The nominal value of global debt declined by $4 trillion to below $300 trillion in 2022, helped by stronger growth momentum and an inflation-driven rise in borrowing costs.

“Following a substantial surge in 2020-2021 during the pandemic, the global debt pile shrank … to $299 trillion in 2022. This marks the first annual decline since 2015”, notably in Europe and Japan, the Institute of International Finance (IIF) said in its latest Global Debt Monitor report.

The retrenchment was driven “entirely by mature markets” whose total debt dropped at the end of last year to about $200 trillion, down from more than $206 trillion recorded at the close of 2021.

However, despite a sharp rise in borrowing costs, emerging market debt continued its upward trend in sharp contrast to developed markets. The emerging markets' debt pile hit a new high of $98 trillion last year.

“Russia, Singapore, India, Mexico and Vietnam saw the largest rise in the US dollar value of their outstanding debt,” the IIF said.

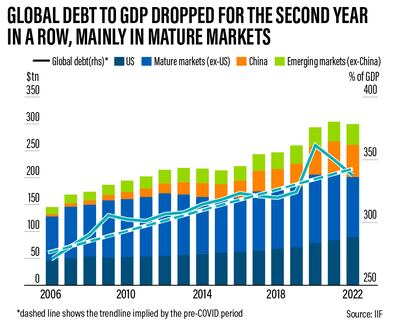

Strong economic activity and high inflation pushed the global debt-to-gross domestic product ratio lower in 2022, the second annual drop in a row.

The global debt-to-GDP ratio dropped by 12 percentage points to 338 per cent at the end of last year. Mature markets recorded a significant drop, with total debt ratio declining by more than 20 percentage points to 390 per cent of their GDP.

“The sharpest drop was among European countries, led by Cyprus, Norway and the UK,” the IIF report said.

While many emerging markets recorded a slight decline in their debt ratios last year, the total debt-to-GDP ratio rose by 2 percentage points to 250 per cent, largely driven by borrowings in Singapore and China.

The global debt pile hit the record $306 trillion in the first quarter of 2022, but stronger economic growth and a sharp rise in interest rates deterred sovereign, corporate and household borrowers from accumulating debt.

Central banks around the world have increased their benchmark policy rates to curb inflation. The US Federal Reserve has been aggressively increasing it benchmark rates and more raises are expected as it aims to bring inflation from 40-year highs last year to its target range of 2 per cent.

Better economic data in the third quarter of last year, easing inflation and the reopening of the Chinese economy have also brightened global economic prospects this year.

Last month, the International Monetary Fund increased its estimate for the global economy this year by 0.2 percentage points from its October forecast, with growth now estimated at 2.9 per cent for the year following a 3.4 per cent expansion in 2022.

The IIF said the pace of debt accumulation in the non-financial corporate sector decelerated significantly last year. Less than $900 billion was added to the global corporate debt mountain, though this still brought the total to a new high of nearly $90 trillion.

“While higher funding costs along with fears over a global slowdown cut corporate borrowing in much of the world, the strength of the US economy prompted a surge in borrowing among US corporates,” the IIF report said.

“In fact, 2022 saw US non-financial corporate debt hit over $20 trillion, increasing by over $1.7 trillion from 2021 levels — the largest annual increase on record.”

Though the value of global debt declined last year, a close look at quarterly debt figures suggest that the fourth quarter of 2022 “might have marked an inflection point”, the Washington-based institute said.

Central banks in China and Japan provided substantial market liquidity and against that backdrop “our calculations suggest that the global debt pile increased by over $10 trillion in the fourth quarter, partially erasing the large declines in debt levels recorded over the previous quarters in 2022", the IIF said.

Traits of Chinese zodiac animals

Tiger:independent, successful, volatile

Rat:witty, creative, charming

Ox:diligent, perseverent, conservative

Rabbit:gracious, considerate, sensitive

Dragon:prosperous, brave, rash

Snake:calm, thoughtful, stubborn

Horse:faithful, energetic, carefree

Sheep:easy-going, peacemaker, curious

Monkey:family-orientated, clever, playful

Rooster:honest, confident, pompous

Dog:loyal, kind, perfectionist

Boar:loving, tolerant, indulgent

The%C2%A0specs%20

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E2-litre%204-cylinder%20mild%20hybrid%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E7-speed%20S%20tronic%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E265hp%20%2F%20195kW%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20370Nm%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3Efrom%20Dh260%2C000%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20now%3C%2Fp%3E%0A

ROUTE%20TO%20TITLE

%3Cp%3E%3Cstrong%3ERound%201%3A%3C%2Fstrong%3E%20Beat%20Leolia%20Jeanjean%206-1%2C%206-2%3Cbr%3E%3Cstrong%3ERound%202%3A%20%3C%2Fstrong%3EBeat%20Naomi%20Osaka%207-6%2C%201-6%2C%207-5%3Cbr%3E%3Cstrong%3ERound%203%3A%20%3C%2Fstrong%3EBeat%20Marie%20Bouzkova%206-4%2C%206-2%3Cbr%3E%3Cstrong%3ERound%204%3A%3C%2Fstrong%3E%20Beat%20Anastasia%20Potapova%206-0%2C%206-0%3Cbr%3E%3Cstrong%3EQuarter-final%3A%20%3C%2Fstrong%3EBeat%20Marketa%20Vondrousova%206-0%2C%206-2%3Cbr%3E%3Cstrong%3ESemi-final%3A%20%3C%2Fstrong%3EBeat%20Coco%20Gauff%206-2%2C%206-4%3Cbr%3E%3Cstrong%3EFinal%3A%3C%2Fstrong%3E%20Beat%20Jasmine%20Paolini%206-2%2C%206-2%3C%2Fp%3E%0A

'Fantastic Beasts: The Secrets of Dumbledore'

Rating: 3/5

Directed by: David Yates

Starring: Mads Mikkelson, Eddie Redmayne, Ezra Miller, Jude Law

In numbers: China in Dubai

The number of Chinese people living in Dubai: An estimated 200,000

Number of Chinese people in International City: Almost 50,000

Daily visitors to Dragon Mart in 2018/19: 120,000

Daily visitors to Dragon Mart in 2010: 20,000

Percentage increase in visitors in eight years: 500 per cent

Dhadak 2

Director: Shazia Iqbal

Starring: Siddhant Chaturvedi, Triptii Dimri

Rating: 1/5

500 People from Gaza enter France

115 Special programme for artists

25 Evacuation of injured and sick

The specs

Engine: 2.0-litre 4cyl turbo

Power: 261hp at 5,500rpm

Torque: 405Nm at 1,750-3,500rpm

Transmission: 9-speed auto

Fuel consumption: 6.9L/100km

On sale: Now

Price: From Dh117,059

A cheaper choice

Vanuatu: $130,000

Why on earth pick Vanuatu? Easy. The South Pacific country has no income tax, wealth tax, capital gains or inheritance tax. And in 2015, when it was hit by Cyclone Pam, it signed an agreement with the EU that gave it some serious passport power.

Cost: A minimum investment of $130,000 for a family of up to four, plus $25,000 in fees.

Criteria: Applicants must have a minimum net worth of $250,000. The process take six to eight weeks, after which the investor must travel to Vanuatu or Hong Kong to take the oath of allegiance. Citizenship and passport are normally provided on the same day.

Benefits: No tax, no restrictions on dual citizenship, no requirement to visit or reside to retain a passport. Visa-free access to 129 countries.

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

What can victims do?

Always use only regulated platforms

Stop all transactions and communication on suspicion

Save all evidence (screenshots, chat logs, transaction IDs)

Report to local authorities

Warn others to prevent further harm

Courtesy: Crystal Intelligence

What the law says

Micro-retirement is not a recognised concept or employment status under Federal Decree Law No. 33 of 2021 on the Regulation of Labour Relations (as amended) (UAE Labour Law). As such, it reflects a voluntary work-life balance practice, rather than a recognised legal employment category, according to Dilini Loku, senior associate for law firm Gateley Middle East.

“Some companies may offer formal sabbatical policies or career break programmes; however, beyond such arrangements, there is no automatic right or statutory entitlement to extended breaks,” she explains.

“Any leave taken beyond statutory entitlements, such as annual leave, is typically regarded as unpaid leave in accordance with Article 33 of the UAE Labour Law. While employees may legally take unpaid leave, such requests are subject to the employer’s discretion and require approval.”

If an employee resigns to pursue micro-retirement, the employment contract is terminated, and the employer is under no legal obligation to rehire the employee in the future unless specific contractual agreements are in place (such as return-to-work arrangements), which are generally uncommon, Ms Loku adds.