwa, which is regulated by the Abu Dhabi Global Market, obtained approval for the new product from the Financial Services Regulatory Authority, the free zone's regulator.

“While we are strong believers in long-term passive investing, we are also conscious of how market conditions might affect short to medium-term goals,” said Mark Chahwan, co-founder and chief executive of Sarwa.

“Having a short-term investing option is an important part of a good financial plan. Our clients were asking for a product to park their cash while earning returns.”

Earlier this month, the UAE Central Bank raised its base rate for the overnight deposit facility by a quarter of a percentage point to 4.65 per cent, from 4.4 per cent, after the US Federal Reserve increased its policy rate by 25 basis points as it continues to fight inflation.

Most central banks in the GCC follow the Fed's policy rate moves due to their currencies being pegged to the US dollar. Kuwait is an exception in the six-member economic bloc as its dinar is linked to a basket of currencies.

While the cost of borrowing has risen in line with the rate increases, banks have been slower to pass on the benefits to savers.

Most local banks in the UAE have minimum salary and minimum balance requirements for their savings accounts.

For example, ADIB's Ghana savings account offers an interest rate of 0.36 per cent but stipulates a minimum salary of Dh20,000 and minimum balance of Dh3,000.

An Emirates NBD savings account offers an annual return of 0.20 per cent while an HSBC savings account has an interest rate of 0.05 per cent.

“The average yield on saving accounts in the UAE banks is around 0.8 per cent as it stands today. Sarwa Save offers almost four times this amount,” Mr Chahwan said.

Sarwa Save is aimed at people who are about to start their investment journey or investors who want to earn a return on their parked cash, he said.

The product is available to new and existing customers through the Sarwa website and mobile app.

For those looking for a Sharia-compliant equivalent, Sarwa offers Save Halal, a low-risk money market funds portfolio that consists of cash and cash-equivalent securities projecting a return of 3 per cent.

This product charges a management fee of 0.5 per cent, which is accounted for in the projected return rate.

The cash account can be integrated with Sarwa Invest accounts and it does not charge a fee for transfers.

The product makes it easier to centralise different investments a customer looks for in one app, from hands-off long-term investing to self-directed trading, and an option of interest on cash, Sarwa said.

The average yield on saving accounts in the UAE banks is around 0.8 per cent as it stands today. Sarwa Save offers almost four times this amount

Mark Chahwan,

co-founder and chief executive of Sarwa

“Diversification is at the essence of a sound investment strategy, and we’re happy to continue expanding our range of wealth management products,” he said.

“Our aim is to help everyone reach their financial goals by managing their money through different tools, all in one place.”

Founded in 2017, Sarwa, which has 100,000 registered users, uses artificial intelligence to rate an investor’s risk tolerance and assigns them a tailored investment portfolio of exchange-traded funds, charging them lower advisory fees than traditional financial advisers and wealth managers.

In August 2021, Sarwa raised $15 million in a funding round led by Abu Dhabi's Mubadala Investment Company.

The series B round brings the trading platform’s total funding from regional and international investors to about $25 million since it was founded, the company said at the time.

Springsteen: Deliver Me from Nowhere

Director: Scott Cooper

Starring: Jeremy Allen White, Odessa Young, Jeremy Strong

Rating: 4/5

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

GAC GS8 Specs

Engine: 2.0-litre 4cyl turbo

Power: 248hp at 5,200rpm

Torque: 400Nm at 1,750-4,000rpm

Transmission: 8-speed auto

Fuel consumption: 9.1L/100km

On sale: Now

Price: From Dh149,900

Specs

Engine: Duel electric motors

Power: 659hp

Torque: 1075Nm

On sale: Available for pre-order now

Price: On request

Company Profile:

Name: The Protein Bakeshop

Date of start: 2013

Founders: Rashi Chowdhary and Saad Umerani

Based: Dubai

Size, number of employees: 12

Funding/investors: $400,000 (2018)

UAE currency: the story behind the money in your pockets

Islamophobia definition

A widely accepted definition was made by the All Party Parliamentary Group on British Muslims in 2019: “Islamophobia is rooted in racism and is a type of racism that targets expressions of Muslimness or perceived Muslimness.” It further defines it as “inciting hatred or violence against Muslims”.

Benefits of first-time home buyers' scheme

- Priority access to new homes from participating developers

- Discounts on sales price of off-plan units

- Flexible payment plans from developers

- Mortgages with better interest rates, faster approval times and reduced fees

- DLD registration fee can be paid through banks or credit cards at zero interest rates

Sholto Byrnes on Myanmar politics

Star%20Wars%3A%20Ahsoka%20

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Various%20%3Cbr%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%20Rosario%20Dawson%2C%20Natasha%20Liu%20Bordizzo%2C%20Lars%20Mikkelsen%20%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%0D%3Cbr%3E%3C%2Fp%3E%0A

How to avoid crypto fraud

- Use unique usernames and passwords while enabling multi-factor authentication.

- Use an offline private key, a physical device that requires manual activation, whenever you access your wallet.

- Avoid suspicious social media ads promoting fraudulent schemes.

- Only invest in crypto projects that you fully understand.

- Critically assess whether a project’s promises or returns seem too good to be true.

- Only use reputable platforms that have a track record of strong regulatory compliance.

- Store funds in hardware wallets as opposed to online exchanges.

INFO

What: DP World Tour Championship

When: November 21-24

Where: Jumeirah Golf Estates, Dubai

Tickets: www.ticketmaster.ae.

The specs

Engine: 2.0-litre 4cyl turbo

Power: 261hp at 5,500rpm

Torque: 405Nm at 1,750-3,500rpm

Transmission: 9-speed auto

Fuel consumption: 6.9L/100km

On sale: Now

Price: From Dh117,059

The Indoor Cricket World Cup

When: September 16-23

Where: Insportz, Dubai

Indoor cricket World Cup:

Insportz, Dubai, September 16-23

UAE fixtures:

Men

Saturday, September 16 – 1.45pm, v New Zealand

Sunday, September 17 – 10.30am, v Australia; 3.45pm, v South Africa

Monday, September 18 – 2pm, v England; 7.15pm, v India

Tuesday, September 19 – 12.15pm, v Singapore; 5.30pm, v Sri Lanka

Thursday, September 21 – 2pm v Malaysia

Friday, September 22 – 3.30pm, semi-final

Saturday, September 23 – 3pm, grand final

Women

Saturday, September 16 – 5.15pm, v Australia

Sunday, September 17 – 2pm, v South Africa; 7.15pm, v New Zealand

Monday, September 18 – 5.30pm, v England

Tuesday, September 19 – 10.30am, v New Zealand; 3.45pm, v South Africa

Thursday, September 21 – 12.15pm, v Australia

Friday, September 22 – 1.30pm, semi-final

Saturday, September 23 – 1pm, grand final

Company%C2%A0profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%20%3C%2Fstrong%3EHayvn%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3E2018%3Cbr%3E%3Cstrong%3EFounders%3A%20%3C%2Fstrong%3EChristopher%20Flinos%2C%20Ahmed%20Ismail%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EAbu%20Dhabi%2C%20UAE%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3Efinancial%3Cbr%3E%3Cstrong%3EInitial%20investment%3A%20%3C%2Fstrong%3Eundisclosed%3Cbr%3E%3Cstrong%3ESize%3A%3C%2Fstrong%3E%2044%20employees%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3Eseries%20B%20in%20the%20second%20half%20of%202023%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EHilbert%20Capital%2C%20Red%20Acre%20Ventures%3C%2Fp%3E%0A