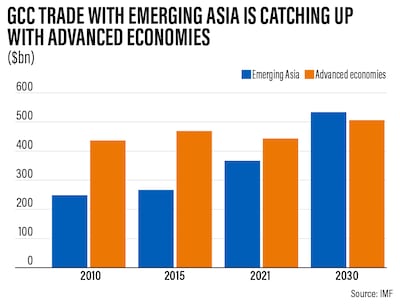

Bilateral trade between the six-member economic bloc of GCC and Asia is set to reach $578 billion by the end of this decade as Gulf economies increasingly pivot to one of the fastest-growing regions in the world.

Two-way trade between the GCC and Asian markets will expand 6 per cent on average annually, surpassing the Gulf bloc’s trade value with advanced economies by 2028, UK-based think tank Asia House said in its latest research on Wednesday.

Emerging Asia will account for about 36.41 per cent of GCC's total trade in the region by 2030, up from the current 30.83 per cent, according to the report released at an event organised by Abu Dhabi-based private equity company Gulf Capital.

“Rapidly expanding ties between the Gulf and Asia are creating a fundamental global shift that will have far-ranging implications for international trade, business and politics,” said Freddie Neve, senior Middle East associate at Asia House, who wrote the Middle East Pivot To Asia 2022 report.

The investment corridor is growing in both directions and across various industries, including oil and non-oil sectors.

“In particular, Gulf economic diversification, which is moving at a staggering pace, is attracting Asian investment into emerging economic sectors within the GCC, such as construction, renewables and technology,” Mr Neve said.

“We also expect sustainability co-operation to grow in importance as Gulf and Asian economies transition away from hydrocarbons over the next few decades.”

Gulf economies are increasingly pivoting to the fast-growing Asian markets. Asia’s rate of growth is set to surpass the rest of the world this year as the outlook of the regional economies improves, despite mounting geopolitical risk and global macroeconomic headwinds, according to the International Monetary Fund.

Growth in Asia increased to 4.7 per cent this year, up from last year's 3.8 per cent, which will make it “by far the most dynamic of the world’s major regions and a bright spot in a slowing global economy”, senior IMF officials wrote in a blog post this week.

The emerging and developing economies in Asia that are expected to expand by 5.3 per cent this year are also driving the economic “dynamism” of the region.

China and India alone are expected to contribute more than half of global growth this year, with the rest of Asia contributing an additional quarter.

Cambodia, Indonesia, Malaysia, the Philippines, Thailand and Vietnam are all back to their robust pre-pandemic growth, the IMF officials said.

The oil-rich economies in the GCC are keen to strengthen trading ties with their partners in Asia.

The UAE, the second-largest Arab economy, has already signed a comprehensive economic partnership agreement with India, Asia’s third-largest economy, and Indonesia. It is negotiating similar deals with several other Asian nations.

Trade between the UAE and India has increased by 10 per cent in the year since the countries signed the treaty, setting the stage for greater co-operation with other Asian economies.

Gulf Capital, which focuses on investments in South-east Asia, had identified this trend early on, and during the past 15 year, “we’ve been looking East when growing [our portfolio] companies from the GCC”, said Karim El Solh, co-founder and chief executive of Gulf Capital.

“Taking our local companies through this corridor has helped us build global champions, which have become trophies for strategic buyers looking at acquiring cross-country platforms to boost their businesses,” he added.

The interest of the GCC’s sovereign wealth funds (SWFs) in Asian investments will also “continue to grow and will be a key trend defining the Middle East pivot to Asia over the next decade”, according to the report.

Gulf SWFs have estimated assets worth more than $2.5 trillion and changes to their investment strategies can have a considerable effect on global finance.

The state funds are looking for ways to increase their exposure to Asian markets.

As of July, they were involved in $28.6 billion worth of acquisitions outside the Middle East and Africa, 45 per cent more than in 2021, with investments heading towards China, India and Singapore, the report said.

“Despite global economic uncertainties, the Middle East pivot to Asia has exceeded expectations in the last year and is likely to accelerate over the next decade, heralding a profound shift in global trade and cross-border investments that will impact growth, business and geopolitics,” Mr Neve said.

SCORES

Multiply Titans 81-2 in 12.1 overs

(Tony de Zorzi, 34)

bt Auckland Aces 80 all out in 16 overs

(Shawn von Borg 4-15, Alfred Mothoa 2-11, Tshepo Moreki 2-16).

UAE cricketers abroad

Sid Jhurani is not the first cricketer from the UAE to go to the UK to try his luck.

Rameez Shahzad Played alongside Ben Stokes and Liam Plunkett in Durham while he was studying there. He also played club cricket as an overseas professional, but his time in the UK stunted his UAE career. The batsman went a decade without playing for the national team.

Yodhin Punja The seam bowler was named in the UAE’s extended World Cup squad in 2015 despite being just 15 at the time. He made his senior UAE debut aged 16, and subsequently took up a scholarship at Claremont High School in the south of England.

A new relationship with the old country

Treaty of Friendship between the United Kingdom of Great Britain and Northern Ireland and the United Arab Emirates

The United kingdom of Great Britain and Northern Ireland and the United Arab Emirates; Considering that the United Arab Emirates has assumed full responsibility as a sovereign and independent State; Determined that the long-standing and traditional relations of close friendship and cooperation between their peoples shall continue; Desiring to give expression to this intention in the form of a Treaty Friendship; Have agreed as follows:

ARTICLE 1 The relations between the United Kingdom of Great Britain and Northern Ireland and the United Arab Emirates shall be governed by a spirit of close friendship. In recognition of this, the Contracting Parties, conscious of their common interest in the peace and stability of the region, shall: (a) consult together on matters of mutual concern in time of need; (b) settle all their disputes by peaceful means in conformity with the provisions of the Charter of the United Nations.

ARTICLE 2 The Contracting Parties shall encourage education, scientific and cultural cooperation between the two States in accordance with arrangements to be agreed. Such arrangements shall cover among other things: (a) the promotion of mutual understanding of their respective cultures, civilisations and languages, the promotion of contacts among professional bodies, universities and cultural institutions; (c) the encouragement of technical, scientific and cultural exchanges.

ARTICLE 3 The Contracting Parties shall maintain the close relationship already existing between them in the field of trade and commerce. Representatives of the Contracting Parties shall meet from time to time to consider means by which such relations can be further developed and strengthened, including the possibility of concluding treaties or agreements on matters of mutual concern.

ARTICLE 4 This Treaty shall enter into force on today’s date and shall remain in force for a period of ten years. Unless twelve months before the expiry of the said period of ten years either Contracting Party shall have given notice to the other of its intention to terminate the Treaty, this Treaty shall remain in force thereafter until the expiry of twelve months from the date on which notice of such intention is given.

IN WITNESS WHEREOF the undersigned have signed this Treaty.

DONE in duplicate at Dubai the second day of December 1971AD, corresponding to the fifteenth day of Shawwal 1391H, in the English and Arabic languages, both texts being equally authoritative.

Signed

Geoffrey Arthur Sheikh Zayed

More from Neighbourhood Watch:

The specs

Engine: 1.5-litre turbo

Power: 181hp

Torque: 230Nm

Transmission: 6-speed automatic

Starting price: Dh79,000

On sale: Now

Race card:

6.30pm: Maiden; Dh165,000; 2,000m

7.05pm: Handicap; Dh165,000; 2,200m

7.40pm: Conditions; Dh240,000; 1,600m

8.15pm: Handicap; Dh190,000; 2,000m

8.50pm: The Garhoud Sprint Listed; Dh265,000; 1,200m

9.25pm: Handicap; Dh170,000; 1,600m

10pm: Handicap; Dh190,000; 1,400m

Generational responses to the pandemic

Devesh Mamtani from Century Financial believes the cash-hoarding tendency of each generation is influenced by what stage of the employment cycle they are in. He offers the following insights:

Baby boomers (those born before 1964): Owing to market uncertainty and the need to survive amid competition, many in this generation are looking for options to hoard more cash and increase their overall savings/investments towards risk-free assets.

Generation X (born between 1965 and 1980): Gen X is currently in its prime working years. With their personal and family finances taking a hit, Generation X is looking at multiple options, including taking out short-term loan facilities with competitive interest rates instead of dipping into their savings account.

Millennials (born between 1981 and 1996): This market situation is giving them a valuable lesson about investing early. Many millennials who had previously not saved or invested are looking to start doing so now.

Electric scooters: some rules to remember

- Riders must be 14-years-old or over

- Wear a protective helmet

- Park the electric scooter in designated parking lots (if any)

- Do not leave electric scooter in locations that obstruct traffic or pedestrians

- Solo riders only, no passengers allowed

- Do not drive outside designated lanes

Ibrahim's play list

Completed an electrical diploma at the Adnoc Technical Institute

Works as a public relations officer with Adnoc

Apart from the piano, he plays the accordion, oud and guitar

His favourite composer is Johann Sebastian Bach

Also enjoys listening to Mozart

Likes all genres of music including Arabic music and jazz

Enjoys rock groups Scorpions and Metallica

Other musicians he likes are Syrian-American pianist Malek Jandali and Lebanese oud player Rabih Abou Khalil

Company%20Profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Cargoz%3Cbr%3E%3Cstrong%3EDate%20started%3A%3C%2Fstrong%3E%20January%202022%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Premlal%20Pullisserry%20and%20Lijo%20Antony%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%3C%2Fstrong%3E%2030%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20Seed%3C%2Fp%3E%0A

The specs: 2018 Nissan 370Z Nismo

The specs: 2018 Nissan 370Z Nismo

Price, base / as tested: Dh182,178

Engine: 3.7-litre V6

Power: 350hp @ 7,400rpm

Torque: 374Nm @ 5,200rpm

Transmission: Seven-speed automatic

Fuel consumption, combined: 10.5L / 100km

More from Neighbourhood Watch:

Killing of Qassem Suleimani

HIJRA

Starring: Lamar Faden, Khairiah Nathmy, Nawaf Al-Dhufairy

Director: Shahad Ameen

Rating: 3/5

If you go...

Etihad flies daily from Abu Dhabi to Zurich, with fares starting from Dh2,807 return. Frequent high speed trains between Zurich and Vienna make stops at St. Anton.

The specs

AT4 Ultimate, as tested

Engine: 6.2-litre V8

Power: 420hp

Torque: 623Nm

Transmission: 10-speed automatic

Price: From Dh330,800 (Elevation: Dh236,400; AT4: Dh286,800; Denali: Dh345,800)

On sale: Now