Oil fundamentals are expected to tighten further as sanctions by the EU on Russian oil exports slowly take effect, squeezing supply even as demand gradually picks up, a new report by UK consultancy Energy Aspects has said.

Brent, the global benchmark for two thirds of the world's oil, is closing in on "key technical levels", with refinery demand set to accelerate further by the end of May, which will push crude higher, the report said.

"We expect forward product prices to continue rolling up with growing demand. Upstream maintenance across the US and North Sea will also further tighten balances," it said.

Even as the EU moves towards an oil embargo and a ban on shipping insurance for vessels carrying Russian fuel to non-EU destinations, prices have remained "relatively subdued", mainly due to concerns about the health of the Chinese economy, given its Covid-19 restrictions.

Brent was trading 0.30 per cent higher, at $112.40 a barrel at 6.25pm UAE time on Friday, while West Texas Intermediate, the gauge that tracks US crude, was up 0.26 per cent to $112.50 a barrel.

Crude prices rose to a notch under $140 per barrel in mid-March after the US and its allies imposed sanctions on Moscow in response to its military offensive in Ukraine. However, prices have been trading lower in the past few weeks amid demand concerns, due to movement restrictions in some cities in China, as the country pursues its zero-Covid policy.

This week, prices started to rise again as China, the world’s largest importer of crude, began easing restrictions in Shanghai.

While the "unwinding of Covid-19 restrictions in Shanghai has been more grinding than expected, and remains prone to pockets of deterioration", the overall situation is improving and infrastructure spending is rising sharply, which will show up in data from the third quarter, Energy Aspects said.

Chinese oil demand losses will not offset declines in Russian supplies, it said.

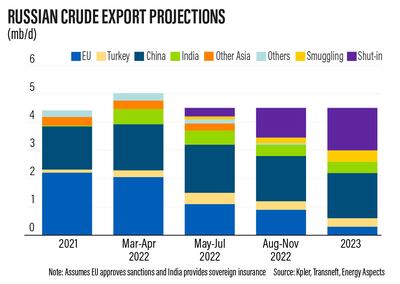

Russian crude and products exports could fall "precipitously" from August if the EU approves the proposed insurance ban for ships carrying Russian oil.

Many investors are waiting for clear data from Russia to confirm supply figures but official information from Moscow has been scant, the report said.

"Our analysis, based on observed gas flaring at Russian oilfields, suggests production averaged 9.75 million barrels per day in April (-1.33 million bpd versus February). Non-routine flaring increased in March but faded away in April, suggesting emergency shutdowns," Energy Aspects said.

Russia accounted for about 45 per cent of EU gas imports and close to 40 per cent of its total gas consumption in 2021, figures compiled by the International Energy Agency indicate.

Europe currently receives 2 million bpd of Russian crude, the Energy Aspects report said, and under its sanctions package, the EU plans to halt imports of crude within six months and products within eight.

But the proposal to prohibit European companies from providing insurance or other assistance to transport Russian oil to any non-European destinations, as well as explicitly prohibiting European-flagged or owned vessels from carrying Russian-origin oil, will also have a major effect on the market, the consultancy said.

These measures, which are likely to come into effect by August, could "severely impact Russian exports to other regions". That is because 95 per cent of tanker insurance is arranged by the International Group of P&I Clubs, which, although based in the UK, is affected by EU sanctions because many members are European insurers, the report said.

Since March, 1.8 million bpd of Russian waterborne crude and 1 million bpd of products left for non-EU countries, including Turkey.

"Even assuming China uses its own vessels and India provides sovereign insurance, a significant chunk of the 2.8 million bpd of liquid flows to non-EU destinations will be at risk once the insurance ban takes effect," Energy Aspects said.

Last month, Opec also lowered its supply forecasts for 2022 due to market uncertainty.

Non-Opec supply in 2022 is forecast to fall by 300,000 bpd to 2.7 million bpd due to a decline in supplies from Russia after sanctions, said the group, which represents some of the top oil producers.

Meanwhile, global demand will rise by 3.67 million bpd in 2022, down 480,000 bpd from its previous forecast, Opec said.

Total consumption is expected to surpass the 100 million bpd mark in the third quarter, as predicted previously by the oil group.

UAE currency: the story behind the money in your pockets

Results

5pm: Al Maha Stables – Maiden (PA) Dh80,000 (Turf) 1,600m; Winner: Reem Baynounah, Fernando Jara (jockey), Mohamed Daggash (trainer)

5.30pm: Wathba Stallions Cup – Maiden (PA) Dh70,000 (T) 1,600m; Winner: AF Afham, Tadhg O’Shea, Ernst Oertel

6pm: Emirates Fillies Classic – Prestige (PA) Dh100,000 (T) 1,600m; Winner: Ghallieah, Sebastien Martino, Jean-Claude Pecout

6.30pm: Emirates Colts Classic – Prestige (PA) Dh100,000 (T) 1,600m; Winner: Yas Xmnsor, Saif Al Balushi, Khalifa Al Neyadi

7pm: The President’s Cup – Group 1 (PA) Dh2,500,000 (T) 2,200m; Winner: Somoud, Adrie de Vries, Jean de Roualle

7.30pm: The President’s Cup – Listed (TB) Dh380,000 (T) 1,400m; Winner: Haqeeqy, Dane O’Neill, John Hyde.

MOUNTAINHEAD REVIEW

Starring: Ramy Youssef, Steve Carell, Jason Schwartzman

Director: Jesse Armstrong

Rating: 3.5/5

The specs

Engine: 2.0-litre 4cyl turbo

Power: 261hp at 5,500rpm

Torque: 405Nm at 1,750-3,500rpm

Transmission: 9-speed auto

Fuel consumption: 6.9L/100km

On sale: Now

Price: From Dh117,059

SPEC%20SHEET%3A%20APPLE%20M3%20MACBOOK%20AIR%20(13%22)

%3Cp%3E%3Cstrong%3EProcessor%3A%3C%2Fstrong%3E%20Apple%20M3%2C%208-core%20CPU%2C%20up%20to%2010-core%20CPU%2C%2016-core%20Neural%20Engine%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EDisplay%3A%3C%2Fstrong%3E%2013.6-inch%20Liquid%20Retina%2C%202560%20x%201664%2C%20224ppi%2C%20500%20nits%2C%20True%20Tone%2C%20wide%20colour%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EMemory%3A%3C%2Fstrong%3E%208%2F16%2F24GB%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStorage%3A%3C%2Fstrong%3E%20256%2F512GB%20%2F%201%2F2TB%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EI%2FO%3A%3C%2Fstrong%3E%20Thunderbolt%203%2FUSB-4%20(2)%2C%203.5mm%20audio%2C%20Touch%20ID%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EConnectivity%3A%3C%2Fstrong%3E%20Wi-Fi%206E%2C%20Bluetooth%205.3%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBattery%3A%3C%2Fstrong%3E%2052.6Wh%20lithium-polymer%2C%20up%20to%2018%20hours%2C%20MagSafe%20charging%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ECamera%3A%3C%2Fstrong%3E%201080p%20FaceTime%20HD%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EVideo%3A%3C%2Fstrong%3E%20Support%20for%20Apple%20ProRes%2C%20HDR%20with%20Dolby%20Vision%2C%20HDR10%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EAudio%3A%3C%2Fstrong%3E%204-speaker%20system%2C%20wide%20stereo%2C%20support%20for%20Dolby%20Atmos%2C%20Spatial%20Audio%20and%20dynamic%20head%20tracking%20(with%20AirPods)%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EColours%3A%3C%2Fstrong%3E%20Midnight%2C%20silver%2C%20space%20grey%2C%20starlight%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EIn%20the%20box%3A%3C%2Fstrong%3E%20MacBook%20Air%2C%2030W%2F35W%20dual-port%2F70w%20power%20adapter%2C%20USB-C-to-MagSafe%20cable%2C%202%20Apple%20stickers%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20From%20Dh4%2C599%3C%2Fp%3E%0A

HAEMOGLOBIN DISORDERS EXPLAINED

Thalassaemia is part of a family of genetic conditions affecting the blood known as haemoglobin disorders.

Haemoglobin is a substance in the red blood cells that carries oxygen and a lack of it triggers anemia, leaving patients very weak, short of breath and pale.

The most severe type of the condition is typically inherited when both parents are carriers. Those patients often require regular blood transfusions - about 450 of the UAE's 2,000 thalassaemia patients - though frequent transfusions can lead to too much iron in the body and heart and liver problems.

The condition mainly affects people of Mediterranean, South Asian, South-East Asian and Middle Eastern origin. Saudi Arabia recorded 45,892 cases of carriers between 2004 and 2014.

A World Health Organisation study estimated that globally there are at least 950,000 'new carrier couples' every year and annually there are 1.33 million at-risk pregnancies.

Volvo ES90 Specs

Engine: Electric single motor (96kW), twin motor (106kW) and twin motor performance (106kW)

Power: 333hp, 449hp, 680hp

Torque: 480Nm, 670Nm, 870Nm

On sale: Later in 2025 or early 2026, depending on region

Price: Exact regional pricing TBA

What sanctions would be reimposed?

Under ‘snapback’, measures imposed on Iran by the UN Security Council in six resolutions would be restored, including:

- An arms embargo

- A ban on uranium enrichment and reprocessing

- A ban on launches and other activities with ballistic missiles capable of delivering nuclear weapons, as well as ballistic missile technology transfer and technical assistance

- A targeted global asset freeze and travel ban on Iranian individuals and entities

- Authorisation for countries to inspect Iran Air Cargo and Islamic Republic of Iran Shipping Lines cargoes for banned goods

Profile of Bitex UAE

Date of launch: November 2018

Founder: Monark Modi

Based: Business Bay, Dubai

Sector: Financial services

Size: Eight employees

Investors: Self-funded to date with $1m of personal savings

UAE currency: the story behind the money in your pockets

If you go

Flying

Despite the extreme distance, flying to Fairbanks is relatively simple, requiring just one transfer in Seattle, which can be reached directly from Dubai with Emirates for Dh6,800 return.

Touring

Gondwana Ecotours’ seven-day Polar Bear Adventure starts in Fairbanks in central Alaska before visiting Kaktovik and Utqiarvik on the North Slope. Polar bear viewing is highly likely in Kaktovik, with up to five two-hour boat tours included. Prices start from Dh11,500 per person, with all local flights, meals and accommodation included; gondwanaecotours.com

Labour dispute

The insured employee may still file an ILOE claim even if a labour dispute is ongoing post termination, but the insurer may suspend or reject payment, until the courts resolve the dispute, especially if the reason for termination is contested. The outcome of the labour court proceedings can directly affect eligibility.

- Abdullah Ishnaneh, Partner, BSA Law