The value of the UAE’s retail e-commerce market rose 53 per cent to a record $3.9 billion in 2020, largely driven by the digital shift in consumer shopping habits amid the Covid-19 pandemic, according to a new report by Dubai Chamber of Commerce and Industry.

The study, based on data from Euromonitor, projected the market value of the online retail e-commerce market will reach $8bn by 2025. The growth will be supported by high incomes, high internet penetration, developed transport logistics, modern digital payment systems, a tech-savvy youth and strong government support, according to Dubai Chamber.

E-commerce accounted for 8 per cent of the UAE’s overall retail market last year, the report added.

Online shopping became more popular after governments across the world introduced movement restrictions to stop the spread of the Covid-19 pandemic.

E-commerce sales in the Middle East and North Africa region are set to triple to $28.5bn next year, from $8.3bn in 2017, according to research by Bain & Company and Google.

Dubai Airport Freezone Authority (Dafza) launched the first phase of Dubai CommerCity, a Dh3.2bn ($871.1 million) dedicated e-commerce free zone in Umm Ramool, in April this year to tap into the rapidly growing e-commerce sector in the region.

The UAE e-commerce sector was responsible for the highest number of licences (196) in May last year, according to data from the UAE National Economic Register.

With the UAE boasting the highest smartphone penetration rate in the Mena region, the share of mobile commerce increased to 42 per cent in 2020 from 29 per cent in 2015, the study said.

“In 2020, the value of the UAE’s retail m-commerce market reached $1.6bn, 56 per cent higher than the previous year. The UAE’s retail m-commerce market is projected to reach $3.9bn by 2025 and grow at a CAGR [compound annual growth rate] of 18.9 per cent between 2020 and 2025,” the report added.

Experts have found that people return 15 per cent to 40 per cent of what they buy online, compared with 5 per cent to 10 per cent for in-store shopping

Although challenges, such as cash on delivery, persist in the UAE e-commerce market, the share of this payment method shrank slightly during the Covid-19 pandemic due to hygiene measures and the development of contactless payments, the report found.

Other challenges include high costs faced by online retailers.

“Apart from picking, packing and delivery cost, one of the biggest costs is high returns of products. Experts have found that people return 15 per cent to 40 per cent of what they buy online, compared with 5 per cent to 10 per cent for in-store shopping,” according to Dubai Chamber.

However, product returns are expected to decline with “improvements of online product details, customer support and visualisation”, the report said.

Meanwhile, consumer spending in the UAE is forecast to grow 3 per cent this year to $146bn, before picking up pace to a CAGR of 4.3 per cent over the next five years to $175bn, according to Euromonitor.

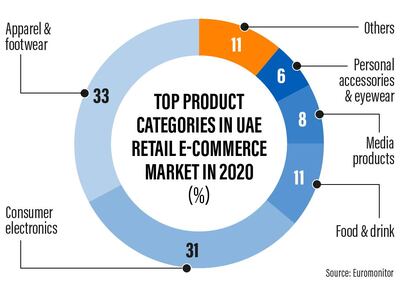

The apparel and footwear category accounted for the highest share (33 per cent or $1.3bn) of the UAE retail e-commerce market in 2020.

Consumer electronics accounted for 31 per cent ($1.2bn) of the market. In this category, demand was high for laptops, personal computers and tablets due to remote working and online education during pandemic-induced movement restrictions, according to Dubai Chamber.

Food and drink accounted for 11 per cent ($400m) of the UAE retail e-commerce market last year.

Retail e-commerce sales of food, drink and consumer electronics products recorded triple-digit growth during the Covid-19 pandemic, according to Euromonitor. Other product categories which recorded more than 50 per cent growth in sales include beauty and personal care, pet care, and apparel and footwear, the chamber said.

The fastest-growing product in the UAE e-commerce market is expected to be personal accessories and eyewear, with a CAGR of 20 per cent from 2020 to 2025, followed by media products, pet care and home care products, the report found.

“E-commerce trends expected to gain momentum with consumers include quicker, safer, more intuitive and personalised experiences, voice-activated shopping, contextual and social commerce, virtual instant reordering and product subscriptions combined with conveniences such as same-day delivery and competitive pricing,” the chamber said.

More from Rashmee Roshan Lall

The specs

Engine: Four electric motors, one at each wheel

Power: 579hp

Torque: 859Nm

Transmission: Single-speed automatic

Price: From Dh825,900

On sale: Now

UAE%20athletes%20heading%20to%20Paris%202024

%3Cp%3E%3Cstrong%3EEquestrian%3C%2Fstrong%3E%3Cbr%3EAbdullah%20Humaid%20Al%20Muhairi%2C%20Abdullah%20Al%20Marri%2C%20Omar%20Al%20Marzooqi%2C%20Salem%20Al%20Suwaidi%2C%20and%20Ali%20Al%20Karbi%20(four%20to%20be%20selected).%3Cbr%3E%3Cstrong%3EJudo%3C%2Fstrong%3E%3Cbr%3EMen%3A%20Narmandakh%20Bayanmunkh%20(66kg)%2C%20Nugzari%20Tatalashvili%20(81kg)%2C%20Aram%20Grigorian%20(90kg)%2C%20Dzhafar%20Kostoev%20(100kg)%2C%20Magomedomar%20Magomedomarov%20(%2B100kg)%3B%20women's%20Khorloodoi%20Bishrelt%20(52kg).%3Cbr%3E%3Cbr%3E%3Cstrong%3ECycling%3C%2Fstrong%3E%3Cbr%3ESafia%20Al%20Sayegh%20(women's%20road%20race).%3Cbr%3E%3Cbr%3E%3Cstrong%3ESwimming%3C%2Fstrong%3E%3Cbr%3EMen%3A%20Yousef%20Rashid%20Al%20Matroushi%20(100m%20freestyle)%3B%20women%3A%20Maha%20Abdullah%20Al%20Shehi%20(200m%20freestyle).%3Cbr%3E%3Cbr%3E%3Cstrong%3EAthletics%3C%2Fstrong%3E%3Cbr%3EMaryam%20Mohammed%20Al%20Farsi%20(women's%20100%20metres).%3C%2Fp%3E%0A

Ferrari 12Cilindri specs

Engine: naturally aspirated 6.5-liter V12

Power: 819hp

Torque: 678Nm at 7,250rpm

Price: From Dh1,700,000

Available: Now

Lowest Test scores

26 - New Zealand v England at Auckland, March 1955

30 - South Africa v England at Port Elizabeth, Feb 1896

30 - South Africa v England at Birmingham, June 1924

35 - South Africa v England at Cape Town, April 1899

36 - South Africa v Australia at Melbourne, Feb. 1932

36 - Australia v England at Birmingham, May 1902

36 - India v Australia at Adelaide, Dec. 2020

38 - Ireland v England at Lord's, July 2019

42 - New Zealand v Australia in Wellington, March 1946

42 - Australia v England in Sydney, Feb. 1888

Who are the Sacklers?

The Sackler family is a transatlantic dynasty that owns Purdue Pharma, which manufactures and markets OxyContin, one of the drugs at the centre of America's opioids crisis. The family is well known for their generous philanthropy towards the world's top cultural institutions, including Guggenheim Museum, the National Portrait Gallery, Tate in Britain, Yale University and the Serpentine Gallery, to name a few. Two branches of the family control Purdue Pharma.

Isaac Sackler and Sophie Greenberg were Jewish immigrants who arrived in New York before the First World War. They had three sons. The first, Arthur, died before OxyContin was invented. The second, Mortimer, who died aged 93 in 2010, was a former chief executive of Purdue Pharma. The third, Raymond, died aged 97 in 2017 and was also a former chief executive of Purdue Pharma.

It was Arthur, a psychiatrist and pharmaceutical marketeer, who started the family business dynasty. He and his brothers bought a small company called Purdue Frederick; among their first products were laxatives and prescription earwax remover.

Arthur's branch of the family has not been involved in Purdue for many years and his daughter, Elizabeth, has spoken out against it, saying the company's role in America's drugs crisis is "morally abhorrent".

The lawsuits that were brought by the attorneys general of New York and Massachussetts named eight Sacklers. This includes Kathe, Mortimer, Richard, Jonathan and Ilene Sackler Lefcourt, who are all the children of either Mortimer or Raymond. Then there's Theresa Sackler, who is Mortimer senior's widow; Beverly, Raymond's widow; and David Sackler, Raymond's grandson.

Members of the Sackler family are rarely seen in public.

The National's picks

4.35pm: Tilal Al Khalediah

5.10pm: Continous

5.45pm: Raging Torrent

6.20pm: West Acre

7pm: Flood Zone

7.40pm: Straight No Chaser

8.15pm: Romantic Warrior

8.50pm: Calandogan

9.30pm: Forever Young

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

The specs: 2018 Nissan Altima

Price, base / as tested: Dh78,000 / Dh97,650

Engine: 2.5-litre in-line four-cylinder

Power: 182hp @ 6,000rpm

Torque: 244Nm @ 4,000rpm

Transmission: Continuously variable tranmission

Fuel consumption, combined: 7.6L / 100km