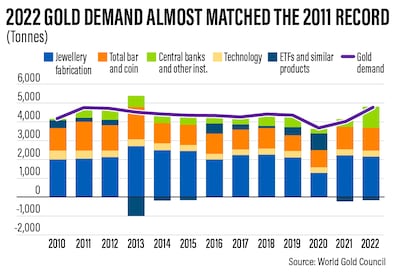

Gold demand rose by 18 per cent in 2022 to an 11-year high of 4,741 tonnes, driven by retail investors and central banks shoring up their bullion reserves, according to the World Gold Council.

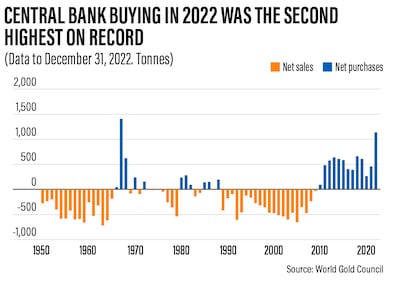

Annual central bank demand for gold more than doubled to 1,136 tonnes last year — its biggest yearly increase since 1967 — from 450 tonnes the year before, amid geopolitical uncertainty and high inflation, the WGC said in its annual report on Tuesday.

Among the central banks that bought gold last year were those in Turkey, China, Egypt and Qatar.

Investment demand for gold in 2022 was up 10 per cent from the previous year, the report said.

Retail investor demand was driven by a notable slowdown in exchange-traded fund (ETF) outflows and strong gold bar and coin demand, it added.

Brisk retail investment lifted bar and coin demand to a nine-year high. Strong growth in Europe, Turkey and the Middle East offset a sharp slowdown in China, where demand was dragged down by Covid-19-related factors, according to the WGC.

“Last year, we saw the highest level of annual gold demand in over a decade, driven in part by colossal central bank demand for the safe-haven asset,” said Louise Street, senior markets analyst at the WGC.

“Gold’s diverse demand drivers played a balancing act as rising interest rates prompted some tactical ETF outflows, while elevated inflation spurred on gold bar and coin investment.

“The need for wealth protection in the global inflationary environment remained a primary motive for gold investment purchases.”

A slowdown in US Federal Reserve interest rate increases is expected to boost the gold price.

Gold, which pays no interest, tends to benefit when interest rates are low as it reduces the opportunity cost of holding bullion.

Global economic growth is projected to rebound to 3.1 per cent in 2024, the International Monetary Fund said in its World Economic Outlook report released on Tuesday.

The IMF raised its global economic growth estimate for this year by 0.2 percentage points to 2.9 per cent from its October forecast, a slowdown from the 3.4 per cent expansion in 2022 and below the historical average of 3.8 per cent over the 2000-2019 period.

The fund said better economic data in the third quarter of last year, cooling inflation and the reopening of China point to resilience in the global economy.

Despite the revision, the Washington-based lender warned that the financial environment remained “fragile” as the fight against inflation is not over and will continue to weigh on the global economy, along with Russia’s war in Ukraine.

Meanwhile, global jewellery demand softened 3 per cent in 2022 to 2,086 tonnes, according to the WGC.

The weakness was driven by a drop in Chinese jewellery demand, which was down 15 per cent as consumer activity was curtailed by Covid-19 lockdowns for most of the year, the report said.

India, the world's second-biggest gold buyer, recorded a 2 per cent decline in gold jewellery demand in 2022, as a rally in local prices to near-record highs curtailed bullion demand during the key December quarter.

Jewellery demand in the Middle East was 15 per cent higher last year, with key contributions from the UAE and Saudi Arabia.

The gold price rally in the fourth quarter also contributed to the annual decline in jewellery demand, the WGC said.

The gold price hit a record annual average of $1,800 per ounce last year, despite facing headwinds from the strong US dollar and rising global interest rates.

Demand for gold in technology dropped by 7 per cent annually as deteriorating global economic conditions hampered demand for consumer electronics, the report said.

Total gold supply in 2022 was up by 2 per cent annually to 4,755 tonnes and remained above pre-pandemic levels. Mine production increased to 3,612 tonnes, hitting a four-year high.

“Turning to 2023, economic forecasts are pointing to a challenging environment and a likely global recession, which could lead to a role reversal in gold investment trends,” Ms Street said.

“If inflation comes down, this could be a headwind for gold bar and coin investment. Conversely, continued weakening of the US dollar and the moderating pace of interest rate hikes could have positive implications for gold-backed ETF demand.”

Jewellery consumption will remain resilient, bolstered by a release of pent-up demand as China reopens, she said.

However, it could be dragged down by a consumer spending squeeze if there is a more severe downturn.

2025 Fifa Club World Cup groups

Group A: Palmeiras, Porto, Al Ahly, Inter Miami.

Group B: Paris Saint-Germain, Atletico Madrid, Botafogo, Seattle.

Group C: Bayern Munich, Auckland City, Boca Juniors, Benfica.

Group D: Flamengo, ES Tunis, Chelsea, Leon.

Group E: River Plate, Urawa, Monterrey, Inter Milan.

Group F: Fluminense, Borussia Dortmund, Ulsan, Mamelodi Sundowns.

Group G: Manchester City, Wydad, Al Ain, Juventus.

Group H: Real Madrid, Al Hilal, Pachuca, Salzburg.

The years Ramadan fell in May

Russia's Muslim Heartlands

Dominic Rubin, Oxford

Profile of VoucherSkout

Date of launch: November 2016

Founder: David Tobias

Based: Jumeirah Lake Towers

Sector: Technology

Size: 18 employees

Stage: Embarking on a Series A round to raise $5 million in the first quarter of 2019 with a 20 per cent stake

Investors: Seed round was self-funded with “millions of dollars”

BMW M5 specs

Engine: 4.4-litre twin-turbo V-8 petrol enging with additional electric motor

Power: 727hp

Torque: 1,000Nm

Transmission: 8-speed auto

Fuel consumption: 10.6L/100km

On sale: Now

Price: From Dh650,000

Company Profile

Name: Thndr

Started: 2019

Co-founders: Ahmad Hammouda and Seif Amr

Sector: FinTech

Headquarters: Egypt

UAE base: Hub71, Abu Dhabi

Current number of staff: More than 150

Funds raised: $22 million

Results

%3Cp%3E%0D%3Cstrong%3EElite%20men%3C%2Fstrong%3E%0D%3Cbr%3E1.%20Amare%20Hailemichael%20Samson%20(ERI)%202%3A07%3A10%0D%3Cbr%3E2.%20Leornard%20Barsoton%20(KEN)%202%3A09%3A37%0D%3Cbr%3E3.%20Ilham%20Ozbilan%20(TUR)%202%3A10%3A16%0D%3Cbr%3E4.%20Gideon%20Chepkonga%20(KEN)%202%3A11%3A17%0D%3Cbr%3E5.%20Isaac%20Timoi%20(KEN)%202%3A11%3A34%0D%3Cbr%3E%3Cstrong%3EElite%20women%3C%2Fstrong%3E%0D%3Cbr%3E1.%20Brigid%20Kosgei%20(KEN)%202%3A19%3A15%0D%3Cbr%3E2.%20Hawi%20Feysa%20Gejia%20(ETH)%202%3A24%3A03%0D%3Cbr%3E3.%20Sintayehu%20Dessi%20(ETH)%202%3A25%3A36%0D%3Cbr%3E4.%20Aurelia%20Kiptui%20(KEN)%202%3A28%3A59%0D%3Cbr%3E5.%20Emily%20Kipchumba%20(KEN)%202%3A29%3A52%3C%2Fp%3E%0A

The specs: 2019 Haval H6

Price, base: Dh69,900

Engine: 2.0-litre turbocharged four-cylinder

Transmission: Seven-speed automatic

Power: 197hp @ 5,500rpm

Torque: 315Nm @ 2,000rpm

Fuel economy, combined: 7.0L / 100km

If you go

The flights

The closest international airport for those travelling from the UAE is Denver, Colorado. British Airways (www.ba.com) flies from the UAE via London from Dh3,700 return, including taxes. From there, transfers can be arranged to the ranch or it’s a seven-hour drive. Alternatively, take an internal flight to the counties of Cody, Casper, or Billings

The stay

Red Reflet offers a series of packages, with prices varying depending on season. All meals and activities are included, with prices starting from US$2,218 (Dh7,150) per person for a minimum stay of three nights, including taxes. For more information, visit red-reflet-ranch.net.

White hydrogen: Naturally occurring hydrogen

Chromite: Hard, metallic mineral containing iron oxide and chromium oxide

Ultramafic rocks: Dark-coloured rocks rich in magnesium or iron with very low silica content

Ophiolite: A section of the earth’s crust, which is oceanic in nature that has since been uplifted and exposed on land

Olivine: A commonly occurring magnesium iron silicate mineral that derives its name for its olive-green yellow-green colour

UAE currency: the story behind the money in your pockets

Why the Tourist Club?

Originally, The Club (which many people chose to call the “British Club”) was the only place where one could use the beach with changing rooms and a shower, and get refreshments.

In the early 1970s, the Government of Abu Dhabi wanted to give more people a place to get together on the beach, with some facilities for children. The place chosen was where the annual boat race was held, which Sheikh Zayed always attended and which brought crowds of locals and expatriates to the stretch of beach to the left of Le Méridien and the Marina.

It started with a round two-storey building, erected in about two weeks by Orient Contracting for Sheikh Zayed to use at one these races. Soon many facilities were planned and built, and members were invited to join.

Why it was called “Nadi Al Siyahi” is beyond me. But it is likely that one wanted to convey the idea that this was open to all comers. Because there was no danger of encountering alcohol on the premises, unlike at The Club, it was a place in particular for the many Arab expatriate civil servants to join. Initially the fees were very low and membership was offered free to many people, too.

Eventually there was a skating rink, bowling and many other amusements.

Frauke Heard-Bey is a historian and has lived in Abu Dhabi since 1968.

Ferrari 12Cilindri specs

Engine: naturally aspirated 6.5-liter V12

Power: 819hp

Torque: 678Nm at 7,250rpm

Price: From Dh1,700,000

Available: Now

Company Profile

Name: JustClean

Based: Kuwait with offices in other GCC countries

Launch year: 2016

Number of employees: 130

Sector: online laundry service

Funding: $12.9m from Kuwait-based Faith Capital Holding