When Russian tanks last rolled in anger down European roads, the iron links of energy binding the continent had not yet been forged.

The response by Europe and the US to Moscow’s military offensive in Ukraine will be painful for consumers, but it will eventually reshape the energy world ― and not to Russia’s gain. The Arab world and all oil and gas exporters, need to be prepared.

Berlin, Brussels and Moscow forged their fetters from the start of Soviet gas sales to Austria in September 1968, the month after the crushing of the Prague Spring. The idea of energy trade to discourage war was a good bet on the self-preservation instincts of Soviet apparatchiks, but has succumbed to what many see as new adventurism.

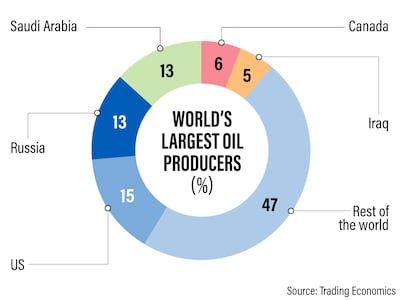

The European Commission’s new strategy, shown in leaked drafts, aims to reduce, then eliminate dependence on Russian fossil fuels. Russia accounts for 25 per cent of world gas exports, nearly all to Europe, 18 per cent of coal sales, and between 11 to 13 per cent of oil exports, about half of that to Europe.

In comparison, the September 1973 oil embargo launched by a group of Arab petroleum exporters cut world production by only 7 per cent, was over by March 1974 and did not affect other fuels. Yet it severely damaged the world economy, hugely boosted energy efficiency, led to the rise of nuclear power, the early days of solar and wind and created the modern energy security architecture.

Now, the combined effects of sanctions, informal bans, war disruption and Russian counter-measures will be titanic. At risk are supplies not just of fossil fuels, but fertilisers, food, aluminium, metals used in batteries and electrolysers, and nuclear fuels. A steep global recession is likely.

From a mix of war disruption, policy, economics, caution and moral suasion, Russia will cease over this decade to be an important energy supplier to Europe. Mr Putin has launched this offensive at a bad time: the move for decarbonisation, and the rising viability of low-carbon technologies, already posed a severe threat to his country’s fossil fuel exports.

Opec+, which of course includes Russia, chose on Wednesday to hold to its regular plan of increasing oil production targets by 400,000 barrels per day each month. It did not see physical supply disruptions yet. But those are clearly coming, through sanctions. The group will soon have to decide whether to unleash its unevenly distributed spare capacity or risk a colossal price spike followed by demand destruction.

Russia’s own output will slump as it can no longer access the funds and technology for more challenging frontier fields. Its remaining sales will reorient towards China and other Asian countries, competing more with the Gulf, but opening up its traditional space in Europe.

In January, Saudi Aramco bought a stake in Poland’s second-largest refinery, promising to supply almost half the country’s oil. Saudi Arabia and other Arab oil producers with plans to expand capacity will find ready markets.

Overall, though, Europe will dramatically accelerate its efforts to get off petroleum. That will drive forward electric vehicles and hydrogen worldwide. Gulf oil exporters can expect a very good few years, but this crisis sharpens the threat of peak oil demand.

As my colleague at the Columbia Centre on Global Energy Policy, the sanctions specialist Richard Nephew, suggests, permitted Russian oil (and gas) sales to Europe could be ratcheted down over time. That would allow the market some time to adjust. It would guarantee a growing quantity of non-Russian gas imports, effectively underwriting new supply.

Or similarly, Europe could impose steep tariffs on Russian gas to prefer all other sources first and retain much of the resulting revenue. The vast bulk of Gazprom’s exports have nowhere to go but Europe – much smaller amounts to China flow from different fields in east Siberia.

The International Energy Agency has laid out a ten-point plan that would reduce Europe’s gas imports from Russia by a third this year. This includes alternative supplies, greater energy efficiency, more renewables and nuclear, and conservation by consumers. Several other studies show how the need for Russian gas could be eliminated entirely before 2030.

Turkey is a key node. The supply from Azerbaijan through Georgia to Turkey and on to Greece and Italy faces a threat from Russian troops ensconced in Georgia’s occupied region of South Ossetia. Its mountains are not far from the gas pipeline south of the capital Tbilisi and Gori, home town of Josef Stalin, “the broad-chested Ossete” as he was dubbed by poet and Gulag victim Osip Mandelstam.

But Turkey has found sizeable gas reserves in its part of the Black Sea. Last month, president Recep Tayyip Erdogan met Nechirvan Barzani, president of Iraq’s semi-autonomous Kurdistan region, and expressed interest in Kurdish gas. A pipeline is already under construction almost to the Turkish border. From there, it could displace Russian supplies in Turkey and flow on to south-eastern Europe.

The huge boost required in European liquefied natural gas (LNG) imports – a potential 60 billion cubic metres per year in the short term, 160 bcm in the longer term – is equivalent ultimately to about a third of the existing world LNG market. That is a giant prize for Middle Eastern countries that can increase LNG exports, notably Qatar by the 2025-27 period, but also the UAE and possibly east Mediterranean.

Not a molecule of Russian hydrogen is ever going to enter the EU now. For Gulf countries, which have begun building their energy strategies around exporting this clean future fuel, a big potential competitor has just knocked itself out. The demand for low-carbon hydrogen to replace oil, gas, coal in steelmaking, ammonia in fertiliser manufacture – will accelerate dramatically.

Even if the Ukraine conflict ends soon, the shock has already rewired thinking on diplomacy, the military – and energy. The future looks cleaner, safer, and wealthier. To get there, the world first needs to avoid catastrophe.

Robin M. Mills is CEO of Qamar Energy, and author of The Myth of the Oil Crisis

GAC GS8 Specs

Engine: 2.0-litre 4cyl turbo

Power: 248hp at 5,200rpm

Torque: 400Nm at 1,750-4,000rpm

Transmission: 8-speed auto

Fuel consumption: 9.1L/100km

On sale: Now

Price: From Dh149,900

Specs

Engine: Duel electric motors

Power: 659hp

Torque: 1075Nm

On sale: Available for pre-order now

Price: On request

MATCH INFO

Uefa Champions League, Group B

Barcelona v Inter Milan

Camp Nou, Barcelona

Wednesday, 11pm (UAE)

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E2.0-litre%204-cyl%20turbo%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E190hp%20at%205%2C600rpm%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E320Nm%20at%201%2C500-4%2C000rpm%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E7-speed%20dual-clutch%20auto%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%20%3C%2Fstrong%3E10.9L%2F100km%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh119%2C900%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3ENow%3C%2Fp%3E%0A

DUBAI%20BLING%3A%20EPISODE%201

%3Cp%3E%3Cstrong%3ECreator%3A%20%3C%2Fstrong%3ENetflix%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%20%3C%2Fstrong%3EKris%20Fade%2C%20Ebraheem%20Al%20Samadi%2C%20Zeina%20Khoury%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%202%2F5%3C%2Fp%3E%0A

Chef Nobu's advice for eating sushi

“One mistake people always make is adding extra wasabi. There is no need for this, because it should already be there between the rice and the fish.

“When eating nigiri, you must dip the fish – not the rice – in soy sauce, otherwise the rice will collapse. Also, don’t use too much soy sauce or it will make you thirsty. For sushi rolls, dip a little of the rice-covered roll lightly in soy sauce and eat in one bite.

“Chopsticks are acceptable, but really, I recommend using your fingers for sushi. Do use chopsticks for sashimi, though.

“The ginger should be eaten separately as a palette cleanser and used to clear the mouth when switching between different pieces of fish.”

The specs: 2019 Mini Cooper

Price, base: Dh141,740 (three-door) / Dh165,900 (five-door)

Engine: 1.5-litre four-cylinder (Cooper) / 2.0-litre four-cylinder (Cooper S)

Power: 136hp @ 4,500rpm (Cooper) / 192hp @ 5,000rpm (Cooper S)

Torque: 220Nm @ 1,480rpm (Cooper) / 280Nm @ 1,350rpm (Cooper S)

Transmission: Seven-speed automatic

Fuel consumption, combined: 4.8L to 5.4L / 100km

WOMAN AND CHILD

Director: Saeed Roustaee

Starring: Parinaz Izadyar, Payman Maadi

Rating: 4/5

Normcore explained

Something of a fashion anomaly, normcore is essentially a celebration of the unremarkable. The term was first popularised by an article in New York magazine in 2014 and has been dubbed “ugly”, “bland’ and "anti-style" by fashion writers. It’s hallmarks are comfort, a lack of pretentiousness and neutrality – it is a trend for those who would rather not stand out from the crowd. For the most part, the style is unisex, favouring loose silhouettes, thrift-shop threads, baseball caps and boyish trainers. It is important to note that normcore is not synonymous with cheapness or low quality; there are high-fashion brands, including Parisian label Vetements, that specialise in this style. Embraced by fashion-forward street-style stars around the globe, it’s uptake in the UAE has been relatively slow.

WHAT%20ARE%20THE%20PRODUCTS%20WITHIN%20THE%20THREE%20MAJOR%20CATEGORIES%3F

%3Cp%3E%3Cstrong%3EAdvanced%20materials%3A%3C%2Fstrong%3E%20specifically%20engineered%20to%20exhibit%20novel%20or%20enhanced%20properties%2C%20that%20confer%20superior%20performance%20relative%20to%20conventional%20materials%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EAdvanced%20components%3A%3C%2Fstrong%3E%20includes%20semiconductor%20components%2C%20such%20as%20microprocessors%20and%20other%20computer%20chips%2C%20and%20computer%20vision%20components%20such%20as%20lenses%20and%20image%20sensors%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EAdvanced%20products%3A%3C%2Fstrong%3E%20includes%20personal%20electronics%2C%20smart%20home%20devices%20and%20space%20technologies%2C%20along%20with%20industry-enabling%20products%20such%20as%20robots%2C%203D%20printing%20equipment%20and%20exoskeletons%3C%2Fp%3E%0A%3Cp%3E%3Cem%3ESource%3A%20Strategy%26amp%3B%3C%2Fem%3E%3C%2Fp%3E%0A

BIOSAFETY LABS SECURITY LEVELS

Biosafety Level 1

The lowest safety level. These labs work with viruses that are minimal risk to humans.

Hand washing is required on entry and exit and potentially infectious material decontaminated with bleach before thrown away.

Must have a lock. Access limited. Lab does not need to be isolated from other buildings.

Used as teaching spaces.

Study microorganisms such as Staphylococcus which causes food poisoning.

Biosafety Level 2

These labs deal with pathogens that can be harmful to people and the environment such as Hepatitis, HIV and salmonella.

Working in Level 2 requires special training in handling pathogenic agents.

Extra safety and security precautions are taken in addition to those at Level 1

Biosafety Level 3

These labs contain material that can be lethal if inhaled. This includes SARS coronavirus, MERS, and yellow fever.

Significant extra precautions are taken with staff given specific immunisations when dealing with certain diseases.

Infectious material is examined in a biological safety cabinet.

Personnel must wear protective gowns that must be discarded or decontaminated after use.

Strict safety and handling procedures are in place. There must be double entrances to the building and they must contain self-closing doors to reduce risk of pathogen aerosols escaping.

Windows must be sealed. Air from must be filtered before it can be recirculated.

Biosafety Level 4

The highest level for biosafety precautions. Scientist work with highly dangerous diseases that have no vaccine or cure.

All material must be decontaminated.

Personnel must wear a positive pressure suit for protection. On leaving the lab this must pass through decontamination shower before they have a personal shower.

Entry is severely restricted to trained and authorised personnel. All entries are recorded.

Entrance must be via airlocks.

Brief scores:

Pakistan (1st innings) 181: Babar 71; Olivier 6-37

South Africa (1st innings) 223: Bavuma 53; Amir 4-62

Pakistan (2nd innings) 190: Masood 65, Imam 57; Olivier 5-59

MATCH INFO

Sheffield United 3

Fleck 19, Mousset 52, McBurnie 90

Manchester United 3

Williams 72, Greenwood 77, Rashford 79

2018 ICC World Twenty20 Asian Western Sub Regional Qualifier

Event info: The tournament in Kuwait is the first phase of the qualifying process for sides from Asia for the 2020 World T20 in Australia. The UAE must finish within the top three teams out of the six at the competition to advance to the Asia regional finals. Success at regional finals would mean progression to the World T20 Qualifier.

Teams: UAE, Bahrain, Saudi Arabia, Kuwait, Maldives, Qatar

Friday fixtures: 9.30am (UAE time) - Kuwait v Maldives, Qatar v UAE; 3pm - Saudi Arabia v Bahrain

Thor%3A%20Love%20and%20Thunder%20

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Taika%20Waititi%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Chris%20Hemsworth%2C%20Natalie%20Portman%2C%20Christian%20Bale%2C%20Russell%20Crowe%2C%20Tessa%20Thompson%2C%20Taika%20Waititi%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

Groom and Two Brides

Director: Elie Semaan

Starring: Abdullah Boushehri, Laila Abdallah, Lulwa Almulla

Rating: 3/5

Results

6pm: Dubai Trophy – Conditions (TB) $100,000 (Turf) 1,200m

Winner: Silent Speech, William Buick (jockey), Charlie Appleby

(trainer)

6.35pm: Jumeirah Derby Trial – Conditions (TB) $60,000 (T)

1,800m

Winner: Island Falcon, Frankie Dettori, Saeed bin Suroor

7.10pm: UAE 2000 Guineas Trial – Conditions (TB) $60,000 (Dirt)

1,400m

Winner: Rawy, Mickael Barzalona, Salem bin Ghadayer

7.45pm: Al Rashidiya – Group 2 (TB) $180,000 (T) 1,800m

Winner: Desert Fire, Hector Crouch, Saeed bin Suroor

8.20pm: Al Fahidi Fort – Group 2 (TB) $180,000 (T) 1,400m

Winner: Naval Crown, William Buick, Charlie Appleby

8.55pm: Dubawi Stakes – Group 3 (TB) $150,000 (D) 1,200m

Winner: Al Tariq, Pat Dobbs, Doug Watsons

9.30pm: Aliyah – Rated Conditions (TB) $80,000 (D) 2,000m

Winner: Dubai Icon, Patrick Cosgrave, Saeed bin Suroor

2020 Oscars winners: in numbers

- Parasite – 4

- 1917– 3

- Ford v Ferrari – 2

- Joker – 2

- Once Upon a Time ... in Hollywood – 2

- American Factory – 1

- Bombshell – 1

- Hair Love – 1

- Jojo Rabbit – 1

- Judy – 1

- Little Women – 1

- Learning to Skateboard in a Warzone (If You're a Girl) – 1

- Marriage Story – 1

- Rocketman – 1

- The Neighbors' Window – 1

- Toy Story 4 – 1

Company%20Profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%20%3C%2Fstrong%3ENamara%0D%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3EJune%202022%0D%3Cbr%3E%3Cstrong%3EFounder%3A%20%3C%2Fstrong%3EMohammed%20Alnamara%0D%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDubai%20%0D%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EMicrofinance%0D%3Cbr%3E%3Cstrong%3ECurrent%20number%20of%20staff%3A%20%3C%2Fstrong%3E16%0D%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3ESeries%20A%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EFamily%20offices%0D%3Cbr%3E%3C%2Fp%3E%0A

SERIE A FIXTURES

Saturday (All UAE kick-off times)

Cagliari v AC Milan (6pm)

Lazio v Napoli (9pm)

Inter Milan v Atalanta (11.45pm)

Sunday

Udinese v Sassuolo (3.30pm)

Sampdoria v Brescia (6pm)

Fiorentina v SPAL (6pm)

Torino v Bologna (6pm)

Verona v Genoa (9pm)

Roma V Juventus (11.45pm)

Parma v Lecce (11.45pm)

More from Neighbourhood Watch:

The Written World: How Literature Shaped History

Martin Puchner

Granta

'Operation Mincemeat'

Director: John Madden

Cast: Colin Firth, Matthew Macfayden, Kelly Macdonald and Penelope Wilton

Rating: 4/5

Springsteen: Deliver Me from Nowhere

Director: Scott Cooper

Starring: Jeremy Allen White, Odessa Young, Jeremy Strong

Rating: 4/5

The specs

Engine: four-litre V6 and 3.5-litre V6 twin-turbo

Transmission: six-speed and 10-speed

Power: 271 and 409 horsepower

Torque: 385 and 650Nm

Price: from Dh229,900 to Dh355,000