Sachin Kharvi, who sells fruits and vegetables in a bustling market in India’s financial capital Mumbai, only accepted cash for his products until four months ago.

But as the coronavirus pandemic spread across the length and the breadth of the country, Mr Kharvi and other vendors in the market were forced to roll out mobile payments options as customers shied away from cash due to safety concerns.

“Now, 50 per cent of my customers are using mobile payment apps like Google Pay and Paytm,” he says.

India's digital payments sector was booming long before the pandemic. Mobile payments alone registered a 163 per cent growth to $286 billion in 2019 compared to the previous year, according to an S&P Global report.

It is a sector that companies are keen to tap and the competition is heating up as international players look to get a slice of the booming payments market in Asia's third-largest economy.

WhatsApp this month became the latest entrant to India's flourishing payment industry. It will take on the three largest companies in the space: Google Pay, Walmart-owned PhonePe, and Paytm, which is backed by Softbank and Alibaba.

“WhatsApp is definitely going to be a big disruptor in this space,” says Utkarsh Sinha, the managing director of Bexley Advisors, a Mumbai-based advisory firm that works with technology companies. “Few companies have the might that WhatsApp does to upend the market.”

The Facebook-owned messaging app aims to capitalise on its large user base of some 400 million people in India, which is its largest market.

WhatsApp users are already on the app multiple times a day and that is a significant advantage it has over the competition, Mr Sinha says.

“I would be very surprised if [WhatsApp] does not become the number one or number two [player] in the next couple of years,” he says.

Google Pay is currently the most popular app for mobile payments, with some 75 million active users in India on its platform transacting in May. PhonePe had 60 million users and one-time market leader Paytm, had 30 million in the same month, according to a report by Bernstein.

Underpinned by rising smartphone ownership along with lower handset and data costs, the sector is primed for further growth .

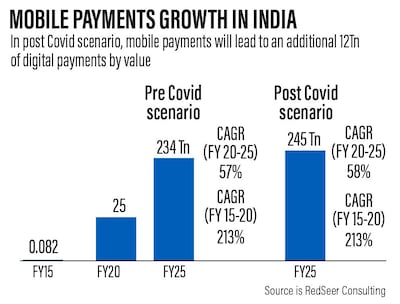

A report published in September by RedSeer Consulting projects mobile payments in India to grow 58 per cent annually to reach 245 trillion rupees ($3.3tn) by 2025.

The Covid-19 outbreak is giving an additional 5 per cent boost to these projections, according to the report.

“Consumers are now pushing this because they're safety conscious and they're reaching out to retailers to accept digital payments,” says Anand Kumar Bajaj, managing director and chief executive at PayNearby, which partners with small local stores to facilitate their use of digital financial services. “The pandemic is a key driver.”

Mobile payments “are catching on like wildfire”, says Mr Sinha. “And it's not just [at] the top of the pyramid; it's [at] the bottom of the pyramid too.”

Digital payments are also being propelled further by Prime Minister Narendra Modi's government that has pushed to turn its largely cash-based economy cashless. India's widely-publicised demonetisation move in 2016, when the two highest value banknotes were banned overnight in a crackdown on hoarding of illegal cash, was also part of the country's efforts to develop digital payments.

“I would say a push from the government and the banking regulator towards greater digital payments adoption is working,” says Nitish Asthana, president and chief operating officer at Pine Labs, a platform for retailers in India, providing transaction technology and financing. “While India still is a cash-dominant economy, the mind-sets are gradually changing. ”

He says that “India’s rising and aspirational middle class with increasing household income is ready to experiment with digital modes ... and add to that the young demographics which is internet savvy ... and the environment is ripe”.

WhatsApp will [also] be a big [game] changer, especially in smaller towns where WhatsApp is already well-known for most of the population

As a result, Mr Asthana says “the market is huge and there is room for everyone”.

“WhatsApp will [also] be a big [game] changer, especially in smaller towns where WhatsApp is already well-known for most of the population,” says Mandar Agashe, the founder and managing director of Sarvatra Technologies.

“We have not even scratched the surface of the markets and we already talking about numbers in billions of transactions,” he says.

But there are some restrictions on the pace at which WhatsApp – which started testing its service in India in 2018 – will be able to grow.

The National Payments Corporation of India has limited the company to 20 million users initially and WhatsApp will only be allowed to expand gradually.

Mr Agashe at Sarvatra Technologies says these restrictions give the ecosystem time “to be ready for a sudden surge in transactions”.

Payment services including Google Pay and WhatsApp operate on the Unified Payments Interface, or UPI, developed by the Indian government. This means that the platforms have to be linked to a bank account and debit card, and instant money transfers are made bank to bank, as opposed to the money being moved to and held in a separate digital wallet.

The National Payments Corporation of India, which controls UPI transactions, on November 5 – the same day WhatsApp's roll out was announced – said that each third-party app could only handle up to a 30 per cent share of the total UPI transaction volumes. This cap comes into effect from the beginning of 2021, but companies already operating in the market will have two years to comply with the rule.

Google Pay, currently the market leader, has hit out against the move. “A choice-based and open model is key to drive this momentum,” Sajith Sivanandan, the business head at Google Pay, India, said in a statement in reaction to the government measure. “This announcement has come as a surprise and has implications for millions who use UPI for their daily payments and could impact the further adoption of UPI and the end goal of financial inclusion.”

But industry insiders say it will help in preventing a monopoly in the market.

“It's to help citizens or there could be monopolistic moves which could swing the pricing, so I think the intent of the cap is not bad,” says Mr Bajaj.

With several companies operating in the sector, industry insiders say market leaders will emerge eventually.

“While it's a crowded space, competition is always good from a consumer innovation perspective,” says Ashwin Sivakumar, the co-founder and chief of digital business growth at JugularSocial Group.

“We are now likely to see more innovation and even more integrated value propositions from all the players in this space. We might end up seeing some market consolidation and emergence of a couple of clear leaders in this space.”

Meanwhile for WhatsApp – which is largely used by individuals – getting businesses on board to use its payments service could be the key to eventual monetisation, analysts say.

It's a question of whether WhatsApp ends up unseating Google Pay as the largest player in India

Some of the groundwork towards this has already been laid.

This year, Facebook invested $5.7bn for a 10 per cent stake in Jio, a technology platform controlled by Asia's richest man, Mukesh Ambani. Jio is taking on the likes of Amazon as it vies for a chunk of the e-commerce market in India. WhatsApp is likely to play a significant role in the fight for dominance with its payment service, having already tied up for an online booking service with JioMart that facilitates purchases and delivers groceries from local stores.

All the elements are in place for WhatsApp Pay to succeed in India, financial technology experts say.

“It's a question of whether WhatsApp ends up unseating Google Pay as the largest player in India,” says Mr Sinha.

The more serious side of specialty coffee

While the taste of beans and freshness of roast is paramount to the specialty coffee scene, so is sustainability and workers’ rights.

The bulk of genuine specialty coffee companies aim to improve on these elements in every stage of production via direct relationships with farmers. For instance, Mokha 1450 on Al Wasl Road strives to work predominantly with women-owned and -operated coffee organisations, including female farmers in the Sabree mountains of Yemen.

Because, as the boutique’s owner, Garfield Kerr, points out: “women represent over 90 per cent of the coffee value chain, but are woefully underrepresented in less than 10 per cent of ownership and management throughout the global coffee industry.”

One of the UAE’s largest suppliers of green (meaning not-yet-roasted) beans, Raw Coffee, is a founding member of the Partnership of Gender Equity, which aims to empower female coffee farmers and harvesters.

Also, globally, many companies have found the perfect way to recycle old coffee grounds: they create the perfect fertile soil in which to grow mushrooms.

The%20specs

%3Cp%3E%0D%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E4.0-litre%20twin-turbo%20V8%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E666hp%20at%206%2C000rpm%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E850Nm%20at%202%2C300-4%2C500rpm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E8-speed%20auto%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3EQ1%202023%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3Efrom%20Dh1.15%20million%20(estimate)%3C%2Fp%3E%0A

Red flags

- Promises of high, fixed or 'guaranteed' returns.

- Unregulated structured products or complex investments often used to bypass traditional safeguards.

- Lack of clear information, vague language, no access to audited financials.

- Overseas companies targeting investors in other jurisdictions - this can make legal recovery difficult.

- Hard-selling tactics - creating urgency, offering 'exclusive' deals.

Courtesy: Carol Glynn, founder of Conscious Finance Coaching

Tonight's Chat on The National

Tonight's Chat is a series of online conversations on The National. The series features a diverse range of celebrities, politicians and business leaders from around the Arab world.

Tonight’s Chat host Ricardo Karam is a renowned author and broadcaster who has previously interviewed Bill Gates, Carlos Ghosn, Andre Agassi and the late Zaha Hadid, among others.

Intellectually curious and thought-provoking, Tonight’s Chat moves the conversation forward.

Facebook | Our website | Instagram

What the law says

Micro-retirement is not a recognised concept or employment status under Federal Decree Law No. 33 of 2021 on the Regulation of Labour Relations (as amended) (UAE Labour Law). As such, it reflects a voluntary work-life balance practice, rather than a recognised legal employment category, according to Dilini Loku, senior associate for law firm Gateley Middle East.

“Some companies may offer formal sabbatical policies or career break programmes; however, beyond such arrangements, there is no automatic right or statutory entitlement to extended breaks,” she explains.

“Any leave taken beyond statutory entitlements, such as annual leave, is typically regarded as unpaid leave in accordance with Article 33 of the UAE Labour Law. While employees may legally take unpaid leave, such requests are subject to the employer’s discretion and require approval.”

If an employee resigns to pursue micro-retirement, the employment contract is terminated, and the employer is under no legal obligation to rehire the employee in the future unless specific contractual agreements are in place (such as return-to-work arrangements), which are generally uncommon, Ms Loku adds.

How the UAE gratuity payment is calculated now

Employees leaving an organisation are entitled to an end-of-service gratuity after completing at least one year of service.

The tenure is calculated on the number of days worked and does not include lengthy leave periods, such as a sabbatical. If you have worked for a company between one and five years, you are paid 21 days of pay based on your final basic salary. After five years, however, you are entitled to 30 days of pay. The total lump sum you receive is based on the duration of your employment.

1. For those who have worked between one and five years, on a basic salary of Dh10,000 (calculation based on 30 days):

a. Dh10,000 ÷ 30 = Dh333.33. Your daily wage is Dh333.33

b. Dh333.33 x 21 = Dh7,000. So 21 days salary equates to Dh7,000 in gratuity entitlement for each year of service. Multiply this figure for every year of service up to five years.

2. For those who have worked more than five years

c. 333.33 x 30 = Dh10,000. So 30 days’ salary is Dh10,000 in gratuity entitlement for each year of service.

Note: The maximum figure cannot exceed two years total salary figure.

UAE currency: the story behind the money in your pockets

The specs

Engine: 3.0-litre six-cylinder turbo

Power: 398hp from 5,250rpm

Torque: 580Nm at 1,900-4,800rpm

Transmission: Eight-speed auto

Fuel economy, combined: 6.5L/100km

On sale: December

Price: From Dh330,000 (estimate)

The National's picks

4.35pm: Tilal Al Khalediah

5.10pm: Continous

5.45pm: Raging Torrent

6.20pm: West Acre

7pm: Flood Zone

7.40pm: Straight No Chaser

8.15pm: Romantic Warrior

8.50pm: Calandogan

9.30pm: Forever Young

'Outclassed in Kuwait'

Taleb Alrefai,

HBKU Press

From Zero

Artist: Linkin Park

Label: Warner Records

Number of tracks: 11

Rating: 4/5

Is it worth it? We put cheesecake frap to the test.

The verdict from the nutritionists is damning. But does a cheesecake frappuccino taste good enough to merit the indulgence?

My advice is to only go there if you have unusually sweet tooth. I like my puddings, but this was a bit much even for me. The first hit is a winner, but it's downhill, slowly, from there. Each sip is a little less satisfying than the last, and maybe it was just all that sugar, but it isn't long before the rush is replaced by a creeping remorse. And half of the thing is still left.

The caramel version is far superior to the blueberry, too. If someone put a full caramel cheesecake through a liquidiser and scooped out the contents, it would probably taste something like this. Blueberry, on the other hand, has more of an artificial taste. It's like someone has tried to invent this drink in a lab, and while early results were promising, they're still in the testing phase. It isn't terrible, but something isn't quite right either.

So if you want an experience, go for a small, and opt for the caramel. But if you want a cheesecake, it's probably more satisfying, and not quite as unhealthy, to just order the real thing.

The 100 Best Novels in Translation

Boyd Tonkin, Galileo Press

Credit Score explained

What is a credit score?

In the UAE your credit score is a number generated by the Al Etihad Credit Bureau (AECB), which represents your credit worthiness – in other words, your risk of defaulting on any debt repayments. In this country, the number is between 300 and 900. A low score indicates a higher risk of default, while a high score indicates you are a lower risk.

Why is it important?

Financial institutions will use it to decide whether or not you are a credit risk. Those with better scores may also receive preferential interest rates or terms on products such as loans, credit cards and mortgages.

How is it calculated?

The AECB collects information on your payment behaviour from banks as well as utilitiy and telecoms providers.

How can I improve my score?

By paying your bills on time and not missing any repayments, particularly your loan, credit card and mortgage payments. It is also wise to limit the number of credit card and loan applications you make and to reduce your outstanding balances.

How do I know if my score is low or high?

By checking it. Visit one of AECB’s Customer Happiness Centres with an original and valid Emirates ID, passport copy and valid email address. Liv. customers can also access the score directly from the banking app.

How much does it cost?

A credit report costs Dh100 while a report with the score included costs Dh150. Those only wanting the credit score pay Dh60. VAT is payable on top.

More from Neighbourhood Watch:

Infiniti QX80 specs

Engine: twin-turbocharged 3.5-liter V6

Power: 450hp

Torque: 700Nm

Price: From Dh450,000, Autograph model from Dh510,000

Available: Now

John%20Wick%3A%20Chapter%204

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Chad%20Stahelski%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Keanu%20Reeves%2C%20Laurence%20Fishburne%2C%20George%20Georgiou%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E4%2F5%3C%2Fp%3E%0A

The specs: 2018 Audi RS5

Price, base: Dh359,200

Engine: 2.9L twin-turbo V6

Transmission: Eight-speed automatic

Power: 450hp at 5,700rpm

Torque: 600Nm at 1,900rpm

Fuel economy, combined: 8.7L / 100km

UAE jiu-jitsu squad

Men: Hamad Nawad and Khalid Al Balushi (56kg), Omar Al Fadhli and Saeed Al Mazroui (62kg), Taleb Al Kirbi and Humaid Al Kaabi (69kg), Mohammed Al Qubaisi and Saud Al Hammadi (70kg), Khalfan Belhol and Mohammad Haitham Radhi (85kg), Faisal Al Ketbi and Zayed Al Kaabi (94kg)

Women: Wadima Al Yafei and Mahra Al Hanaei (49kg), Bashayer Al Matrooshi and Hessa Al Shamsi (62kg)

Director: Shady Ali

Cast: Boumi Fouad , Mohamed Tharout and Hisham Ismael

Rating: 3/5

if you go

The flights

Etihad and Emirates fly direct from the UAE to Seoul from Dh3,775 return, including taxes

The package

Ski Safari offers a seven-night ski package to Korea, including five nights at the Dragon Valley Hotel in Yongpyong and two nights at Seoul CenterMark hotel, from £720 (Dh3,488) per person, including transfers, based on two travelling in January

The info

Visit www.gokorea.co.uk

The Lost Letters of William Woolf

Helen Cullen, Graydon House

How to donate

Text the following numbers:

2289 - Dh10

6025 - Dh 20

2252 - Dh 50

2208 - Dh 100

6020 - Dh 200

*numbers work for both Etisalat and du

MORE ON INTERNATIONAL JUSTICE

The%20Roundup

%3Cp%3EDirector%3A%20Lee%20Sang-yong%3Cbr%3EStars%3A%20Ma%20Dong-seok%2C%20Sukku%20Son%2C%20Choi%20Gwi-hwa%3Cbr%3ERating%3A%204%2F5%3C%2Fp%3E%0A

Padmaavat

Director: Sanjay Leela Bhansali

Starring: Ranveer Singh, Deepika Padukone, Shahid Kapoor, Jim Sarbh

3.5/5

The%20specs%20

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3EDual%20permanently%20excited%20synchronous%20motors%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E516hp%20or%20400Kw%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E858Nm%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle%20speed%20auto%3Cbr%3E%3Cstrong%3ERange%3A%20%3C%2Fstrong%3E485km%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh699%2C000%3C%2Fp%3E%0A

UAE currency: the story behind the money in your pockets

info-box

COMPANY PROFILE

Company name: Happy Tenant

Started: January 2019

Co-founders: Joe Moufarrej and Umar Rana

Based: Dubai

Sector: Technology, real-estate

Initial investment: Dh2.5 million

Investors: Self-funded

Total customers: 4,000

Abu Dhabi traffic facts

Drivers in Abu Dhabi spend 10 per cent longer in congested conditions than they would on a free-flowing road

The highest volume of traffic on the roads is found between 7am and 8am on a Sunday.

Travelling before 7am on a Sunday could save up to four hours per year on a 30-minute commute.

The day was the least congestion in Abu Dhabi in 2019 was Tuesday, August 13.

The highest levels of traffic were found on Sunday, November 10.

Drivers in Abu Dhabi lost 41 hours spent in traffic jams in rush hour during 2019

The%20specs

%3Cp%3E%3Cstrong%3EPowertrain%3A%20%3C%2Fstrong%3ESingle%20electric%20motor%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E201hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E310Nm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESingle-speed%20auto%0D%3Cbr%3E%3Cstrong%3EBattery%3A%20%3C%2Fstrong%3E53kWh%20lithium-ion%20battery%20pack%20(GS%20base%20model)%3B%2070kWh%20battery%20pack%20(GF)%0D%3Cbr%3E%3Cstrong%3ETouring%20range%3A%20%3C%2Fstrong%3E350km%20(GS)%3B%20480km%20(GF)%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C900%20(GS)%3B%20Dh149%2C000%20(GF)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A

The specs

Engine: 2.0-litre 4-cylturbo

Transmission: seven-speed DSG automatic

Power: 242bhp

Torque: 370Nm

Price: Dh136,814

Brolliology: A History of the Umbrella in Life and Literature

By Marion Rankine

Melville House

More from Rashmee Roshan Lall

More from Neighbourhood Watch: