A few days separate us from Expo 2020. Eight years after winning the bid to host the global fair, and almost two years since the onset of the Covid-19 pandemic, the world will gather in Dubai to celebrate innovation across art, business, science and more.

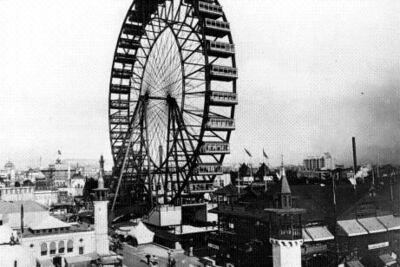

The world’s largest fair has long been the focal point for introducing innovative ideas to the public. It was during Expo 1876, held in Philadelphia in the US, that the telephone was unveiled to the world, and it was at the 1901 fair, in Buffalo, New York, that the X-ray machine was introduced. The ice cream cone made its debut in 1904 at St Louis, Missouri.

Expo 2020 is the first time that the event has been held in the Arab world. It will introduce us to the latest technologies that could revolutionise our lives, as previous creations have, and inspire future generations.

But more than that, Expo 2020 reminds us why it is essential to celebrate innovation. Because it is when we celebrate innovation and creativity that positive changes take place and humanity rises together.

Expo 2020 is a reminder of how cross-cultural dialogues inspire us to think beyond our horizons and invite us to challenge our perspectives.

The fair encourages us to celebrate innovation in our daily business and personal lives.

It is thinking outside the box and imagining a new way of doing things that gave birth to the development of revolutionary brands such as Apple. Expo 2020 invites us to incorporate imagination into our daily routine.

Let us take a moment to reflect on the last time we had dedicated business meetings that focused solely on imagining new possibilities beyond our protocols and procedures. When was the last time we thought about approaching solutions differently?

Expo 2020 encourages us to explore, widening our imagination, looking beyond our immediate geographies, meeting new people and planning to do something different every day.

Expo 2020 reminds us that innovation should be celebrated because it is essential to human prosperity.

We can start incorporating innovation in our work and celebrating it by applying simple steps today.

Make it routine to host brainstorming sessions outside of the confinement of your office walls. A simple change of scenery can encourage the flow of inspiration.

Celebrate employees who revolutionise processes or services.

Create your own version of Expo, where your team members imagine and present new possibilities across your work and the industry.

Allow room for experimentation to test new products and solutions.

Involve the public, or your customers, in your brainstorming sessions.

Do not limit seeking inspiration to your geography. Explore and look for ideas in new destinations.

Above all, Expo demonstrates what happens when businesses and creative people collaborate.

Earlier this year, Dubai launched The Dubai Creative Economy Strategy that aims to double the creative industries’ contribution to Dubai’s economy to 5 per cent by 2025, above the 3 per cent the global industry contributes to the world economy, according to the UN.

It is imperative that more businesses partner with the growing creative industry, collaborate with creative entrepreneurs and support the sector.

Everything great that surrounds us today was just an idea once. As we celebrate the opening of Expo 2020, we are reminded to step outside our comfort zone, to aim bigger and dare to dream.

Who knows … our next idea may positively impact the lives of everyone on this planet.

Manar Al Hinai is an award-winning Emirati journalist and entrepreneur who manages her marketing and communications company in Abu Dhabi.

UAE squad

Esha Oza (captain), Al Maseera Jahangir, Emily Thomas, Heena Hotchandani, Indhuja Nandakumar, Katie Thompson, Lavanya Keny, Mehak Thakur, Michelle Botha, Rinitha Rajith, Samaira Dharnidharka, Siya Gokhale, Sashikala Silva, Suraksha Kotte, Theertha Satish (wicketkeeper) Udeni Kuruppuarachchige, Vaishnave Mahesh.

UAE tour of Zimbabwe

All matches in Bulawayo

Friday, Sept 26 – First ODI

Sunday, Sept 28 – Second ODI

Tuesday, Sept 30 – Third ODI

Thursday, Oct 2 – Fourth ODI

Sunday, Oct 5 – First T20I

Monday, Oct 6 – Second T20I

Our legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

Vaccine Progress in the Middle East

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

Score

Third Test, Day 2

New Zealand 274

Pakistan 139-3 (61 ov)

Pakistan trail by 135 runs with 7 wickets remaining in the innings

How to apply for a drone permit

- Individuals must register on UAE Drone app or website using their UAE Pass

- Add all their personal details, including name, nationality, passport number, Emiratis ID, email and phone number

- Upload the training certificate from a centre accredited by the GCAA

- Submit their request

What are the regulations?

- Fly it within visual line of sight

- Never over populated areas

- Ensure maximum flying height of 400 feet (122 metres) above ground level is not crossed

- Users must avoid flying over restricted areas listed on the UAE Drone app

- Only fly the drone during the day, and never at night

- Should have a live feed of the drone flight

- Drones must weigh 5 kg or less

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Bedu%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202021%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Khaled%20Al%20Huraimel%2C%20Matti%20Zinder%2C%20Amin%20Al%20Zarouni%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%2C%20UAE%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EIndustry%3A%3C%2Fstrong%3E%20AI%2C%20metaverse%2C%20Web3%20and%20blockchain%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFunding%3A%3C%2Fstrong%3E%20Currently%20in%20pre-seed%20round%20to%20raise%20%245%20million%20to%20%247%20million%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20Privately%20funded%3C%2Fp%3E%0A

Jigra

Starring: Alia Bhatt, Vedang Raina, Manoj Pahwa, Harsh Singh

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

Ferrari 12Cilindri specs

Engine: naturally aspirated 6.5-liter V12

Power: 819hp

Torque: 678Nm at 7,250rpm

Price: From Dh1,700,000

Available: Now

MATCH INFO

Rugby World Cup (all times UAE)

Final: England v South Africa, Saturday, 1pm

Last-16

France 4

Griezmann (13' pen), Pavard (57'), Mbappe (64', 68')

Argentina 3

Di Maria (41'), Mercado (48'), Aguero (90 3')

The%20specs%3A%202024%20Mercedes%20E200

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E2.0-litre%20four-cyl%20turbo%20%2B%20mild%20hybrid%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E204hp%20at%205%2C800rpm%20%2B23hp%20hybrid%20boost%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E320Nm%20at%201%2C800rpm%20%2B205Nm%20hybrid%20boost%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E9-speed%20auto%0D%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%20%3C%2Fstrong%3E7.3L%2F100km%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3ENovember%2FDecember%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh205%2C000%20(estimate)%3C%2Fp%3E%0A

How much do leading UAE’s UK curriculum schools charge for Year 6?

- Nord Anglia International School (Dubai) – Dh85,032

- Kings School Al Barsha (Dubai) – Dh71,905

- Brighton College Abu Dhabi - Dh68,560

- Jumeirah English Speaking School (Dubai) – Dh59,728

- Gems Wellington International School – Dubai Branch – Dh58,488

- The British School Al Khubairat (Abu Dhabi) - Dh54,170

- Dubai English Speaking School – Dh51,269

*Annual tuition fees covering the 2024/2025 academic year

EXPATS

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Lulu%20Wang%26nbsp%3B%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Nicole%20Kidman%2C%20Sarayu%20Blue%2C%20Ji-young%20Yoo%2C%20Brian%20Tee%2C%20Jack%20Huston%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

The specs

Engine: 2.0-litre 4cyl turbo

Power: 261hp at 5,500rpm

Torque: 405Nm at 1,750-3,500rpm

Transmission: 9-speed auto

Fuel consumption: 6.9L/100km

On sale: Now

Price: From Dh117,059

GAC GS8 Specs

Engine: 2.0-litre 4cyl turbo

Power: 248hp at 5,200rpm

Torque: 400Nm at 1,750-4,000rpm

Transmission: 8-speed auto

Fuel consumption: 9.1L/100km

On sale: Now

Price: From Dh149,900

Wallabies

Updated team: 15-Israel Folau, 14-Dane Haylett-Petty, 13-Reece Hodge, 12-Matt Toomua, 11-Marika Koroibete, 10-Kurtley Beale, 9-Will Genia, 8-Pete Samu, 7-Michael Hooper (captain), 6-Lukhan Tui, 5-Adam Coleman, 4-Rory Arnold, 3-Allan Alaalatoa, 2-Tatafu Polota-Nau, 1-Scott Sio.

Replacements: 16-Folau Faingaa, 17-Tom Robertson, 18-Taniela Tupou, 19-Izack Rodda, 20-Ned Hanigan, 21-Joe Powell, 22-Bernard Foley, 23-Jack Maddocks.

Our family matters legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

Specs

Engine: Electric motor generating 54.2kWh (Cooper SE and Aceman SE), 64.6kW (Countryman All4 SE)

Power: 218hp (Cooper and Aceman), 313hp (Countryman)

Torque: 330Nm (Cooper and Aceman), 494Nm (Countryman)

On sale: Now

Price: From Dh158,000 (Cooper), Dh168,000 (Aceman), Dh190,000 (Countryman)

Scores in brief:

- New Medical Centre 129-5 in 17 overs bt Zayed Cricket Academy 125-6 in 20 overs.

- William Hare Abu Dhabi Gymkhana 188-8 in 20 overs bt One Stop Tourism 184-8 in 20 overs

- Alubond Tigers 138-7 in 20 overs bt United Bank Limited 132-7 in 20 overs

- Multiplex 142-6 in 17 overs bt Xconcepts Automobili 140 all out in 20 overs

Company profile

Name: Back to Games and Boardgame Space

Started: Back to Games (2015); Boardgame Space (Mark Azzam became co-founder in 2017)

Founder: Back to Games (Mr Azzam); Boardgame Space (Mr Azzam and Feras Al Bastaki)

Based: Dubai and Abu Dhabi

Industry: Back to Games (retail); Boardgame Space (wholesale and distribution)

Funding: Back to Games: self-funded by Mr Azzam with Dh1.3 million; Mr Azzam invested Dh250,000 in Boardgame Space

Growth: Back to Games: from 300 products in 2015 to 7,000 in 2019; Boardgame Space: from 34 games in 2017 to 3,500 in 2019

RESULT

Manchester United 2 Burnley 2

Man United: Lingard (53', 90' 1)

Burnley: Barnes (3'), Defour (36')

Man of the Match: Jesse Lingard (Manchester United)

THE SPECS

Engine: 6.75-litre twin-turbocharged V12 petrol engine

Power: 420kW

Torque: 780Nm

Transmission: 8-speed automatic

Price: From Dh1,350,000

On sale: Available for preorder now

UAE currency: the story behind the money in your pockets

Name: Brendalle Belaza

From: Crossing Rubber, Philippines

Arrived in the UAE: 2007

Favourite place in Abu Dhabi: NYUAD campus

Favourite photography style: Street photography

Favourite book: Harry Potter

Kibsons%20Cares

%3Cp%3E%3Cstrong%3ERecycling%3Cbr%3E%3C%2Fstrong%3EAny%20time%20you%20receive%20a%20Kibsons%20order%2C%20you%20can%20return%20your%20cardboard%20box%20to%20the%20drivers.%20They%E2%80%99ll%20be%20happy%20to%20take%20it%20off%20your%20hands%20and%20ensure%20it%20gets%20reused%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EKind%20to%20health%20and%20planet%3C%2Fstrong%3E%3Cbr%3ESolar%20%E2%80%93%2025-50%25%20of%20electricity%20saved%3Cbr%3EWater%20%E2%80%93%2075%25%20of%20water%20reused%3Cbr%3EBiofuel%20%E2%80%93%20Kibsons%20fleet%20to%20get%2020%25%20more%20mileage%20per%20litre%20with%20biofuel%20additives%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ESustainable%20grocery%20shopping%3C%2Fstrong%3E%3Cbr%3ENo%20antibiotics%3Cbr%3ENo%20added%20hormones%3Cbr%3ENo%20GMO%3Cbr%3ENo%20preservatives%3Cbr%3EMSG%20free%3Cbr%3E100%25%20natural%3C%2Fp%3E%0A

More coverage from the Future Forum

Spider-Man: No Way Home

Director: Jon Watts

Stars: Tom Holland, Zendaya, Jacob Batalon

Rating:*****

COMPANY%20PROFILE%20

%3Cp%3E%3Cstrong%3EName%3A%3C%2Fstrong%3E%20Haltia.ai%0D%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202023%0D%3Cbr%3E%3Cstrong%3ECo-founders%3A%3C%2Fstrong%3E%20Arto%20Bendiken%20and%20Talal%20Thabet%0D%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%2C%20UAE%0D%3Cbr%3E%3Cstrong%3EIndustry%3A%3C%2Fstrong%3E%20AI%0D%3Cbr%3E%3Cstrong%3ENumber%20of%20employees%3A%3C%2Fstrong%3E%2041%0D%3Cbr%3E%3Cstrong%3EFunding%3A%3C%2Fstrong%3E%20About%20%241.7%20million%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20Self%2C%20family%20and%20friends%26nbsp%3B%3C%2Fp%3E%0A

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20OneOrder%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%20March%202022%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Tamer%20Amer%20and%20Karim%20Maurice%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Cairo%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%20%3C%2Fstrong%3E82%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20Series%20A%3C%2Fp%3E%0A