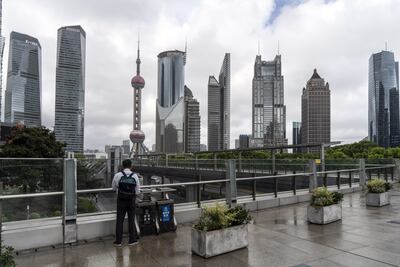

Chinese stocks swept to their biggest single-day gains in 16 years on Monday, with domestic A-shares registering their highest turnover yet, as investors rushed to join a rally sparked by Beijing's latest stimulus measures.

The CSI300 blue-chip index is now up nearly 30 per cent from its February low, which by some market definitions suggests it is in a bull market, but much of the gains have happened very quickly over a few sessions since last week.

Many traders, fearing they may miss out of the upsurge ahead of a week-long holiday starting on Tuesday, helped lift the CSI300 index 8.5 per cent at the close, taking its five-day gain to over 25 per cent, the strongest on record.

The broader Shanghai Composite Index, meanwhile, recorded a total turnover of 1.17 trillion yuan ($166.84 billion) and surged 8.1 per cent. That took its five-day gains since last Tuesday, when Beijing began rolling out stimulus measures to arrest a slowdown in the broader economy, to 21.4 per cent, the strongest since 1996.

It was also the best single-day percentage gain for both the CSI and SSEC indexes since 2008.

Similarly, the smaller Shenzhen index soared 11 per cent and recorded a turnover of 1.4 trillion yuan.

The rally in Chinese stocks has come on the back of last week's most aggressive stimulus measures announced by Beijing since the pandemic – ranging from rate cuts to fiscal support – in an attempt to shore up its ailing economy.

Particularly in a boost for stocks, the People's Bank of China's also introduced props for the capital market, one of which includes a swap programme allowing funds, insurers and brokers easier access to funding in order to buy stocks.

That lit a fire under beaten-down Chinese equities that had been languishing near multiyear lows as recently as early this month, as investors fretted over China's growth prospects.

“It's really a big turnaround, the policies are so intensive, we have never seen such clear instruction to stop housing prices declining and support the stock market,” said Dickie Wong, executive director of research at Kingston Securities.

“Many foreign investors are afraid of missing out, local retail investors are asking me what they should add to, institutional investors are rushing to the market to catch up, and the large inflows have pushed the Hang Seng index up to 21,000.”

Hong Kong's Hang Seng index, which advanced 2.4 per cent on Monday, is now up roughly 24 per cent for the year, dethroning Taiwan to become Asia's best performing stock market.

Adding to the strong momentum was news on Sunday from China's central bank saying that it would tell banks to lower mortgage rates for existing home loans before October 31, as part of policies to support the country's property market.

Guangzhou city also announced the same day the end of all restrictions on home purchases, while Shanghai and Shenzhen eased curbs on buying.

That catapulted shares of property companies on Monday, with mainland-listed property stocks advancing 8.2 per cent, while the Hang Seng Mainland Properties Index charged 6.4 per cent higher.

Investor optimism the latest measures could help revive China's weak domestic consumption also lifted shares of consumer staples up 8.8 per cent, its biggest daily percentage gain in 16 years.

For the month, the CSI300 index clocked a gain of 21 per cent, its best performance since December 2014. The Shanghai Composite Index similarly ended September with a 17 per cent increase, its most since April 2015.

The Hang Seng index had its best month since November 2022 with a 17 per cent rise, after delivering its biggest weekly rise since 1998 last week, and fifth largest in the last half-century.

Mainland financial markets will be closed October 1-7 for National Day holidays.

UAE currency: the story behind the money in your pockets

Benefits of first-time home buyers' scheme

- Priority access to new homes from participating developers

- Discounts on sales price of off-plan units

- Flexible payment plans from developers

- Mortgages with better interest rates, faster approval times and reduced fees

- DLD registration fee can be paid through banks or credit cards at zero interest rates

HIJRA

Starring: Lamar Faden, Khairiah Nathmy, Nawaf Al-Dhufairy

Director: Shahad Ameen

Rating: 3/5

Killing of Qassem Suleimani

ICC T20 Team of 2021

Jos Buttler, Mohammad Rizwan, Babar Azam, Aiden Markram, Mitchell Marsh, David Miller, Tabraiz Shamsi, Josh Hazlewood, Wanindu Hasaranga, Mustafizur Rahman, Shaheen Afridi

War 2

Director: Ayan Mukerji

Stars: Hrithik Roshan, NTR, Kiara Advani, Ashutosh Rana

Rating: 2/5

Killing of Qassem Suleimani

Red flags

- Promises of high, fixed or 'guaranteed' returns.

- Unregulated structured products or complex investments often used to bypass traditional safeguards.

- Lack of clear information, vague language, no access to audited financials.

- Overseas companies targeting investors in other jurisdictions - this can make legal recovery difficult.

- Hard-selling tactics - creating urgency, offering 'exclusive' deals.

Courtesy: Carol Glynn, founder of Conscious Finance Coaching

PFA Team of the Year: David de Gea, Kyle Walker, Jan Vertonghen, Nicolas Otamendi, Marcos Alonso, David Silva, Kevin De Bruyne, Christian Eriksen, Harry Kane, Mohamed Salah, Sergio Aguero

Dubai Bling season three

Cast: Loujain Adada, Zeina Khoury, Farhana Bodi, Ebraheem Al Samadi, Mona Kattan, and couples Safa & Fahad Siddiqui and DJ Bliss & Danya Mohammed

Rating: 1/5

The biog

First Job: Abu Dhabi Department of Petroleum in 1974

Current role: Chairperson of Al Maskari Holding since 2008

Career high: Regularly cited on Forbes list of 100 most powerful Arab Businesswomen

Achievement: Helped establish Al Maskari Medical Centre in 1969 in Abu Dhabi’s Western Region

Future plan: Will now concentrate on her charitable work

The years Ramadan fell in May

KILLING OF QASSEM SULEIMANI

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%203.0-litre%20six-cylinder%20turbo%20(BMW%20B58)%3Cbr%3E%3Cstrong%3EPower%3A%3C%2Fstrong%3E%20340hp%20at%206%2C500rpm%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20500Nm%20from%201%2C600-4%2C500rpm%3Cbr%3E%3Cstrong%3ETransmission%3A%3C%2Fstrong%3E%20ZF%208-speed%20auto%3Cbr%3E%3Cstrong%3E0-100kph%3A%3C%2Fstrong%3E%204.2sec%3Cbr%3E%3Cstrong%3ETop%20speed%3A%3C%2Fstrong%3E%20267kph%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3Cbr%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20From%20Dh462%2C189%3Cbr%3E%3Cstrong%3EWarranty%3A%3C%2Fstrong%3E%2030-month%2F48%2C000k%3C%2Fp%3E%0A

MATCH INFO

Uefa Champions League final:

Who: Real Madrid v Liverpool

Where: NSC Olimpiyskiy Stadium, Kiev, Ukraine

When: Saturday, May 26, 10.45pm (UAE)

TV: Match on BeIN Sports

Killing of Qassem Suleimani

Itcan profile

Founders: Mansour Althani and Abdullah Althani

Based: Business Bay, with offices in Saudi Arabia, Egypt and India

Sector: Technology, digital marketing and e-commerce

Size: 70 employees

Revenue: On track to make Dh100 million in revenue this year since its 2015 launch

Funding: Self-funded to date

More on Quran memorisation:

Company profile

Name: Thndr

Started: October 2020

Founders: Ahmad Hammouda and Seif Amr

Based: Cairo, Egypt

Sector: FinTech

Initial investment: pre-seed of $800,000

Funding stage: series A; $20 million

Investors: Tiger Global, Beco Capital, Prosus Ventures, Y Combinator, Global Ventures, Abdul Latif Jameel, Endure Capital, 4DX Ventures, Plus VC, Rabacap and MSA Capital

The Voice of Hind Rajab

Starring: Saja Kilani, Clara Khoury, Motaz Malhees

Director: Kaouther Ben Hania

Rating: 4/5

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

The specs

AT4 Ultimate, as tested

Engine: 6.2-litre V8

Power: 420hp

Torque: 623Nm

Transmission: 10-speed automatic

Price: From Dh330,800 (Elevation: Dh236,400; AT4: Dh286,800; Denali: Dh345,800)

On sale: Now

The specs

Engine: 3.0-litre six-cylinder turbo

Power: 398hp from 5,250rpm

Torque: 580Nm at 1,900-4,800rpm

Transmission: Eight-speed auto

Fuel economy, combined: 6.5L/100km

On sale: December

Price: From Dh330,000 (estimate)