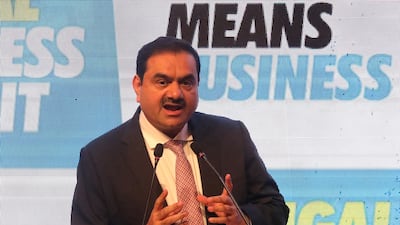

Shares in Adani Group companies fell after US investor Hindenburg Research said it was shorting the conglomerate’s stocks and accused companies owned by Asia’s richest man of “brazen” market manipulation and accounting fraud.

Billionaire Gautam Adani’s flagship company Adani Enterprises and Adani Ports and Special Economic Zone dropped as much as 3.7 per cent and 7.3 per cent respectively on Wednesday despite relatively small free-floats.

It came after Hindenburg, a US-based investment research firm that specialises in activist short-selling, made wide-ranging allegations of purported corporate malpractice following a two-year investigation into the tycoon’s companies.

Cement makers ACC and Ambuja Cements, Mr Adani’s recent acquisitions which are more widely traded, plunged by as much as 7.2 per cent and 9.7 per cent.

The 2032 dollar bond issued by Adani Ports sank 7 cents to 71.5 cents on the dollar, its biggest drop since issuance in 2021, according to data compiled by Bloomberg.

Adani Green Energy’s note maturing in 2024 fell 2.7 cents to 92 cents, the most in three months.

Hindenburg’s January 24 report, constituting the research company’s opinions and investigative commentary where readers are advised that use of the report is at the reader’s own risk, details a web of Adani family controlled offshore shell entities in tax havens. It claims these were used to facilitate corruption, money laundering and taxpayer theft, while siphoning money from the group’s listed companies.

The report is “a malicious combination of selective misinformation and stale, baseless and discredited allegations”, Adani group chief financial officer Jugeshinder Singh said.

The report was released on the same day that a key share sale from Adani Enterprises, aimed at attracting a broader network of investors, is set to open for subscription.

The timing “clearly betrays a brazen, mala fide intention to undermine” and damage the share sale plan, said Mr Singh.

The broadside from Hindenburg comes at a critical time for the ports-to-power tycoon.

Mr Adani is seeking to raise his international profile and is aggressively branching into new businesses, including cement and media, in his power base of India, where he is seen to enjoy a close relationship with Prime Minister Narendra Modi.

The Adani empire’s expansion plans are closely aligned to the government’s development and economic goals.

Mr Adani rocketed up the Bloomberg Billionaire’s Index last year past the likes of Bill Gates and Warren Buffett, and his fortune is now $118.9 billion, making him the fourth-wealthiest person in the world.

While many of the allegations made by Hindenburg against Mr Adani were already known, including over-valuations and concentrated holdings by Mauritius-based investors in his companies, some details gleaned from the entire Mauritius registry have been made public for the first time, said Brian Freitas, an Auckland-based analyst who publishes independent research on website Smartkarma.

“It will not only shine a light on the group, but also on corporate governance in India,” said Mr Freitas.

But the report is unlikely to have “any big impact on the follow-on offer because the company would have ensured that there is sufficient demand for the book to be covered”.

A prominent research outfit, Hindenburg is best known for its critical reports on the electric vehicle space. It was instrumental in bringing down the founder of e-truck company Nikola, which was accused by Hindenburg in 2020 of being built on “dozens of lies”.

Nikola founder Trevor Milton eventually stepped down as chairman and was found guilty of securities fraud. More recent targets include Clover Health and Lordstown Motors.

Hindenburg said it had taken a short position in Mr Adani’s companies through US-traded bonds and non-Indian-traded derivative instruments.

Some of their main allegations include: the offshore shell network seems to be used for earnings manipulation; Adani Group has previously been the focus of four major government investigations relating to allegations of fraud; and that the auditor “hardly seems capable of complex audit work” when Adani Enterprises alone has 156 subsidiaries and many more joint ventures.

Adani companies trade at price-to-earnings ratios many times that of peer companies both in India and around the globe, including companies in the Reliance empire of rival tycoon Mukesh Ambani — Mr Adani’s predecessor as Asia’s richest man.

There are some signs that the bull run is slowing, with most Adani group stocks starting the year with declines even before Hindenburg’s report.

Investors and analysts have also flagged concerns over the high levels of debt seen in the empire’s listed units.

Gross debt at six Adani firms — Adani Enterprises, Adani Green Energy, Adani Ports, Adani Power, Adani Total Gas and Adani Transmission — stood at 1.88 trillion rupees ($23 billion) as of the end of March 2022.

“Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its seven key listed companies have 85 per cent downside purely on a fundamental basis owing to sky-high valuations,” Hindenburg said in the report.

At a glance

Global events: Much of the UK’s economic woes were blamed on “increased global uncertainty”, which can be interpreted as the economic impact of the Ukraine war and the uncertainty over Donald Trump’s tariffs.

Growth forecasts: Cut for 2025 from 2 per cent to 1 per cent. The OBR watchdog also estimated inflation will average 3.2 per cent this year

Welfare: Universal credit health element cut by 50 per cent and frozen for new claimants, building on cuts to the disability and incapacity bill set out earlier this month

Spending cuts: Overall day-to day-spending across government cut by £6.1bn in 2029-30

Tax evasion: Steps to crack down on tax evasion to raise “£6.5bn per year” for the public purse

Defence: New high-tech weaponry, upgrading HM Naval Base in Portsmouth

Housing: Housebuilding to reach its highest in 40 years, with planning reforms helping generate an extra £3.4bn for public finances

Padmaavat

Director: Sanjay Leela Bhansali

Starring: Ranveer Singh, Deepika Padukone, Shahid Kapoor, Jim Sarbh

3.5/5

UAE SQUAD

Mohammed Naveed (captain), Mohamed Usman (vice captain), Ashfaq Ahmed, Chirag Suri, Shaiman Anwar, Mohammed Boota, Ghulam Shabber, Imran Haider, Tahir Mughal, Amir Hayat, Zahoor Khan, Qadeer Ahmed, Fahad Nawaz, Abdul Shakoor, Sultan Ahmed, CP Rizwan

UAE currency: the story behind the money in your pockets

WOMAN AND CHILD

Director: Saeed Roustaee

Starring: Parinaz Izadyar, Payman Maadi

Rating: 4/5

UAE rugby in numbers

5 - Year sponsorship deal between Hesco and Jebel Ali Dragons

700 - Dubai Hurricanes had more than 700 playing members last season between their mini and youth, men's and women's teams

Dh600,000 - Dubai Exiles' budget for pitch and court hire next season, for their rugby, netball and cricket teams

Dh1.8m - Dubai Hurricanes' overall budget for next season

Dh2.8m - Dubai Exiles’ overall budget for next season

SPECS

%3Cp%3E%3Cstrong%3EEngine%3C%2Fstrong%3E%3A%202-litre%20direct%20injection%20turbo%20%0D%3Cbr%3E%3Cstrong%3ETransmission%3C%2Fstrong%3E%3A%207-speed%20automatic%20%0D%3Cbr%3E%3Cstrong%3EPower%3C%2Fstrong%3E%3A%20261hp%20%0D%3Cbr%3E%3Cstrong%3ETorque%3C%2Fstrong%3E%3A%20400Nm%20%0D%3Cbr%3E%3Cstrong%3EPrice%3C%2Fstrong%3E%3A%20From%20Dh134%2C999%26nbsp%3B%3C%2Fp%3E%0A

Specs

Engine: Electric motor generating 54.2kWh (Cooper SE and Aceman SE), 64.6kW (Countryman All4 SE)

Power: 218hp (Cooper and Aceman), 313hp (Countryman)

Torque: 330Nm (Cooper and Aceman), 494Nm (Countryman)

On sale: Now

Price: From Dh158,000 (Cooper), Dh168,000 (Aceman), Dh190,000 (Countryman)

Specs

Engine: 51.5kW electric motor

Range: 400km

Power: 134bhp

Torque: 175Nm

Price: From Dh98,800

Available: Now

More from Neighbourhood Watch:

Tips for taking the metro

- set out well ahead of time

- make sure you have at least Dh15 on you Nol card, as there could be big queues for top-up machines

- enter the right cabin. The train may be too busy to move between carriages once you're on

- don't carry too much luggage and tuck it under a seat to make room for fellow passengers

What is blockchain?

Blockchain is a form of distributed ledger technology, a digital system in which data is recorded across multiple places at the same time. Unlike traditional databases, DLTs have no central administrator or centralised data storage. They are transparent because the data is visible and, because they are automatically replicated and impossible to be tampered with, they are secure.

The main difference between blockchain and other forms of DLT is the way data is stored as ‘blocks’ – new transactions are added to the existing ‘chain’ of past transactions, hence the name ‘blockchain’. It is impossible to delete or modify information on the chain due to the replication of blocks across various locations.

Blockchain is mostly associated with cryptocurrency Bitcoin. Due to the inability to tamper with transactions, advocates say this makes the currency more secure and safer than traditional systems. It is maintained by a network of people referred to as ‘miners’, who receive rewards for solving complex mathematical equations that enable transactions to go through.

However, one of the major problems that has come to light has been the presence of illicit material buried in the Bitcoin blockchain, linking it to the dark web.

Other blockchain platforms can offer things like smart contracts, which are automatically implemented when specific conditions from all interested parties are reached, cutting the time involved and the risk of mistakes. Another use could be storing medical records, as patients can be confident their information cannot be changed. The technology can also be used in supply chains, voting and has the potential to used for storing property records.

ENGLAND SQUAD

Team: 15 Mike Brown, 14 Anthony Watson, 13 Ben Te'o, 12 Owen Farrell, 11 Jonny May, 10 George Ford, 9 Ben Youngs, 1 Mako Vunipola, 2 Dylan Hartley, 3 Dan Cole, 4 Joe Launchbury, 5 Maro Itoje, 6 Courtney Lawes, 7 Chris Robshaw, 8 Sam Simmonds

Replacements 16 Jamie George, 17 Alec Hepburn, 18 Harry Williams, 19 George Kruis, 20 Sam Underhill, 21 Danny Care, 22 Jonathan Joseph, 23 Jack Nowell

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Alaan%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202021%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Parthi%20Duraisamy%20and%20Karun%20Kurien%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20FinTech%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20%247%20million%20raised%20in%20total%20%E2%80%94%20%242.5%20million%20in%20a%20seed%20round%20and%20%244.5%20million%20in%20a%20pre-series%20A%20round%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

Real estate tokenisation project

Dubai launched the pilot phase of its real estate tokenisation project last month.

The initiative focuses on converting real estate assets into digital tokens recorded on blockchain technology and helps in streamlining the process of buying, selling and investing, the Dubai Land Department said.

Dubai’s real estate tokenisation market is projected to reach Dh60 billion ($16.33 billion) by 2033, representing 7 per cent of the emirate’s total property transactions, according to the DLD.

The specs

Engine: 2.0-litre 4cyl turbo

Power: 261hp at 5,500rpm

Torque: 405Nm at 1,750-3,500rpm

Transmission: 9-speed auto

Fuel consumption: 6.9L/100km

On sale: Now

Price: From Dh117,059

BMW M5 specs

Engine: 4.4-litre twin-turbo V-8 petrol enging with additional electric motor

Power: 727hp

Torque: 1,000Nm

Transmission: 8-speed auto

Fuel consumption: 10.6L/100km

On sale: Now

Price: From Dh650,000

Benefits of first-time home buyers' scheme

- Priority access to new homes from participating developers

- Discounts on sales price of off-plan units

- Flexible payment plans from developers

- Mortgages with better interest rates, faster approval times and reduced fees

- DLD registration fee can be paid through banks or credit cards at zero interest rates

Labour dispute

The insured employee may still file an ILOE claim even if a labour dispute is ongoing post termination, but the insurer may suspend or reject payment, until the courts resolve the dispute, especially if the reason for termination is contested. The outcome of the labour court proceedings can directly affect eligibility.

- Abdullah Ishnaneh, Partner, BSA Law

New process leads to panic among jobseekers

As a UAE-based travel agent who processes tourist visas from the Philippines, Jennifer Pacia Gado is fielding a lot of calls from concerned travellers just now. And they are all asking the same question.

“My clients are mostly Filipinos, and they [all want to know] about good conduct certificates,” says the 34-year-old Filipina, who has lived in the UAE for five years.

Ms Gado contacted the Philippines Embassy to get more information on the certificate so she can share it with her clients. She says many are worried about the process and associated costs – which could be as high as Dh500 to obtain and attest a good conduct certificate from the Philippines for jobseekers already living in the UAE.

“They are worried about this because when they arrive here without the NBI [National Bureau of Investigation] clearance, it is a hassle because it takes time,” she says.

“They need to go first to the embassy to apply for the application of the NBI clearance. After that they have go to the police station [in the UAE] for the fingerprints. And then they will apply for the special power of attorney so that someone can finish the process in the Philippines. So it is a long process and more expensive if you are doing it from here.”