Global sukuk issuance is set to bounce back in 2021 to as much as $151 billion as borrowers rush to sell Sharia-compliant bonds amid low interest rates, Mohamed Damak, the global head of Islamic finance at ratings agency S&P Global, said.

The economic recovery in Malaysia, Indonesia and the GCC – three core Islamic finance markets – and the ample liquidity provided by central banks around the world will drive growth in the market, he said in a report.

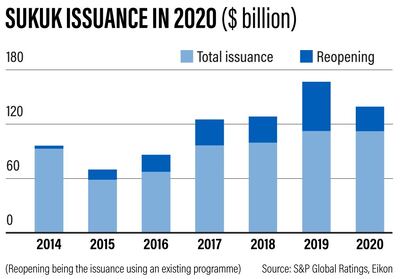

Total issuance in 2021 is forecast to be in the $140bn-$151bn range. At the lower end of estimate, the size of the market this year would be just above the $139.6bn total seen in 2020, but lower than the $167bn record witnessed in 2019.

“Market conditions should remain buoyant throughout 2021, with record-low interest rates and abundant liquidity,” Mr Damak said.

“We also expect GDP growth in the core Islamic finance countries … to recover from a sharp recession in 2020 [and] we assume that the price of oil will stabilise at about $50 per barrel in 2021. Together, these factors underpin a stronger performance by the global sukuk market in 2021.”

The ratings agency expects $65bn of sukuk to mature this year, with part of that sum likely to be refinanced, which will help to drive the volume of issuances.

While some sovereigns in core Islamic finance countries will tap the sukuk market more aggressively in 2021, the market will also benefit from the increased sale of corporate Islamic bonds.

“Their activity was muted in 2020 as they held on to cash and deferred capital expenditure because of the pandemic," Mr Damak said. “They [corporate sector issuers] are likely to execute some of this capex in 2021, thereby necessitating access to capital markets.”

First Abu Dhabi Bank, the UAE's biggest bank by assets, on Monday said it raised $500m through the lowest ever yield on a five-year dollar-denominated sukuk by a Middle East and North Africa bank. Pricing on the first dollar sukuk deal of the year represented a “negative new issue premium” when compared to FAB’s January 2025 maturity sukuk, the lender added.

Central banks around the world have rolled out monetary stimulus measures last year to support financial markets and limit the impact of the pandemic on their economies. Interest rates have been set near or below zero in many countries.

Lower interest rates are expected to remain in place this year and beyond, as the global economy continues to recover. The International Monetary Fund expects global GDP to expand 5.2 per cent in 2021 after contracting 4.4 per cent last year.

“We expect central banks will keep interest rates exceptionally low and continue to offer liquidity support as necessary,” Mr Damak said.

S&P estimate a sukuk market revival is based on the assumption that the pandemic will come under control gradually in the core countries from the second quarter of 2021, through a combination of vaccines, medical treatments and testing.

Market conditions should remain buoyant throughout 2021, with record-low interest rates and abundant liquidity

However, downside risks for the core Islamic finance countries remain significant, including their ability to control the pandemic even with the availability of vaccines.

“The main risk is that further waves of Covid-19 and the requisite containment measures may harm the countries' fragile economic recovery,” Mr Damak said. “This could affect the countries directly, or indirectly through lower commodity prices, exports and capital flows.”

S&P predicts the number of defaults or restructurings among sukuk issuers with low credit quality will increase in 2021 as “regulatory forbearance measures come to an end”.

“This will test the robustness of the legal documents used for sukuk issuances,” it warned.

Mr Damak expects a unified global legal and regulatory framework for Islamic finance market to emerge over the next 12 to18 months.

“We believe that such a framework could help resolve the lack of standardisation and harmonisation that the Islamic finance industry has faced for decades.”

Manchester City 4

Otamendi (52) Sterling (59) Stones (67) Brahim Diaz (81)

Real Madrid 1

Oscar (90)

The years Ramadan fell in May

Retirement funds heavily invested in equities at a risky time

Pension funds in growing economies in Asia, Latin America and the Middle East have a sharply higher percentage of assets parked in stocks, just at a time when trade tensions threaten to derail markets.

Retirement money managers in 14 geographies now allocate 40 per cent of their assets to equities, an 8 percentage-point climb over the past five years, according to a Mercer survey released last week that canvassed government, corporate and mandatory pension funds with almost $5 trillion in assets under management. That compares with about 25 per cent for pension funds in Europe.

The escalating trade spat between the US and China has heightened fears that stocks are ripe for a downturn. With tensions mounting and outcomes driven more by politics than economics, the S&P 500 Index will be on course for a “full-scale bear market” without Federal Reserve interest-rate cuts, Citigroup’s global macro strategy team said earlier this week.

The increased allocation to equities by growth-market pension funds has come at the expense of fixed-income investments, which declined 11 percentage points over the five years, according to the survey.

Hong Kong funds have the highest exposure to equities at 66 per cent, although that’s been relatively stable over the period. Japan’s equity allocation jumped 13 percentage points while South Korea’s increased 8 percentage points.

The money managers are also directing a higher portion of their funds to assets outside of their home countries. On average, foreign stocks now account for 49 per cent of respondents’ equity investments, 4 percentage points higher than five years ago, while foreign fixed-income exposure climbed 7 percentage points to 23 per cent. Funds in Japan, South Korea, Malaysia and Taiwan are among those seeking greater diversification in stocks and fixed income.

• Bloomberg

Breast cancer in men: the facts

1) Breast cancer is men is rare but can develop rapidly. It usually occurs in those over the ages of 60, but can occasionally affect younger men.

2) Symptoms can include a lump, discharge, swollen glands or a rash.

3) People with a history of cancer in the family can be more susceptible.

4) Treatments include surgery and chemotherapy but early diagnosis is the key.

5) Anyone concerned is urged to contact their doctor

Sleep Well Beast

The National

4AD

PREMIER LEAGUE FIXTURES

All times UAE ( 4 GMT)

Saturday

West Ham United v Tottenham Hotspur (3.30pm)

Burnley v Huddersfield Town (7pm)

Everton v Bournemouth (7pm)

Manchester City v Crystal Palace (7pm)

Southampton v Manchester United (7pm)

Stoke City v Chelsea (7pm)

Swansea City v Watford (7pm)

Leicester City v Liverpool (8.30pm)

Sunday

Brighton and Hove Albion v Newcastle United (7pm)

Monday

Arsenal v West Bromwich Albion (11pm)

Aggro%20Dr1ft

%3Cp%3EDirector%3A%20Harmony%20Korine%3Cbr%3EStars%3A%20Jordi%20Molla%2C%20Travis%20Scott%3Cbr%3ERating%3A%202%2F5%3C%2Fp%3E%0A

AI traffic lights to ease congestion at seven points to Sheikh Zayed bin Sultan Street

The seven points are:

Shakhbout bin Sultan Street

Dhafeer Street

Hadbat Al Ghubainah Street (outbound)

Salama bint Butti Street

Al Dhafra Street

Rabdan Street

Umm Yifina Street exit (inbound)

EPL's youngest

- Ethan Nwaneri (Arsenal)

15 years, 181 days old

- Max Dowman (Arsenal)

15 years, 235 days old

- Jeremy Monga (Leicester)

15 years, 271 days old

- Harvey Elliott (Fulham)

16 years, 30 days old

- Matthew Briggs (Fulham)

16 years, 68 days old

The Pope's itinerary

Sunday, February 3, 2019 - Rome to Abu Dhabi

1pm: departure by plane from Rome / Fiumicino to Abu Dhabi

10pm: arrival at Abu Dhabi Presidential Airport

Monday, February 4

12pm: welcome ceremony at the main entrance of the Presidential Palace

12.20pm: visit Abu Dhabi Crown Prince at Presidential Palace

5pm: private meeting with Muslim Council of Elders at Sheikh Zayed Grand Mosque

6.10pm: Inter-religious in the Founder's Memorial

Tuesday, February 5 - Abu Dhabi to Rome

9.15am: private visit to undisclosed cathedral

10.30am: public mass at Zayed Sports City – with a homily by Pope Francis

12.40pm: farewell at Abu Dhabi Presidential Airport

1pm: departure by plane to Rome

5pm: arrival at the Rome / Ciampino International Airport

The specs

Engine: 4.0-litre, six-cylinder

Transmission: six-speed manual

Power: 395bhp

Torque: 420Nm

Price: from Dh321,200

On sale: now

FIXTURES

All games 6pm UAE on Sunday:

Arsenal v Watford

Burnley v Brighton

Chelsea v Wolves

Crystal Palace v Tottenham

Everton v Bournemouth

Leicester v Man United

Man City v Norwich

Newcastle v Liverpool

Southampton v Sheffield United

West Ham v Aston Villa

Russia's Muslim Heartlands

Dominic Rubin, Oxford

UAE currency: the story behind the money in your pockets

The specs: 2018 BMW R nineT Scrambler

Price, base / as tested Dh57,000

Engine 1,170cc air/oil-cooled flat twin four-stroke engine

Transmission Six-speed gearbox

Power 110hp) @ 7,750rpm

Torque 116Nm @ 6,000rpm

Fuel economy, combined 5.3L / 100km

Living in...

This article is part of a guide on where to live in the UAE. Our reporters will profile some of the country’s most desirable districts, provide an estimate of rental prices and introduce you to some of the residents who call each area home.

Our family matters legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

RESULTS

6.30pm: Maiden (TB) Dh 82,500 (Dirt) 1.600m

Winner: Miller’s House, Richard Mullen (jockey), Satish Seemar (trainer).

7.05pm: Maiden (TB) Dh 82,500 (D) 2,000m

Winner: Kanood, Adrie de Vries, Fawzi Nass.

7.50pm: Handicap (TB) Dh 82,500 (D) 1,600m

Winner: Gervais, Sandro Paiva, Ali Rashid Al Raihe.

8.15pm: The Garhoud Sprint Listed (TB) Dh 132,500 (D) 1,200m

Winner: Important Mission, Royston Ffrench, Salem bin Ghadayer.

8.50pm: The Entisar Listed (TB) Dh 132,500 (D) 2,000m

Winner: Firnas, Xavier Ziani, Salem bin Ghadayer.

9.25pm: Conditions (TB) Dh 120,000 (D) 1,400m

Winner: Zhou Storm, Connor Beasley, Ali Rashid Al Raihe.

SERIE A FIXTURES

Friday Sassuolo v Benevento (Kick-off 11.45pm)

Saturday Crotone v Spezia (6pm), Torino v Udinese (9pm), Lazio v Verona (11.45pm)

Sunday Cagliari v Inter Milan (3.30pm), Atalanta v Fiorentina (6pm), Napoli v Sampdoria (6pm), Bologna v Roma (6pm), Genoa v Juventus (9pm), AC Milan v Parma (11.45pm)