Digital economies require digital currencies. Technological developments and innovation have transformed the payment system landscape in the past decade, with an additional boost from the pandemic.

Personal, government and business payments shifted away from mainly cash to online and digital payments, embraced FinTech (eg, for financial market transactions, lending, wealth management), with tech companies such as Apple and Alibaba disintermediating banks.

Retail, wholesale, cross-border and financial payment systems now enable e-commerce and digital finance including digital assets and cryptocurrencies such as Bitcoin and Ethereum.

Data suggests there is substantial appetite for cryptocurrencies in the Middle East and North Africa: the region had the sixth largest crypto economy globally, with an estimated $389.8 billion in on-chain value received, in the year ending June 2023 (about 7.2 per cent of global transaction volumes).

Saudi Arabia reported the highest growth globally in the volume of cryptocurrency transactions during this period.

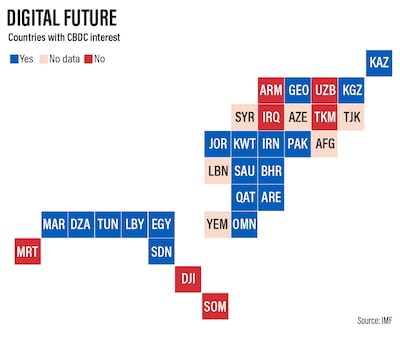

As the use of cash declines, central banks have been exploring the feasibility of establishing their own peer-to-peer payment systems through Central Bank Digital Currencies (CBDCs). Currently, about 134 countries and currency unions (representing 98 per cent of global gross domestic product) are exploring CBDCs, including 13 in the Arab world.

While many are in pilot stages, Bahrain, Saudi Arabia and the UAE have moved to the more advanced “proof-of-concept” stage.

Globally, three countries have launched a retail CBDC – the Bahamas, Jamaica and Nigeria – and a 2022 BIS survey forecasts there could be 15 retail and nine wholesale CBDCs publicly circulating in 2030.

A retail CBDC is used by the general public, while a wholesale CBDC is accessible only by financial and certain non-bank institutions.

In contrast to cryptocurrencies, which are mainly decentralised, CBDCs are digital cash, legal tender, issued by and a liability of the central bank. They are basic payment infrastructure for increasingly digital economies, enabling secure, efficient, monetary, financial and digital transactions.

The International Monetary Fund highlights the need to build trust in CBDCs through robust institutional, legal and technological safeguards to protect user privacy while ensuring compliance with anti-money laundering and combatting the financing of terrorism (AML/CFT) standards.

The successful implementation and adoption of CBDCs requires secure and inclusive public digital infrastructure to facilitate integration and competition between public and private payment providers.

The adoption requirements pose challenges for developing countries. There are large digital and financial divides across the Mena region, with only about two thirds of the population in the Arab states using the internet (in line with the global average). The wide disparities within the region reflect the economic and digitalisation divide between the oil-rich GCC and the non-oil countries.

Benefits for Mena region

The roll-out and use of CBDCs offer multiple macro and socio-economic benefits in the Mena region as the digital economy expands.

Firstly, for the developing nations subset, a retail CBDC could lead to greater financial inclusion. As per the Global Findex Database 2021, only 48 per cent of adults in the region (excluding high-income nations) have a financial account, about 23 percentage points lower compared to the developing economy average.

Secondly, CBDCs can be used for social transfers, for targeting subsidies as well as for payment of fees and taxes in an efficient and cost-effective manner.

Thirdly, for the more advanced nations such as the UAE and Saudi Arabia that aspire to be international financial centres, wholesale CBDCs would facilitate cross-border payments and settlement. Interoperability would enable greater adoption and usage of the CBDC, but this requires ongoing co-operation between central banks. This will ensure that differences in legislation and national standards for data handling or cyber security provisions can be aligned.

Fourthly, leveraging data derived from CBDC usage can be used to establish credit profiles to reduce lending gaps.

What needs to be done?

CBDCs need to be complemented by secure and inclusive digital public infrastructure, a cohesive, integrated digital network including digital ID, payments and data exchange.

This could be along the lines of a national digital ID (eg, India’s success with the Aadhar card), real time payment systems (eg, Thailand’s PromptPay, Brazil’s Pix or Egypt’s InstaPay) or integrated payment systems (eg, digital Yuan e-CNY pilot programme and integration with Hong Kong) among others.

Digital inclusion needs to be one of the pillars of a CBDC rollout, along with financial literacy and data protection integrated into the process. Effectively, CBDCs are public goods and require swifter action and implementation.

Will CBDCs accelerate de-dollarisation?

Following the visit of President Sheikh Mohamed to China, a joint statement by the Chinese and UAE central banks highlighted the role of CBDCs in enhancing cross-border trade and investment. The UAE had completed in late January its first cross-border payment using the digital dirham – a payment of Dh50 million to China using the BIS mBridge cross-border CBDC platform where both countries are participants.

Saudi Arabia joined the mBridge project on June 6.

These moves could result in an alternative to conducting cross-border transactions without depending on the dollar.

The UAE and Saudi Arabia’s successful Project Aber in 2020 to settle cross-border payments, and their co-operation under the mBridge project, can be seen as a stepping stone towards greater economic and financial integration in the wider GCC region.

Globally, the dollar’s dominance in transactions has been long-standing: according to SWIFT, it accounted for 47.37 per cent of total transaction value as of March. However, oil sales are also being transacted in non-dollar currencies including the Chinese yuan and the UAE dirham.

Weaponisation of the dollar (eg, via financial sanctions or freezing of assets and using the income on sanctioned assets) renders “risk-free” US assets risky, encouraging countries to reduce the share of dollar assets, including in international reserves.

The dollar in allocated reserves globally stood at 58.4 per cent as of end-2023, from around 70 per cent at the turn of the century, with central banks raising the share of non-traditional reserve currencies (including the yuan, Australian dollar, and the Nordic currencies among others) as opposed to euro, yen or pound.

There has also been a distinct shift to holding gold as a hedge instead, helping boost gold prices. A successful implementation of CBDCs could boost de-dollarisation – reduce the dependence on SWIFT and the use of dollars, thereby changing and challenging the current geopolitical financial topography.

Given the role of China as the world’s biggest trading nation, it is the yuan and the petro-yuan that will become the de facto Brics+ trade finance and payments currency.

Nasser Saidi is the president of Nasser Saidi and Associates. He was formerly Lebanon's economy minister and a vice-governor of the Central Bank of Lebanon

The specs

A4 35 TFSI

Engine: 2.0-litre, four-cylinder

Transmission: seven-speed S-tronic automatic

Power: 150bhp

Torque: 270Nm

Price: Dh150,000 (estimate)

On sale: First Q 2020

A4 S4 TDI

Engine: 3.0-litre V6 turbo diesel

Transmission: eight-speed PDK automatic

Power: 350bhp

Torque: 700Nm

Price: Dh165,000 (estimate)

On sale: First Q 2020

The five new places of worship

Church of South Indian Parish

St Andrew's Church Mussaffah branch

St Andrew's Church Al Ain branch

St John's Baptist Church, Ruwais

Church of the Virgin Mary and St Paul the Apostle, Ruwais

Getting there

The flights

Flydubai operates up to seven flights a week to Helsinki. Return fares to Helsinki from Dubai start from Dh1,545 in Economy and Dh7,560 in Business Class.

The stay

Golden Crown Igloos in Levi offer stays from Dh1,215 per person per night for a superior igloo; www.leviniglut.net

Panorama Hotel in Levi is conveniently located at the top of Levi fell, a short walk from the gondola. Stays start from Dh292 per night based on two people sharing; www. golevi.fi/en/accommodation/hotel-levi-panorama

Arctic Treehouse Hotel in Rovaniemi offers stays from Dh1,379 per night based on two people sharing; www.arctictreehousehotel.com

UAE currency: the story behind the money in your pockets

How to wear a kandura

Dos

- Wear the right fabric for the right season and occasion

- Always ask for the dress code if you don’t know

- Wear a white kandura, white ghutra / shemagh (headwear) and black shoes for work

- Wear 100 per cent cotton under the kandura as most fabrics are polyester

Don’ts

- Wear hamdania for work, always wear a ghutra and agal

- Buy a kandura only based on how it feels; ask questions about the fabric and understand what you are buying

Gulf Under 19s

Pools

A – Dubai College, Deira International School, Al Ain Amblers, Warriors

B – Dubai English Speaking College, Repton Royals, Jumeirah College, Gems World Academy

C – British School Al Khubairat, Abu Dhabi Harlequins, Dubai Hurricanes, Al Yasmina Academy

D – Dubai Exiles, Jumeirah English Speaking School, English College, Bahrain Colts

Recent winners

2018 – Dubai College

2017 – British School Al Khubairat

2016 – Dubai English Speaking School

2015 – Al Ain Amblers

2014 – Dubai College

More from Rashmee Roshan Lall

Results

6.30pm Al Maktoum Challenge Round-3 Group 1 (PA) US$100,000 (Dirt) 2,000m, Winner Bandar, Fernando Jara (jockey), Majed Al Jahouri (trainer).

7.05pm Meydan Classic Listed (TB) $175,000 (Turf) 1,600m, Winner Well Of Wisdom, William Buick, Charlie Appleby.

7.40pm Handicap (TB) $135,000 (T) 2,000m, Winner Star Safari, Mickael Barzalona, Charlie Appleby.

8.15pm Handicap (TB) $135,000 (D) 1,600m, Winner Moqarrar, Fabrice Veron, Erwan Charpy.

8.50pm Nad Al Sheba Trophy Group 2 (TB) $300,000 (T) 2,810m, Winner Secret Advisor, William Buick, Charlie Appleby.

9.25pm Curlin Stakes Listed (TB) $175,000 (D) 2,000m, Winner Parsimony, William Buick, Doug O’Neill.

10pm Handicap (TB) $135,000 (T) 2,000m, Winner Simsir, Ronan Whelan, Michael Halford.

10.35pm Handicap (TB) $175,000 (T) 1,400m, Winner Velorum, Mickael Barzalona, Charlie Appleby.

Quick%20facts

%3Cul%3E%0A%3Cli%3EStorstockholms%20Lokaltrafik%20(SL)%20offers%20free%20guided%20tours%20of%20art%20in%20the%20metro%20and%20at%20the%20stations%3C%2Fli%3E%0A%3Cli%3EThe%20tours%20are%20free%20of%20charge%3B%20all%20you%20need%20is%20a%20valid%20SL%20ticket%2C%20for%20which%20a%20single%20journey%20(valid%20for%2075%20minutes)%20costs%2039%20Swedish%20krone%20(%243.75)%3C%2Fli%3E%0A%3Cli%3ETravel%20cards%20for%20unlimited%20journeys%20are%20priced%20at%20165%20Swedish%20krone%20for%2024%20hours%3C%2Fli%3E%0A%3Cli%3EAvoid%20rush%20hour%20%E2%80%93%20between%209.30%20am%20and%204.30%20pm%20%E2%80%93%20to%20explore%20the%20artwork%20at%20leisure%3C%2Fli%3E%0A%3C%2Ful%3E%0A

The%20Genius%20of%20Their%20Age

%3Cp%3EAuthor%3A%20S%20Frederick%20Starr%3Cbr%3EPublisher%3A%20Oxford%20University%20Press%3Cbr%3EPages%3A%20290%3Cbr%3EAvailable%3A%20January%2024%3C%2Fp%3E%0A

A MINECRAFT MOVIE

Director: Jared Hess

Starring: Jack Black, Jennifer Coolidge, Jason Momoa

Rating: 3/5

The%20Color%20Purple

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EBlitz%20Bazawule%3Cbr%3E%3Cstrong%3EStarring%3A%20%3C%2Fstrong%3EFantasia%20Barrino%2C%20Taraji%20P%20Henson%2C%20Danielle%20Brooks%2C%20Colman%20Domingo%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

TOURNAMENT INFO

Fixtures

Sunday January 5 - Oman v UAE

Monday January 6 - UAE v Namibia

Wednesday January 8 - Oman v Namibia

Thursday January 9 - Oman v UAE

Saturday January 11 - UAE v Namibia

Sunday January 12 – Oman v Namibia

UAE squad

Ahmed Raza (captain), Rohan Mustafa, Mohammed Usman, CP Rizwan, Waheed Ahmed, Zawar Farid, Darius D’Silva, Karthik Meiyappan, Jonathan Figy, Vriitya Aravind, Zahoor Khan, Junaid Siddique, Basil Hameed, Chirag Suri

The%20specs

%3Cp%3E%3Cstrong%3EPowertrain%3A%20%3C%2Fstrong%3ESingle%20electric%20motor%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E201hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E310Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20auto%0D%3Cbr%3E%3Cstrong%3EBattery%3A%20%3C%2Fstrong%3E53kWh%20lithium-ion%20battery%20pack%20(GS%20base%20model)%3B%2070kWh%20battery%20pack%20(GF)%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E350km%20(GS)%3B%20480km%20(GF)%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C900%20(GS)%3B%20Dh149%2C000%20(GF)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A

What's in the deal?

Agreement aims to boost trade by £25.5bn a year in the long run, compared with a total of £42.6bn in 2024

India will slash levies on medical devices, machinery, cosmetics, soft drinks and lamb.

India will also cut automotive tariffs to 10% under a quota from over 100% currently.

Indian employees in the UK will receive three years exemption from social security payments

India expects 99% of exports to benefit from zero duty, raising opportunities for textiles, marine products, footwear and jewellery

Evacuations to France hit by controversy

- Over 500 Gazans have been evacuated to France since November 2023

- Evacuations were paused after a student already in France posted anti-Semitic content and was subsequently expelled to Qatar

- The Foreign Ministry launched a review to determine how authorities failed to detect the posts before her entry

- Artists and researchers fall under a programme called Pause that began in 2017

- It has benefited more than 700 people from 44 countries, including Syria, Turkey, Iran, and Sudan

- Since the start of the Gaza war, it has also included 45 Gazan beneficiaries

- Unlike students, they are allowed to bring their families to France

More from Aya Iskandarani

Key facilities

- Olympic-size swimming pool with a split bulkhead for multi-use configurations, including water polo and 50m/25m training lanes

- Premier League-standard football pitch

- 400m Olympic running track

- NBA-spec basketball court with auditorium

- 600-seat auditorium

- Spaces for historical and cultural exploration

- An elevated football field that doubles as a helipad

- Specialist robotics and science laboratories

- AR and VR-enabled learning centres

- Disruption Lab and Research Centre for developing entrepreneurial skills

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Switch%20Foods%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202022%3Cbr%3E%3Cstrong%3EFounder%3A%3C%2Fstrong%3E%20Edward%20Hamod%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Abu%20Dhabi%2C%20UAE%3Cbr%3E%3Cstrong%3EIndustry%3A%3C%2Fstrong%3E%20Plant-based%20meat%20production%3Cbr%3E%3Cstrong%3ENumber%20of%20employees%3A%3C%2Fstrong%3E%2034%3Cbr%3E%3Cstrong%3EFunding%3A%3C%2Fstrong%3E%20%246.5%20million%3Cbr%3E%3Cstrong%3EFunding%20round%3A%3C%2Fstrong%3E%20Seed%3Cbr%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20Based%20in%20US%20and%20across%20Middle%20East%3C%2Fp%3E%0A

Mohammed bin Zayed Majlis

The five pillars of Islam

Killing of Qassem Suleimani

UAE currency: the story behind the money in your pockets