Banking start-up Zeta this month became India’s latest company to cross the $1 billion valuation mark, raising $250 million from the SoftBank Vision Fund amid signs that investment flows into the country’s FinTech sector are beginning to recover.

Zeta, which is now valued at $1.45bn, is a platform for banks to operate credit and debit cards, daily transactions, loans and mobile banking through a cloud-based system.

The platform acts as “a bank in a box” for an industry that still uses outdated software, says Bhavin Turakhia, a seasoned entrepreneur and the chief executive of Zeta.

“The simple problem we are addressing is that banking software is still kind of stuck in the stone ages,” says Mr Turakhia, who co-founded Zeta in 2015.

“Banks spend close to probably $300bn a year on information technology infrastructure and IT spending and our role is to try to capture as much of that market for Zeta.”

The start-up is part of India’s fast-growing FinTech sector, which has experienced green shoots of a recovery after the Covid-19 pandemic tightened funding last year, analysts say.

The sector received $2.7bn in funding last year, down from $3.5bn in 2019, according to data from KPMG.

“FinTech has made a strong comeback in 2021,” says Devendra Agrawal, founder and chief executive of Dexter Capital Advisers. “We have seen big funding rounds already.”

Bengaluru-based online payment company Razorpay raised $160m in April from venture capital company Sequoia Capital India and GIC Private, Singapore’s sovereign wealth fund, taking its valuation to $3bn. Credit card rewards company CRED also raised $215m in April from investors including Falcon Edge Capital and Tiger Global.

Meanwhile, one of the biggest names in India’s FinTech sector, Paytm – backed by Alibaba and SoftBank – is working on plans to raise $3bn in what could be the country’s biggest initial public offering if it materialises, according to Bloomberg.

The Covid-19 pandemic has helped to boost the potential and acceptance of many FinTech platforms in India by hastening the shift towards digitalisation, analysts say.

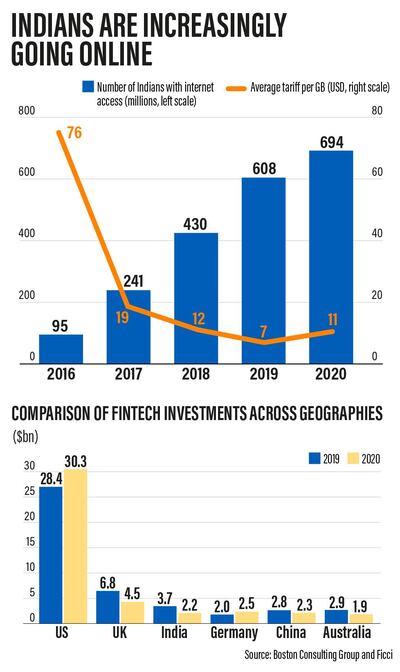

Other favourable trends for the sector include the country’s rapidly growing use of the internet amid expanding smartphone ownership and lower data costs in recent years.

Movement restrictions imposed to curb the spread of the virus have also led to an increase in contactless payments.

“While certain FinTech segments such as lending were negatively affected due to Covid, the pandemic has led to a digital shift in consumer behaviour when it comes to availing financial services,” says Mr Agrawal.

Zeta started meetings to raise funds in January last year but the process was halted because of the pandemic, says Mr Turakhia. The company resumed work on raising funds in November and went to market in January.

“There was already some level of pandemic fatigue and we had a greater reception, spoke to a bunch of funds, narrowed down the top three and signed with SoftBank,” he says.

The value of India's FinTech sector is projected to grow to between $150bn and $160bn by 2025, up from $50bn to $60bn last year, according to a report by the Boston Consulting Group and Ficci. However, the sector will require investment worth $20bn to $25bn over the next five years, the report says.

“There is no doubt that an increasing number of foreign investors are betting on the Indian FinTech industry,” says Raj N, founder and chairman of Indian FinTech company Zaggle. “Moreover, India has evolved into one of the biggest FinTech hubs in Asia.”

Covid-19 has been a “blessing in disguise, with the FinTech industry witnessing unprecedented growth,” and this has also pushed many banks and financial institutions to link up with start-ups, he says.

The FinTech sector’s growth is helped by the fact that India’s financial services remain “underpenetrated, compared to developed countries”, according to Mr Agrawal.

“FinTechs have come up with several innovative products and services – including pay later, online-only insurance, app-based loans within minutes – to cater to this vast untapped market, hitherto ignored by traditional players.”

The development of strong and supportive regulatory policies for the financial technology industry is essential to promote the country's business environment

Investor interest in the FinTech sector started to rebound at the end of last year “when people realised that the pandemic is here to stay and it has triggered tremendous momentum on many digital businesses”, says Shishir Mankad, managing partner and head of financial services at Praxis Global Alliance.

Another factor driving investment into the sector is that companies such as CRED and Zeta are coming up with new and more sophisticated offerings, says Mr Mankad.

“There has been a clear sign of maturity in the FinTech sector. Clearly, the first rush of companies has been discovered and the new stories that are coming out are much more nuanced in their business models.”

Experts expect to see more innovative FinTech companies emerge in India in the coming years.

“While this FinTech revolution is unfolding in India, many of the incumbents [such as] banks and insurance companies have also started to figure out and think through how they should engage with these players,” says Mr Mankad.

However, there are still issues that must be fixed, according to industry insiders, including a pressing need to improve cyber security in the FinTech sector.

“The development of strong and supportive regulatory policies for the FinTech industry is essential to promote the country’s business environment,” says Mr Raj.

Another major challenge for the sector is profit generation.

“The FinTech space in India is certainly at a point – especially for some of the mature businesses such as the payment business – where nobody is questioning whether you can build a large franchise,” says Mr Mankad.

“The question now to be solved is what is the monetisation for this vast customer base and franchise you have built?”

Customer acquisition costs will only reduce as volumes grow, paving the way for profitability and increased scope for businesses to expand in India, according to Utkarsh Sinha, managing director at Mumbai-based Bexley Advisers.

“The Indian FinTech ecosystem continues to be under-tapped, leaving significant room for growth,” he says. “We are still to monetise the largely untapped smaller towns and the advent of 5G will rapidly accelerate their ability to transact online.”

These opportunities “indicate that foreign investor interest in this space should continue”, he says. SoftBank’s recent investment in Zeta should only support this trend.

“We entered 2020 shaky on the news of the poor year SoftBank had in 2019, which chilled both late and early-stage investor sentiments,” says Mr Sinha.

“Now that they are back with a renewed focus on unit economics and that gives confidence to earlier-stage investments.”

Zeta plans to plough the money from its latest funding round into an aggressive expansion.

Its customers include 10 banks, among them HDFC, one of India’s biggest lenders, and 25 FinTechs, including Sodexo, an employee benefits company with about 30 million global users.

About 25 per cent to 30 per cent of capital will go towards adding more products to its platform, says Mr Turakhia.

The rest is earmarked for sales and marketing and a five-fold expansion of its teams in those departments as it aims to ramp up its presence in the Americas, Europe and the Middle East.

There is no better time for expansion as Covid-19 has “definitely has accelerated the receptiveness and the pace at which financial institutions are looking to transform to launch new modern products on a platform such as Zeta”, says Mr Turakhia.

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Revibe%20%0D%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202022%0D%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Hamza%20Iraqui%20and%20Abdessamad%20Ben%20Zakour%20%0D%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20UAE%20%0D%3Cbr%3E%3Cstrong%3EIndustry%3A%3C%2Fstrong%3E%20Refurbished%20electronics%20%0D%3Cbr%3E%3Cstrong%3EFunds%20raised%20so%20far%3A%3C%2Fstrong%3E%20%2410m%20%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EFlat6Labs%2C%20Resonance%20and%20various%20others%0D%3C%2Fp%3E%0A

Huddersfield Town permanent signings:

- Steve Mounie (striker): signed from Montpellier for £11 million

- Tom Ince (winger): signed from Derby County for £7.7m

- Aaron Mooy (midfielder): signed from Manchester City for £7.7m

- Laurent Depoitre (striker): signed from Porto for £3.4m

- Scott Malone (defender): signed from Fulham for £3.3m

- Zanka (defender): signed from Copenhagen for £2.3m

- Elias Kachunga (winger): signed for Ingolstadt for £1.1m

- Danny WIlliams (midfielder): signed from Reading on a free transfer

Innotech Profile

Date started: 2013

Founder/CEO: Othman Al Mandhari

Based: Muscat, Oman

Sector: Additive manufacturing, 3D printing technologies

Size: 15 full-time employees

Stage: Seed stage and seeking Series A round of financing

Investors: Oman Technology Fund from 2017 to 2019, exited through an agreement with a new investor to secure new funding that it under negotiation right now.

The Bio

Favourite place in UAE: Al Rams pearling village

What one book should everyone read: Any book written before electricity was invented. When a writer willingly worked under candlelight, you know he/she had a real passion for their craft

Your favourite type of pearl: All of them. No pearl looks the same and each carries its own unique characteristics, like humans

Best time to swim in the sea: When there is enough light to see beneath the surface

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

Five famous companies founded by teens

There are numerous success stories of teen businesses that were created in college dorm rooms and other modest circumstances. Below are some of the most recognisable names in the industry:

- Facebook: Mark Zuckerberg and his friends started Facebook when he was a 19-year-old Harvard undergraduate.

- Dell: When Michael Dell was an undergraduate student at Texas University in 1984, he started upgrading computers for profit. He starting working full-time on his business when he was 19. Eventually, his company became the Dell Computer Corporation and then Dell Inc.

- Subway: Fred DeLuca opened the first Subway restaurant when he was 17. In 1965, Mr DeLuca needed extra money for college, so he decided to open his own business. Peter Buck, a family friend, lent him $1,000 and together, they opened Pete’s Super Submarines. A few years later, the company was rebranded and called Subway.

- Mashable: In 2005, Pete Cashmore created Mashable in Scotland when he was a teenager. The site was then a technology blog. Over the next few decades, Mr Cashmore has turned Mashable into a global media company.

- Oculus VR: Palmer Luckey founded Oculus VR in June 2012, when he was 19. In August that year, Oculus launched its Kickstarter campaign and raised more than $1 million in three days. Facebook bought Oculus for $2 billion two years later.

Gothia Cup 2025

4,872 matches

1,942 teams

116 pitches

76 nations

26 UAE teams

15 Lebanese teams

2 Kuwaiti teams

Company%20profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Fasset%0D%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3E2019%0D%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Mohammad%20Raafi%20Hossain%2C%20Daniel%20Ahmed%0D%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%0D%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EFinTech%0D%3Cbr%3E%3Cstrong%3EInitial%20investment%3A%3C%2Fstrong%3E%20%242.45%20million%0D%3Cbr%3E%3Cstrong%3ECurrent%20number%20of%20staff%3A%3C%2Fstrong%3E%2086%0D%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20Pre-series%20B%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20Investcorp%2C%20Liberty%20City%20Ventures%2C%20Fatima%20Gobi%20Ventures%2C%20Primal%20Capital%2C%20Wealthwell%20Ventures%2C%20FHS%20Capital%2C%20VN2%20Capital%2C%20local%20family%20offices%3C%2Fp%3E%0A

What is the FNC?

The Federal National Council is one of five federal authorities established by the UAE constitution. It held its first session on December 2, 1972, a year to the day after Federation.

It has 40 members, eight of whom are women. The members represent the UAE population through each of the emirates. Abu Dhabi and Dubai have eight members each, Sharjah and Ras al Khaimah six, and Ajman, Fujairah and Umm Al Quwain have four.

They bring Emirati issues to the council for debate and put those concerns to ministers summoned for questioning.

The FNC’s main functions include passing, amending or rejecting federal draft laws, discussing international treaties and agreements, and offering recommendations on general subjects raised during sessions.

Federal draft laws must first pass through the FNC for recommendations when members can amend the laws to suit the needs of citizens. The draft laws are then forwarded to the Cabinet for consideration and approval.

Since 2006, half of the members have been elected by UAE citizens to serve four-year terms and the other half are appointed by the Ruler’s Courts of the seven emirates.

In the 2015 elections, 78 of the 252 candidates were women. Women also represented 48 per cent of all voters and 67 per cent of the voters were under the age of 40.

Our legal columnist

Name: Yousef Al Bahar

Advocate at Al Bahar & Associate Advocates and Legal Consultants, established in 1994

Education: Mr Al Bahar was born in 1979 and graduated in 2008 from the Judicial Institute. He took after his father, who was one of the first Emirati lawyers

ELIO

Starring: Yonas Kibreab, Zoe Saldana, Brad Garrett

Directors: Madeline Sharafian, Domee Shi, Adrian Molina

Rating: 4/5

Director: Laxman Utekar

Cast: Vicky Kaushal, Akshaye Khanna, Diana Penty, Vineet Kumar Singh, Rashmika Mandanna

Rating: 1/5

EA Sports FC 26

Publisher: EA Sports

Consoles: PC, PlayStation 4/5, Xbox Series X/S

Rating: 3/5

Company profile

Name: GiftBag.ae

Based: Dubai

Founded: 2011

Number of employees: 4

Sector: E-commerce

Funding: Self-funded to date

Our legal consultant

Name: Dr Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

Profile

Name: Carzaty

Founders: Marwan Chaar and Hassan Jaffar

Launched: 2017

Employees: 22

Based: Dubai and Muscat

Sector: Automobile retail

Funding to date: $5.5 million

THE BIO:

Sabri Razouk, 74

Athlete and fitness trainer

Married, father of six

Favourite exercise: Bench press

Must-eat weekly meal: Steak with beans, carrots, broccoli, crust and corn

Power drink: A glass of yoghurt

Role model: Any good man

How to help

Donate towards food and a flight by transferring money to this registered charity's account.

Account name: Dar Al Ber Society

Account Number: 11 530 734

IBAN: AE 9805 000 000 000 11 530 734

Bank Name: Abu Dhabi Islamic Bank

To ensure that your contribution reaches these people, please send the copy of deposit/transfer receipt to: juhi.khan@daralber.ae

Tips for newlyweds to better manage finances

All couples are unique and have to create a financial blueprint that is most suitable for their relationship, says Vijay Valecha, chief investment officer at Century Financial. He offers his top five tips for couples to better manage their finances.

Discuss your assets and debts: When married, it’s important to understand each other’s personal financial situation. It’s necessary to know upfront what each party brings to the table, as debts and assets affect spending habits and joint loan qualifications. Discussing all aspects of their finances as a couple prevents anyone from being blindsided later.

Decide on the financial/saving goals: Spouses should independently list their top goals and share their lists with one another to shape a joint plan. Writing down clear goals will help them determine how much to save each month, how much to put aside for short-term goals, and how they will reach their long-term financial goals.

Set a budget: A budget can keep the couple be mindful of their income and expenses. With a monthly budget, couples will know exactly how much they can spend in a category each month, how much they have to work with and what spending areas need to be evaluated.

Decide who manages what: When it comes to handling finances, it’s a good idea to decide who manages what. For example, one person might take on the day-to-day bills, while the other tackles long-term investments and retirement plans.

Money date nights: Talking about money should be a healthy, ongoing conversation and couples should not wait for something to go wrong. They should set time aside every month to talk about future financial decisions and see the progress they’ve made together towards accomplishing their goals.

BIOSAFETY LABS SECURITY LEVELS

Biosafety Level 1

The lowest safety level. These labs work with viruses that are minimal risk to humans.

Hand washing is required on entry and exit and potentially infectious material decontaminated with bleach before thrown away.

Must have a lock. Access limited. Lab does not need to be isolated from other buildings.

Used as teaching spaces.

Study microorganisms such as Staphylococcus which causes food poisoning.

Biosafety Level 2

These labs deal with pathogens that can be harmful to people and the environment such as Hepatitis, HIV and salmonella.

Working in Level 2 requires special training in handling pathogenic agents.

Extra safety and security precautions are taken in addition to those at Level 1

Biosafety Level 3

These labs contain material that can be lethal if inhaled. This includes SARS coronavirus, MERS, and yellow fever.

Significant extra precautions are taken with staff given specific immunisations when dealing with certain diseases.

Infectious material is examined in a biological safety cabinet.

Personnel must wear protective gowns that must be discarded or decontaminated after use.

Strict safety and handling procedures are in place. There must be double entrances to the building and they must contain self-closing doors to reduce risk of pathogen aerosols escaping.

Windows must be sealed. Air from must be filtered before it can be recirculated.

Biosafety Level 4

The highest level for biosafety precautions. Scientist work with highly dangerous diseases that have no vaccine or cure.

All material must be decontaminated.

Personnel must wear a positive pressure suit for protection. On leaving the lab this must pass through decontamination shower before they have a personal shower.

Entry is severely restricted to trained and authorised personnel. All entries are recorded.

Entrance must be via airlocks.