It was a "baptism of fire" for Ahmed Abdelaal when he took the reins of Mashreq, one of the oldest family-controlled financial institutions in Dubai, from its chief executive of almost three decades, Abdulaziz Al Ghurair, in 2019.

As if the intensifying trade war between the US and China was not enough to worry banks amid disruption to businesses and slowing economic growth, Covid-19 struck in 2020 and everything that could go wrong did go wrong for companies, financial institutions and the economy at large.

Mr Abdelaal, in his first role as chief executive of a bank, found himself diving headfirst into crisis management mode.

Ensuring the safety of more than 6,000 staff in markets across the Middle East, Asia and Europe, and serving customers as best as the bank could amid lockdowns was a multi-front fight and an all-consuming task for the top executive in his early fifties.

“In the beginning, [2020] was a great year and everything was going well. But all of a sudden, you have the trade war between China and the US [intensifying] and then the year culminating in [the] pandemic and it was really, really challenging,” Mr Abdelaal, a banking veteran of 30 years, tells The National.

Banking veteran

An alumnus of both London Business School and Harvard Business School, he joined Mashreq after a 10-year stint at HSBC Middle East, where his last role was to lead the corporate banking franchise in the broader Middle East, North Africa and Turkey region for Europe’s biggest bank.

He moved to Mashreq as group head of corporate and investment banking in November 2017, allowing him time to become familiar with the culture, understand the business dynamics and develop chemistry with Mr Al Ghurair, who was instrumental in building up the lender to become one of the fastest-growing financial institutions in the region.

“One fine day, he [Mr Al Ghurair] came and said: 'I would like you to lead the next phase of growth for Mashreq,' and it came to me as a surprise, because I didn't expect it to happen that soon,” he says.

“I didn’t think that it was on the cards [that soon] when he had hired me to lead the corporate and investment banking platform.”

Changing the guard

The changing of the guard at one of Dubai’s oldest financial institutions took place in October 2019 when Mr Al Ghurair became chairman of the board of the Al Ghurair family-controlled lender, leaving the bank's day-to-day affairs to Mr Abdelaal.

“We had planned this transition some time ago and Ahmed [Abdelaal] was brought on to the leadership team … with that in mind,” Mr Al Ghurair said at the time.

But filling the shoes of someone like Mr Al Ghurair, who apart from being one of the most recognised bankers in the Middle East, was chairman of the UAE Banks Federation, the former speaker of the Federal National Council, as well as a well-versed businessman with a disciplined mentality, was a daunting prospect, Mr Abdelaal says.

“He is multifaceted, let me put it this way, so taking over from him was a challenge, but also, it was an opportunity because … [he] agreed to extend help to someone like me who was doing his first CEO job,” he says.

The fact that Mr Al Ghurair knew the organisation and its DNA better than anyone else helped Mr Abdelaal navigate the typical tests facing a new corporate leader, be they managerial or board room pressure.

“So, as much as it was a challenge to fill his shoes, it was also an opportunity for me to leverage that to my advantage to the max,” he says.

The journey of recovering from the shock of the pandemic to transforming the bank into a next-generation, technologically advanced financial institution for the digital age was fraught with multiple challenges.

And no challenge was greater than the change of culture; a journey which, he says, continues.

“You can change the rules, policies and procedures, and you can change people and KPIs [key performance indicators], but if you don't change the culture that comes with it, nothing works,” Mr Abdelaal says.

Over the past four years, the lender has embarked on the journey to “change the way we think down at the DNA level, to have client experience as the ultimate measure for everything that we do”, he adds.

A people person

The first order of the business once he took the helm was the town hall meeting, where Mr Abdelaal also appointed himself as Mashreq’s chief people officer and the chief future officer.

“I said [to the staff] that [the] number one priority in my mind is people and number two is client experience, and if we deliver on one and two, we can easily deliver on three, which is shareholder value,” he says.

He has also charted the future course of the legacy lender. The ultimate objective is to morph the institution into a banking as a service (BaaS) platform, essentially a bank for hire for third parties.

BaaS refers to a system that allows non-banking entities such as FinTech companies, start-ups, online retailers and even major corporations to leverage the infrastructure of a traditional bank to extend financial services to their customers without the need to hold a full banking licence.

They can offer services including opening of accounts, payment processing and loans, and branded credit cards through application programming interfaces (APIs) that can be integrated with other companies' systems.

More than just a bank

“Not a bank” is what Mashreq aims to be in five years, Mr Abdelaal says.

“I see [it] as a facilitator of financial services, or provider of financial services as a service rather than an interface for clients.”

Major telecoms operators and FinTechs, as well as online retailers and start-ups are looking to build their own financial platforms to capitalise on a fast-growing BaaS market.

The Middle East and Africa's BaaS market was valued at $66.14 billion last year and the industry’s aggregate revenue is expected to grow 7.4 per cent annually between 2024 and 2030, reaching more than $109 billion by the end of this decade, according to a report by Steller Market Research.

“What we are trying to do right now is to offer [that] rather than you having to do it from scratch, building infrastructure, having to [comply] with the regulatory requirements that are dynamically evolving by the minute, I will do that on your behalf, and you can enjoy the interface,” Mr Abdelaal says.

Future strategy

The bank’s recent partnership with the UAE’s home-grown retailer Noon and its non-resident Indian customers being able to open bank accounts with Indian lenders are examples of Mashreq’s growing BaaS ambitions.

“This is the role that we want to play: rather than competing, facilitating,” he says.

The bank is heavily investing in its digitisation agenda, and it is also open to mergers and acquisitions opportunities that support its wider strategy objectives, he adds.

Mashreq has already cut its bricks-and-mortar branch network from 34 to seven across the UAE, and Mr Abdelaal says the asset-light model “speaks the language of the future” and is the way to growth.

The bank has acquired four times the number of clients every year that it gained through its old bricks-and-mortar network.

“Last year, we onboarded more than 400,000 new clients, purely using our digital channels.”

The digital model has also boosted Mashreq's operations and financial performance.

“Building resilience was the key because had we not built that in terms of investing in our infrastructure and in the right talent, we wouldn't have been able to stand up to the ever-changing dynamics in the region,” he says.

“You will not be able to answer to the challenge that you are facing from FinTechs or big techs, and [would] not be able to answer the ever-changing expectations of your clients.”

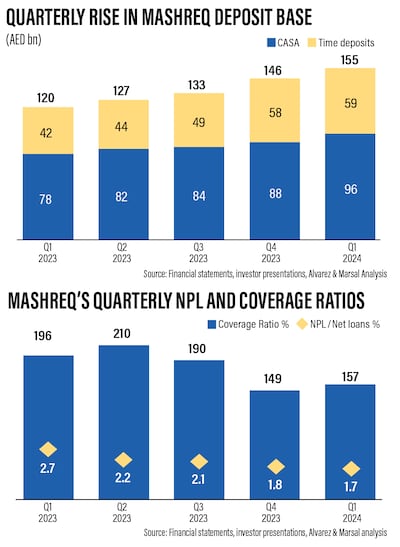

The lender reported net profit of Dh2 billion ($544.6 million) in the first quarter of this year, a 25 per cent year-on-year increase. Net income before the 9 per cent corporate tax climbed 36 per cent on annual basis to Dh2.3 billion.

Exceptional business growth, healthy client margins, the current interest rate environment, and low-risk costs were the main drivers of profitability, Mashreq said in a bourse filing last month.

The quarterly income builds on Mashreq’s 2023 performance, when the bank delivered the highest return on equity in the market as well as the lowest industrywide loan impairment ratio, Mr Abdelaal says.

He sees continued growth in business driven by all segments of the bank, including its revamped wealth management offering, as well as its strategies for retail clients.

Growth beyond borders

Mashreq remains upbeat about the economic strength of the Gulf economies, despite geopolitical uncertainties, and Mr Abdelaal says the lender plans to export its digital model in the UAE to other GCC countries as well as markets beyond the region.

The lender has already received in-principle approval from Oman’s banking regulator to start operations in the sultanate and it expects Saudi Central Bank Sama to grant approval for a full banking licence in the kingdom in the next 12 months.

In Pakistan, Mashreq is in the final stretch of talks with regulators and the lender hopes to launch its digital bank in the South Asian country of 245 million people soon, he says.

The focus right now is on how to capitalise on “what we have been delivering so far and how we're going to grow this in the years to come”, Mr Abdelaal says.

“I keep telling everyone, whatever we are doing this year is for the next or the following year.”

With his foot firmly on the accelerator to speed up Mashreq’s digital transformation, growth and expansion is high on Mr Abdelaal’s priority list.

He wants his legacy to be about people, about the business he is transforming and about the impact he is having on the lives of those he works with on a daily basis.

“When I leave, the legacy that I want to leave is that when my name pops up at any given point of time, whether I'm there or not, people will say good stuff [about me] as a professional [and] as a human being,” Mr Abdelaal says.