The Opec+ alliance of oil-producing countries is to extend its current output curbs until the end of 2025 amid concerns about growing non-Opec+ supply and the impact of high interest rates on global crude demand.

The group decided to "extend the level of overall crude oil production ... starting January 1, 2025, until December 31, 2025", the alliance said.

The cuts come as Brent, the benchmark for two-thirds of the world’s oil, has lost about 10 per cent of its value after hitting a multi-month high of $91 a barrel in April.

The UAE has been given a higher oil production level for 2025. The country will receive a production quota of an additional 300,000 barrels a day to be phased in gradually over the first nine months of the next year, Opec said after a ministerial monitoring committee meeting on Sunday.

head of oil trading, Rystad Energy

The Opec+ ministerial meeting will be held every six months and the next meeting will be held on December 1.

The oil producers' group said it has also extended the assessment period by the three independent sources to the end of November 2025, "to be used as guidance for 2026 reference production levels".

Members of the group remain committed to "achieve and sustain a stable oil market, and to provide long-term guidance and transparency for the market" and in line with its approach of "being precautious, proactive, and pre-emptive", the group said.

The Organisation of the Petroleum Exporting Countries and allies led by Russia, together known as Opec+, has made a series of deep output cuts since late 2022.

Opec+ has total production curbs of 5.86 million barrels per day in place, including a reduction of 2 million bpd agreed on in 2022, and voluntary cuts of 1.66 million bpd, announced in April last year and extended to December 2024.

The Opec+ aggregate cuts of 3.66 million bpd that were valid through to the end of 2024, and 2.2 million bpd of voluntary cuts by some members, expiring this month, amounted to about 5.7 per cent of global demand.

The countries which have made voluntary cuts that are deeper than those agreed with the wider group are Algeria, Iraq, Kazakhstan, Kuwait, Oman, Russia, Saudi Arabia and the UAE.

Officials of these countries met in person in the Saudi capital Riyadh to discuss the the extension of the voluntary cuts, the kingdom's Energy Ministry said in a statement carried by Saudi Press Agency on Sunday.

"These countries will extend their additional voluntary cuts of 2.2 million barrels per day, that were announced in November 2023, until the end of September 2024 and then the 2.2 million barrels per day cut will be gradually phased out on a monthly basis until the end of September 2025 to support market stability," the statement said.

"This monthly increase can be paused or reversed subject to market conditions."

While crude prices briefly soared above $90 a barrel in April as conflict in the Middle East threatened regional exports, they have since declined.

Brent traded 0.29 per cent lower at $81.62 a barrel at the market close on Friday. West Texas Intermediate, the gauge that tracks US crude, was down 1.18 per cent at $76.99 a barrel.

Opec expects strong economic growth from emerging economies, particularly China and India, to drive crude demand this year.

The group has maintained an optimistic growth forecast of 2.25 million bpd in its last 11 oil market updates.

In contrast, the US Energy Information Administration (EIA) and the International Energy Agency (IEA) are forecasting lower growth rates, estimating an increase of close to 1 million bpd.

In its latest oil market report, the IEA lowered its oil demand growth forecast for 2024 by 140,000 barrels per day to 1.1 million bpd, citing weak demand in Europe.

“While there is a positive outlook on a demand increase for the next three to four months, crude and condensate supply is concerning,” said Mukesh Sahdev, senior vice president & head of oil trading at Rystad Energy.

The Norway-based consultancy said its analysis indicates that an increase in refinery crude consumption and exports since the Covid-19 pandemic's low levels is higher than the production that is accounted for.

“There is clearly an unexplained supply from Opec+ of [more than] 1 million bpd. The muted oil price reaction to cuts and erosion of backwardation to near contango reflects some unexplained surplus,” Mr Sahdev said in a research note on Friday.

Non-Opec+ supply

Supply from countries outside the Opec+ alliance is set to grow in the range of 1 million bpd to 1.5 million bpd this year, according to estimates from Opec and the IEA.

The US, the world’s largest oil and gas producer, is heading for another year of record production, although with a significantly smaller increase as companies scale back activity following a wave of acquisitions in the industry, analysts have said.

Production from American oilfields reached a record high of 12.9 million bpd last year as companies utilised new technology to counterbalance lower oil prices and reduced rig counts.

Wood Mackenzie has forecast a 270,000-bpd growth in output this year, which is close to the 260,000-bpd increase projected by the EIA, the statistical arm of the Department of Energy.

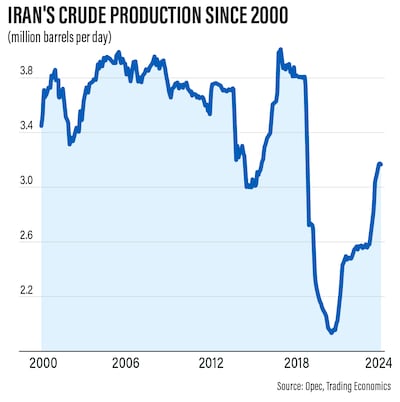

Meanwhile, Iran, which was the second-largest source of crude supply growth last year after the US, plans to raise its production to 4 million bpd, Iranian media reported this week, without specifying a timeframe.

Last year, the country's production reached 3.4 million bpd, with exports at about 1.5 million bpd.

Interest rate concerns

At the start of 2024, some economists predicted the US Federal Reserve would cut interest rates, driven by concerns about slowing economic growth and potentially rising unemployment.

However, the Fed has maintained a cautious stance due to persistent inflation. While inflation has shown signs of decline from its peak in mid-2022, it has remained above the central bank’s 2 per cent inflation target.

High interest rates can weigh on economic growth, lowering crude demand.

“Inflation readings recorded levels worse than market expectations earlier this year, this has accordingly diminished investors’ hopes for a rate cut this summer, so most market expectations shifted to the possibility of starting to reduce interest rates in late 2024,” said Mohamed Hashad, chief market strategist at Noor Capital.

“Investors and market participants are awaiting a slew of readings of personal consumption expenditures, personal income, and consumer spending in the US."

Fed officials have kept interest rates in the range of 5.25 per cent to 5.5 per cent, a two-decade high, since last July.