The California Department of Financial Protection and Innovation has seized First Republic Bank, with JP Morgan Chase set to take over the failed lender after efforts to rescue it failed.

The DFPI appointed the Federal Deposit Insurance Corporation as receiver and accepted JP Morgan's bid to assume all deposits and purchase the assets of First Republic Bank, according to a statement on Monday.

As of April 13, First Republic Bank had about $229.1 billion in assets and $103.9 billion in deposits. According to the order of possession, the bank had $14.9 billion in available cash on hand as of close of business on April 28.

"The combination of continuing deposit outflows and replacing funding shortfalls with higher interest borrowings is not a sustainable business model. This has jeopardised the viability of the bank," the order said.

As a result, the DFPI said it took action in line with California financial laws after it deemed that First Republic was “conducting its business in an unsafe or unsound manner due to its present financial condition”, making it difficult for the bank to continue operating.

“Our government invited us and others to step up, and we did,” said Jamie Dimon, chairman and chief executive of JPMorgan.

“Our financial strength, capabilities and business model allowed us to develop a bid to execute the transaction in a way to minimise costs to the Deposit Insurance Fund.

“This acquisition modestly benefits our company overall, it is accretive to shareholders, it helps further advance our wealth strategy, and it is complementary to our existing franchise,” Mr Dimon said.

The agreement comes after financial turmoil engulfed mid-size regional banks in the US and led to the collapse of Silicon Valley Bank and Signature Bank last month.

JP Morgan led a group of 11 banks that extended a $30 billion lifeline to First Republic in March but the move failed to quell investor concerns.

Last week, San Francisco-based First Republic said it was taking steps to shore up its balance sheet and cut its workforce after deposits fell to about $104.5 billion in the first quarter of this year, from $176 billion in the fourth quarter of 2022, despite it receiving $30 billion from Bank of America, Citigroup, JP Morgan and Wells Fargo.

Without the cash provided by America’s largest banks, First Republic’s decline in deposits would have been about $102 billion during the March banking crisis.

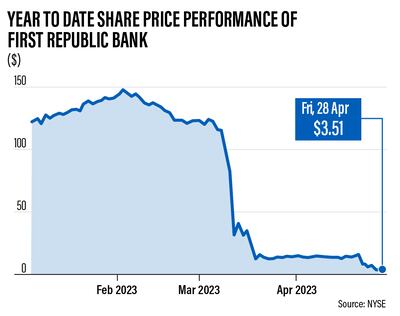

Despite First Republic's assurances, the share price of the lender tumbled and was down more than 97 per cent so far this year as of market close on Friday.

As part of the transaction announced on Monday, First Republic Bank’s 84 offices in eight states will reopen as branches of JP Morgan on Monday during normal business hours.

All depositors of First Republic Bank will become depositors of JP Morgan and will have full access to all of their deposits.

Deposits will continue to be insured by the FDIC and customers do not need to change their banking relationship in order to retain their deposit insurance cover up to applicable limits.

The FDIC insures deposits up to $250,000 per each individual account and institution.

The FDIC said on Monday that First Republic customers should continue to use their existing branch until they received notice on the completion of system changes that will allow other JP Morgan branches to process their accounts as well.

The FDIC and JP Morgan are also entering into a loss-share transaction on single family, residential and commercial loans it purchased from the former First Republic Bank.

As a result of this transaction, the substantial majority of First Republic ’s assets, including approximately $173 billion of loans and approximately $30 billion of securities have been acquired.

About $92 billion of deposits, including $30 billion of large bank deposits, will be repaid post-close or eliminated as part of the consolidation.

The FDIC will provide loss share agreements covering acquired single-family residential mortgage loans and commercial loans, as well as $50 billion of five-year, fixed-rate term financing.

JP Morgan is not assuming First Republic’s corporate debt or preferred stock.

JP Morgan said it expects an upfront, one-time, post-tax gain of approximately $2.6 billion, which does not reflect the approximately $2 billion dollars of post-tax restructuring costs anticipated over the next 18 months.

It said it remains very well-capitalised and maintains healthy liquidity buffers.

“The FDIC as receiver and JP Morgan Chase, National Association, will share in the losses and potential recoveries on the loans covered by the loss-share agreement,” the FDIC said.

“The loss-share transaction is projected to maximise recoveries on the assets by keeping them in the private sector. The transaction is also expected to minimise disruptions for loan customers.”

In addition, JP Morgan will assume all qualified financial contracts.

“The resolution of First Republic Bank involved a highly competitive bidding process and resulted in a transaction consistent with the least-cost requirements of the Federal Deposit Insurance Act,” the statement said.

The FDIC estimates the cost to the Deposit Insurance Fund will be about $13 billion, but said the final cost would be determined when it terminates the receivership.

"Traders understand that most of these [bank] failures are taking place due to the ultra-high interest rates, but the interesting thing is that the failure of this bank will change nothing for the Fed as it will still continue with its normal plans," said Naeem Aslam, chief investment officer at Zaye Capital Markets.

"This week we will see the Fed hike the interest rate by 25 basis points, but the important thing to watch out for now is how their future trajectory will look."

Brief scores:

QPR 0

Watford 1

Capoue 45' 1

UAE currency: the story behind the money in your pockets

The Sand Castle

Director: Matty Brown

Stars: Nadine Labaki, Ziad Bakri, Zain Al Rafeea, Riman Al Rafeea

Rating: 2.5/5

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

COMPANY PROFILE

Name: Kumulus Water

Started: 2021

Founders: Iheb Triki and Mohamed Ali Abid

Based: Tunisia

Sector: Water technology

Number of staff: 22

Investment raised: $4 million

Global state-owned investor ranking by size

|

1.

|

United States

|

|

2.

|

China

|

|

3.

|

UAE

|

|

4.

|

Japan

|

|

5

|

Norway

|

|

6.

|

Canada

|

|

7.

|

Singapore

|

|

8.

|

Australia

|

|

9.

|

Saudi Arabia

|

|

10.

|

South Korea

|

How to wear a kandura

Dos

- Wear the right fabric for the right season and occasion

- Always ask for the dress code if you don’t know

- Wear a white kandura, white ghutra / shemagh (headwear) and black shoes for work

- Wear 100 per cent cotton under the kandura as most fabrics are polyester

Don’ts

- Wear hamdania for work, always wear a ghutra and agal

- Buy a kandura only based on how it feels; ask questions about the fabric and understand what you are buying

BOSH!'s pantry essentials

Nutritional yeast

This is Firth's pick and an ingredient he says, "gives you an instant cheesy flavour". He advises making your own cream cheese with it or simply using it to whip up a mac and cheese or wholesome lasagne. It's available in organic and specialist grocery stores across the UAE.

Seeds

"We've got a big jar of mixed seeds in our kitchen," Theasby explains. "That's what you use to make a bolognese or pie or salad: just grab a handful of seeds and sprinkle them over the top. It's a really good way to make sure you're getting your omegas."

Umami flavours

"I could say soya sauce, but I'll say all umami-makers and have them in the same batch," says Firth. He suggests having items such as Marmite, balsamic vinegar and other general, dark, umami-tasting products in your cupboard "to make your bolognese a little bit more 'umptious'".

Onions and garlic

"If you've got them, you can cook basically anything from that base," says Theasby. "These ingredients are so prevalent in every world cuisine and if you've got them in your cupboard, then you know you've got the foundation of a really nice meal."

Your grain of choice

Whether rice, quinoa, pasta or buckwheat, Firth advises always having a stock of your favourite grains in the cupboard. "That you, you have an instant meal and all you have to do is just chuck a bit of veg in."

'Young girls thinking of big ideas'

Words come easy for aspiring writer Afra Al Muhairb. The business side of books, on the other hand, is entirely foreign to the 16-year-old Emirati. So, she followed her father’s advice and enroled in the Abu Dhabi Education Council’s summer entrepreneurship course at Abu Dhabi University hoping to pick up a few new skills.

“Most of us have this dream of opening a business,” said Afra, referring to her peers are “young girls thinking of big ideas.”

In the three-week class, pupils are challenged to come up with a business and develop an operational and marketing plan to support their idea. But, the learning goes far beyond sales and branding, said teacher Sonia Elhaj.

“It’s not only about starting up a business, it’s all the meta skills that goes with it -- building self confidence, communication,” said Ms Elhaj. “It’s a way to coach them and to harness ideas and to allow them to be creative. They are really hungry to do this and be heard. They are so happy to be actually doing something, to be engaged in creating something new, not only sitting and listening and getting new information and new knowledge. Now they are applying that knowledge.”

Afra’s team decided to focus their business idea on a restaurant modelled after the Leaning Tower of Pisa. Each level would have a different international cuisine and all the meat would be halal. The pupils thought of this after discussing a common problem they face when travelling abroad.

“Sometimes we find the struggle of finding halal food, so we just eat fish and cheese, so it’s hard for us to spend 20 days with fish and cheese,” said Afra. “So we made this tower so every person who comes – from Africa, from America – they will find the right food to eat.”

rpennington@thenational.ae

LIVING IN...

This article is part of a guide on where to live in the UAE. Our reporters will profile some of the country’s most desirable districts, provide an estimate of rental prices and introduce you to some of the residents who call each area home.

Where to donate in the UAE

The Emirates Charity Portal

You can donate to several registered charities through a “donation catalogue”. The use of the donation is quite specific, such as buying a fan for a poor family in Niger for Dh130.

The General Authority of Islamic Affairs & Endowments

The site has an e-donation service accepting debit card, credit card or e-Dirham, an electronic payment tool developed by the Ministry of Finance and First Abu Dhabi Bank.

Al Noor Special Needs Centre

You can donate online or order Smiles n’ Stuff products handcrafted by Al Noor students. The centre publishes a wish list of extras needed, starting at Dh500.

Beit Al Khair Society

Beit Al Khair Society has the motto “From – and to – the UAE,” with donations going towards the neediest in the country. Its website has a list of physical donation sites, but people can also contribute money by SMS, bank transfer and through the hotline 800-22554.

Dar Al Ber Society

Dar Al Ber Society, which has charity projects in 39 countries, accept cash payments, money transfers or SMS donations. Its donation hotline is 800-79.

Dubai Cares

Dubai Cares provides several options for individuals and companies to donate, including online, through banks, at retail outlets, via phone and by purchasing Dubai Cares branded merchandise. It is currently running a campaign called Bookings 2030, which allows people to help change the future of six underprivileged children and young people.

Emirates Airline Foundation

Those who travel on Emirates have undoubtedly seen the little donation envelopes in the seat pockets. But the foundation also accepts donations online and in the form of Skywards Miles. Donated miles are used to sponsor travel for doctors, surgeons, engineers and other professionals volunteering on humanitarian missions around the world.

Emirates Red Crescent

On the Emirates Red Crescent website you can choose between 35 different purposes for your donation, such as providing food for fasters, supporting debtors and contributing to a refugee women fund. It also has a list of bank accounts for each donation type.

Gulf for Good

Gulf for Good raises funds for partner charity projects through challenges, like climbing Kilimanjaro and cycling through Thailand. This year’s projects are in partnership with Street Child Nepal, Larchfield Kids, the Foundation for African Empowerment and SOS Children's Villages. Since 2001, the organisation has raised more than $3.5 million (Dh12.8m) in support of over 50 children’s charities.

Noor Dubai Foundation

Sheikh Mohammed bin Rashid Al Maktoum launched the Noor Dubai Foundation a decade ago with the aim of eliminating all forms of preventable blindness globally. You can donate Dh50 to support mobile eye camps by texting the word “Noor” to 4565 (Etisalat) or 4849 (du).

UAE currency: the story behind the money in your pockets

Armies of Sand

By Kenneth Pollack (Oxford University Press)

AWARDS

%3Cp%3E%3Cstrong%3EBest%20Male%20black%20belt%3A%20%3C%2Fstrong%3ELucas%20Protasio%20(BRA)%3Cbr%3E%3Cstrong%3EBest%20female%20black%20belt%3A%20%3C%2Fstrong%3EJulia%20Alves%20(BRA)%3Cbr%3E%3Cstrong%3EBest%20Masters%20black%20belt%3A%3C%2Fstrong%3E%20Igor%20Silva%20(BRA)%3Cbr%3E%3Cstrong%3EBest%20Asian%20Jiu-Jitsu%20Federation%3A%3C%2Fstrong%3E%20Kazakhstan%3Cbr%3E%3Cstrong%3EBest%20Academy%20in%20UAE%3A%20%3C%2Fstrong%3ECommando%20Group%2C%20Abu%20Dhabi%3Cbr%3E%3Cstrong%3EBest%20International%20Academy%3A%3C%2Fstrong%3E%20Commando%20Group%2C%20Abu%20Dhabi%3Cbr%3E%3Cstrong%3EAfrican%20Player%20of%20the%20Year%3A%20%3C%2Fstrong%3EKatiuscia%20Yasmira%20Dias%20(GNB)%3Cbr%3E%3Cstrong%3EOceanian%20Player%20of%20the%20Year%3A%20%3C%2Fstrong%3EAnton%20Minenko%20(AUS)%3Cbr%3E%3Cstrong%3EEuropean%20Player%20of%20the%20Year%3A%3C%2Fstrong%3E%20Rose%20El%20Sharouni%20(NED)%3Cbr%3E%3Cstrong%3ENorth%20and%20Central%20American%20Player%20of%20the%20Year%3A%20%3C%2Fstrong%3EAlexa%20Yanes%20(USA)%3Cbr%3E%3Cstrong%3EAsian%20Player%20of%20the%20Year%3A%20%3C%2Fstrong%3EZayed%20Al%20Katheeri%20(UAE)%3Cbr%3E%3Cstrong%3ERookie%20of%20the%20Year%3A%3C%2Fstrong%3E%20Rui%20Neto%20(BRA)Rui%20Neto%20(BRA)%3C%2Fp%3E%0A

ONCE UPON A TIME IN GAZA

Starring: Nader Abd Alhay, Majd Eid, Ramzi Maqdisi

Directors: Tarzan and Arab Nasser

Rating: 4.5/5

UAE currency: the story behind the money in your pockets