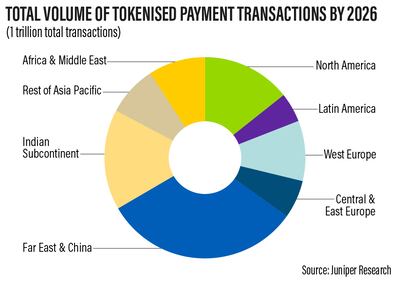

Global tokenised payment transactions are expected to increase 47 per cent to more than one trillion by 2026 from this year, as the e-commerce industry's adoption of secure “one-click” transactions and Internet of Things (IoT) solutions continues to grow, according to Juniper Research.

About 680 billion transactions are expected in 2022, as quick transaction solutions such as click-to-pay and auto-filling of checkout details, continue to grow, a study by the UK-based company said.

Tokenisation is the process of replacing things with high value, such as bank cards and account details, with alternative codes called “tokens” that have low or no intrinsic value.

This boosts security by removing the most valuable data that cyber criminals can steal during the transaction process.

“Protecting payment data is integral to the security of the payments ecosystem. In an increasingly interconnected world, with a growing number of payment options, the need for strong security solutions is clear,” Juniper said.

Card networks are encouraging the mass adoption of tokenisation to also improve payment approval rates, it said.

“With so many payment methods now in use, the need to ensure that consumer data is protected across all channels is only growing.”

The Far East and China region will account for about a third of the tokenised transaction market by 2026, with IoT solutions expected to lead the growth.

IoT-driven payments — transactions made using connected devices beyond smartphones and computers, including wearables, cars and home appliances — are expected to record the largest growth in the tokenisation market over the next five years.

Tokenised IoT transactions are set to hit about 19 billion by 2027, a fivefold increase from 3.8 billion in 2022, the study showed.

“Tokenisation is critical in facilitating IoT payments, enabling transactions to be made via new use cases and form factors, and unlocking new revenue opportunities for payment providers,” the report said.

The volume of tokenised online and mobile e-commerce transactions is expected to grow by 74 per cent by 2026, driven by the increasing customer expectation of a faster and frictionless checkout experience, which one-click solutions offer.

The market's growth will also be driven by benefits such as time savings for the end-user through the elimination of the need for customers to re-enter payment credentials when shopping online.

However, many organisations are yet to adopt tokenisation, given the long development cycle.

“Tokenisation vendors, other than the already advanced card networks, must begin scaling their own IoT tokenisation solutions or risk missing this lucrative opportunity,” the report said.

Key findings of Jenkins report

- Founder of the Muslim Brotherhood, Hassan al Banna, "accepted the political utility of violence"

- Views of key Muslim Brotherhood ideologue, Sayyid Qutb, have “consistently been understood” as permitting “the use of extreme violence in the pursuit of the perfect Islamic society” and “never been institutionally disowned” by the movement.

- Muslim Brotherhood at all levels has repeatedly defended Hamas attacks against Israel, including the use of suicide bombers and the killing of civilians.

- Laying out the report in the House of Commons, David Cameron told MPs: "The main findings of the review support the conclusion that membership of, association with, or influence by the Muslim Brotherhood should be considered as a possible indicator of extremism."

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

Champions League Last 16

Red Bull Salzburg (AUT) v Bayern Munich (GER)

Sporting Lisbon (POR) v Manchester City (ENG)

Benfica (POR) v Ajax (NED)

Chelsea (ENG) v Lille (FRA)

Atletico Madrid (ESP) v Manchester United (ENG)

Villarreal (ESP) v Juventus (ITA)

Inter Milan (ITA) v Liverpool (ENG)

Paris Saint-Germain v Real Madrid (ESP)

The candidates

Dr Ayham Ammora, scientist and business executive

Ali Azeem, business leader

Tony Booth, professor of education

Lord Browne, former BP chief executive

Dr Mohamed El-Erian, economist

Professor Wyn Evans, astrophysicist

Dr Mark Mann, scientist

Gina MIller, anti-Brexit campaigner

Lord Smith, former Cabinet minister

Sandi Toksvig, broadcaster

U19 WORLD CUP, WEST INDIES

UAE group fixtures (all in St Kitts)

Saturday 15 January: v Canada

Thursday 20 January: v England

Saturday 22 January: v Bangladesh

UAE squad

Alishan Sharafu (captain), Shival Bawa, Jash Giyanani, Sailles Jaishankar, Nilansh Keswani, Aayan Khan, Punya Mehra, Ali Naseer, Ronak Panoly, Dhruv Parashar, Vinayak Raghavan, Soorya Sathish, Aryansh Sharma, Adithya Shetty, Kai Smith

Groom and Two Brides

Director: Elie Semaan

Starring: Abdullah Boushehri, Laila Abdallah, Lulwa Almulla

Rating: 3/5

Barings Bank

Barings, one of Britain’s oldest investment banks, was

founded in 1762 and operated for 233 years before it went bust after a trading

scandal.

Barings Bank collapsed in February 1995 following colossal

losses caused by rogue trader Nick Lesson.

Leeson gambled more than $1 billion in speculative trades,

wiping out the venerable merchant bank’s cash reserves.

T20 WORLD CUP QUALIFIERS

Qualifier A, Muscat

(All matches to be streamed live on icc.tv)

Fixtures

Friday, February 18: 10am Oman v Nepal, Canada v Philippines; 2pm Ireland v UAE, Germany v Bahrain

Saturday, February 19: 10am Oman v Canada, Nepal v Philippines; 2pm UAE v Germany, Ireland v Bahrain

Monday, February 21: 10am Ireland v Germany, UAE v Bahrain; 2pm Nepal v Canada, Oman v Philippines

Tuesday, February 22: 2pm Semi-finals

Thursday, February 24: 2pm Final

UAE squad:Ahmed Raza(captain), Muhammad Waseem, Chirag Suri, Vriitya Aravind, Rohan Mustafa, Kashif Daud, Zahoor Khan, Alishan Sharafu, Raja Akifullah, Karthik Meiyappan, Junaid Siddique, Basil Hameed, Zafar Farid, Mohammed Boota, Mohammed Usman, Rahul Bhatia

How to book

Call DHA on 800342

Once you are registered, you will receive a confirmation text message

Present the SMS and your Emirates ID at the centre

DHA medical personnel will take a nasal swab

Check results within 48 hours on the DHA app under ‘Lab Results’ and then ‘Patient Services’

Results

57kg quarter-finals

Zakaria Eljamari (UAE) beat Hamed Al Matari (YEM) by points 3-0.

60kg quarter-finals

Ibrahim Bilal (UAE) beat Hyan Aljmyah (SYR) RSC round 2.

63.5kg quarter-finals

Nouredine Samir (UAE) beat Shamlan A Othman (KUW) by points 3-0.

67kg quarter-finals

Mohammed Mardi (UAE) beat Ahmad Ondash (LBN) by points 2-1.

71kg quarter-finals

Ahmad Bahman (UAE) defeated Lalthasanga Lelhchhun (IND) by points 3-0.

Amine El Moatassime (UAE) beat Seyed Kaveh Safakhaneh (IRI) by points 3-0.

81kg quarter-finals

Ilyass Habibali (UAE) beat Ahmad Hilal (PLE) by points 3-0

Getting there

The flights

Flydubai operates up to seven flights a week to Helsinki. Return fares to Helsinki from Dubai start from Dh1,545 in Economy and Dh7,560 in Business Class.

The stay

Golden Crown Igloos in Levi offer stays from Dh1,215 per person per night for a superior igloo; www.leviniglut.net

Panorama Hotel in Levi is conveniently located at the top of Levi fell, a short walk from the gondola. Stays start from Dh292 per night based on two people sharing; www. golevi.fi/en/accommodation/hotel-levi-panorama

Arctic Treehouse Hotel in Rovaniemi offers stays from Dh1,379 per night based on two people sharing; www.arctictreehousehotel.com

Mercedes-AMG GT 63 S E Performance: the specs

Engine: 4.0-litre twin-turbo V8 plus rear-mounted electric motor

Power: 843hp at N/A rpm

Torque: 1470Nm N/A rpm

Transmission: 9-speed auto

Fuel consumption: 8.6L/100km

On sale: October to December

Price: From Dh875,000 (estimate)

ONCE UPON A TIME IN GAZA

Starring: Nader Abd Alhay, Majd Eid, Ramzi Maqdisi

Directors: Tarzan and Arab Nasser

Rating: 4.5/5

AT%20A%20GLANCE

%3Cp%3E%3Cstrong%3EWindfall%3C%2Fstrong%3E%0D%3Cbr%3EAn%20%E2%80%9Cenergy%20profits%20levy%E2%80%9D%20to%20raise%20around%20%C2%A35bn%20in%20a%20year.%20The%20temporary%20one-off%20tax%20will%20hit%20oil%20and%20gas%20firms%20by%2025%20per%20cent%20on%20extraordinary%20profits.%20An%2080%20per%20cent%20investment%20allowance%20should%20calm%20Conservative%20nerves%20that%20the%20move%20will%20dent%20North%20Sea%20firms%E2%80%99%20investment%20to%20save%20them%2091p%20for%20every%20%C2%A31%20they%20spend.%0D%3Cbr%3E%3Cstrong%3EA%20universal%20grant%3C%2Fstrong%3E%0D%3Cbr%3EEnergy%20bills%20discount%2C%20which%20was%20effectively%20a%20%C2%A3200%20loan%2C%20has%20doubled%20to%20a%20%C2%A3400%20discount%20on%20bills%20for%20all%20households%20from%20October%20that%20will%20not%20need%20to%20be%20paid%20back.%0D%3Cbr%3E%3Cstrong%3ETargeted%20measures%3C%2Fstrong%3E%0D%3Cbr%3EMore%20than%20eight%20million%20of%20the%20lowest%20income%20households%20will%20receive%20a%20%C2%A3650%20one-off%20payment.%20It%20will%20apply%20to%20households%20on%20Universal%20Credit%2C%20Tax%20Credits%2C%20Pension%20Credit%20and%20legacy%20benefits.%0D%3Cbr%3ESeparate%20one-off%20payments%20of%20%C2%A3300%20will%20go%20to%20pensioners%20and%20%C2%A3150%20for%20those%20receiving%20disability%20benefits.%3C%2Fp%3E%0A

Key products and UAE prices

iPhone XS

With a 5.8-inch screen, it will be an advance version of the iPhone X. It will be dual sim and comes with better battery life, a faster processor and better camera. A new gold colour will be available.

Price: Dh4,229

iPhone XS Max

It is expected to be a grander version of the iPhone X with a 6.5-inch screen; an inch bigger than the screen of the iPhone 8 Plus.

Price: Dh4,649

iPhone XR

A low-cost version of the iPhone X with a 6.1-inch screen, it is expected to attract mass attention. According to industry experts, it is likely to have aluminium edges instead of stainless steel.

Price: Dh3,179

Apple Watch Series 4

More comprehensive health device with edge-to-edge displays that are more than 30 per cent bigger than displays on current models.