Residential and industrial property will be the strongest real estate investment asset classes globally in 2022, according to research from consultancy Savills.

Global real estate investment volumes rose 38 per cent to $1.3 trillion in the 12 months to November 2021, compared with the corresponding period in 2020, Savills said, as an increasing number of funds looked to invest in the asset class.

The number of funds focusing on real estate also hit a record, with 1,250 such funds committing $365 billion last year, compared with 1,000 funds in 2020, according to investment data company Preqin.

As population growth picks up again, especially in the UAE and Saudi Arabia, residential development will continue to remain a key focus area

Swapnil Pillai,

associate director of Middle East research at Savills

“While industrial emerged as a strong but natural winner as a result of a flourishing e-commerce sector, prime offices found favour once again across the Middle East markets as employees returned to the workplace,” Swapnil Pillai, associate director of Middle East research at Savills, said.

“As population growth picks up again, especially in the UAE and Saudi Arabia, residential development will continue to remain a key focus area.”

UAE property prices are expected to continue rising in 2022, driven by supportive economic reforms and an accelerated vaccination programme that has helped to hasten a rebound from the coronavirus-induced slowdown last year.

Environmental, social and governance (ESG) standards will influence investor property investment and purchasing decisions in the GCC over the next 10 years, according to an October report by Mashreq, the Dubai lender controlled by Al Ghurair family.

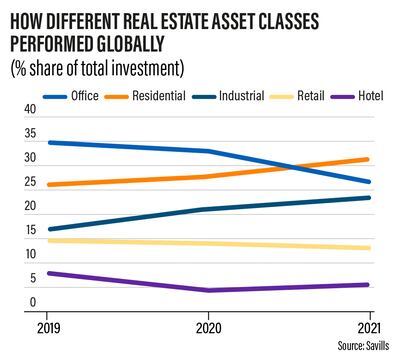

Residential – including multi-family, student and senior housing – was the largest sector for investment globally in 2021, overtaking offices for the first time, Savills said.

“Investors are increasingly attracted to residential’s secure, income-generating qualities, robust demand and resilience against technological disintermediation, but while strong activity will continue in 2022, a dearth of standing stock means that development will be the entry point for many,” Savills said.

Prime residential properties in Dubai will continue to attract investor demand, while other segments of the residential market play catch up, the consultancy said.

Riyadh and Cairo will be other residential markets that attract investors, with opportunity for the development of branded residences in Egypt, the research cited.

While global investment in the offices sector remained below pre-pandemic levels, volumes in the industrial sector rose 54 per cent, Savills said.

Prime offices occupied by government organisations and multinational corporations will remain core assets in big cities across the UAE, Saudi Arabia, Bahrain, Oman and Egypt, the research revealed.

This will be followed by multi-let offices in good locations across Cairo and Riyadh.

Commercial property demand is being driven by sectors including banking and financial services, technology and FinTech, according to the consultancy.

“While the stats show offices were less loved than residential last year, despite the multitude of headlines about e-commerce growth, they still made up a greater proportion of the global market than industrial,” said Paul Tostevin, a director in Savills’ world research department.

Meanwhile, e-commerce continues to fuel demand for quality warehouses but the Middle East is still one of the most underpenetrated markets for online shopping, according to Savills.

Super-regional malls across Dubai, Cairo and Riyadh will become more popular with investors in 2022 while community retail establishments across mixed-use developments in Dubai, Abu Dhabi, Riyadh and Cairo will also be in focus, the researchers found.

If you go

The flights

Emirates and Etihad fly direct to Nairobi, with fares starting from Dh1,695. The resort can be reached from Nairobi via a 35-minute flight from Wilson Airport or Jomo Kenyatta International Airport, or by road, which takes at least three hours.

The rooms

Rooms at Fairmont Mount Kenya range from Dh1,870 per night for a deluxe room to Dh11,000 per night for the William Holden Cottage.

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%3A%3C%2Fstrong%3E%20Vault%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3EJune%202023%3Cbr%3E%3Cstrong%3ECo-founders%3A%20%3C%2Fstrong%3EBilal%20Abou-Diab%20and%20Sami%20Abdul%20Hadi%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EAbu%20Dhabi%3Cbr%3E%3Cstrong%3ELicensed%20by%3A%3C%2Fstrong%3E%20Abu%20Dhabi%20Global%20Market%3Cbr%3E%3Cstrong%3EIndustry%3A%20%3C%2Fstrong%3EInvestment%20and%20wealth%20advisory%3Cbr%3E%3Cstrong%3EFunding%3A%20%3C%2Fstrong%3E%241%20million%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EOutliers%20VC%20and%20angel%20investors%3Cbr%3E%3Cstrong%3ENumber%20of%20employees%3A%20%3C%2Fstrong%3E14%3Cbr%3E%3C%2Fp%3E%0A

EPL's youngest

- Ethan Nwaneri (Arsenal)

15 years, 181 days old

- Max Dowman (Arsenal)

15 years, 235 days old

- Jeremy Monga (Leicester)

15 years, 271 days old

- Harvey Elliott (Fulham)

16 years, 30 days old

- Matthew Briggs (Fulham)

16 years, 68 days old

Seven%20Winters%20in%20Tehran

%3Cp%3E%3Cstrong%3EDirector%20%3A%3C%2Fstrong%3E%20Steffi%20Niederzoll%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%20Reyhaneh%20Jabbari%2C%20Shole%20Pakravan%2C%20Zar%20Amir%20Ebrahimi%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

Asia Cup Qualifier

Final

UAE v Hong Kong

Live on OSN Cricket HD. Coverage starts at 5.30am

Surianah's top five jazz artists

Billie Holliday: for the burn and also the way she told stories.

Thelonius Monk: for his earnestness.

Duke Ellington: for his edge and spirituality.

Louis Armstrong: his legacy is undeniable. He is considered as one of the most revolutionary and influential musicians.

Terence Blanchard: very political - a lot of jazz musicians are making protest music right now.

Timeline

1947

Ferrari’s road-car company is formed and its first badged car, the 125 S, rolls off the assembly line

1962

250 GTO is unveiled

1969

Fiat becomes a Ferrari shareholder, acquiring 50 per cent of the company

1972

The Fiorano circuit, Ferrari’s racetrack for development and testing, opens

1976

First automatic Ferrari, the 400 Automatic, is made

1987

F40 launched

1988

Enzo Ferrari dies; Fiat expands its stake in the company to 90 per cent

2002

The Enzo model is announced

2010

Ferrari World opens in Abu Dhabi

2011

First four-wheel drive Ferrari, the FF, is unveiled

2013

LaFerrari, the first Ferrari hybrid, arrives

2014

Fiat Chrysler announces the split of Ferrari from the parent company

2015

Ferrari launches on Wall Street

2017

812 Superfast unveiled; Ferrari celebrates its 70th anniversary

Results

5.30pm: Maiden (TB) Dh82,500 (Dirt) 1,600m, Winner: Panadol, Mickael Barzalona (jockey), Salem bin Ghadayer (trainer)

6.05pm: Maiden (TB) Dh82,500 (Turf) 1,400m, Winner: Mayehaab, Adrie de Vries, Fawzi Nass

6.40pm: Handicap (TB) Dh85,000 (D) 1,600m, Winner: Monoski, Mickael Barzalona, Salem bin Ghadayer

7.15pm: Handicap (TB) Dh102,500 (T) 1,800m, Winner: Eastern World, Royston Ffrench, Charlie Appleby

7.50pm: Handicap (TB) Dh92,500 (D) 1,200m, Winner: Madkal, Adrie de Vries, Fawzi Nass

8.25pm: Handicap (TB) Dh92,500 (T) 1,200m, Winner: Taneen, Dane O’Neill, Musabah Al Muhairi

Profile of Udrive

Date started: March 2016

Founder: Hasib Khan

Based: Dubai

Employees: 40

Amount raised (to date): $3.25m – $750,000 seed funding in 2017 and a Seed round of $2.5m last year. Raised $1.3m from Eureeca investors in January 2021 as part of a Series A round with a $5m target.