Investments of up to $13.5 trillion will be needed by 2050 to help hard-to-abate sectors such as production, energy and transport to transition to a sustainable and carbon-neutral future, a World Economic Forum report said.

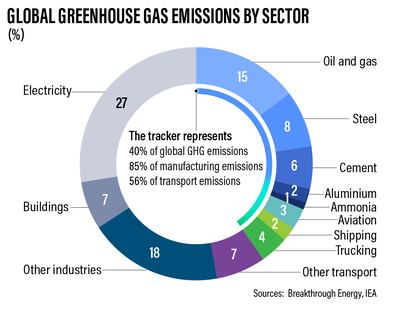

The report, released before the Cop28 summit begins in Dubai this week, focuses on progress towards achieving net-zero emissions in eight industries – steel, cement, aluminium, ammonia (excluding other chemicals), oil and gas, aviation, shipping and trucking – which depend on fossil fuels for 90 per cent of their energy demand.

While the pathway to net zero in these sectors will differ based on "unique sectoral and regional factors", greater investments are required in clean power, hydrogen and infrastructure for carbon capture, utilisation and storage (CCUS) to accelerate decarbonisation, it said.

A "robust enabling environment" is also essential to allow them to achieve their respective decarbonisation objectives, said the Net-Zero Industry Tracker 2023 report, published by the WEF along with Accenture.

“Decarbonising these industrial and transport sectors, which emit 40 per cent of global greenhouse gas emissions today, is essential to achieving net zero, especially as demand for industrial products and transport services will continue to be strong,” said Roberto Bocca, head of centre for energy and materials at the WEF.

“Significant infrastructure investments are required, complemented by policies and stronger incentives so industries can switch to low-emission technologies, while ensuring access to affordable and reliable resources critical for economic growth.”

Over the past three years, absolute emissions have grown by an average of 8 per cent due to increased activity and demand, the report found.

Sectors including cement and steel are facing the most complex decarbonisation challenges due to their energy intensity, with their use of energy "equivalent to more than three times" that of the amount consumed in the US.

Emission-intensive sectors are not currently aligned with the trajectory to reach net zero by 2050 – as determined by the International Energy Agency and industry specific scenarios and targets, the report said.

The $13.5 trillion in investments covers the average clean power generation costs of solar, off-shore and on-shore wind, nuclear and geothermal, electrolyser costs for clean hydrogen and carbon transport, as well as storage costs.

"They must be complemented by policies and incentives that can help the industries make the switch while ensuring access to affordable and reliable resources that are critical for economic growth," the WEF said.

Global investments in energy transition technology alone must quadruple to $35 trillion, the International Renewable Energy Agency said in a June report.

A record 295 gigawatts of renewable energy capacity was added globally in 2022, up about 10 per cent from the year before, according to the Abu Dhabi-based agency.

However, most of the growth was concentrated in the US, the EU and China, highlighting a growing disparity in clean energy adoption worldwide.

"The majority of the technologies needed to deliver net-zero emissions are expected to reach commercial maturity after 2030, highlighting the need for collaborative approaches to research, develop and scale them," the WEF report said.

Carbon pricing, tax subsidies, public procurement and development of strong business cases can support in mobilising necessary investments.

But raising capital for "high-risk projects with unproven technologies" could be challenging in the current macroeconomic environment.

The onus will fall on institutional investors and multilateral banks to provide access to low-cost capital linked to emissions targets.

“Collaboration between the public and private sectors is critical to a successful energy transition, and technology can be a key enabler in both managing affordable and reliable access to clean energy and addressing the incremental cost of decarbonisation,” said Muqsit Ashraf, who leads Accenture Strategy.

“Widespread scaling and adoption of clean power, carbon capture and storage, and energy efficiency technologies across sectors are vital for progress. Additionally, business model innovations can also help stimulate demand and accelerate industrial decarbonisation – achieving net-zero objectives and a resilient energy transition.”

The report urged the industrial sectors to focus on five aspects: prioritising clean power technology; promoting shared infrastructure; creating a standardised framework for low-emissions products and an auditable carbon-footprint assessment process to improve transparency; aligning on emissions reduction requirements globally; and improving transparency for low-emissions and low-carbon alternatives.

Studying addiction

This month, Dubai Medical College launched the Middle East’s first master's programme in addiction science.

Together with the Erada Centre for Treatment and Rehabilitation, the college offers a two-year master’s course as well as a one-year diploma in the same subject.

The move was announced earlier this year and is part of a new drive to combat drug abuse and increase the region’s capacity for treating drug addiction.

The candidates

Dr Ayham Ammora, scientist and business executive

Ali Azeem, business leader

Tony Booth, professor of education

Lord Browne, former BP chief executive

Dr Mohamed El-Erian, economist

Professor Wyn Evans, astrophysicist

Dr Mark Mann, scientist

Gina MIller, anti-Brexit campaigner

Lord Smith, former Cabinet minister

Sandi Toksvig, broadcaster

Short-term let permits explained

Homeowners and tenants are allowed to list their properties for rental by registering through the Dubai Tourism website to obtain a permit.

Tenants also require a letter of no objection from their landlord before being allowed to list the property.

There is a cost of Dh1,590 before starting the process, with an additional licence fee of Dh300 per bedroom being rented in your home for the duration of the rental, which ranges from three months to a year.

Anyone hoping to list a property for rental must also provide a copy of their title deeds and Ejari, as well as their Emirates ID.

Conflict, drought, famine

Estimates of the number of deaths caused by the famine range from 400,000 to 1 million, according to a document prepared for the UK House of Lords in 2024.

It has been claimed that the policies of the Ethiopian government, which took control after deposing Emperor Haile Selassie in a military-led revolution in 1974, contributed to the scale of the famine.

Dr Miriam Bradley, senior lecturer in humanitarian studies at the University of Manchester, has argued that, by the early 1980s, “several government policies combined to cause, rather than prevent, a famine which lasted from 1983 to 1985. Mengistu’s government imposed Stalinist-model agricultural policies involving forced collectivisation and villagisation [relocation of communities into planned villages].

The West became aware of the catastrophe through a series of BBC News reports by journalist Michael Buerk in October 1984 describing a “biblical famine” and containing graphic images of thousands of people, including children, facing starvation.

Band Aid

Bob Geldof, singer with the Irish rock group The Boomtown Rats, formed Band Aid in response to the horrific images shown in the news broadcasts.

With Midge Ure of the band Ultravox, he wrote the hit charity single Do They Know it’s Christmas in December 1984, featuring a string of high-profile musicians.

Following the single’s success, the idea to stage a rock concert evolved.

Live Aid was a series of simultaneous concerts that took place at Wembley Stadium in London, John F Kennedy Stadium in Philadelphia, the US, and at various other venues across the world.

The combined event was broadcast to an estimated worldwide audience of 1.5 billion.

How to donate

Send “thenational” to the following numbers or call the hotline on: 0502955999

2289 – Dh10

2252 – Dh 50

6025 – Dh20

6027 – Dh 100

6026 – Dh 200

8 UAE companies helping families reduce their carbon footprint

Greenheart Organic Farms

This Dubai company was one of the country’s first organic farms, set up in 2012, and it now delivers a wide array of fruits and vegetables grown regionally or in the UAE, as well as other grocery items, to both Dubai and Abu Dhabi doorsteps.

www.greenheartuae.com

Modibodi

Founded in Australia, Modibodi is now in the UAE with waste-free, reusable underwear that eliminates the litter created by a woman’s monthly cycle, which adds up to approximately 136kgs of sanitary waste over a lifetime.

www.modibodi.ae

The Good Karma Co

From brushes made of plant fibres to eco-friendly storage solutions, this company has planet-friendly alternatives to almost everything we need, including tin foil and toothbrushes.

www.instagram.com/thegoodkarmaco

Re:told

One Dubai boutique, Re:told, is taking second-hand garments and selling them on at a fraction of the price, helping to cut back on the hundreds of thousands of tonnes of clothes thrown into landfills each year.

www.shopretold.com

Lush

Lush provides products such as shampoo and conditioner as package-free bars with reusable tins to store.

www.mena.lush.com

Bubble Bro

Offering filtered, still and sparkling water on tap, Bubble Bro is attempting to ensure we don’t produce plastic or glass waste. Founded in 2017 by Adel Abu-Aysha, the company is on track to exceeding its target of saving one million bottles by the end of the year.

www.bubble-bro.com

Coethical

This company offers refillable, eco-friendly home cleaning and hygiene products that are all biodegradable, free of chemicals and certifiably not tested on animals.

www.instagram.com/coethical

Eggs & Soldiers

This bricks-and-mortar shop and e-store, founded by a Dubai mum-of-four, is the place to go for all manner of family products – from reusable cloth diapers to organic skincare and sustainable toys.

www.eggsnsoldiers.com

Key facilities

- Olympic-size swimming pool with a split bulkhead for multi-use configurations, including water polo and 50m/25m training lanes

- Premier League-standard football pitch

- 400m Olympic running track

- NBA-spec basketball court with auditorium

- 600-seat auditorium

- Spaces for historical and cultural exploration

- An elevated football field that doubles as a helipad

- Specialist robotics and science laboratories

- AR and VR-enabled learning centres

- Disruption Lab and Research Centre for developing entrepreneurial skills

How to get there

Emirates (www.emirates.com) flies directly to Hanoi, Vietnam, with fares starting from around Dh2,725 return, while Etihad (www.etihad.com) fares cost about Dh2,213 return with a stop. Chuong is 25 kilometres south of Hanoi.

Bib%20Gourmand%20restaurants

%3Cp%3EAl%20Khayma%0D%3Cbr%3EBait%20Maryam%0D%3Cbr%3EBrasserie%20Boulud%0D%3Cbr%3EFi'lia%0D%3Cbr%3Efolly%0D%3Cbr%3EGoldfish%0D%3Cbr%3EIbn%20AlBahr%0D%3Cbr%3EIndya%20by%20Vineet%0D%3Cbr%3EKinoya%0D%3Cbr%3ENinive%0D%3Cbr%3EOrfali%20Bros%0D%3Cbr%3EReif%20Japanese%20Kushiyaki%0D%3Cbr%3EShabestan%0D%3Cbr%3ETeible%3C%2Fp%3E%0A

THE SPECS

Engine: 6.75-litre twin-turbocharged V12 petrol engine

Power: 420kW

Torque: 780Nm

Transmission: 8-speed automatic

Price: From Dh1,350,000

On sale: Available for preorder now

Get inspired

Here are a couple of Valentine’s Day food products that may or may not go the distance (but have got the internet talking anyway).

Sourdough sentiments: Marks & Spencer in the United Kingdom has introduced a slow-baked sourdough loaf dusted with flour to spell out I (heart) you, at £2 (Dh9.5). While it’s not available in the UAE, there’s nothing to stop you taking the idea and creating your own message of love, stencilled on breakfast-inbed toast.

Crisps playing cupid: Crisp company Tyrells has added a spicy addition to its range for Valentine’s Day. The brand describes the new honey and chilli flavour on Twitter as: “A tenderly bracing duo of the tantalising tingle of chilli with sweet and sticky honey. A helping hand to get your heart racing.” Again, not on sale here, but if you’re tempted you could certainly fashion your own flavour mix (spicy Cheetos and caramel popcorn, anyone?).

Benefits of first-time home buyers' scheme

- Priority access to new homes from participating developers

- Discounts on sales price of off-plan units

- Flexible payment plans from developers

- Mortgages with better interest rates, faster approval times and reduced fees

- DLD registration fee can be paid through banks or credit cards at zero interest rates