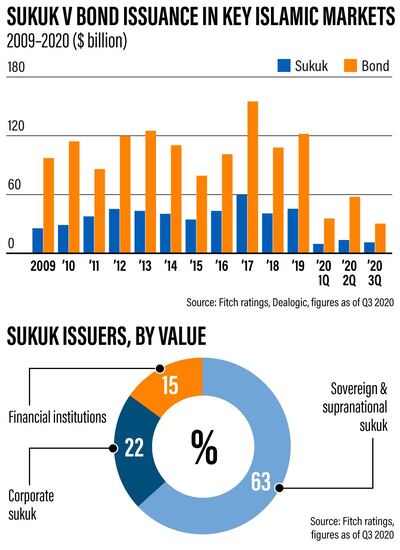

Over a 10-year period between 2009 and 2019, the annual growth rate of sukuk in terms of issuance volume has outstripped conventional bonds. Global sukuk registered a 5.2 per cent compound annual growth rate, compared to 2.3 per cent for conventional bonds. Annual growth rates alone do not convey the full story, though, as the conventional bond market towers over the sukuk market in volume terms.

The global bond market stood at $170 trillion at the end of last year, compared to $490 billion of global sukuk. A quick push of the calculator's buttons shows that the sukuk market is a paltry 0.3 per cent of the conventional bond market, although this is hardly an equitable comparison given the much longer history of conventional bonds and their universal appeal.

While bonds are accepted in every corner of the world, including in the core Islamic finance countries, sukuk remains heavily concentrated in Gulf Cooperation Council countries, Malaysia, Turkey and Indonesia. This brings a sense of reality that for all the much-touted phenomenal growth in Islamic finance, the sukuk market lags far behind conventional bonds, both in terms of issuance volumes and global acceptance.

The sukuk market represents roughly 20 percent of total Islamic finance assets of $2.4tn as of 2019. This is certainly a respectable achievement given that it stood at $25bn in 1995. However, after 25 years, Islamic banking assets continue to dominate the Islamic finance landscape, with a 72 percent share of the industry. Putting this into context, the global conventional bond market is already larger than the total global banking assets. Sukuk clearly has a very high mountain to climb to catch up and with rapid advancements in the technology and digital space, as well as in ESG investing there is a real danger the sukuk market could lose momentum and end up consigned to the margins of the financial markets.

The dual shock of lower oil prices and the economic crisis triggered by the Covid-19 pandemic has dampened sukuk issuance volumes so far this year. Core Islamic finance countries have either not tapped the sukuk market or opted for conventional bonds instead. GCC states have largely given sukuk a miss, with only Dubai and Bahrain issuing sukuk alongside bonds in dual tranche offerings. Between April and September, a total of $34bn in sovereign bonds were raised from the GCC. During the same period, only $2bn worth of sovereign sukuk were sold. Given the difference in these amounts, it is hard not to think of this as a lost opportunity for the sukuk market and the Islamic finance industry.

However, all is not lost as there have been positive developments in the form of the local currency sukuk and green sukuk issuance, as well as advancements in financial technology that could promote sukuk adoption.

Domestic sukuk issuance in Saudi Arabia increased by 45 percent year-on-year to 84 billion Saudi riyals ($22.4bn) in the first nine months of the year, according to Moody’s Investors Service. The government’s efforts to promote a more vibrant local currency sukuk market has yielded results. More efforts are needed to maintain and increase momentum but the Saudi domestic sukuk market seems to be heading in the right direction. The successful development of the domestic market in Saudi Arabia may also spur other GCC states to develop their own local currency sukuk markets.

Another bright spot in Islamic finance is the growth of green sukuk – Sharia-compliant instruments for financing environmentally sustainable projects such as the development of solar plants and other renewable energy schemes.

Green sukuk seems to be gaining traction in the GCC. In May last year, Majid Al Futtaim became the first corporate entity from the GCC to complete a benchmark green sukuk with a $600m ten-year fixed rate issuance and in November, the Islamic Development Bank raised €1bn ($1.19bn) through a five-year green sukuk. More recently, Saudi Electricity Company sold $650m of green sukuk to finance the company’s existing and future green projects.

Islamic FinTech, though still nascent, has the potential to boost Islamic finance growth. The UK currently has the most Sharia-compliant FinTech startups ahead of core Islamic finance countries such as Malaysia, the UAE and Indonesia. Looking further ahead, the growing Muslim population in Europe offers significant opportunities for Islamic challenger banks and FinTech startups. Islamic peer-to-peer (P2P) financing and crowdfunding platforms targeting small and medium-sized enterprises (SMEs) have also emerged in the UK.

In Indonesia, an Islamic microfinance cooperative recently transacted the first ever micro-sukuk through a public blockchain platform. The industry is also looking towards Islamic financial institutions to lead the way by incorporating ESG elements in their business practices with a view to attracting a wave of interest in more ethical investment from conventional customers.

Islamic finance players hope these developments will help the industry to gain the momentum needed to achieve the forecast of $3.8bn of total assets by 2022, as projected by Thomson Reuters.

Lim Say Cheong is chief executive of Lootah Global Capital, a member of The Gulf Bond and Sukuk Association

What the law says

Micro-retirement is not a recognised concept or employment status under Federal Decree Law No. 33 of 2021 on the Regulation of Labour Relations (as amended) (UAE Labour Law). As such, it reflects a voluntary work-life balance practice, rather than a recognised legal employment category, according to Dilini Loku, senior associate for law firm Gateley Middle East.

“Some companies may offer formal sabbatical policies or career break programmes; however, beyond such arrangements, there is no automatic right or statutory entitlement to extended breaks,” she explains.

“Any leave taken beyond statutory entitlements, such as annual leave, is typically regarded as unpaid leave in accordance with Article 33 of the UAE Labour Law. While employees may legally take unpaid leave, such requests are subject to the employer’s discretion and require approval.”

If an employee resigns to pursue micro-retirement, the employment contract is terminated, and the employer is under no legal obligation to rehire the employee in the future unless specific contractual agreements are in place (such as return-to-work arrangements), which are generally uncommon, Ms Loku adds.

Why are asylum seekers being housed in hotels?

The number of asylum applications in the UK has reached a new record high, driven by those illegally entering the country in small boats crossing the English Channel.

A total of 111,084 people applied for asylum in the UK in the year to June 2025, the highest number for any 12-month period since current records began in 2001.

Asylum seekers and their families can be housed in temporary accommodation while their claim is assessed.

The Home Office provides the accommodation, meaning asylum seekers cannot choose where they live.

When there is not enough housing, the Home Office can move people to hotels or large sites like former military bases.

Founders: Abdulmajeed Alsukhan, Turki Bin Zarah and Abdulmohsen Albabtain.

Based: Riyadh

Offices: UAE, Vietnam and Germany

Founded: September, 2020

Number of employees: 70

Sector: FinTech, online payment solutions

Funding to date: $116m in two funding rounds

Investors: Checkout.com, Impact46, Vision Ventures, Wealth Well, Seedra, Khwarizmi, Hala Ventures, Nama Ventures and family offices

Red flags

- Promises of high, fixed or 'guaranteed' returns.

- Unregulated structured products or complex investments often used to bypass traditional safeguards.

- Lack of clear information, vague language, no access to audited financials.

- Overseas companies targeting investors in other jurisdictions - this can make legal recovery difficult.

- Hard-selling tactics - creating urgency, offering 'exclusive' deals.

Courtesy: Carol Glynn, founder of Conscious Finance Coaching

In numbers

1,000 tonnes of waste collected daily:

- 800 tonnes converted into alternative fuel

- 150 tonnes to landfill

- 50 tonnes sold as scrap metal

800 tonnes of RDF replaces 500 tonnes of coal

Two conveyor lines treat more than 350,000 tonnes of waste per year

25 staff on site

Killing of Qassem Suleimani

UAE currency: the story behind the money in your pockets

Zayed Sustainability Prize

Libya's Gold

UN Panel of Experts found regime secretly sold a fifth of the country's gold reserves.

The panel’s 2017 report followed a trail to West Africa where large sums of cash and gold were hidden by Abdullah Al Senussi, Qaddafi’s former intelligence chief, in 2011.

Cases filled with cash that was said to amount to $560m in 100 dollar notes, that was kept by a group of Libyans in Ouagadougou, Burkina Faso.

A second stash was said to have been held in Accra, Ghana, inside boxes at the local offices of an international human rights organisation based in France.

Killing of Qassem Suleimani

The five pillars of Islam

1. Fasting

2. Prayer

3. Hajj

4. Shahada

5. Zakat

Living in...

This article is part of a guide on where to live in the UAE. Our reporters will profile some of the country’s most desirable districts, provide an estimate of rental prices and introduce you to some of the residents who call each area home.

Ant-Man%20and%20the%20Wasp%3A%20Quantumania

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EPeyton%20Reed%3Cbr%3E%3Cbr%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Paul%20Rudd%2C%20Evangeline%20Lilly%2C%20Jonathan%20Majors%3Cbr%3E%3Cbr%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E2%2F5%3C%2Fp%3E%0A

More coverage from the Future Forum

Global state-owned investor ranking by size

|

1.

|

United States

|

|

2.

|

China

|

|

3.

|

UAE

|

|

4.

|

Japan

|

|

5

|

Norway

|

|

6.

|

Canada

|

|

7.

|

Singapore

|

|

8.

|

Australia

|

|

9.

|

Saudi Arabia

|

|

10.

|

South Korea

|

Killing of Qassem Suleimani

The smuggler

Eldarir had arrived at JFK in January 2020 with three suitcases, containing goods he valued at $300, when he was directed to a search area.

Officers found 41 gold artefacts among the bags, including amulets from a funerary set which prepared the deceased for the afterlife.

Also found was a cartouche of a Ptolemaic king on a relief that was originally part of a royal building or temple.

The largest single group of items found in Eldarir’s cases were 400 shabtis, or figurines.

Khouli conviction

Khouli smuggled items into the US by making false declarations to customs about the country of origin and value of the items.

According to Immigration and Customs Enforcement, he provided “false provenances which stated that [two] Egyptian antiquities were part of a collection assembled by Khouli's father in Israel in the 1960s” when in fact “Khouli acquired the Egyptian antiquities from other dealers”.

He was sentenced to one year of probation, six months of home confinement and 200 hours of community service in 2012 after admitting buying and smuggling Egyptian antiquities, including coffins, funerary boats and limestone figures.

For sale

A number of other items said to come from the collection of Ezeldeen Taha Eldarir are currently or recently for sale.

Their provenance is described in near identical terms as the British Museum shabti: bought from Salahaddin Sirmali, "authenticated and appraised" by Hossen Rashed, then imported to the US in 1948.

- An Egyptian Mummy mask dating from 700BC-30BC, is on offer for £11,807 ($15,275) online by a seller in Mexico

- A coffin lid dating back to 664BC-332BC was offered for sale by a Colorado-based art dealer, with a starting price of $65,000

- A shabti that was on sale through a Chicago-based coin dealer, dating from 1567BC-1085BC, is up for $1,950

The White Lotus: Season three

Creator: Mike White

Starring: Walton Goggins, Jason Isaacs, Natasha Rothwell

Rating: 4.5/5

More from Neighbourhood Watch:

GAC GS8 Specs

Engine: 2.0-litre 4cyl turbo

Power: 248hp at 5,200rpm

Torque: 400Nm at 1,750-4,000rpm

Transmission: 8-speed auto

Fuel consumption: 9.1L/100km

On sale: Now

Price: From Dh149,900

Brief scores:

Manchester City 2

Gundogan 27', De Bruyne 85'

Crystal Palace 3

Schlupp 33', Townsend 35', Milivojevic 51' (pen)

Man of the Match: Andros Townsend (Crystal Palace)

Read more about the coronavirus

Studying addiction

This month, Dubai Medical College launched the Middle East’s first master's programme in addiction science.

Together with the Erada Centre for Treatment and Rehabilitation, the college offers a two-year master’s course as well as a one-year diploma in the same subject.

The move was announced earlier this year and is part of a new drive to combat drug abuse and increase the region’s capacity for treating drug addiction.

Brahmastra%3A%20Part%20One%20-%20Shiva

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EAyan%20Mukerji%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%20%3C%2Fstrong%3ERanbir%20Kapoor%2C%20Alia%20Bhatt%20and%20Amitabh%20Bachchan%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%202%2F5%3C%2Fp%3E%0A

What's in the deal?

Agreement aims to boost trade by £25.5bn a year in the long run, compared with a total of £42.6bn in 2024

India will slash levies on medical devices, machinery, cosmetics, soft drinks and lamb.

India will also cut automotive tariffs to 10% under a quota from over 100% currently.

Indian employees in the UK will receive three years exemption from social security payments

India expects 99% of exports to benefit from zero duty, raising opportunities for textiles, marine products, footwear and jewellery

ICC T20 Rankings

1. India - 270 ranking points

2. England - 265 points

3. Pakistan - 261 points

4. South Africa - 253 points

5. Australia - 251 points

6. New Zealand - 250 points

7. West Indies - 240 points

8. Bangladesh - 233 points

9. Sri Lanka - 230 points

10. Afghanistan - 226 points

Results

5pm: Wadi Nagab – Maiden (PA) Dh80,000 (Turf) 1,200m; Winner: Al Falaq, Antonio Fresu (jockey), Ahmed Al Shemaili (trainer)

5.30pm: Wadi Sidr – Handicap (PA) Dh80,000 (T) 1,200m; Winner: AF Majalis, Tadhg O’Shea, Ernst Oertel

6pm: Wathba Stallions Cup – Handicap (PA) Dh70,000 (T) 2,200m; Winner: AF Fakhama, Fernando Jara, Mohamed Daggash

6.30pm: Wadi Shees – Handicap (PA) Dh80,000 (T) 2,200m; Winner: Mutaqadim, Antonio Fresu, Ibrahim Al Hadhrami

7pm: Arabian Triple Crown Round-1 – Listed (PA) Dh230,000 (T) 1,600m; Winner: Bahar Muscat, Antonio Fresu, Ibrahim Al Hadhrami

7.30pm: Wadi Tayyibah – Maiden (TB) Dh80,000 (T) 1,600m; Winner: Poster Paint, Patrick Cosgrave, Bhupat Seemar

Federer's 19 grand slam titles

Australian Open (5 titles) - 2004 bt Marat Safin; 2006 bt Marcos Baghdatis; 2007 bt Fernando Gonzalez; 2010 bt Andy Murray; 2017 bt Rafael Nadal

French Open (1 title) - 2009 bt Robin Soderling

Wimbledon (8 titles) - 2003 bt Mark Philippoussis; 2004 bt Andy Roddick; 2005 bt Andy Roddick; 2006 bt Rafael Nadal; 2007 bt Rafael Nadal; 2009 bt Andy Roddick; 2012 bt Andy Murray; 2017 bt Marin Cilic

US Open (5 titles) - 2004 bt Lleyton Hewitt; 2005 bt Andre Agassi; 2006 bt Andy Roddick; 2007 bt Novak Djokovic; 2008 bt Andy Murray

The Birkin bag is made by Hermès.

It is named after actress and singer Jane Birkin

Noone from Hermès will go on record to say how much a new Birkin costs, how long one would have to wait to get one, and how many bags are actually made each year.

Napoleon

%3Cp%3E%3Cstrong%3EDirector%3C%2Fstrong%3E%3A%20Ridley%20Scott%3Cbr%3E%3Cstrong%3EStars%3C%2Fstrong%3E%3A%20Joaquin%20Phoenix%2C%20Vanessa%20Kirby%2C%20Tahar%20Rahim%3Cbr%3E%3Cstrong%3ERating%3C%2Fstrong%3E%3A%202%2F5%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

COMPANY PROFILE

Company name: BorrowMe (BorrowMe.com)

Date started: August 2021

Founder: Nour Sabri

Based: Dubai, UAE

Sector: E-commerce / Marketplace

Size: Two employees

Funding stage: Seed investment

Initial investment: $200,000

Investors: Amr Manaa (director, PwC Middle East)