ConocoPhillips said on Wednesday that it plans to reduce its workforce by 20 to 25 per cent, becoming the latest major oil producer to announce large layoffs.

“We are always looking at how we can be more efficient with the resources we have,” a company spokesman said in a statement via email.

The Houston-based oil producer has a global workforce of about 13,000 people including contractors and employees. The layoffs will include employees and contractors across its global workforce, with most taking place this year, the spokesman said.

The company did not say where the cuts would occur.

The news of the layoffs was first reported by Reuters, with anonymous sources telling it that the oil producer's chief executive Ryan Lance laid out the plans in a video message earlier on Wednesday.

ConocoPhillips shares fell more than 4 per cent during trading to $94.65 a share, down more than 13 per cent from this time last year.

ConocoPhillips reported second-quarter earnings of $1.97 billion last month, beating Wall Street expectations but down from the $2.33 billion it had reported the same time last year.

In its latest earnings report, ConocoPhillips said it had agreed to sell its Anadarko Basin assets, in Oklahoma, for $1.3 billion. It also noted that it had successfully completed planned turnarounds in Norway and Qatar.

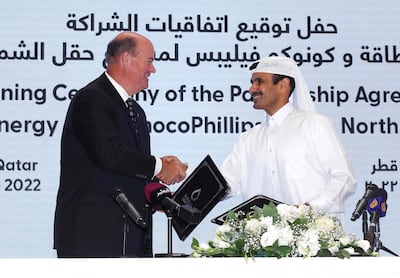

ConocoPhillips, which first began its relationship with QatarEnergy in 2003, participates in three significant liquefied natural gas (LNG) projects in the country.

The announced layoffs are the latest among oil producers as oil prices continue to slide this year.

The price of Brent crude oil, the leading global price benchmark, has fallen more than 11 per cent this year to its current price of $67.05 per barrel as of Wednesday, 4.30pm ET. West Texas Intermediate, which tracks US crude, is down more than 10 per cent this year to 63.90 per barrel.

US shale companies have said they need oil prices to be $65 a barrel on average to profitably drill, according to a quarterly survey from the Federal Reserve Bank of Dallas published in March.

US President Donald Trump's administration has repeatedly said it wants oil at $50 per barrel.

“There cannot be 'US energy dominance' and $50 per barrel oil. Those two statements are contradictory. At $50-per-barrel oil, we will see US oil production start to decline immediately and likely significantly,” one Dallas Fed survey participant commented at the time.

BP, which is also based in Houston, is planning to cut up to 15 per cent (or 6,200) of its office jobs by the end of the year. It is also expected to cut 4,400 contractor positions this year.

And in February, Chevron said it expected to reduce its global workforce by up to 20 per cent by the end of 2026 in an effort to reduce costs.