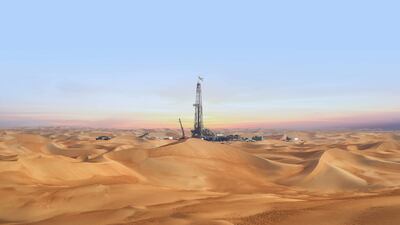

Adnoc Drilling, the Middle East's largest drilling company, has signed a joint venture agreement with global oilfield services company SLB for its land drilling rigs business in Kuwait and Oman, as the Abu Dhabi company seeks to expand beyond the UAE.

The Abu Dhabi company will acquire a 70 per cent stake in the joint venture, it said on Thursday.

The agreement includes eight fully operational land rigs (two in Kuwait and six in Oman) under contract with the respective national oil companies of both countries, Adnoc Drilling said.

“Our partnership with SLB will give us the opportunity to expand beyond the borders of Abu Dhabi. That was one of our objectives from day one of the initial public offering,” chief executive Abdulrahman Al Seiari told The National.

“It is a very strategic move for us establishing ourselves as a leading regional provider of integrated services with scalable and resilient operations. This partnership will provide a solid operational and financial platform to further expand in the region.”

The SLB business is well-established, profitable and operating with long-term contracts, making this a “highly complementary and value-accretive addition to our portfolio”, he said.

Besides the joint venture with SLB, Adnoc Drilling is also directly receiving tenders in both Kuwait and Oman, Mr Al Seiari said. He did not provide any further details.

The latest joint venture is in line with Adnoc Drilling’s aim to boost its partnerships and acquisitions in 2025. The company's profit rose by nearly a quarter to $341 million in the first three months of the year due to growth in its rig fleet and expansion in new markets.

The Adnoc unit is looking for “potential joint ventures” and partnerships that “go beyond” Abu Dhabi, Mr Al Seiari told The National earlier this month.

“We are looking at other potential joint ventures … those are on the table [and] we are studying them,” he said at the time.

Last year, the company teamed up with Alpha Dhabi Holding, a unit of Abu Dhabi's International Holding Company, to launch Enersol, a tech-focused venture. It aims to invest $1.5 billion in technology-driven companies in the oilfield services sector by the end of 2025.

Enersol has already acquired four companies and has spent $800 million out of the $1.5 billion capital expenditure set aside for the end of 2025.

Through the new partnership with SLB, Adnoc Drilling said it will gain immediate access to earnings, cash flow and returns through the operating land drilling rigs in Kuwait and Oman, accelerating its expansion into key Gulf geographies.

“We're talking about hundreds of rigs in Kuwait and Oman. It's not limited to just eight rigs,” the Mr Al Seiari said.

The company currently owns 57 rigs in Abu Dhabi and plans to increase the count to 62 in 2025.

Adnoc Drilling has six rigs being built for delivery between later this year and the end of 2027, Mr Al Seiari said.

Asked how the shift to renewables would affect demand for rigs, he said there would always be demand for oil, and, therefore, rigs.

Jesus Lamas, president of Middle East and North Africa at SLB, said the company looks forward to expanding its “broader strategic partnerships with key regional leaders across the energy value chain”.

The formation of the joint venture and the acquisition of the 70 per cent stake, along with the completion of the transaction, are subject to regulatory approvals, likely in the first quarter of 2026, the company said.

Adnoc Drilling expects to fully consolidate the newly acquired business in its financial reporting from 2026, it said.

The Abu Dhabi company is the largest integrated drilling services company in the Middle East by fleet size. It owned 142 rigs – 95 onshore and 47 offshore – by the end of last year, with three new island rigs on order for 2026. The company expects that to grow to at least 148 rigs by the end of 2026 and 151 by the end of 2028.

The biog

Name: Abeer Al Shahi

Emirate: Sharjah – Khor Fakkan

Education: Master’s degree in special education, preparing for a PhD in philosophy.

Favourite activities: Bungee jumping

Favourite quote: “My people and I will not settle for anything less than first place” – Sheikh Mohammed bin Rashid.

WOMAN AND CHILD

Director: Saeed Roustaee

Starring: Parinaz Izadyar, Payman Maadi

Rating: 4/5

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%206.5-litre%20V12%20and%20three%20electric%20motors%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E1%2C015hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E1%2C500Nm%20(estimate)%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%3C%2Fstrong%3E%20Eight-speed%20dual-clutch%20auto%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Early%202024%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh2%20million%20(estimate)%3C%2Fp%3E%0A

Read more from Aya Iskandarani

Our legal consultants

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

The Pope's itinerary

Sunday, February 3, 2019 - Rome to Abu Dhabi

1pm: departure by plane from Rome / Fiumicino to Abu Dhabi

10pm: arrival at Abu Dhabi Presidential Airport

Monday, February 4

12pm: welcome ceremony at the main entrance of the Presidential Palace

12.20pm: visit Abu Dhabi Crown Prince at Presidential Palace

5pm: private meeting with Muslim Council of Elders at Sheikh Zayed Grand Mosque

6.10pm: Inter-religious in the Founder's Memorial

Tuesday, February 5 - Abu Dhabi to Rome

9.15am: private visit to undisclosed cathedral

10.30am: public mass at Zayed Sports City – with a homily by Pope Francis

12.40pm: farewell at Abu Dhabi Presidential Airport

1pm: departure by plane to Rome

5pm: arrival at the Rome / Ciampino International Airport

TOURNAMENT INFO

Fixtures

Sunday January 5 - Oman v UAE

Monday January 6 - UAE v Namibia

Wednesday January 8 - Oman v Namibia

Thursday January 9 - Oman v UAE

Saturday January 11 - UAE v Namibia

Sunday January 12 – Oman v Namibia

UAE squad

Ahmed Raza (captain), Rohan Mustafa, Mohammed Usman, CP Rizwan, Waheed Ahmed, Zawar Farid, Darius D’Silva, Karthik Meiyappan, Jonathan Figy, Vriitya Aravind, Zahoor Khan, Junaid Siddique, Basil Hameed, Chirag Suri

Muslim Council of Elders condemns terrorism on religious sites

The Muslim Council of Elders has strongly condemned the criminal attacks on religious sites in Britain.

It firmly rejected “acts of terrorism, which constitute a flagrant violation of the sanctity of houses of worship”.

“Attacking places of worship is a form of terrorism and extremism that threatens peace and stability within societies,” it said.

The council also warned against the rise of hate speech, racism, extremism and Islamophobia. It urged the international community to join efforts to promote tolerance and peaceful coexistence.

more from Janine di Giovanni

PROVISIONAL FIXTURE LIST

Premier League

Wednesday, June 17 (Kick-offs uae times) Aston Villa v Sheffield United 9pm; Manchester City v Arsenal 11pm

Friday, June 19 Norwich v Southampton 9pm; Tottenham v Manchester United 11pm

Saturday, June 20 Watford v Leicester 3.30pm; Brighton v Arsenal 6pm; West Ham v Wolves 8.30pm; Bournemouth v Crystal Palace 10.45pm

Sunday, June 21 Newcastle v Sheffield United 2pm; Aston Villa v Chelsea 7.30pm; Everton v Liverpool 10pm

Monday, June 22 Manchester City v Burnley 11pm (Sky)

Tuesday, June 23 Southampton v Arsenal 9pm; Tottenham v West Ham 11.15pm

Wednesday, June 24 Manchester United v Sheffield United 9pm; Newcastle v Aston Villa 9pm; Norwich v Everton 9pm; Liverpool v Crystal Palace 11.15pm

Thursday, June 25 Burnley v Watford 9pm; Leicester v Brighton 9pm; Chelsea v Manchester City 11.15pm; Wolves v Bournemouth 11.15pm

Sunday June 28 Aston Villa vs Wolves 3pm; Watford vs Southampton 7.30pm

Monday June 29 Crystal Palace vs Burnley 11pm

Tuesday June 30 Brighton vs Manchester United 9pm; Sheffield United vs Tottenham 11.15pm

Wednesday July 1 Bournemouth vs Newcastle 9pm; Everton vs Leicester 9pm; West Ham vs Chelsea 11.15pm

Thursday July 2 Arsenal vs Norwich 9pm; Manchester City vs Liverpool 11.15pm